Acoustic Vehicle Alerting System (AVAS) Market Size, Growth and Trends

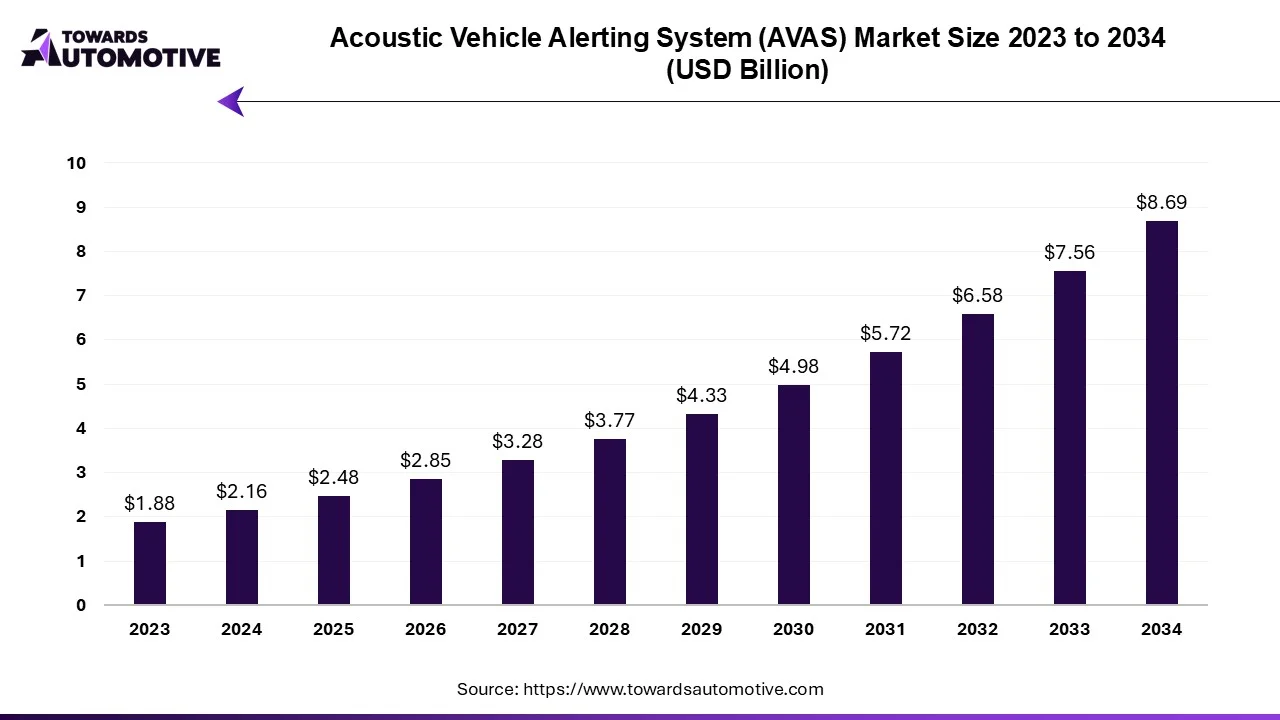

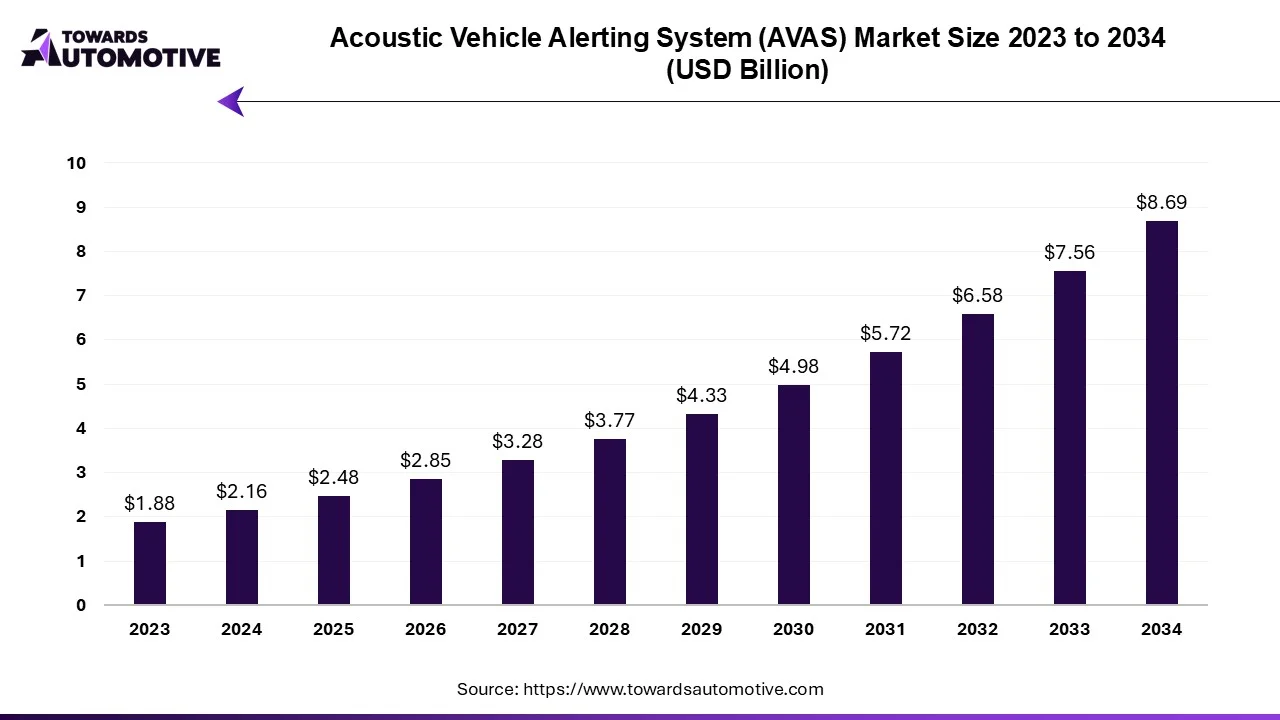

The acoustic vehicle alerting system (AVAS) market is forecasted to expand from USD 2.48 billion in 2025 to USD 8.69 billion by 2034, growing at a CAGR of 14.93% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Acoustic Vehicle Alerting System (AVAS) market is experiencing significant growth, driven by increasing concerns over pedestrian safety, regulatory mandates, and the rise of electric vehicles (EVs) in urban environments. AVAS, also known as acoustic vehicle warning systems (AVWS), generates artificial sound to alert pedestrians and cyclists of approaching electric or hybrid vehicles, mitigating the risk of accidents and improving road safety. With the global push towards sustainable mobility and smart transportation solutions, the AVAS market is poised for substantial expansion in the coming years.

Key Drivers and Trends

- Regulatory Compliance: Government regulations mandating the installation of AVAS systems in electric and hybrid vehicles to improve pedestrian safety are driving market growth. Regions such as Europe and North America have already implemented legislation requiring EVs to emit audible alerts at low speeds to alert pedestrians, cyclists, and visually impaired individuals of their presence.

- Technological Advancements: Advances in sound synthesis algorithms, speaker design, and vehicle integration technologies are enhancing the effectiveness and versatility of AVAS systems. Manufacturers are developing innovative solutions to generate distinctive, directional sounds that comply with regulatory requirements while minimizing noise pollution and driver distraction.

- Urbanization and Traffic Congestion: Rapid urbanization, increasing traffic congestion, and the proliferation of electric mobility solutions in urban areas are amplifying the need for effective AVAS solutions. These systems help improve pedestrian awareness, reduce the risk of accidents at intersections and pedestrian crossings, and foster harmonious coexistence between vehicles and vulnerable road users in dense urban environments.

