July 2025

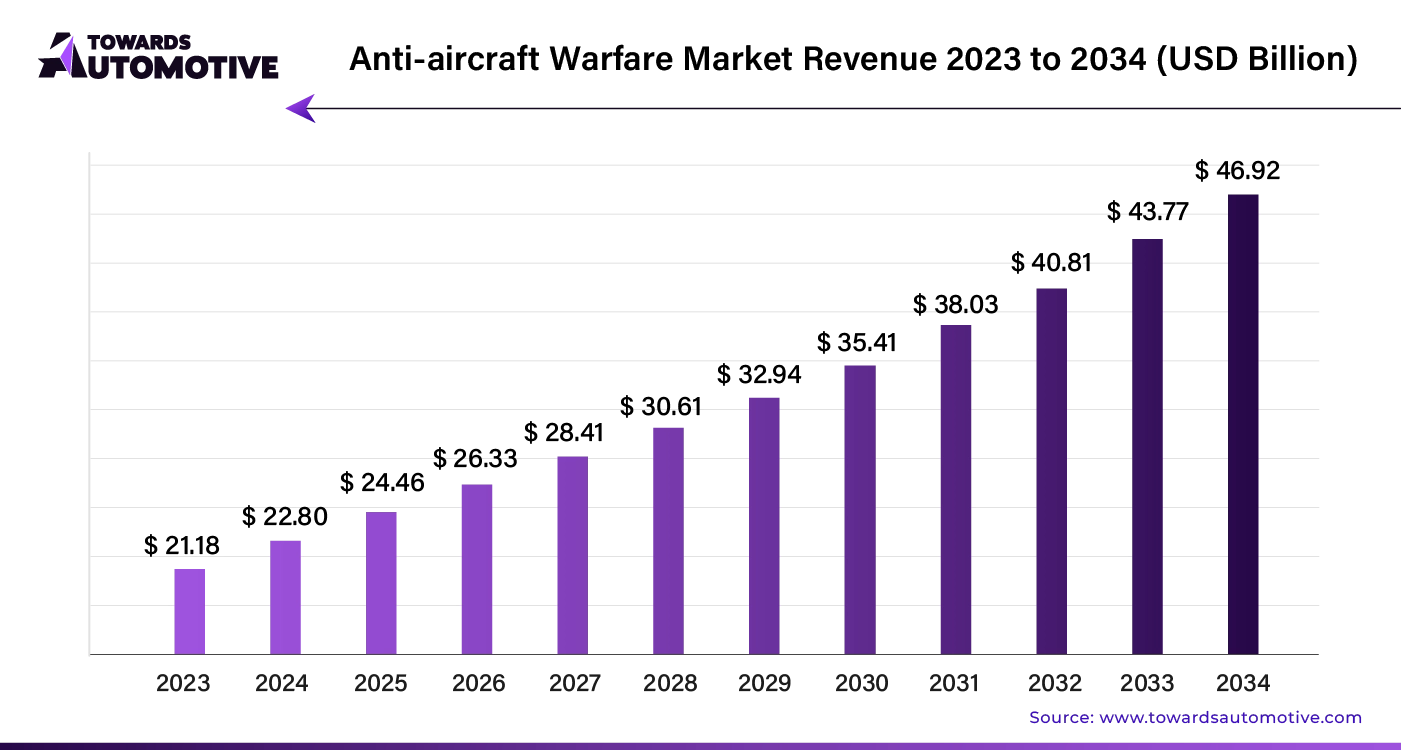

The anti-aircraft warfare market is anticipated to grow from USD 24.46 billion in 2025 to USD 46.92 billion by 2034, with a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2025 to 2034. The growing demand for stealth guided-missile technology coupled with rapid investment by aerospace brands on developing advanced air defense systems has boosted the market expansion.

