December 2025

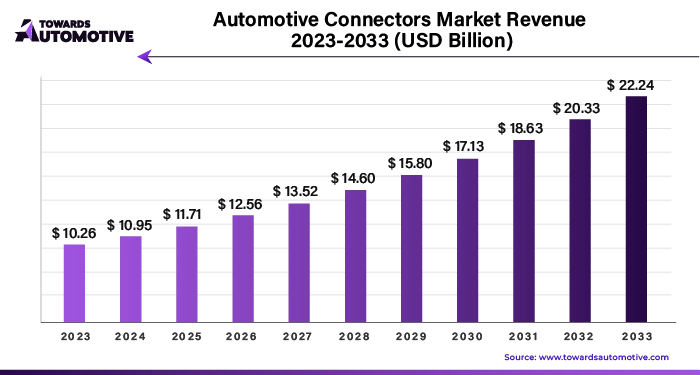

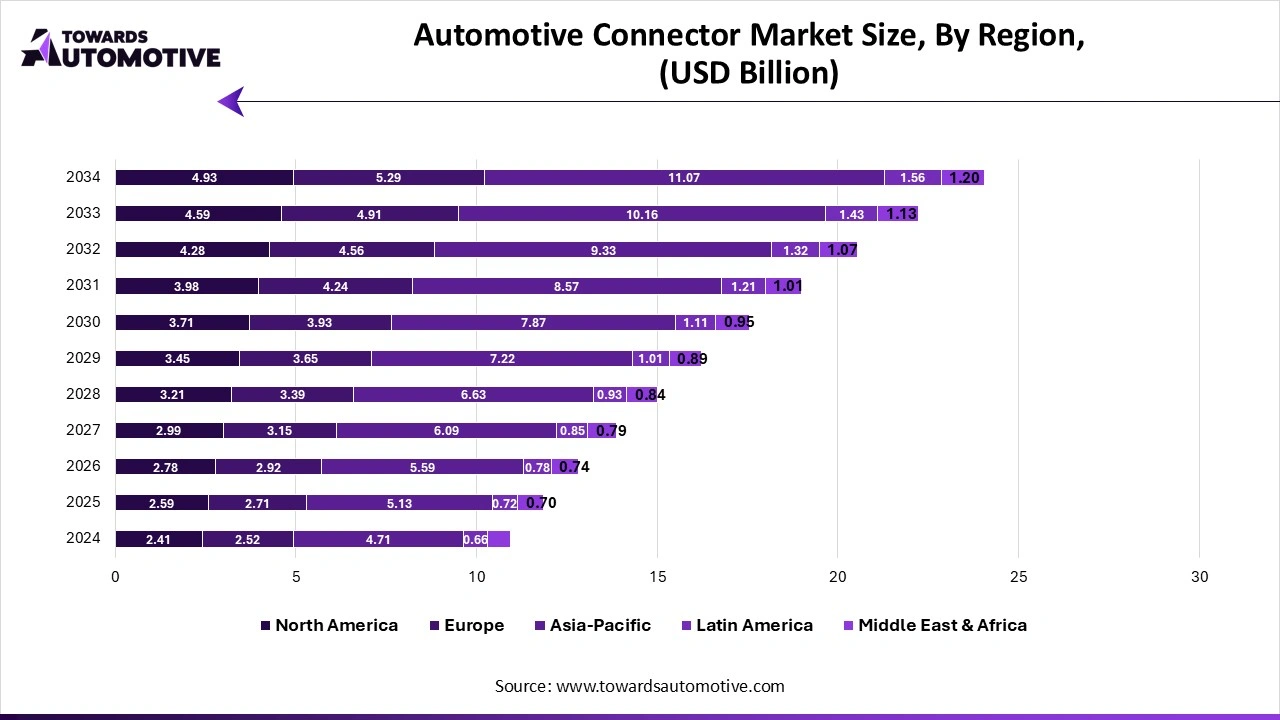

The global automotive connector market is forecast to grow from USD 13.52 billion in 2025 to USD 24.08 billion by 2034, driven by a CAGR of 8.19% from 2025 to 2034.

