April 2025

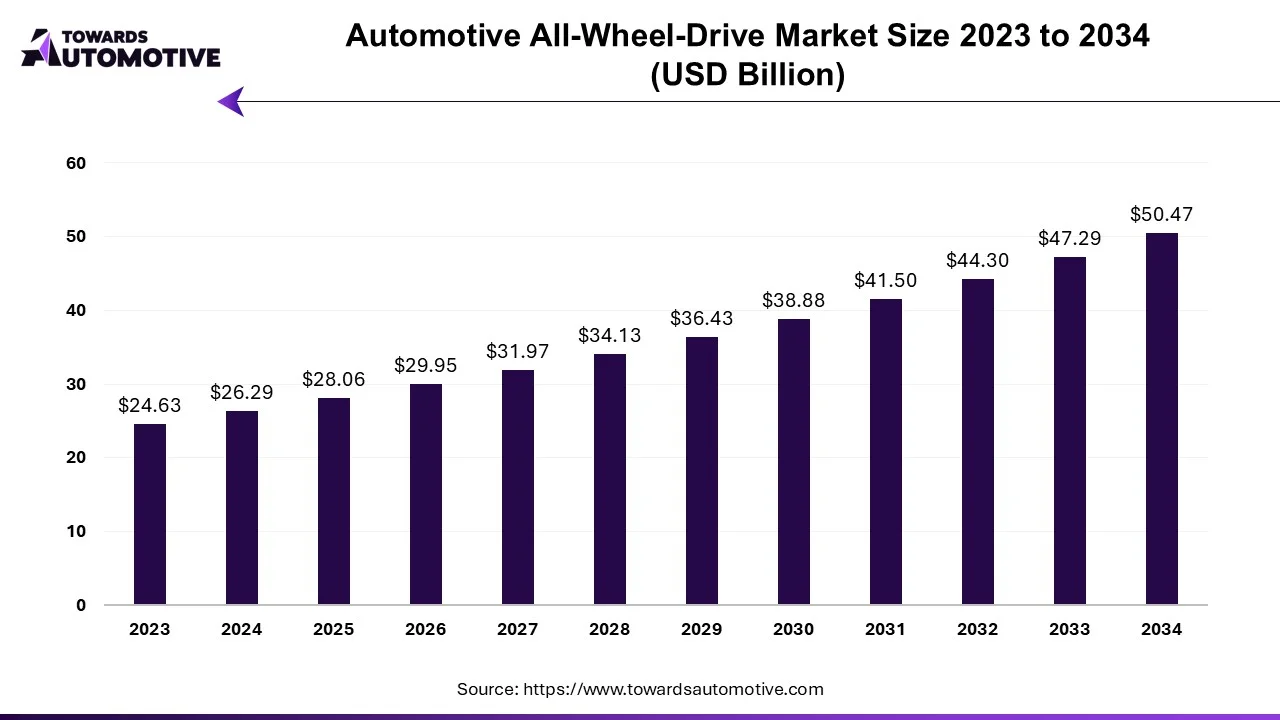

The automotive all-wheel-drive market is projected to reach USD 50.47 billion by 2034, growing from USD 28.06 billion in 2025, at a CAGR of 6.74% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The CAGR of the four-wheel drive market is attributed to the rising concern over road safety, stemming from the increase in accidents globally. This surge in accidents, resulting in numerous fatalities, has fueled the demand for four-wheel drive systems as a safety measure. With a growing number of accidents reported, particularly on international highways, there is a projected uptick in the demand for four-wheel drive vehicles in the coming years. The popularity of these systems has been on the rise recently and is expected to continue during the forecast period.

