March 2025

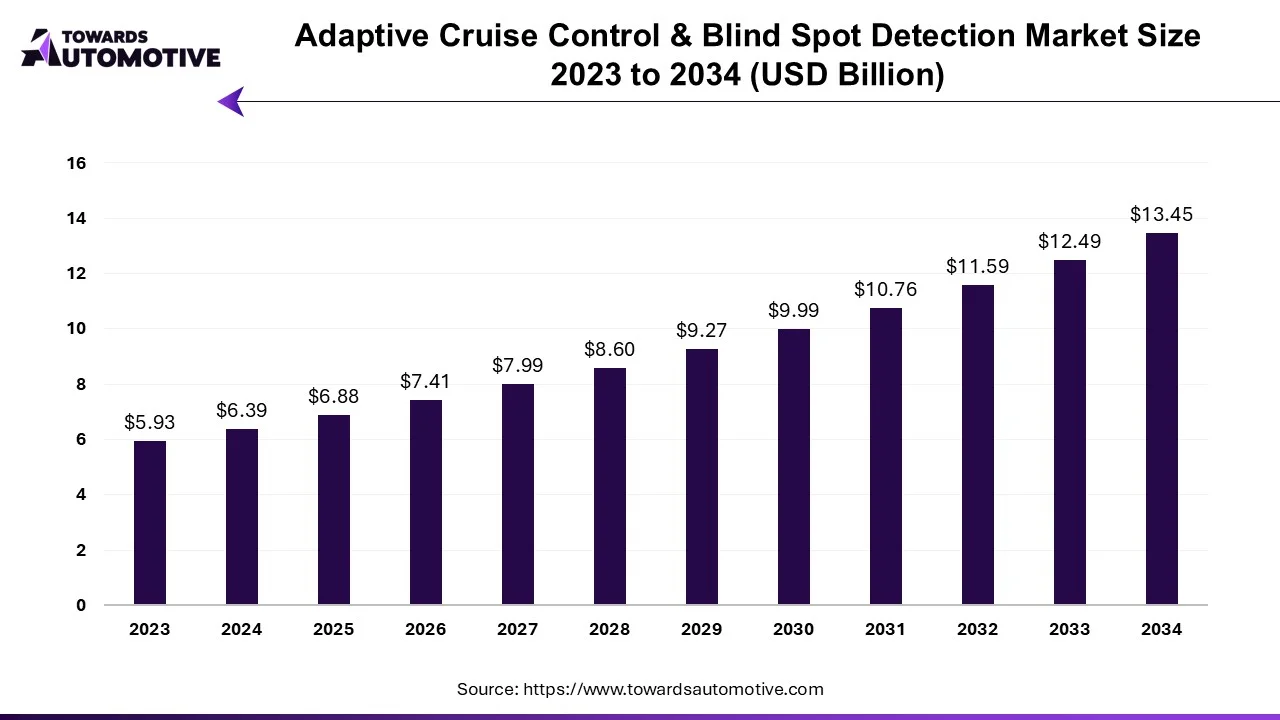

The adaptive cruise control and blind spot monitoring market is forecasted to expand from USD 6.88 billion in 2025 to USD 13.45 billion by 2034, growing at a CAGR of 7.73% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The global automotive industry faced significant challenges due to the COVID-19 pandemic, including product cuts, production interruptions, travel restrictions, and reduced car sales in 2022, leading to sluggish economic growth.

The implementation of stricter safety regulations and growing concerns about vehicle safety among consumers are expected to drive long-term market growth. According to the World Health Organization, approximately 1.35 million people die in road traffic crashes annually, often due to drivers' inability to assess situations accurately and make appropriate decisions. Government initiatives aimed at reducing road traffic fatalities have spurred the adoption of new safety technologies.