The automotive connectors market is a vital component of the automotive industry, responsible for ensuring reliable electrical connections between various vehicle systems and components. With the increasing complexity of modern vehicles, which are now equipped with advanced electronics, infotainment systems, safety features, and electric powertrains, the demand for high-performance connectors is growing rapidly. Automotive connectors facilitate communication between electronic control units (ECUs), sensors, and actuators, ensuring smooth operation of functions such as engine control, lighting, climate control, and navigation systems.

One of the primary drivers of the automotive connector market is the growing adoption of electric and hybrid vehicles. These vehicles require more intricate and efficient electrical systems to manage energy distribution and communication between battery management systems and other critical components. As a result, demand for specialized connectors designed for high-voltage and high-power applications is on the rise.

Another factor contributing to the growth of the market is the increased focus on vehicle safety. Advanced driver assistance systems (ADAS), airbags, and crash detection systems rely heavily on reliable connectors to ensure they function seamlessly, enhancing vehicle safety and regulatory compliance. The trend toward autonomous driving is also driving innovation in the automotive connector market. As self-driving vehicles become more prevalent, the need for robust, high-speed data transmission and secure connections becomes crucial, further boosting the demand for advanced connectors.

The role of AI in the automotive connectors market is transformative, enhancing both the design and functionality of connectors to meet the increasing demands of modern vehicles. As vehicles become more electrified and autonomous, AI plays a critical role in optimizing the performance and efficiency of the electrical systems that rely on connectors for seamless communication between components. One of the key contributions of AI is in predictive maintenance and quality control. AI-driven systems can analyze data from sensors and connectors to detect potential faults or failures before they occur, improving the reliability of vehicle systems. By monitoring real-time data, AI can predict wear and tear on connectors, reducing the likelihood of malfunction and minimizing downtime for repairs.

AI also aids in design optimization. Through machine learning algorithms, manufacturers can simulate various designs and materials to create more durable and efficient connectors that can withstand harsh automotive environments such as extreme temperatures, vibrations, and moisture. This leads to improved performance and longevity of connectors in both electric vehicles (EVs) and traditional internal combustion engine (ICE) vehicles. In autonomous vehicles, AI enhances the need for high-speed data transmission between components like sensors, cameras, and control units. AI-powered systems ensure that connectors support the high bandwidth and low-latency communication necessary for advanced driver assistance systems (ADAS) and autonomous driving technologies, improving vehicle safety and performance.

In July 2024, Emobi announced partnership with Autocrypt. This partnership aims at integrating AI in EV plugs.

