April 2025

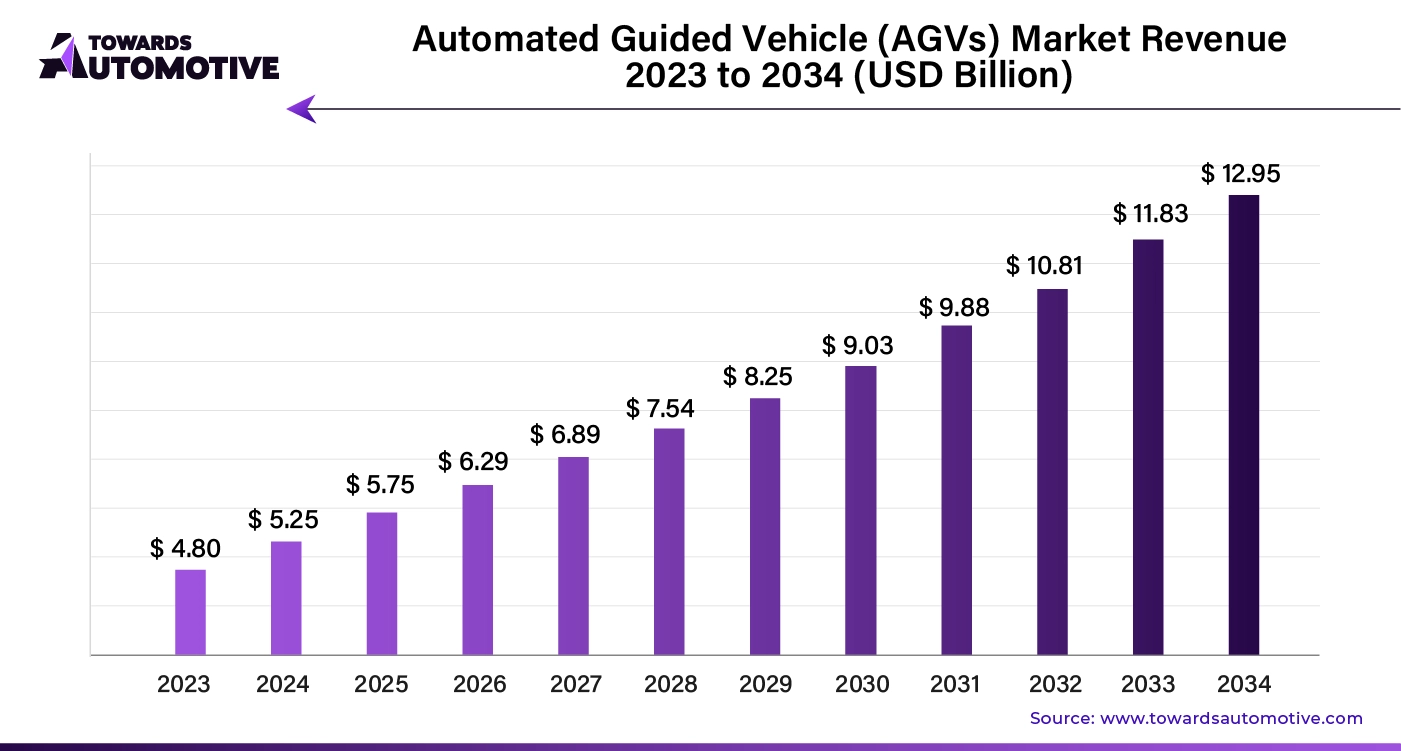

The global automated guided vehicle (AGVs) market size is calculated at USD 5.25 billion in 2024 and is expected to be worth USD 12.95 billion by 2034, expanding at a CAGR of 9.44% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Automated Guided Vehicle (AGVs) market is rapidly growing due to advancements in automation and the increasing need for efficient material handling solutions across industries. AGVs are autonomous vehicles used to transport goods in manufacturing facilities, warehouses, and distribution centers. With the rise of e-commerce and the push for greater operational efficiency, businesses are increasingly adopting AGVs to streamline processes, reduce labor costs, and improve productivity. These vehicles are equipped with advanced sensors, cameras, and navigation systems, allowing them to operate safely in dynamic environments. The demand for AGVs is further driven by the growing trend toward Industry 4.0, which emphasizes smart manufacturing and the integration of artificial intelligence (AI) and machine learning (ML) in industrial operations. Additionally, sectors such as automotive, logistics, and pharmaceuticals are significantly contributing to the AGV market's expansion. As companies seek to improve supply chain management and maintain competitive advantages, the adoption of AGVs is expected to rise, fostering innovation in automation technologies and reshaping the landscape of material handling.

