December 2025

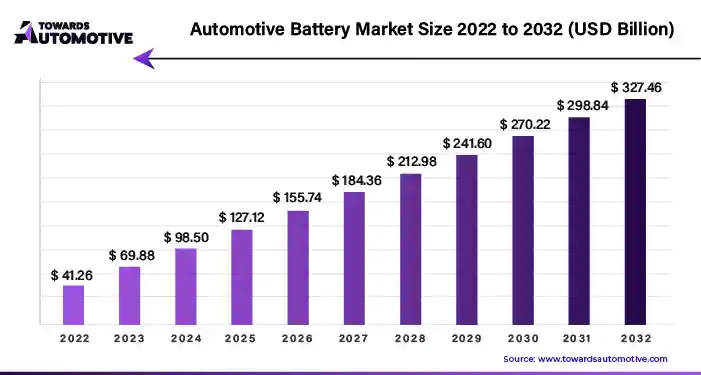

The automotive battery market is set to grow from USD 98.63 billion in 2025 to USD 462.10 billion by 2034, with an expected CAGR of 18.72% over the forecast period from 2025 to 2034.

The automotive battery market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of batteries for the automotive sector. There are several types of batteries developed in this sector comprising of lithium-ion based, lead-acid based, nickel based, sodium-ion and some others. These batteries are designed for different types of vehicles consisting of passenger cars, commercial vehicles, and some others. The growing sales of BEVs in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the electric vehicle industry around the world.

| Metric | Details |

| Market Size in 2024 | USD 83.08 Billion |

| Projected Market Size in 2034 | USD 462.10 Billion |

| CAGR (2025 - 2034) | 18.72% |

| Market Segmentation | By Type, By Drive, By Sales Channel and By Region |

| Top Key Players | Panasonic Corporation; LG Energy Solution.; Exide Technologies; GS Yuasa International Ltd. |

The passenger cars segment led the industry. The growing demand for luxury cars among elite class people has boosted the market expansion. Also, the increasing sales of electric hatchbacks coupled with rapid adoption of SUVs by off-roading enthusiasts is further contributing to the industrial growth. Additionally, rising trend of fuel-efficient cars in mid-income nations such as India, Vietnam, Indonesia and some others is expected to drive the growth of the automotive battery market.