Vehicle safety features play a crucial role in preventing injuries and reducing fatalities in accidents by keeping occupants securely positioned and providing alerts and assistance during critical situations. Common safety systems include Lane Departure Warning System (LDWS), Tire Pressure Monitoring System (TPMS), and Electronic Stability Control (ESC). The rising awareness of vehicle safety among consumers has fueled the development of advanced safety features such as cruise control and blind spot monitoring.

Additionally, the growth in global luxury goods sales has contributed to the expansion of the ACC and BSD markets. The increasing demand for high-performance vehicles is driven by factors such as urbanization and the desire for recreational travel, particularly in metropolitan areas where people seek short getaways and enjoy fast driving experiences. However, the pursuit of faster vehicles underscores the importance of ensuring high levels of safety, especially at higher speeds.

Technological advancements have been instrumental in enhancing the performance of fast cars, with automakers continuously integrating new technologies to improve engine performance, aerodynamics, and overall vehicle design. These advancements enable vehicles to achieve higher speeds and deliver superior performance. Nevertheless, the emphasis on vehicle safety remains paramount, highlighting the critical role of vehicle security systems in ensuring safe driving experiences, even at high speeds.

Blind spot detection (BSD) systems utilize electronic detection devices positioned on both sides of the vehicle. These devices emit electromagnetic waves, typically radar wavelengths, or capture and analyze images using digital cameras.

When a BSD system detects a vehicle approaching from the rear and the driver attempts to change lanes into the path of the approaching vehicle, it alerts the driver of a potential collision through visual alerts in the driver's peripheral vision and/or audible warnings. Modern BSD systems may also include features that assist the vehicle in returning to a safe position.

Ford was the first automaker to introduce blind spot detection in its vehicles with the Blind Spot Information System (BLIS) in 2005. Initially using cameras mounted near the side mirrors, the system now employs radar sensors installed in the car's bumpers. Other options on the market include Audi's Side Assist and Infiniti's Blind Spot Warning (BSW) systems.

Infiniti's Blind Spot Intervention System is a notable advancement in BSD technology, as it can detect vehicles in the blind spot and intervene if the driver attempts to change lanes when it's unsafe to do so.

The demand for effective driving techniques and accident prevention, particularly in both passenger and commercial vehicles, is steadily increasing. Commercial vehicles, due to their larger size, have larger blind spots compared to passenger vehicles. Consequently, companies are developing BSD systems specifically tailored for these vehicles in collaboration with automobile manufacturers.

Original Equipment Manufacturers (OEMs) dominate over 90% of the BSD market research, with limited aftermarket participation. Growing concerns about vehicle safety and the rising number of accidents caused by blind spots are key drivers of the BSD industry.

Active safety features like autonomous emergency braking, lane assist, adaptive cruise control, and collision avoidance systems are designed to enhance driver and passenger safety, particularly at highway speeds. These systems utilize sensors, cameras, and radar technology to monitor the vehicle's surroundings and respond swiftly to potential threats, such as avoiding collisions, maintaining lane position, and controlling speed.

The demand for faster cars is accompanied by an increasing desire for greater safety features to mitigate the risks associated with high-speed driving. Consequently, there is a growing market for automotive security systems as manufacturers strive to meet these safety requirements.

