April 2025

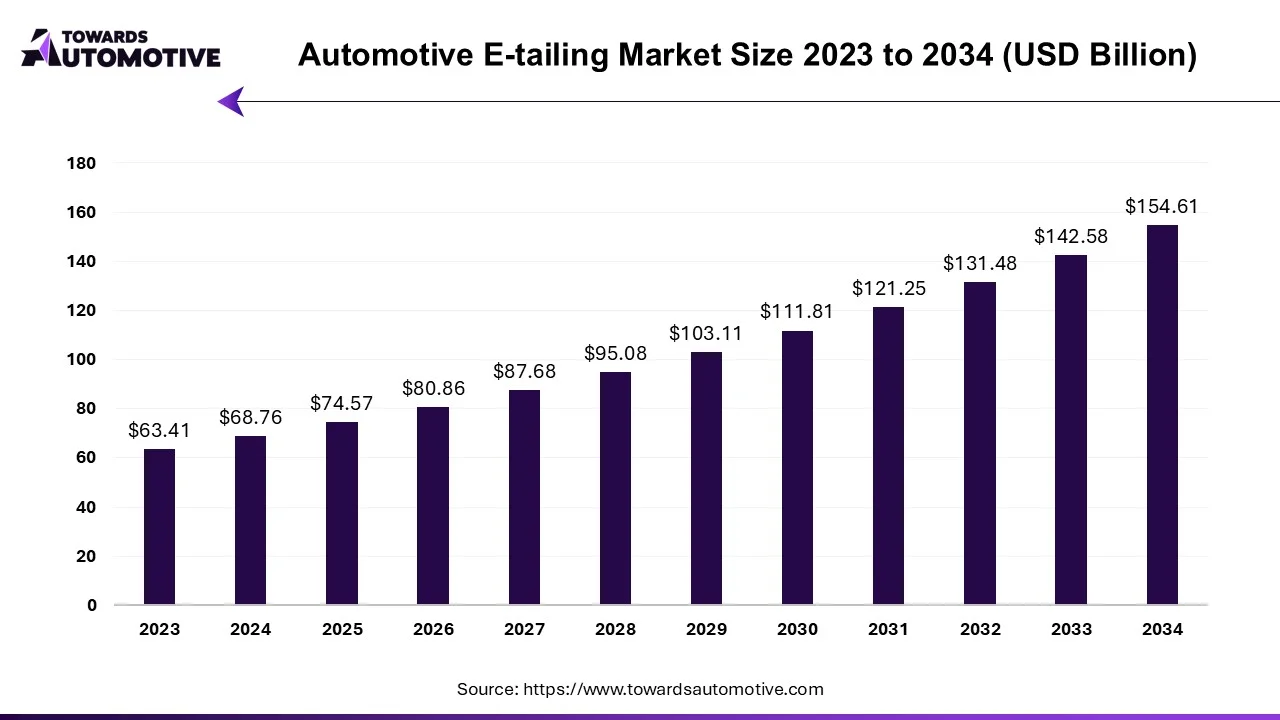

The automotive E-tailing market is anticipated to grow from USD 74.57 billion in 2025 to USD 154.61 billion by 2034, with a compound annual growth rate (CAGR) of 8.44% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The onset of the COVID-19 pandemic brought about significant disruptions to the electric vehicle (EV) market, primarily due to widespread factory closures and production limitations within the automotive industry. These challenges resulted in a slowdown in production as businesses grappled with adapting to the new operating conditions. However, amidst these difficulties, a notable shift occurred as consumers increasingly turned to online platforms for their automotive needs.

This surge in online shopping for auto parts and accessories provided a glimmer of hope for the industry, indicating a potential avenue for sustained growth. Consumers, drawn by the convenience, variety, and availability of branded products offered by e-commerce platforms, began to embrace online channels for their automotive purchases. This trend is expected to persist and even intensify in the coming years as consumer confidence in online shopping continues to rise.

Despite the promising prospects offered by the digital marketplace, several challenges loom on the horizon. Cybercrimes related to online trading pose a significant threat, undermining consumer trust and confidence in digital transactions. Moreover, inefficiencies in online services, such as delays or inaccuracies in product delivery, risk tarnishing the reputation of e-commerce platforms and dampening consumer enthusiasm.

Another pressing concern is the proliferation of counterfeit products in the online market, which not only erodes consumer trust but also threatens the integrity of the automotive industry. Addressing these issues will be crucial in sustaining the momentum of online automotive sales and ensuring long-term market growth.

Amidst these challenges, the automotive market, including the burgeoning second-hand car segment, presents opportunities for market players to capitalize on. Additionally, increased spending by small and medium-sized enterprises (SMEs) and the growing influence of e-commerce platforms are driving overall market expansion.

