April 2025

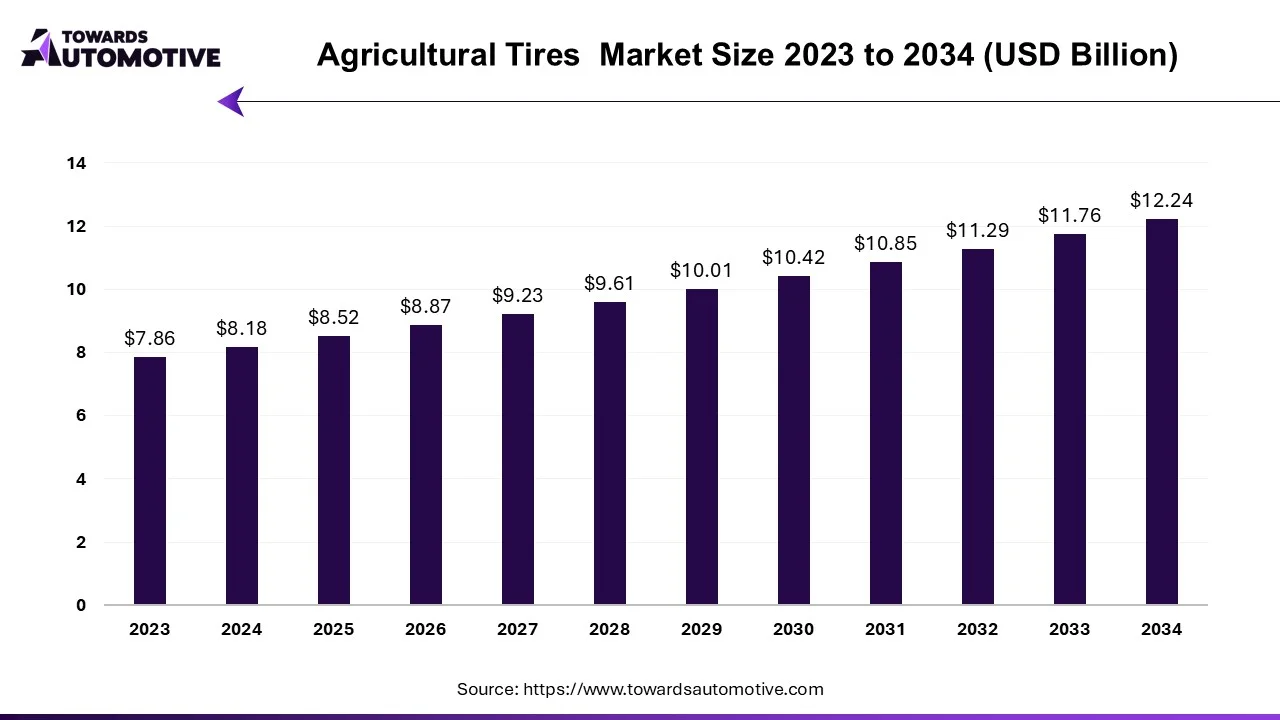

The agricultural tires market is expected to increase from USD 8.25 billion in 2025 to USD 12.24 billion by 2034, growing at a CAGR of 4.11% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The closure of major businesses has led to a decline in the demand for agricultural equipment, posing a challenge to economic growth. Additionally, tire manufacturers have experienced an increase in production stocks, prompting them to explore strategies such as layoffs and inventory reduction to manage the surplus. Since the tire industry is closely linked to original equipment manufacturers (OEMs), this surplus poses significant losses until it is addressed. Despite overall favorable market conditions, demand is contingent upon the severity of the economic crisis, impacting farmers' incomes and their ability to invest in agricultural machinery. Agricultural equipment sales witnessed a decrease in 2020 due to the profound impact of the COVID-19 pandemic on the automotive industry, including the agricultural vehicles sector.

Agricultural tires, a specialized category used for agricultural vehicles and machinery, are employed across various equipment such as sprayers, tractors, trucks, and lawn mowers. Selecting the appropriate farm tires involves considering factors like tractor size, soil compaction, fuel efficiency, traction requirements, and weight. The agricultural tire industry comprises two main segments: replacement agricultural tires and original equipment (OE) agricultural tires, further divided into bias-ply tires and radial tires. Radial tires, featuring multiple layers of rubber overlapping each other with plies perpendicular to the bead and ground, offer better durability and shock absorption compared to bias-ply tires.