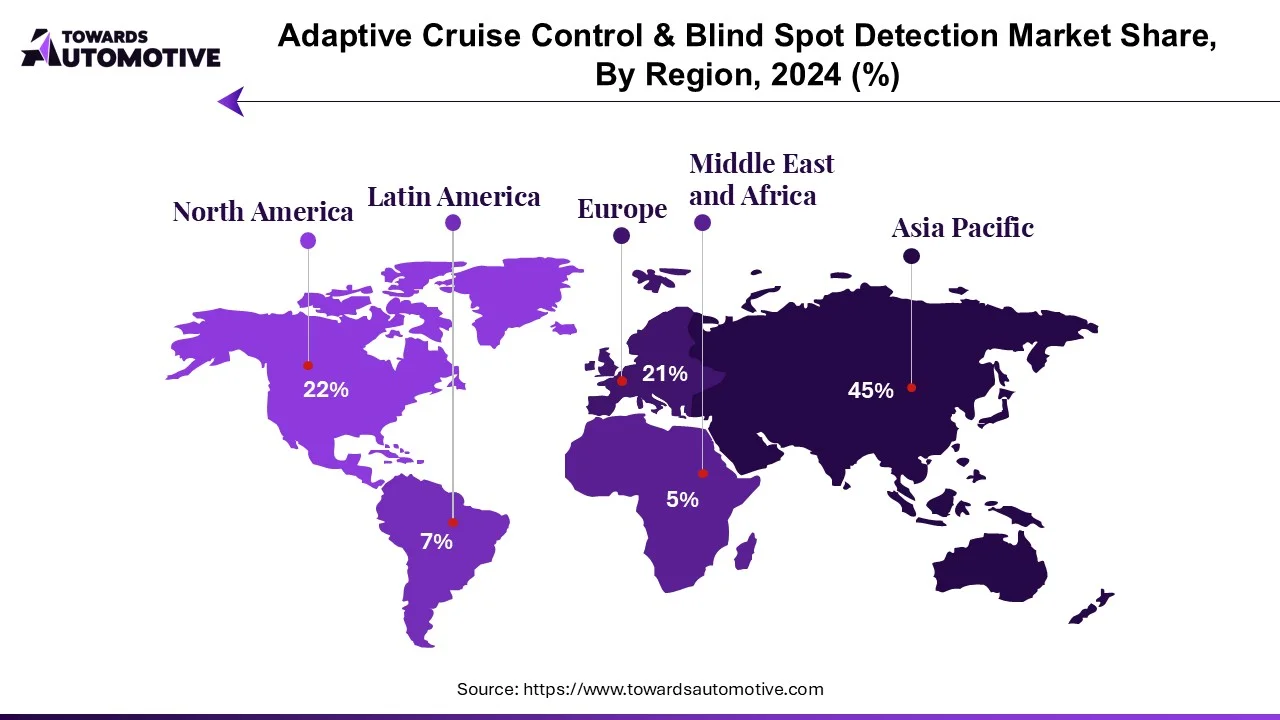

The Asia-Pacific region is poised to drive growth in the Blind Spot Detection (BSD) and Adaptive Cruise Control (ACC) market. Factors such as rising sales of luxury vehicles and the overall enhancement of vehicle safety have fueled the demand for BSD and ACC systems. Initiatives like the US New Car Assessment Program (US NCAP), led by the US National Highway Traffic Safety Administration (NHTSA), seek to incorporate these safety measures to address consumer safety concerns. Furthermore, advancements in measurement systems are expected to positively impact vehicle safety.

The presence of rapidly developing countries such as Japan and South Korea, coupled with stringent vehicle safety regulations in the region, has influenced the driving assistance sector. These regulations are on par with those in Europe and North America. The improvement of healthcare systems in countries like India, Thailand, and Indonesia has spurred demand for high-quality passenger vehicles and increased the adoption of Advanced Driver Assistance Systems (ADAS) in these markets.

Growing awareness about driving safety is driving the market for vehicles equipped with ADAS technology. Government mandates are pushing automakers to produce cars equipped with advanced ADAS modules. Additionally, the surge in vehicle usage in the region has created opportunities for Tier 1 companies to develop and deliver ADAS solutions using cutting-edge technologies and superior customer service.

The Adaptive Cruise Control (ACC) and Blind Spot Detection (BSD) markets have merged, with key players including Continental AG, Hella KGaA Hueck & Co, Mobileye, Denso Corporation, and Delphi Automotive PLC. To comply with car safety standards, major players in the ACC and BSD markets have begun investing in research and development activities.

For example:

The Adaptive Cruise Control (ACC) and Blind-Spot Detection (BSD) market is segmented by type, vehicle type, sales channel type, technology, and geography.

By Type

By Vehicle Type

By Sales Channel

By Geography

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us