Artificial Intelligence (AI) plays a crucial role in enhancing the efficiency and capabilities of Automated Guided Vehicles (AGVs) market. AI enables AGVs to navigate more intelligently by integrating machine learning algorithms and real-time data processing. These systems allow AGVs to make decisions, adapt to changes in their environment, and optimize routes without human intervention. AI-powered AGVs can recognize obstacles, predict potential collisions, and reroute dynamically, which enhances safety and operational efficiency.

AI also helps AGVs in improving task management by enabling predictive maintenance and self-diagnosis, which reduces downtime and improves vehicle reliability. The ability of AGVs to learn from historical data and refine their performance over time allows businesses to optimize material handling operations. Additionally, AI integration supports advanced applications such as multi-vehicle coordination, where AGVs communicate with each other to efficiently share tasks and streamline workflows in large-scale industrial environments.

As industries continue to prioritize automation and efficiency, the role of AI in AGVs will expand, enabling more sophisticated operations, reducing human errors, and significantly boosting productivity across sectors such as manufacturing, logistics, and warehousing. AI is thus a key driver of innovation and growth in the AGV market.

The rising application of Automated Guided Vehicles (AGVs) in the aerospace and automotive sectors is significantly driving the growth of the AGV market. In both industries, the need for precise, efficient, and automated material handling solutions has become critical as companies focus on improving production processes and reducing costs. In aerospace, AGVs are used for transporting heavy components, such as aircraft engines and fuselage sections, enhancing safety and reducing the risk of damage during movement. Similarly, in the automotive sector, AGVs are employed in assembly lines and logistics operations, where they facilitate just-in-time (JIT) production, optimize workflows, and ensure seamless integration into increasingly automated manufacturing environments.

The adoption of AGVs in these sectors is fueled by the growing demand for automation to meet higher production volumes and strict quality standards. AGVs enable manufacturers to streamline operations, reduce reliance on manual labor, and improve operational efficiency, particularly in handling bulky or complex components. As aerospace and automotive manufacturers continue to modernize their facilities and adopt smart manufacturing practices, the demand for AGVs is expected to grow, further propelling market expansion. This trend reflects the broader shift toward industrial automation and the increasing integration of AGVs in critical industrial processes.

The Automated Guided Vehicle (AGV) market faces several restraints that hinder its full potential for growth. High initial investment costs and the complexity of integrating AGVs into existing infrastructure pose challenges for businesses, especially small and medium-sized enterprises (SMEs). Additionally, the need for skilled labor to operate and maintain these advanced systems adds to operational expenses. Limited flexibility in adapting to dynamic environments and concerns about system reliability also slow widespread adoption. These factors collectively act as barriers, restricting the rapid expansion of the AGV market.

Hybrid Automated Guided Vehicles (AGVs) are creating new opportunities in the AGV market by offering a flexible and versatile solution for material handling across industries. Unlike traditional AGVs that rely solely on predefined paths and automated navigation, hybrid AGVs can seamlessly switch between automated and manual control, allowing for greater adaptability in dynamic environments. This dual-mode capability makes hybrid AGVs particularly appealing in industries such as manufacturing, warehousing, and logistics, where operational needs can vary significantly and may require human intervention at times.

The rise of hybrid AGVs is driven by the need for more cost-effective and scalable automation solutions. Companies can benefit from increased flexibility, as hybrid AGVs can operate autonomously when needed and be manually controlled for complex tasks or in environments that are not fully optimized for automation. This reduces downtime, improves operational efficiency, and lowers overall labor costs.

Moreover, hybrid AGVs support industries in their transition to full automation by providing a gradual integration path. As businesses explore automation options, hybrid AGVs offer a practical solution for handling diverse workloads, thus expanding the market potential for AGVs and creating new growth opportunities in the automation landscape.