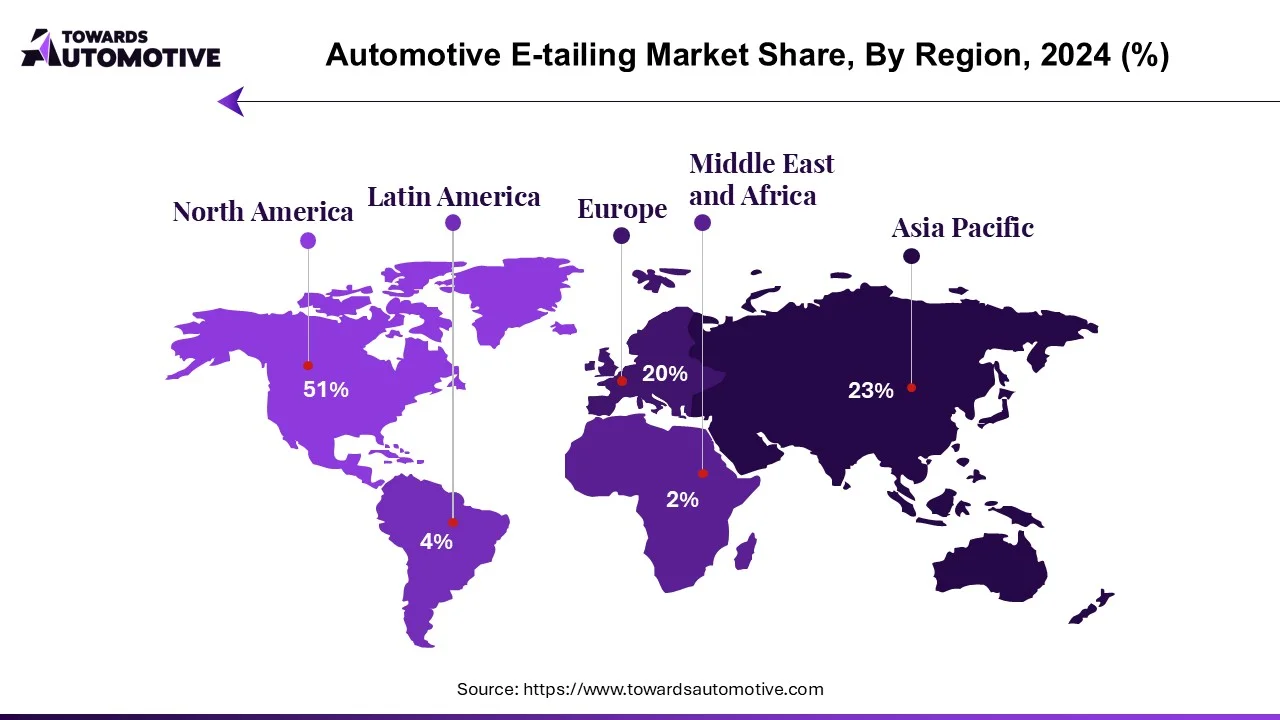

Looking ahead, the Asia Pacific region, particularly China, is poised to emerge as a key player in the global EV market. With its advanced technological infrastructure, high internet penetration rates, and substantial vehicle ownership levels, China is expected to lead the charge in driving market growth in the region and beyond.

The automotive infotainment and multimedia market exhibits a dynamic landscape characterized by the presence of original equipment manufacturers (OEMs) alongside aftermarket players. This sector within automotive electronics is undergoing significant transformation, with startups introducing an array of services and innovative technology products geared towards enhancing entertainment, information dissemination, and media consumption experiences, all while ensuring vehicle safety remains uncompromised.

Infotainment and multimedia systems encompass both hardware and software components designed to deliver audio and video entertainment to vehicle occupants. These systems encompass a range of applications, including interactive dashboards, Bluetooth-enabled devices, and integrated audiovisual systems. The growing consumer demand for convenience and comfort is poised to drive substantial growth within the infotainment and multimedia industry.

An increasingly digitized consumer landscape, particularly among younger demographics, is expected to exert a notable influence on future automotive purchasing decisions. For instance, a significant majority of millennials, numbering over 70%, view technology and infotainment functionalities as essential features when considering vehicle purchases. Furthermore, the expanding penetration of mobile devices is further shaping consumer preferences in this regard.

The online marketplace for infotainment and multimedia products is buoyed by factors such as free shipping, extensive customer reviews, and a diverse array of product options. As consumers embrace the Internet of Things (IoT) paradigm, the demand for vehicle infotainment and multimedia solutions from electronic retailers is witnessing a rapid uptick, reflecting the growing importance placed on connectivity and digital integration in modern automotive experiences.

The United States is poised to maintain its dominance within the North American region, expected to command the largest share of the overall market throughout the forecast period. The region's growth trajectory is anticipated to be propelled by the burgeoning demand observed across online and mobile platforms in recent years.

Factors such as the increasing preference for hassle-free shopping experiences, robust infrastructure supporting e-commerce, and a strong affinity for online purchasing among regional consumers are expected to fuel business expansion in North America. Furthermore, the high demand for luxury vehicles further contributes to the conducive business environment in the region.

Major e-commerce players, including Alibaba Group, Amazon.com, Ebay Inc., and Flipkart Internet Private Limited, have played pivotal roles in fostering a thriving online marketplace in North America. Amazon's foray into the automotive market, marked by strategic collaborations with renowned home appliance brands like Robert Bosch, Federal-Mogul, Dorman Products, and Cardone Industries, underscores the company's commitment to diversifying its product offerings.

With Amazon's competitive pricing strategy, offering auto parts at an average of 23 percent lower than traditional brick-and-mortar competitors such as Autozone, Advance Auto Parts, and O'Reilly Auto Parts, the online retailer is poised to capture a significant share of the automotive market. Moreover, Amazon's continuous expansion of its product portfolio and focus on efficient and timely delivery services further solidify its position in the automotive e-commerce landscape.

Additionally, niche online car dealerships are also making strides to streamline their operations, narrowing the scope of their offerings to enhance the online retail experience. These concerted efforts are anticipated to bolster online retail sales in North America, driving further growth in the automotive market segment during the forecast period.

By Component Type

By Vehicle Type

By Vendor Type

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us