Additionally, numerous government initiatives aimed at strengthening the defense sector along with ongoing development in next-generation radar tracking technologies is playing a vital role in shaping the industrial landscape. The integration of AI in defense systems for countering drones is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The anti-aircraft warfare market is a crucial sector of the aerospace industry. This industry deals in development and distribution of air defense systems around the world. There are different types of systems developed in this sector consisting of weapon systems, radar systems, electronic warfare systems, command and control systems, and some others. These systems are capable of numerous activities including support, protection, attack and some others. It is designed for operating in various ranges such as short range, medium range and long range. This market is expected to rise significantly with the growth of the defense sector in different parts of the globe.

| Metric | Details |

| Market Size in 2025 | USD 24.46 Billion |

| Projected Market Size in 2034 | USD 46.92 Billion |

| CAGR (2025 - 2034) | 7.5% |

| Leading Region | North America |

| Market Segmentation | By Capability, By Systems, By Range, By Platform and By Region |

| Top Key Players | General Dynamics Corporation, Hanwha Defense, Israel Aerospace Industries |

The major trends in this market consists of partnerships, business expansions and rising military expenditure.

The weapon systems segment dominated the market. The growing use of anti-aircraft guns for providing defense against aerial threats such as helicopters, airplanes, drones and some others has boosted the market expansion. Additionally, the increasing application of anti-aircraft missile in warfare zones for providing additional defense against ballistic missiles is playing a vital role in shaping the industrial landscape. Moreover, partnerships among market players and government for deploying high-quality weapon systems is expected to drive the growth of the anti-aircraft warfare market.

The radar systems segment is expected to rise with a considerable CAGR during the forecast period. The rising use of radar systems in defense sector to detect, track, and classify aerial threats such as aircraft, missiles, and drones has driven the market growth. Additionally, rapid investment by government of several countries for deploying high-quality radar systems in their military bases is playing a vital role in shaping the industry in a positive direction. Moreover, the growing demand for high-data-rate samplers enabled radar systems to capture and process large amounts of information is expected to boost the growth of the anti-aircraft warfare market.

The medium range (20 – 100 km) segment held the largest share of the market. The growing demand for medium-ranged defense systems to detect aerial threats has boosted the market expansion. Additionally, the deployment of unmanned aerial vehicles (UAVS) in the defense sector to improve nearby security is playing a vital role in shaping the industrial landscape. Moreover, the rising application of these warfare systems to protect against various aerial systems such cruise missiles, tactical ballistic missiles, aircrafts and some others is expected to drive the growth of the anti-aircraft warfare market.

The long range (>100 km) segment is expected to expand with a notable CAGR during the forecast period. The rising demand for long-range defense systems to provide enhanced protection against threats that are deployed in far distance has boosted the market expansion. Additionally, increasing focus of defense organizations on deploying long-range air defense solutions to combat enemies is playing a vital role in shaping the industry in a positive direction. Moreover, the integration of these systems for enhancing national security, protecting critical infrastructure, providing strategic defense capabilities and some others is expected to foster the growth of the anti-aircraft warfare market.

North America generated led the anti-aircraft warfare market. The growing adoption of advanced aerial defense systems in the U.S. and Canada has boosted the market expansion. Additionally, rapid investment by government for deploying high-quality missile destroyers coupled with rising emphasis of defense companies to open up new production facilities is contributing to the industry in a positive manner. Moreover, the presence of various market players such as Lockheed Martin Corporation, Northrop Grumman, L3Harris Technologies, Inc. and some others is expected to propel the growth of the anti-aircraft warfare market in this region.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The increasing demand for advanced air defense systems in several countries such as India, China, Japan, South Korea and some others has driven the market growth. Additionally, the rising focus of government to strengthen the defense and military sector coupled with rise in number of defense startups is contributing to the industry in a positive manner. Moreover, the presence of several market players such as LIG Nex1, Hanwha Corporation, Bharat Dynamics Limited, Paras Defence and Space Technologies, and some others is expected to foster the growth of the anti-aircraft warfare market in this region.