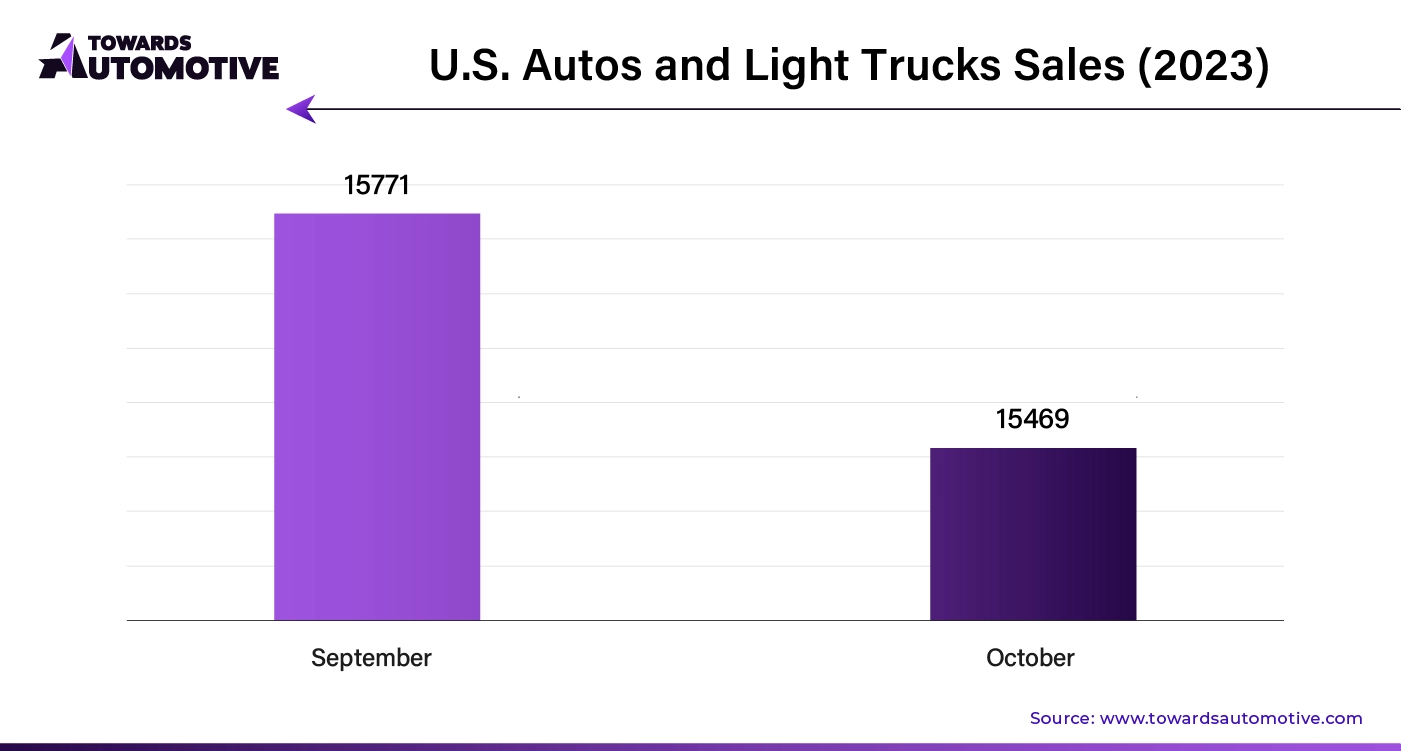

The rising sales of commercial vehicles are significantly driving the growth of the automotive connectors market. As demand for commercial vehicles increases across sectors such as logistics, construction, public transportation, and e-commerce, there is a parallel need for more robust, reliable, and advanced electrical systems. Commercial vehicles, including trucks, buses, and vans, rely heavily on a network of connectors to ensure proper communication between various vehicle systems, including engine management, safety features, telematics, and infotainment systems.

One of the key reasons commercial vehicle sales boost the automotive connector market is the increasing complexity of vehicle electronics. Modern commercial vehicles are equipped with advanced driver assistance systems (ADAS), telematics for fleet management, and navigation systems, all of which require highly efficient connectors to ensure seamless data transfer and system integration. This complexity calls for connectors that can handle higher power and more data, especially in electric and hybrid commercial vehicles, where powertrain electrification adds new demands on electrical systems.

Additionally, the growing emphasis on vehicle safety and regulatory compliance in commercial transportation is pushing manufacturers to incorporate more sophisticated electrical systems, further fueling the demand for high-performance connectors. For instance, connectors are crucial in systems like electronic stability control (ESC), airbags, and braking systems, ensuring safe and reliable operation.

As the commercial vehicle sector continues to grow, especially with the push for electric commercial fleets and smart fleet management solutions, the automotive connector market will experience sustained growth, driven by the need for enhanced connectivity, safety, and efficiency in vehicle operations.

The automotive connectors market faces several restraints that can hinder its growth. One key challenge is the high cost of advanced connectors, particularly those used in electric vehicles (EVs) and autonomous systems. These connectors require precision engineering and durable materials, which can drive up manufacturing costs and limit widespread adoption, especially in cost-sensitive regions. Additionally, complexity in connector design due to increasing vehicle electronics can lead to compatibility issues and higher maintenance costs. Furthermore, stringent regulations around vehicle safety and emissions add pressure on manufacturers to meet compliance standards, impacting production timelines and costs.