The laser guidance segment held the largest share of the market. The laser guidance segment is a key driver of growth in the Automated Guided Vehicle (AGVs) market, offering precision and flexibility in navigation that significantly enhances the efficiency of material handling operations. Laser-guided AGVs use advanced laser scanners and reflectors to determine their exact location within a facility, allowing for highly accurate and reliable navigation in complex environments. This technology enables AGVs to operate with minimal human intervention, adapt to changes in their surroundings, and avoid obstacles, making it ideal for dynamic and crowded industrial settings such as warehouses, manufacturing plants, and distribution centers.

The growing demand for automation solutions that offer precision and adaptability has fueled the adoption of laser-guided AGVs. Industries such as automotive, logistics, and pharmaceuticals benefit from this technology, as it improves operational efficiency, reduces the risk of accidents, and minimizes downtime. Additionally, the ease of reprogramming laser-guided AGVs for different tasks and routes offers significant advantages in flexible manufacturing and just-in-time (JIT) production systems.

The logistics and warehousing segment led the market. The logistics and warehousing operations a major driver of growth in the Automated Guided Vehicle (AGVs) market, as companies increasingly adopt automation to enhance efficiency and reduce operational costs. AGVs play a critical role in streamlining material handling, inventory management, and order fulfillment processes in large warehouses and distribution centers. With the surge in e-commerce and the need for faster, more accurate delivery services, logistics operators are turning to AGVs to handle the high volume of goods and reduce reliance on manual labor.

AGVs enable real-time tracking and efficient movement of goods, optimizing workflows and minimizing human error. In warehousing environments, they can transport products, manage storage, and facilitate just-in-time (JIT) order picking, all while reducing operational bottlenecks. Their ability to work continuously and autonomously makes them particularly valuable in high-demand, fast-paced logistics environments.

As businesses strive to meet growing consumer expectations for quick and efficient deliveries, the integration of AGVs into logistics and warehousing operations has become a key growth driver. The increasing need for automated solutions to handle expanding product lines and inventory has made this segment one of the most dynamic forces in the AGV market.

The tow vehicle segment dominated the market. The tow vehicle segment is a significant driver of growth in the Automated Guided Vehicle (AGVs) market, offering robust solutions for industries requiring efficient and automated material transportation. Tow AGVs, designed to pull carts or trailers loaded with heavy goods, are widely used in sectors such as automotive, manufacturing, and logistics, where the need for moving large volumes of materials is critical. These vehicles streamline internal logistics by automating the transport of materials between production lines, storage areas, and shipping docks, reducing manual labor and increasing operational efficiency.

One of the key advantages of tow AGVs is their ability to transport multiple loads in a single trip, making them highly efficient for operations that involve bulk material handling. This significantly enhances productivity in industries with high throughput requirements, such as automotive assembly plants and large warehouses. Additionally, tow AGVs are easily programmable and can be integrated into flexible production environments, allowing companies to optimize workflows and minimize downtime.

The growing demand for automation, coupled with the need to improve efficiency and reduce operational costs, has positioned the tow vehicle segment as a key contributor to the expansion of the AGV market across various industries.

The indoor segment accounted for the largest share of the industry. The indoor segment is a key driver of growth in the Automated Guided Vehicle (AGVs) market, as industries increasingly adopt automation for indoor material handling processes. AGVs are widely used in indoor environments such as factories, warehouses, and distribution centers, where they streamline tasks like transporting goods, managing inventory, and supporting assembly line operations. These environments require precise, efficient, and reliable movement of materials, and AGVs provide an ideal solution by reducing human intervention and optimizing workflows.

Indoor AGVs are particularly advantageous in environments with high throughput and repetitive tasks, as they ensure consistent performance, minimize errors, and reduce labor costs. Their ability to navigate tight spaces, avoid obstacles, and adapt to changing conditions makes them indispensable for improving operational efficiency in confined indoor settings. The rise of smart factories and the growing focus on Industry 4.0 further fuel the adoption of indoor AGVs, as businesses seek to integrate automation into their processes.

As companies continue to prioritize operational efficiency and cost reduction, the indoor segment is expected to play a crucial role in driving the growth of the AGV market, particularly in sectors like manufacturing, logistics, and warehousing.