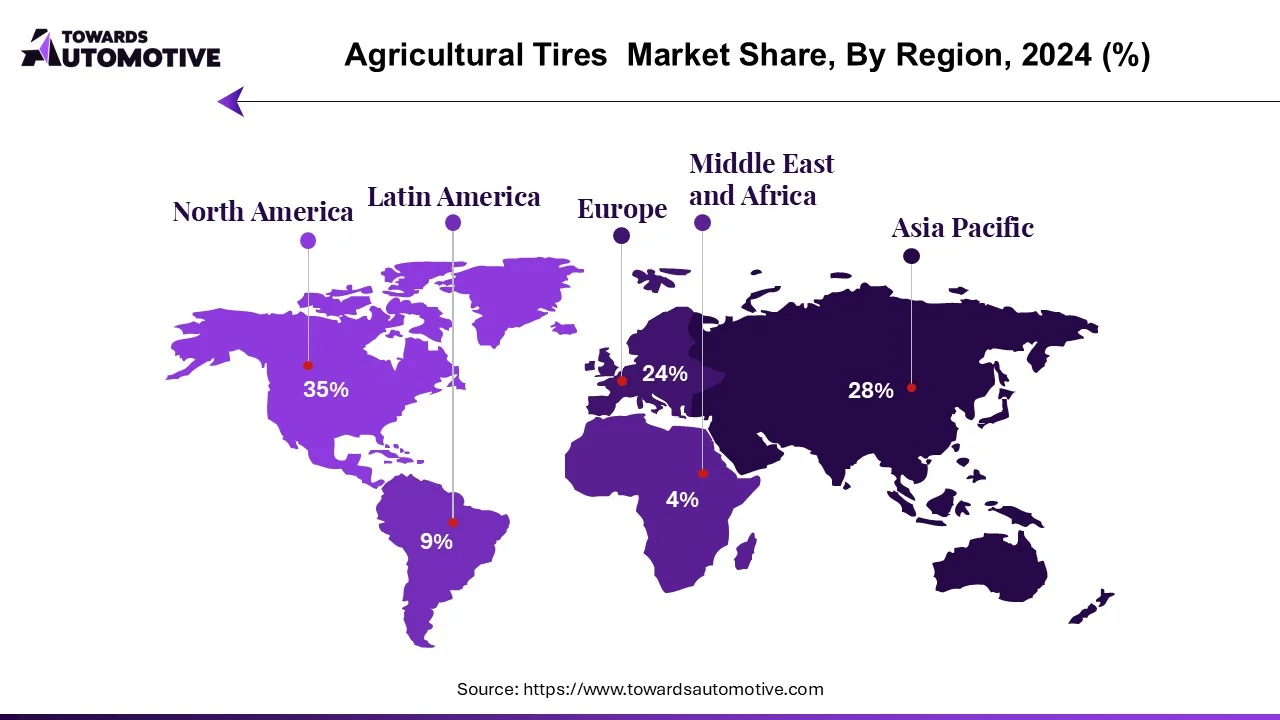

The agricultural tire market is driven by the increasing demand for efficient and effective agricultural equipment, particularly in field code design. Germany stands as the second-largest exporter and producer of agricultural tires globally after China. Factors such as the growing demand for agricultural products and the integration of technology in agricultural equipment contribute significantly to economic growth.

The agricultural aftermarket presents a highly fragmented landscape, posing risks for OEMs in this space. Changing agricultural machinery and the need for tires with enhanced durability in new terrains necessitate innovations such as floating tires, rubber tires, trailer tires, and flexible steel-wall composite rubber tires.

Rapid urbanization and rising living standards have exerted pressure on global food production, necessitating the expansion of agriculture to meet growing demand. This trend augments the demand for agricultural vehicles, thereby increasing the demand for tires during the forecast period.

The increasing demand for quality products featuring high resistance to puncture and wear will drive the production of premium agricultural tires, contributing to market growth and enhancing global food quality.

Local companies often leverage their strengths to focus on specialized services for tractors and crop equipment, aiming to retain customers. As the demand for agricultural products rises, the agricultural sector's need for tires continues to grow, prompting companies to invest in expanding their resources to meet escalating demand.

Migration from rural to urban areas, rising labor costs, and a shortage of skilled workers in many developing countries are driving sales of tractors. Scarcity and escalating costs in agriculture are key factors contributing to this growth.

The increasing demand for efficiency and the rise in labor costs are expected to drive up the demand for agricultural tractors. Productivity in the agricultural tractor market is anticipated to be affected by these factors during the forecast period.

Agricultural vehicles play a crucial role in performing essential daily tasks in farming and agriculture, such as planting, scouting, stone selection, and irrigation. Most of these tasks are now mechanized, leading to regular tire replacements and driving the growth of the global agricultural tires market during the forecast period.

The percentage of a country's total population engaged in agriculture is directly affected by factors like urbanization and agricultural prices. Consequently, to reduce reliance on labor, farmers are investing in agricultural equipment that reduces farming time and labor.

Governments have introduced new strategies to promote local production and consumption, aiming to streamline supply chains and address labor shortages in agriculture. To support small businesses, governments have implemented significant tax reforms.

For Instance,

Farmers have made significant investments in agricultural equipment to operate at high capacity with fewer labor resources. Despite the higher initial investment, these equipment contribute to improving overall crop quality and quantity. Many farmers are now downsizing their farming operations and renting out parts of their farms to offset rising labor costs.