Smart connectors are revolutionizing the automotive connectors market by creating new opportunities for enhanced vehicle performance, reliability, and efficiency. Unlike traditional connectors, smart connectors are embedded with sensors and diagnostic capabilities, enabling real-time monitoring and data collection. These connectors can detect potential issues such as wear and tear, corrosion, or power fluctuations, providing predictive maintenance capabilities. By alerting drivers or fleet operators to maintenance needs before failures occur, smart connectors help reduce downtime and repair costs, making them highly valuable in commercial fleet management and advanced automotive systems.

Smart connectors also play a crucial role in the growing landscape of autonomous vehicles and advanced driver assistance systems (ADAS). These systems require highly reliable, low-latency data transmission, and smart connectors ensure optimal communication between critical components such as sensors, cameras, radar, and control units. This supports safer and more efficient vehicle operations.

Furthermore, as electric vehicles (EVs) become more widespread, smart connectors enhance the efficiency of high-voltage and high-power connections. Their ability to manage power distribution and monitor energy flow in real time is essential for the growing electrification trend in the automotive sector.

The fiber optic segment held the largest share of the market. The fiber optic segment is driving significant growth in the automotive connectors market due to the increasing demand for high-speed data transmission and improved vehicle communication systems. Fiber optic connectors provide faster and more reliable data transfer compared to traditional copper-based connectors, making them ideal for modern vehicles equipped with advanced technologies such as autonomous driving, advanced driver assistance systems (ADAS), and infotainment systems.

As vehicles become more connected, the need for high-bandwidth communication to support real-time data processing and exchange between various electronic systems is growing. Fiber optics offer low-latency, high-speed connectivity, which is crucial for systems like cameras, radar, and LiDAR in autonomous and semi-autonomous vehicles. This ensures smoother operation and greater safety by enabling rapid decision-making based on real-time sensor data.

Additionally, the lightweight nature of fiber optic cables compared to copper alternatives contributes to overall vehicle weight reduction, which is a key factor in improving fuel efficiency and performance, particularly in electric vehicles (EVs). As automakers strive to meet stringent fuel efficiency and emission standards, the adoption of fiber optics in vehicle design supports these goals.