- Integration with Vehicle Connectivity: The integration of AVAS systems with vehicle connectivity and communication platforms enables proactive collision avoidance, adaptive sound modulation, and real-time traffic management. Connected AVAS solutions leverage data from onboard sensors, GPS, and vehicle-to-everything (V2X) communication to adapt sound emissions dynamically based on surrounding traffic conditions and pedestrian movements.

Market Segmentation and Application

The AVAS market can be segmented based on technology, vehicle type, and end-user application:

By Technology

- External Speaker Systems

- Engine Sound Synthesis

- Virtual Sound Projection

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Public Transport Vehicles

By End-User Application

- OEM (Original Equipment Manufacturers)

- Aftermarket

By Region

- North America

- United States

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

- South Africa

- Rest of Middle East and Africa

Regional Outlook

- North America: Stringent safety regulations, consumer awareness, and the adoption of electric mobility solutions drive market growth in North America. The United States and Canada are witnessing increased deployment of AVAS systems in electric vehicles across major urban centers.

- Europe: Europe leads the AVAS market, propelled by regulatory mandates such as the European Union's AVAS requirement for all new electric and hybrid vehicles. Countries like Germany, France, and the UK are at the forefront of AVAS adoption, fostering innovation and standardization in sound emission technologies.

- Asia-Pacific: Rapid urbanization, rising EV adoption, and government initiatives to enhance road safety fuel market growth in the Asia-Pacific region. Countries like China, Japan, and South Korea are investing in AVAS infrastructure to address pedestrian safety challenges in densely populated cities.

Key Players and Competitive Landscape

The AVAS market features a competitive landscape with key players focusing on product innovation, strategic partnerships, and regulatory compliance.

Prominent companies operating in the AVAS market include:

- Harman International Industries, Inc.

- Continental AG

- Delphi Technologies (BorgWarner Inc.)

- Denso Corporation

- Panasonic Corporation

- Nissan Motor Corporation

- Tesla, Inc.

- Volkswagen AG

- Hyundai Motor Company

- General Motors Company

Recent Developments in the Acoustic Vehicle Alerting System Market

- In December 2023, major automotive manufacturers announced the integration of advanced AVAS technology into their electric vehicle (EV) models to comply with regulatory requirements mandating the installation of audible warning systems for pedestrian safety. The latest AVAS solutions feature customizable sound profiles, real-time monitoring capabilities, and adaptive volume control to enhance pedestrian awareness and mitigate the risk of accidents in urban environments.

- In November 2023, leading AVAS suppliers unveiled next-generation acoustic warning systems designed to address the evolving needs of the automotive industry for effective pedestrian protection and traffic safety. The new AVAS solutions leverage artificial intelligence (AI) algorithms, sensor fusion technology, and digital sound processing techniques to generate dynamic warning signals that adapt to changing driving conditions, vehicle speeds, and ambient noise levels for optimal effectiveness.

- In October 2023, regulatory authorities in key automotive markets implemented updated safety standards and testing protocols for AVAS-equipped vehicles to ensure compliance with sound emission regulations and pedestrian safety requirements. Automakers and AVAS suppliers collaborated closely to develop and certify AVAS solutions that meet the stringent regulatory criteria while delivering consistent performance and reliability across different vehicle platforms and operating conditions.

- In September 2023, research and development initiatives focused on enhancing the functionality and performance of AVAS technology through innovations in sound generation, localization, and directional projection capabilities. Emerging AVAS solutions incorporate advanced acoustics principles, psychoacoustic modeling, and immersive sound design techniques to create intuitive and non-intrusive warning signals that effectively alert pedestrians to the presence and movement of electric vehicles in their vicinity.

- In August 2023, industry partnerships and collaborations accelerated the deployment of AVAS technology across a wide range of vehicle segments, including passenger cars, commercial vehicles, and public transport fleets. AVAS suppliers collaborated with automotive OEMs, tier-1 suppliers, and regulatory agencies to standardize AVAS integration requirements, optimize system performance, and streamline certification processes for seamless market adoption and global harmonization.