The hardware segment dominated the industry. The hardware segment is a pivotal driver of growth in the Automated Guided Vehicle (AGVs) market, as advancements in AGV technology increasingly rely on sophisticated hardware components. Key hardware elements, such as sensors, cameras, and control systems, play a crucial role in enhancing the functionality and efficiency of AGVs. These components enable precise navigation, obstacle detection, and real-time data processing, which are essential for the seamless operation of AGVs in diverse industrial environments.

Innovations in hardware technology, including the development of more advanced and reliable sensors, better battery systems, and improved onboard computing power, are driving the expansion of the AGV market. High-performance hardware allows AGVs to operate autonomously with increased accuracy and safety, facilitating applications such as material handling, inventory management, and automated transport within warehouses and production facilities.

The growing demand for automation and the need for efficient, scalable solutions in sectors like logistics, manufacturing, and healthcare are fueling investments in AGV hardware. As businesses seek to enhance operational efficiency and reduce costs, the continued advancement and integration of cutting-edge hardware components are expected to be key factors driving the growth of the AGV market.

The lead battery segment led the dominant share of the market. The lead battery segment is a significant driver of growth in the Automated Guided Vehicle (AGVs) market, providing a reliable and cost-effective energy solution for AGVs used in various industrial applications. Lead-acid batteries are favored for their robustness, durability, and relatively low initial investment compared to other battery technologies. They offer a dependable power source for AGVs, supporting extended operational hours and heavy-duty performance required in demanding environments like warehouses, manufacturing facilities, and distribution centers.

The lead battery’s ability to deliver high discharge rates and withstand frequent charge cycles makes it ideal for the high-intensity use typical of AGVs. Additionally, advancements in lead-acid battery technology, such as improved energy density and faster charging capabilities, are enhancing the performance and efficiency of AGVs. These improvements contribute to longer operational periods and reduced downtime, which are crucial for maintaining productivity and operational efficiency in industrial settings.

As industries continue to prioritize cost-effective and efficient automation solutions, the lead battery segment is expected to play a vital role in driving the AGV market’s expansion. The combination of affordability, reliability, and technological advancements in lead batteries positions them as a key component in the growth of the AGV sector.

The manufacturing segment held a dominant share of the market. The manufacturing segment is a major driver of growth in the Automated Guided Vehicle (AGVs) market, as industries seek to enhance efficiency and streamline operations through automation. AGVs play a critical role in manufacturing environments by automating material handling tasks such as transporting components, moving products between production lines, and managing inventory. This automation helps manufacturers reduce reliance on manual labor, minimize errors, and optimize production workflows, leading to increased productivity and cost savings.

The integration of AGVs in manufacturing facilities supports just-in-time (JIT) production, improves supply chain management, and enhances overall operational efficiency. Advanced AGV systems, equipped with sophisticated navigation and control technologies, facilitate smooth and reliable movement of materials, even in complex and high-traffic production environments. As manufacturers adopt smart technologies and Industry 4.0 practices, the demand for AGVs that offer flexibility, scalability, and seamless integration with existing systems continues to grow.

The drive towards automation and the need for efficient, scalable solutions in the manufacturing sector are propelling the expansion of the AGV market. By enabling more efficient material handling and reducing operational bottlenecks, AGVs are becoming indispensable tools in modern manufacturing processes.