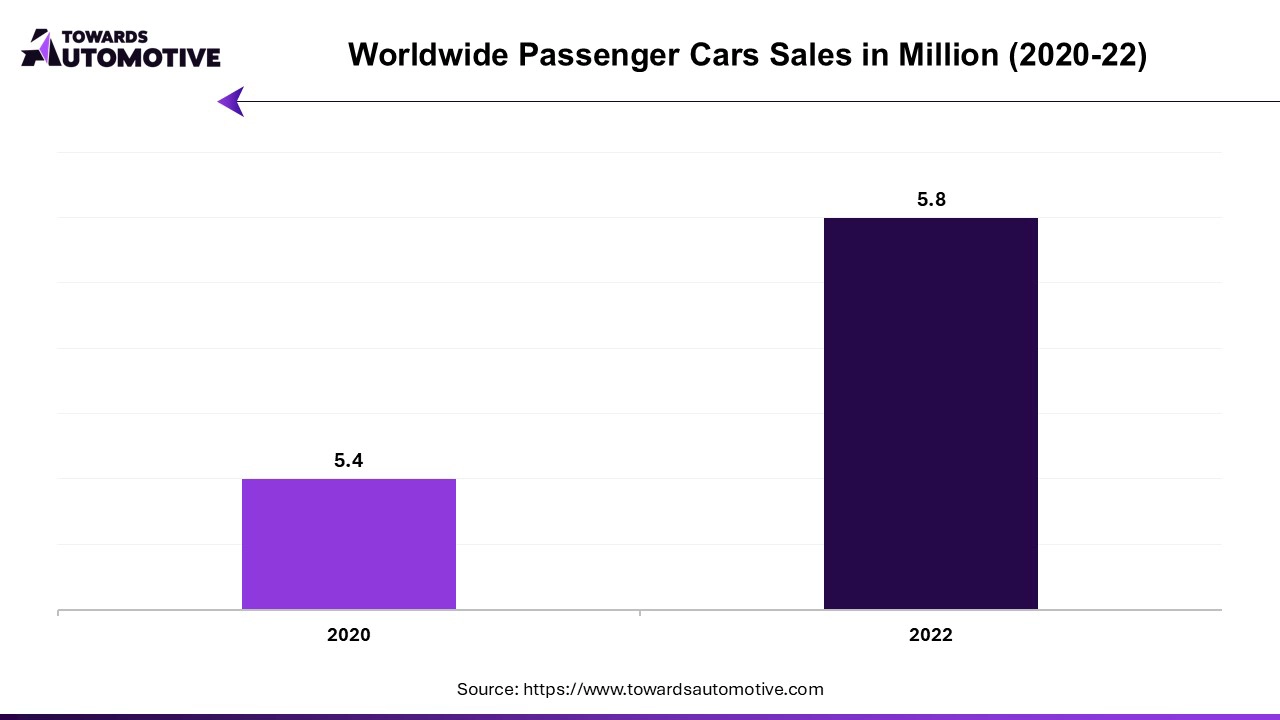

The passenger car segment dominated the industry. The passenger car segment is a major driver of growth in the automotive connectors market, reflecting the increasing complexity and integration of electronic systems within vehicles. As passenger cars evolve with advanced technologies, there is a growing need for connectors that facilitate reliable and efficient communication between various components. Modern passenger cars are equipped with a multitude of electronic systems, including infotainment units, advanced driver assistance systems (ADAS), navigation systems, and in-vehicle networking, all of which rely heavily on a network of connectors.

The demand for high-performance connectors is driven by the need for seamless connectivity and data transmission to support features such as touchscreens, voice recognition, and real-time traffic updates. Additionally, the integration of safety features like airbags, electronic stability control (ESC), and collision avoidance systems requires advanced connectors that ensure reliable operation and compliance with safety standards.

Furthermore, the push towards electric and hybrid vehicles within the passenger car segment necessitates connectors that can handle high-voltage and high-power applications efficiently. This includes connectors for battery management systems, charging ports, and electric drive systems. As consumer expectations for comfort, safety, and technology continue to rise, the passenger car segment remains a crucial growth driver for the automotive connectors market, fueling demand for innovative and reliable connector solutions.