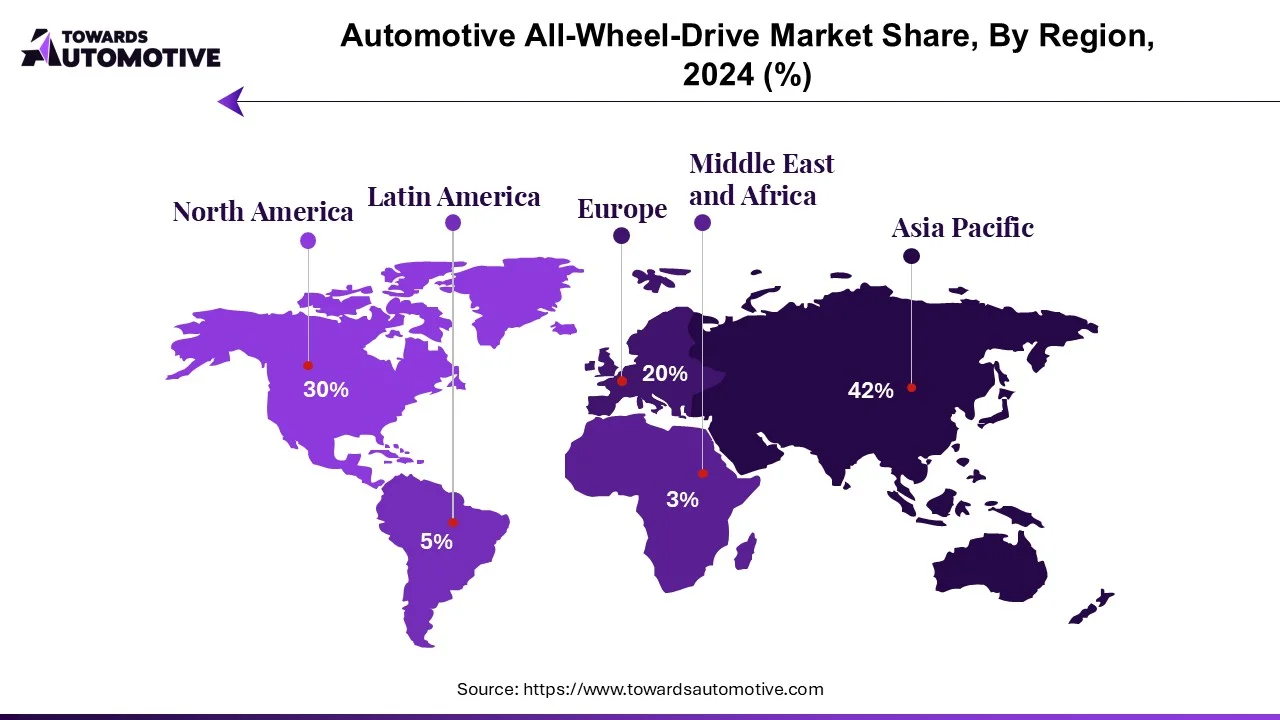

According to the World Health Organization's Global Road Safety Status Report, over 1.24 million people lost their lives in accidents worldwide in 2010. The escalating number of accidents has prompted countries to enact traffic safety regulations, with leading regions such as the EU and US taking proactive measures in regulating vehicle safety standards. Consequently, Original Equipment Manufacturers (OEMs) are introducing vehicles equipped with safety features aimed at enhancing vehicle stability, safety, and overall drivability. The All-Wheel Drive (AWD) system enhances vehicle stability and provides better traction compared to Rear-Wheel Drive (RWD) or Front-Wheel Drive (FWD) systems, driving up the demand for four-wheel drive vehicles, especially in developed regions like Europe and North America. In contrast, developing markets such as Asia-Pacific and other parts of the world are witnessing a gradual decline in demand for non-wheel drive vehicles. Harsh winter conditions and rugged terrains are fueling the demand for four-wheel drive vehicles to minimize accidents and ensure passenger and driver safety.

Technological advancements in the global four-wheel drive market are poised to shape the industry's trajectory. Today, various technologies available in the market are transforming modern vehicles into energy-efficient, automated, and safe systems. This trend is expected to facilitate smoother operation of four-wheel drive systems throughout the forecast period. While the demand for part-time 4x4 transmission remains high, advancements in technology are positioning four-wheel drive as an indispensable feature in vehicles. For instance, advancements in traction control system technology are pivotal in enhancing vehicle performance and driving safety.

The COVID-19 pandemic adversely impacted the industry due to the temporary closure of production facilities by major OEM companies, leading to a decline in global production and sales. However, with the resurgence of the economy and the revival of global automobile production, the market is witnessing a resurgence. Although passenger car sales experienced a dip in 2021 due to the pandemic, the market is gradually recovering.

The development and enhancement of All-Wheel Drive (AWD) systems and their integration into the burgeoning electric vehicle market are significant factors expected to propel the growth of the research industry in the forecast period. For instance, in June 2022, Hyundai India announced its plans to launch the new AWD electric car Hyundai Ioniq 5 in mid-August 2022. The improved performance and cooling of AWD systems are anticipated to drive future demand for four-wheel drive vehicles, particularly in North America, Europe, and the rapidly growing luxury vehicle market in the Asia-Pacific region.

Advancements in safety, security, and management systems are among the factors poised to fuel growth in the education sector. Previously limited to high-end vehicles, these systems are now being integrated into small cars and hybrid electric vehicles, driving global demand. New entrants in the automotive industry are continuously striving to develop and enhance four-wheel drive systems to boost performance and fuel efficiency, further shaping the market landscape.

The demand for passenger cars, particularly SUVs, has surged due to features like enhanced sportiness, handling, and traction provided by all-wheel drive (AWD) systems compared to sedans and crossovers. This trend is expected to continue between 2018 and 2022, driven by economic developments in both developed and developing countries. Currently, over 65% of SUVs on the roads worldwide are equipped with AWD powertrains.

For instance,

Safety remains a crucial factor in the selection of passenger cars equipped with AWD powertrains, especially in regions like North America and Europe where driving performance in winter or adverse weather conditions is paramount. Moreover, the integration of four-wheel drive into electric vehicles, including hybrids, plug-in hybrids, and battery electric vehicles, comes at a higher cost but is increasingly becoming essential.

For instance,

As the automotive industry continues to develop motor cars and hybrid electric cars, the demand for four-wheel drive systems is expected to grow steadily during the forecast period, aligning with advancements in technology and consumer preferences.

The four-wheel drive vehicle industry is characterized by key players such as BorgWarner Corporation, Toyota Motor Corporation, Eaton Corporation, Continental AG, Haldex AG, JTEKT Corporation, Dana Corporation, Nissan Motor Co., Ltd., and Magna International Corporation. These companies are actively expanding their businesses by leveraging new technologies to gain a competitive edge over their rivals.

A four-wheel drive vehicle is equipped with a powertrain capable of supplying power to all four wheels, either continuously or as needed. The typical configuration for four-wheel drive is the 4x4 setup, which consists of two axles capable of distributing power to all four wheels.

By Vehicle Type

By Propulsion Type

By System Type

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us