April 2025

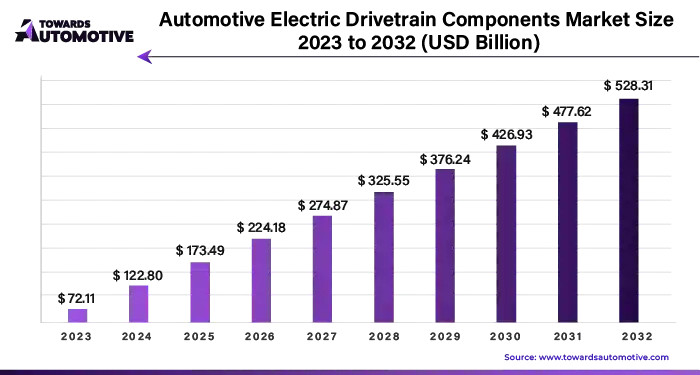

The automotive electric drivetrain components market is forecasted to expand from USD 99.73 billion in 2025 to USD 429.02 billion by 2034, growing at a CAGR of 17.60% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The global automotive industry is undergoing a monumental shift towards electric and hybrid vehicles, driving substantial growth in the electric vehicle (EV) market in recent years. This transformation is fueled by advancements in technology, which have led to significant reductions in production costs and improvements in performance across key components such as electric motors and batteries. As a result, electric motors and batteries have become integral parts of modern electric cars, paving the way for increased adoption and market penetration.

To further bolster the adoption of electric vehicles, companies are prioritizing the enhancement of charging infrastructure to optimize performance and durability. This includes investments in research and development (R&D) to develop more efficient and reliable charging systems that cater to the evolving needs of consumers and the automotive industry.

Moreover, government incentives and regulatory measures are playing a crucial role in driving business growth within the electric vehicle market. Incentives such as tax credits, rebates, and subsidies incentivize consumers to purchase electric vehicles while tighter emissions standards and regulations push automakers to accelerate the development and deployment of electric and hybrid vehicles. This dynamic regulatory landscape creates a competitive environment where innovation and economic growth are paramount for businesses to thrive and remain competitive in the evolving automotive industry.

The electric vehicle industry faced significant challenges during the global COVID-19 pandemic, experiencing disruptions in production, supply chain logistics, and demand. Shutdowns and restrictions led to delays in vehicle manufacturing and assembly, impacting the overall electric vehicle market.

However, amidst the challenges, the pandemic underscored the importance of efficient and sustainable mobility solutions. Governments and consumers alike have recognized the need to invest in energy-efficient and clean transportation alternatives. This renewed focus on sustainability and environmental concerns has led to increased interest and support for electric vehicles and other clean energy solutions.

As the world gradually recovers from the pandemic, the transition to electric transportation is expected to gain momentum. Governments are likely to implement policies and incentives to promote the adoption of electric vehicles, further driving growth in the electric vehicle industry. Additionally, consumers are increasingly prioritizing environmentally friendly options, contributing to the continued expansion of the electric vehicle market.

Advancements in battery technology and renewable energy systems are driving significant expansions in the electric vehicle industry. As these technologies become more efficient and cost-effective, businesses across various sectors are increasingly transitioning to electric powertrain components.

Automobile manufacturers are particularly embracing in-house production of electric vehicles to ensure quality control and cost efficiency. This shift towards electric vehicle production is not only driven by environmental concerns but also by the growing demand for sustainable transportation solutions.

Furthermore, collaboration between automakers and technology companies is on the rise, leading to increased innovation in electrical energy and energy efficiency. By working together, these entities are able to develop cutting-edge solutions that address the challenges associated with electric vehicle adoption.

One such solution is the development of a fast charging standard, which aims to overcome barriers related to charging infrastructure and range anxiety. This standardization effort is crucial for the widespread adoption of electric vehicles and is contributing to the rapid growth of electric powertrain components in the automotive industry.

From a revenue perspective, the battery pack stands out as the primary power source for electric vehicles, projected to reach approximately $39.8 billion in 2022. Electric drive modules, which encompass generators and motors, are also pivotal components, facilitating the conversion of electrical energy into mechanical power. Key components like the DC/AC inverter and DC/DC converter are crucial for managing the distribution and conversion of electricity within the vehicle.

Thermal generators, responsible for regulating battery temperature and power distribution, although commanding a smaller market share, play a significant role in enhancing the efficiency and performance of electric vehicles.

When considering vehicle types, pure electric vehicles, relying solely on battery-stored electricity, are anticipated to witness a substantial growth rate of 67.3% by 2022, driven by consumer demand and governmental initiatives promoting zero-emission transportation. Hybrid electric vehicles (HEVs), blending internal combustion engines with electric components for enhanced fuel efficiency, hold a significant market share. Plug-in hybrid electric vehicles (PHEVs), offering the flexibility of both electric and gasoline propulsion, also contribute to the market.

Fuel cell electric vehicles (FCEVs) are viewed as a promising technology, yet their adoption is hindered by infrastructure challenges, particularly in residential and workplace charging infrastructure. The distribution of the market across these vehicle types reflects the diverse electric options available to consumers, with pure electric vehicles and hybrids leading the way.

In terms of sales projections, the original equipment manufacturer (OEM) segment of the electric vehicle market is forecasted to grow at a robust CAGR of 23.6% through 2032. OEMs play a critical role in integrating these components directly into EV systems, ensuring compatibility and seamless integration. This segment's significance is underscored by the increasing demand for electric vehicles as automakers transition towards electrification.

The US automotive electric powertrain market is set to achieve a milestone, reaching an estimated value of US$7.35 billion in 2022. Renowned for its robust automotive industry, the United States boasts major automakers that are making substantial investments in research, development, and the production of electric vehicles. This emphasis on electrification is fueling a surge in demand for energy-efficient products, driving significant investments across the spectrum of research, development, and production within the electric powertrain sector.

Some of the major companies operating in the automotive electric drivetrain components market are:

Strategic collaboration, innovation, and effective marketing strategies form the cornerstone of these companies' efforts to expand their business footprint. Furthermore, substantial investments in research and development are pivotal, enabling them to pioneer new products and capitalize on emerging market opportunities for sustained growth and profitability.

By Components

By Vehicle Type

By Sales Channel

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us