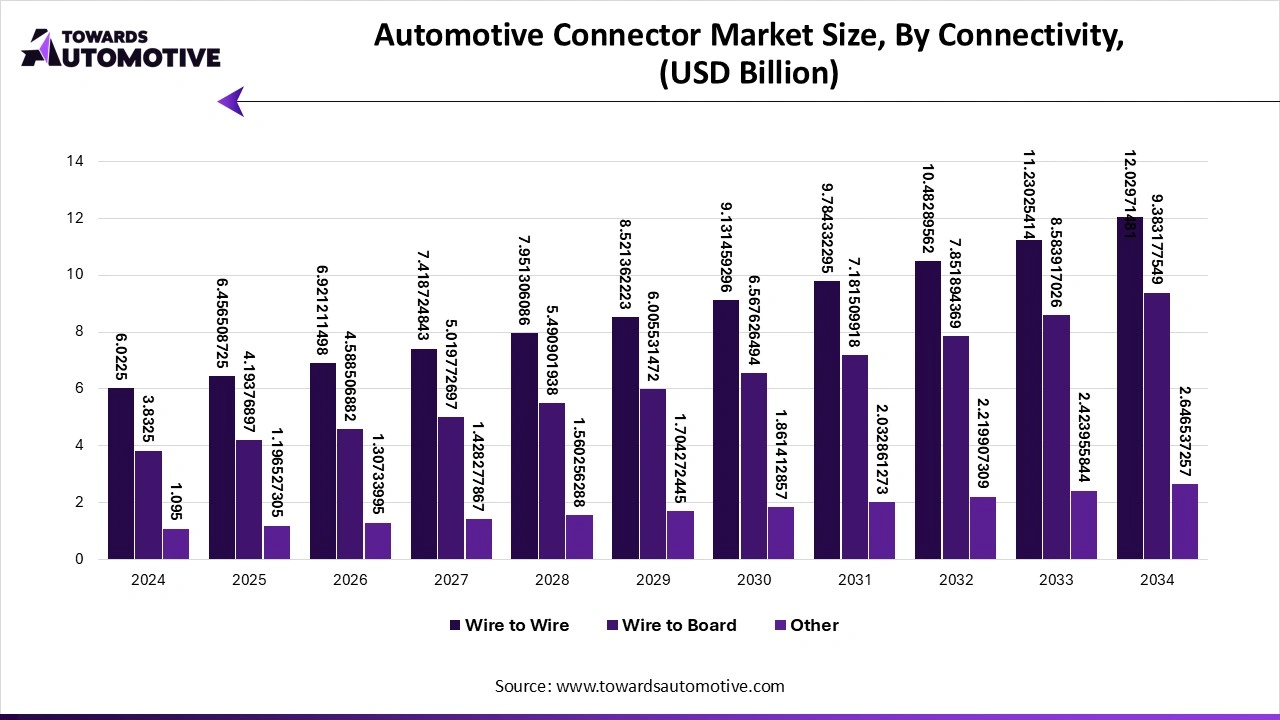

The wire-to-wire segment led the market. The wire-to-wire segment is a key driver of growth in the automotive connectors market, reflecting its essential role in enabling reliable and efficient electrical connections within vehicles. Wire-to-wire connectors facilitate the seamless connection between different wires or cables, allowing for effective communication and power distribution across various automotive systems. This type of connector is crucial in managing the complex wiring harnesses found in modern vehicles, where numerous electrical components and systems need to be interconnected. As vehicles become increasingly advanced, with sophisticated infotainment systems, advanced driver assistance systems (ADAS), and hybrid or electric powertrains, the demand for robust and high-performance wire-to-wire connectors grows. These connectors must support high data rates and endure harsh automotive environments, including temperature fluctuations, vibrations, and exposure to moisture.

Additionally, the trend towards modular vehicle designs and customizable wiring solutions in the automotive industry further boosts the demand for versatile wire-to-wire connectors. They provide flexibility and reliability in assembling vehicle wiring harnesses, which is essential for meeting varying design specifications and performance requirements.