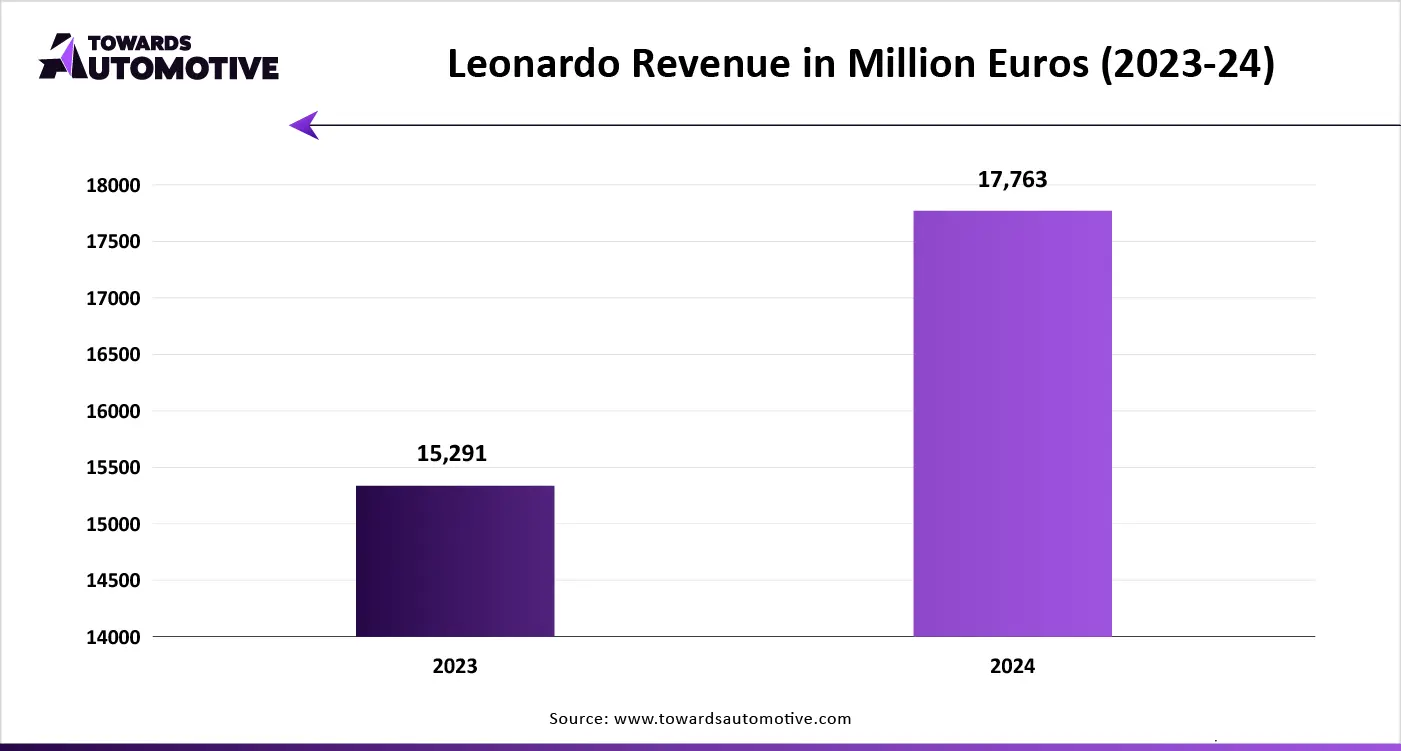

The anti-aircraft warfare market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Aselsan A.S., BAE Systems PLC, Diehl Stiftung & Co. KG, Elbit Systems, General Dynamics Corporation, Hanwha Defense, Israel Aerospace Industries, Leonardo S.p.A., Lockheed Martin Corporation, MBDA, Northrop Grumman, Rheinmetall AG, Saab AB, Thales Group, the Boeing Company and some others. These companies are constantly engaged in developing anti-aircraft systems and adopting numerous strategies such as joint ventures, collaborations, business expansions, launches, acquisitions, partnerships and some others to maintain their dominance in this industry.

By Capability

By Systems

By Range

By Platform

By Region

July 2025

July 2025

July 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us