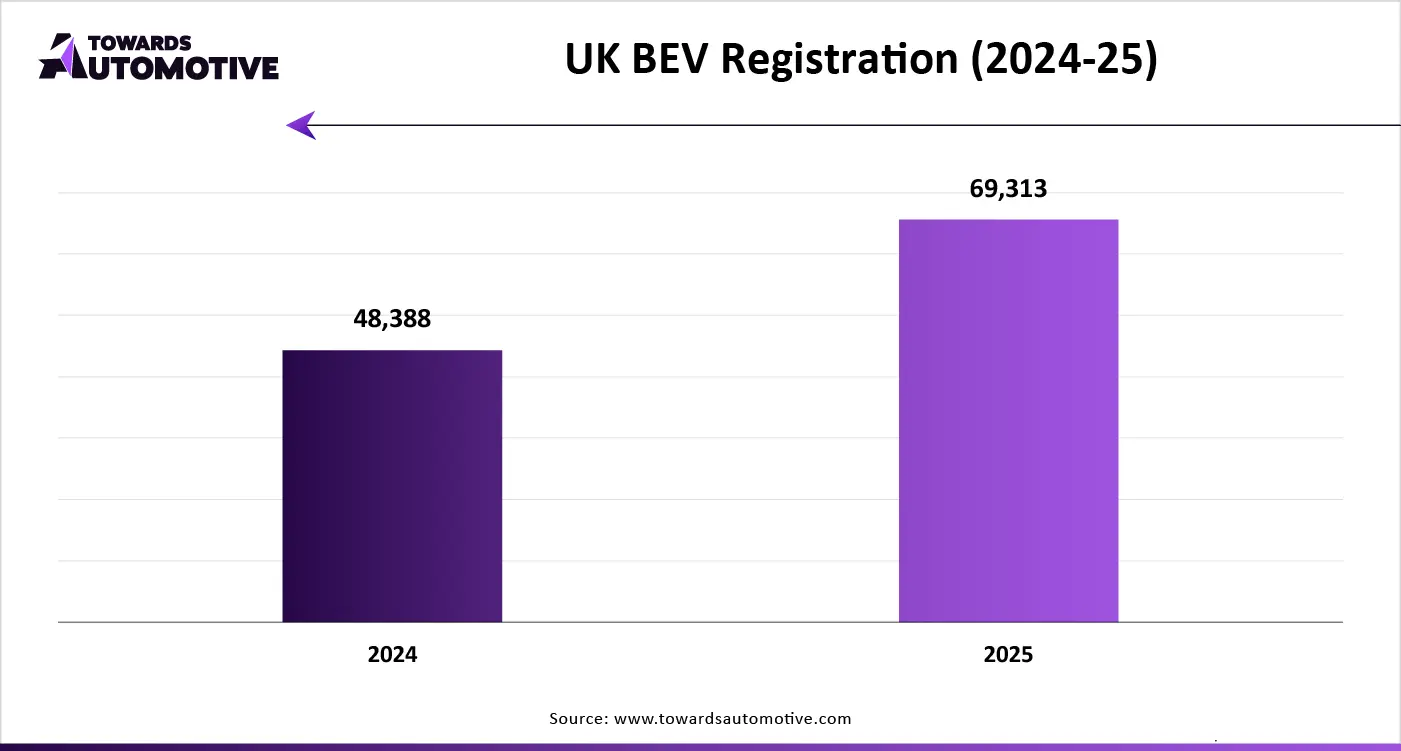

The commercial vehicle segment is likely to grow with a significant rate during the forecast period. The growing demand for heavy duty trucks from several industries such as oil and gas, chemicals, logistics and some others has boosted the market expansion. Additionally, the increasing adoption of LCEVs in e-commerce sector along with rise in number of fleet operators is further adding to the industrial growth. Moreover, surge in demand for electric buses and autonomous trucks in western nations such as UK, France, Germany, U.S., UAE and some others is likely to boost the growth of the automotive battery market.

The lead-acid battery segment held the largest share of the market. The rising use of lead-acid batteries in ICE vehicles for operating various tasks is driving the market expansion. Also, the growing adoption of lead-acid batteries in commercial vehicles along with numerous partnerships among automotive brands and battery manufacturers for developing advanced lead-acid batteries is contributing significantly to the industrial growth. Moreover, numerous advantages of these batteries including low-cost, high-power output, mature technology and some others is projected to foster the growth of the automotive battery market.

The sodium-ion battery segment is anticipated to rise with a significant CAGR during the forecast period. The rising use of these batteries in electric vehicles to deliver superior driving range has boosted the market growth. Additionally, constant research and developments by institutions for developing sodium-ion batteries is further adding to the overall industrial expansion. Moreover, the geopolitical tensions among China and the U.S. have disturbed the supply chain of lithium-ion batteries that in turn increases the demand for sodium-ion batteries, thereby driving the growth of the automotive battery market.

The Electric Vehicles (EV) segment dominated this industry. The growing sales and production of EVs around the world has boosted the market expansion. Additionally, numerous government initiatives aimed at adopting EVs along with rapid investment by various public-sector entities for developing the EV charging infrastructure is likely to shape the industry in a positive direction. Moreover, partnerships and collaborations among EV brands and battery manufacturers for developing EV batteries is further driving the growth of the automotive battery market.

The Internal Combustion Engine (ICE) vehicles segment is predicted to rise with a considerable CAGR during the forecast period. The growing sales of gasoline-powered passenger vehicles has increased the demand for lithium-ion batteries, thereby fostering the industrial expansion. Additionally, the rising use of lead-acid batteries in diesel trucks along with technological advancements in battery manufacturing sector has boosted the market growth. Moreover, rapid investment by battery companies for opening new battery manufacturing plants to cater the needs of the ICE vehicles is further accelerating the growth of the automotive battery market.

North America held the highest share of the automotive battery market. The growing adoption of electric vehicles in countries such as Canada and the U.S. for lowering emission has boosted the market expansion. Additionally, the rising demand for high-performance cars along with rapid investment by battery companies for opening new manufacturing facilities is further adding to the industrial growth. Moreover, the presence of several automotive brands such as Ford, Chevrolet, Jeep and some others is anticipated to foster the growth of the automotive battery market in this region.

U.S. dominated the market in this region. The growing demand for luxury vehicles along with numerous government initiatives to develop the automotive sector has boosted the market growth. Additionally, the presence of several EV manufacturing brands such as Tesla, Rivian, General Motors and some others is contributing to the industrial expansion.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The rising sales and production of vehicles in several nations such as India, China, Japan, South Korea and some others has boosted the market growth. Also, the rapid developments in the battery manufacturing industry coupled with increasing adoption of hybrid vehicles is adding to the industrial expansion. Moreover, the presence of several market players such as Panasonic Holdings Corporation, LG Energy Solution Ltd., Samsung SDI; and some others is likely to boost the growth of the automotive battery market in this region.

China leads the market in this region. In China, the market is generally driven by the rising sales of commercial vehicles along with abundance of raw materials and availability of skilled labors. Additionally, the presence of well-developed battery industry with various market players such as CALB, CATL, A123 Systems, BYD and some others is projected to foster the market growth.

The automotive battery market is a highly fragmented industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of CATL, Panasonic Corporation; LG Energy Solution.; Exide Technologies; GS Yuasa International Ltd.; A123 Systems (Wanxiang A123 Systems Corp.); East Penn Manufacturing Company; Robert Bosch GmbH; ENERSYS.; Samsung SDI; Hitachi, Ltd and some others. These companies are constantly engaged in developing batteries for the automotive sector and adopting numerous strategies such as business expansions, collaborations, launches, partnerships, acquisitions, joint ventures, and some others to maintain their dominant position in this industry. For instance, in April 2025, Hitachi partnered with JBM Electric Vehicles. This partnership is aimed at integrating Hitachi’s batteries in JBM’s electric buses. Also, in October 2024, SAMSUNG SDI launched a new range of automotive batteries. This new line-up consists of solid-state batteries, 46-phi cylindrical batteries, and LFP+ batteries.

By Type

By Drive

By Sales Channel

By Region

The electric vehicle maintenance industry is expected to grow from USD 21.08 billion in 2024 to USD 84.84 billion by 2034, driven by a CAGR of 15.9%. ...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us