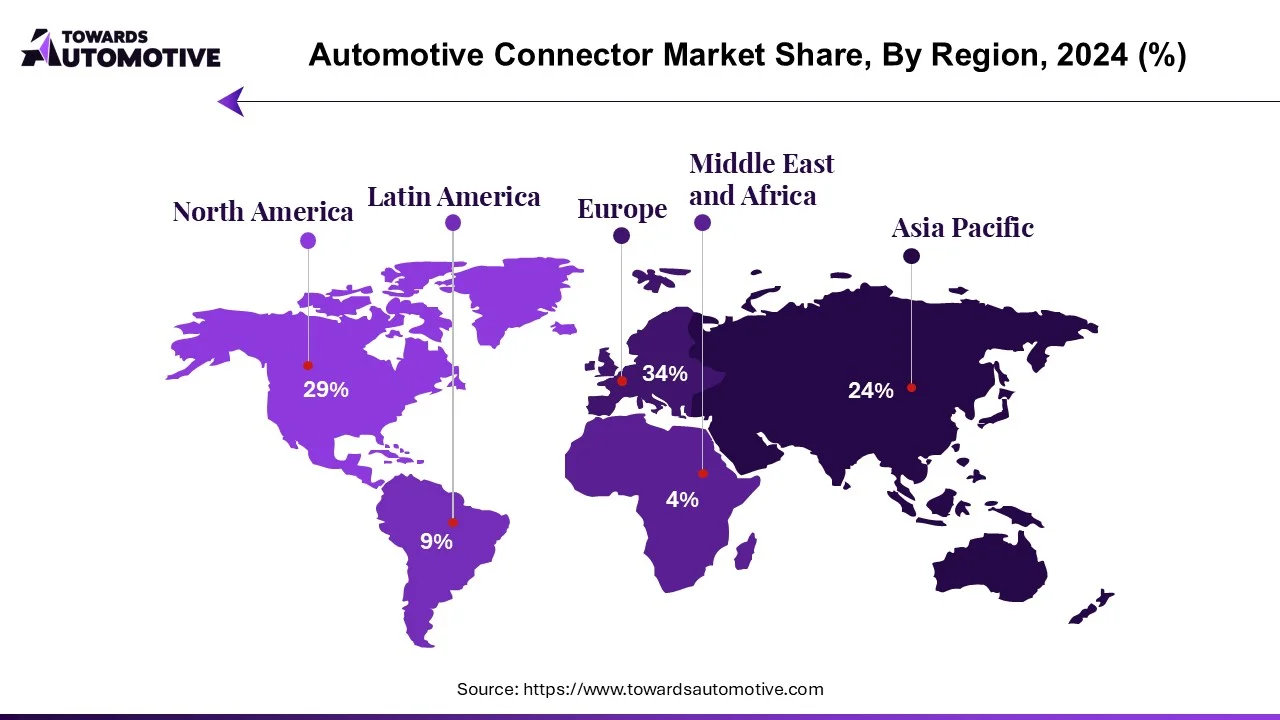

Asia Pacific dominated the automotive connectors market. The automotive connectors market in Asia Pacific (APAC) is experiencing robust growth driven by several key factors. First, rapid vehicle electrification is playing a significant role as the region shifts towards electric vehicles (EVs). With governments offering incentives and consumers increasingly adopting EVs, there is a growing demand for connectors that can handle high-voltage and high-power applications, such as battery management systems and charging infrastructure.

Secondly, rising consumer demand for advanced features is contributing to the growth of the market. Modern vehicles in APAC are increasingly equipped with sophisticated in-vehicle technologies such as infotainment systems, advanced driver assistance systems (ADAS), and connectivity features. These systems require reliable and high-performance connectors to support seamless data transmission and power distribution.

Thirdly, the growing automotive industry in countries like China, India, and Japan is fueling demand for automotive connectors. As vehicle production scales up to meet consumer demand, automakers are integrating more electronic components and systems, driving the need for a wide variety of connectors. The expansion of automotive manufacturing facilities and R&D investments across the region further supports market growth, positioning APAC as a key player in the global automotive connectors market.

Europe is expected to grow with a significant CAGR during the forecast period. The automotive connectors market in Europe is experiencing significant growth, driven by several important factors. First, investment in research and development (R&D) plays a critical role in advancing connector technologies. European automakers and suppliers are continuously investing in R&D to develop high-performance connectors that support advanced automotive systems, such as autonomous driving, electric vehicles (EVs), and advanced driver assistance systems (ADAS). These innovations are pushing the demand for more sophisticated connectors.

Second, technological advancements in the European automotive sector are driving market growth. As vehicles become increasingly complex with higher levels of automation and connectivity, the need for reliable and high-speed connectors grows. These connectors are essential for enabling seamless communication between different vehicle components, ensuring safety, performance, and efficiency.

Lastly, stringent safety and emission regulations in Europe are another major growth driver. The European Union’s rigorous regulatory framework requires automakers to meet high standards for vehicle safety and environmental performance. Connectors are essential for ensuring that systems like emissions controls, electric powertrains, and safety features comply with these regulations, leading to increased demand for reliable and durable connectors. These combined factors make Europe a key region for growth in the automotive connectors market.