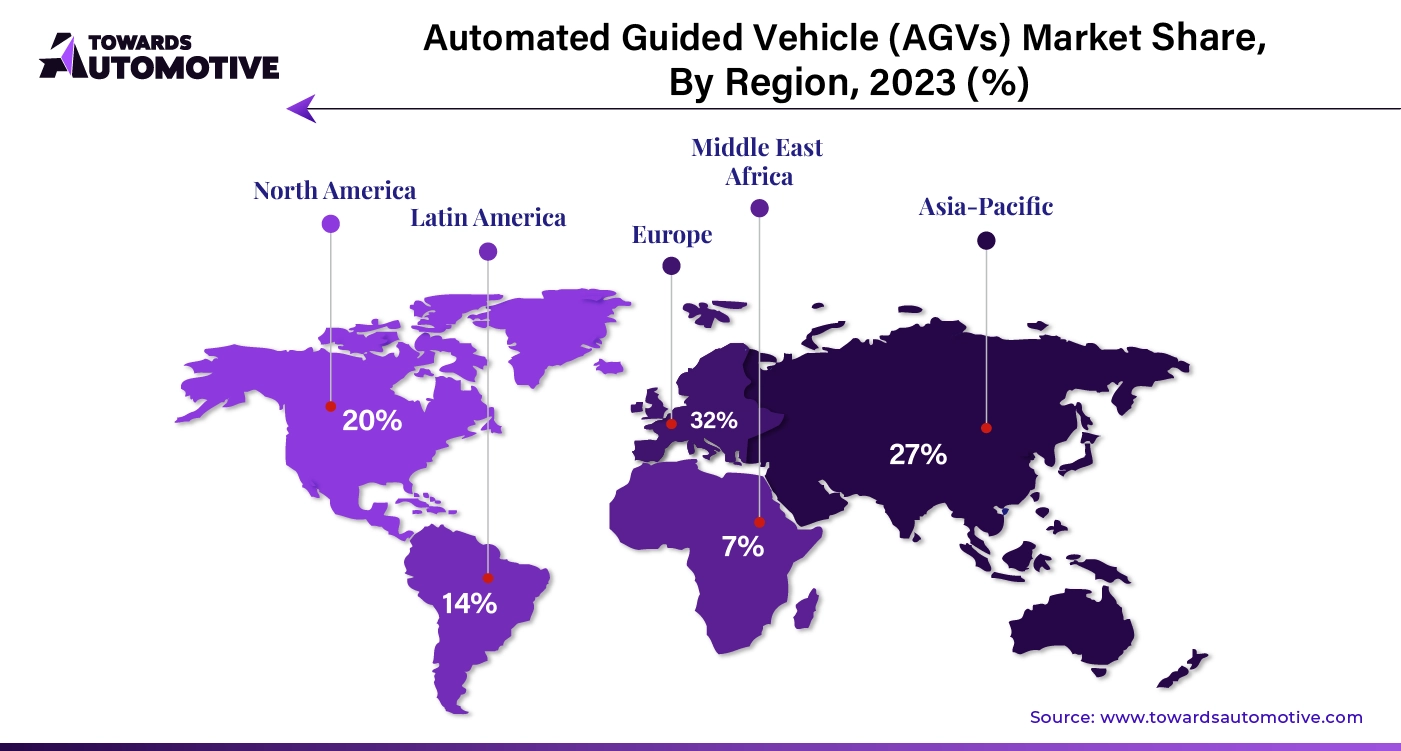

Europe dominated the automated guided vehicle (AGVs) market share by 32% in 2023. In Europe, the growth of the Automated Guided Vehicle (AGV) market is significantly driven by factors such as labor shortages, developed manufacturing and automotive sectors and the integration of Industry 4.0 technologies. Labor shortages across various industries have intensified the need for automation solutions like AGVs to perform repetitive and physically demanding tasks, reducing reliance on human labor and mitigating the impact of workforce gaps.

The region's robust manufacturing and automotive sectors further fuel AGV adoption, as these industries rely on efficient material handling to maintain high production levels and competitive advantage. AGVs enhance operational efficiency, streamline processes, and support complex assembly lines and logistics operations. Additionally, the push towards Industry 4.0 is accelerating the adoption of AGVs, as businesses integrate advanced automation technologies to modernize their operations.

Industry 4.0 emphasizes smart manufacturing and interconnected systems, where AGVs play a critical role by seamlessly integrating with other automated processes and data-driven systems. This alignment with technological advancements, combined with the need to address labor shortages and support key industrial sectors, drives the expansion of the AGV market in Europe, positioning it as a leader in automation and material handling solutions.