With more farmers reducing their reliance on labor, tractor sales are expected to remain healthy in the coming years, driving the demand for tractor tires during the forecast period.

The overall strength of the U.S. economy, encompassing factors such as income levels, purchasing power, and infrastructure development, significantly influences the demand for agricultural tires. A robust economy fosters investment in agriculture, leading to heightened demand for equipment and tires.

Low-pressure tires play a crucial role in reducing soil compaction, as their longer treads distribute the tractor's weight more evenly. Research from Harper Adams University indicates that utilizing low-profile tires can increase productivity by an average of 4%. Consequently, various tire options have emerged in the market to address soil compaction concerns and enhance efficiency while adhering to safety standards.

In September 2020, Michelin introduced its latest agricultural tire, TRAILXBIB, designed for slurry trucks, spreaders, and trucks. This tire boasts exceptional power, longevity, and soil compaction reduction, featuring an air system with Michelin VF Ultraflex technology. Such innovations aim to minimize environmental impact and enhance agricultural yield. Michelin is expanding its range of services to offer digital solutions and connectivity to end customers, suppliers, and partners, further solidifying its presence in the agricultural sector.

The United States boasts a large and diverse agricultural sector, with numerous farms and ranches of varying sizes. The agricultural landscape features a mix of general farming practices, with large farms requiring significant quantities of farm tires to support various equipment and machinery needs. Additionally, the country is witnessing trends such as the consolidation of farms and the adoption of advanced agricultural technologies, contributing to increased productivity and efficiency.

Furthermore, the United States remains a major exporter of agricultural products, contributing to both domestic and international trade. Agricultural exports have experienced steady growth over the past few decades, driven by factors such as population growth, rising incomes, and increased food diversity. This growth underscores the importance of efficient agricultural equipment, including tires, in meeting domestic and global demand for agricultural products.

These factors collectively point to a continued increase in the demand for agricultural tires in the United States in the years to come.

The cost of raw materials is currently low, resulting in reduced production costs for agricultural tires. However, the sector may face limitations in growth due to the decline in availability of natural rubber products. Natural rubber contributes to tire hardening over time, which extends tire lifespan by allowing them to maintain their shape.

Radial tires, characterized by steel plies and a bead angle of 90 degrees to the circumferential centerline, offer durability and flexibility, reducing rolling resistance and improving performance. The demand for radial agricultural tires is expected to rise during the forecast period as a result.

Despite their advantages, radial tires are relatively costly to produce due to their use of synthetic rubber and modern manufacturing processes, necessitating expensive machinery. Consequently, these products have penetrated markets in large agricultural economies such as India and China. However, such factors may pose limitations to business expansion.

Additionally, companies like Carlisle Companies Inc., Trelleborg Wheel Systems, and Macquarie Tire & Rubber operate in this industry.

To sustain market competitiveness, major companies focus on product development and innovation, aiming to expand their product portfolios and maintain strong market presence.

Non-standard tires dominate the market, constituting 57.6% of global revenue in 2022. Their consumption is particularly high in India and China, driven by the abundant natural rubber production in these countries. Moreover, the cost-effective diagonal striated design of bias-ply tires is expected to further bolster their demand.

While the lower cost of raw materials reduces production costs, the sector's growth may be hindered by the decline in natural rubber products. Natural rubber tends to increase tire hardness over time, leading to reduced uniformity and shorter shelf life, thereby affecting the quality of agricultural tires.

Radial tires, characterized by steel plies for durability and a bead pattern at a 90-degree angle to the circumferential centerline, offer flexibility and reduced rolling resistance, thus enhancing performance. Consequently, the demand for radial agricultural tires is anticipated to rise during the forecast period.

However, radial tires are comparatively expensive due to the utilization of synthetic rubber and modern production processes, necessitating costly machinery. Despite their premium pricing, these tires have penetrated large agricultural markets, including India and China, as well as developed economies. Such factors may pose constraints on business expansion.

The tractor segment is projected to account for 44.1% of global revenue in 2022, given its widespread use across diverse agricultural settings. High-horsepower tractors are increasingly favored for their versatility in various agricultural applications, thereby driving tire demand.

Furthermore, the harvest segment is poised for increased tire demand owing to the introduction of specialized crops tailored for agricultural purposes. Initiatives like John Deere's introduction of specialty crops, designed for easy harvesting of crops such as sugar and corn, have spurred demand for tires on large farms.

Agricultural tires, designed specifically for use on farm machinery such as tractors, harvesters, and mowing machines, cater to the unique requirements of agriculture by offering traction, stability, and flotation across diverse terrains. Featuring deep treads, reinforced walls, and robust construction, these tires effectively handle heavy loads, reduce soil compaction, and enhance overall farm performance.

By Sales Channel Type

By Application Type

By Tire Type

By Geography

April 2025

April 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us