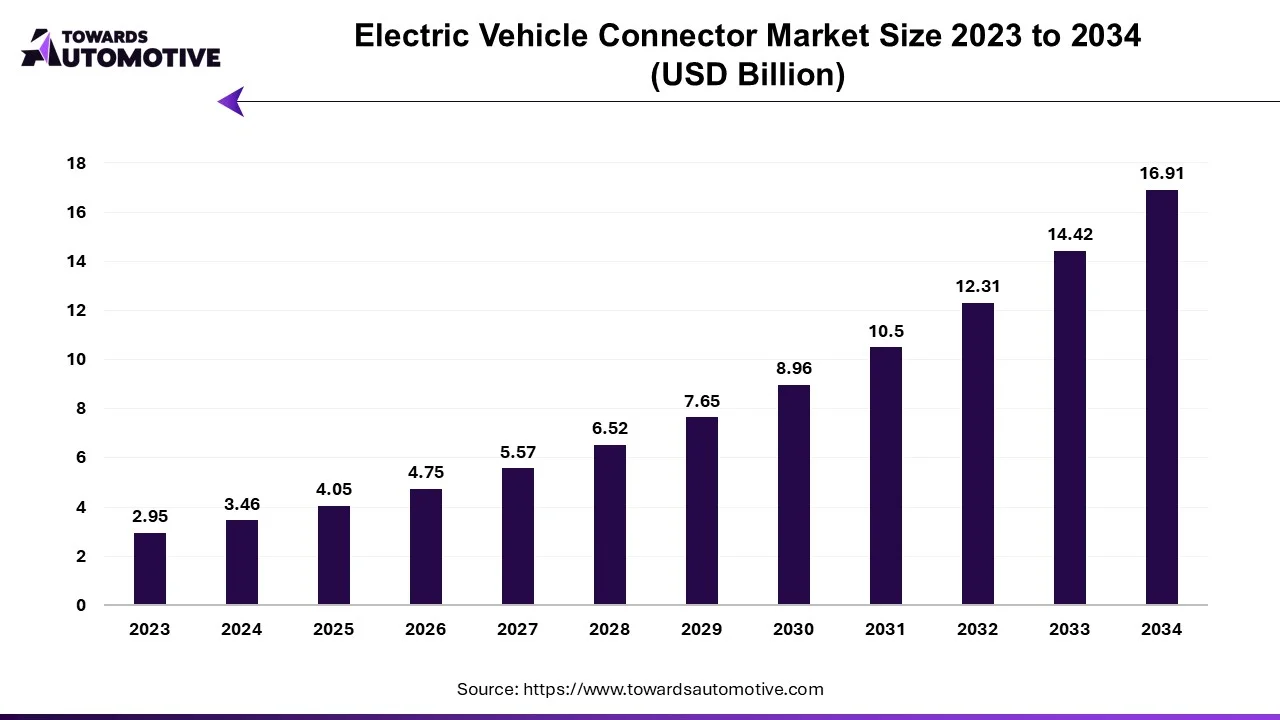

The electric vehicle connector market is forecasted to expand from USD 4.05 billion in 2025 to USD 16.91 billion by 2034, growing at a CAGR of 17.20% from 2025 to 2034.

The electric vehicle connector market is experiencing significant growth as the demand for electric vehicles accelerates globally. EV connectors play a crucial role in ensuring efficient and reliable charging by establishing seamless connections between the vehicle and the charging infrastructure. As governments and industries focus on reducing carbon emissions and promoting sustainable transportation, the adoption of electric vehicles is increasing. This, in turn, drives the need for advanced EV connectors that can support faster, safer, and more efficient charging processes. These connectors come in various types, such as AC, DC, and wireless connectors, each catering to specific charging requirements.

By Product Type

By Connectivity

By Vehicle

By Application

By Vehicle Type

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us