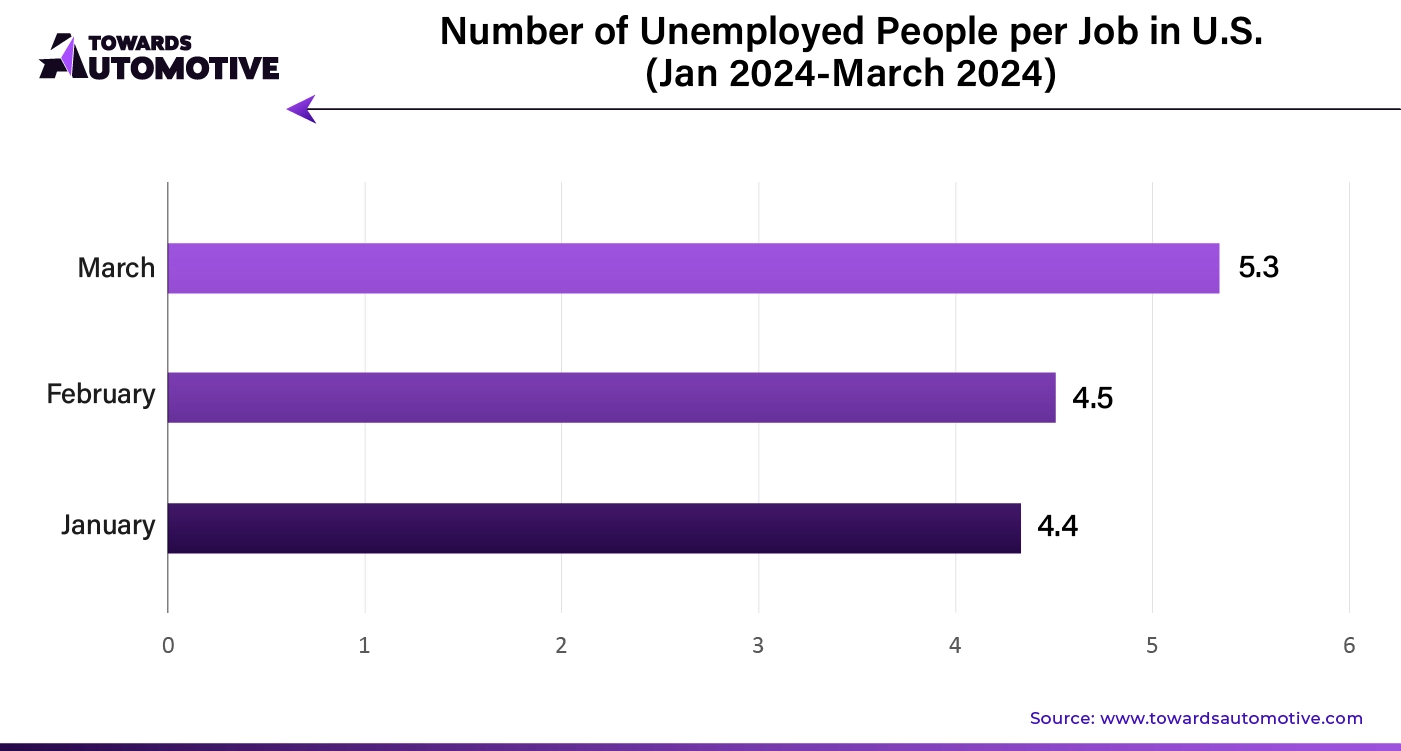

According to the Labor Statistics Data, in U.S, there are around 5.3 people unemployed for a job in March 2024, in February, 4.5 people remained unemployed and in January, the number was 4.4.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. In Asia Pacific, the Automated Guided Vehicle (AGVs) market is experiencing robust growth driven by the expansion of e-commerce, rapid industrialization, and significant urbanization and infrastructure development. The explosive growth of e-commerce in the region has created a surge in demand for efficient and scalable logistics solutions, where AGVs play a pivotal role in optimizing inventory management, order fulfillment, and distribution processes. As businesses strive to meet the increasing consumer expectations for fast and accurate deliveries, AGVs provide the automation needed to enhance efficiency and manage high volumes of goods.

Simultaneously, rapid industrialization across Asia Pacific is modernizing production facilities and supply chains, fueling the adoption of AGVs to streamline material handling and improve operational efficiency. The region's accelerated urbanization and infrastructure development further contribute to AGV market growth by expanding industrial and logistics hubs that require advanced automation solutions to manage complex workflows and large-scale operations. As cities and industrial zones grow, the need for AGVs to navigate and operate efficiently in these evolving environments becomes increasingly critical. Together, these factors drive the adoption of AGVs in Asia Pacific, positioning the region as a significant player in the global automation and material handling market.

By Navigation Type

By Application

By Component

By Battery Type

By Mode of Operation

By Vehicle Type

By End-use Industry

By Region

April 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us