April 2025

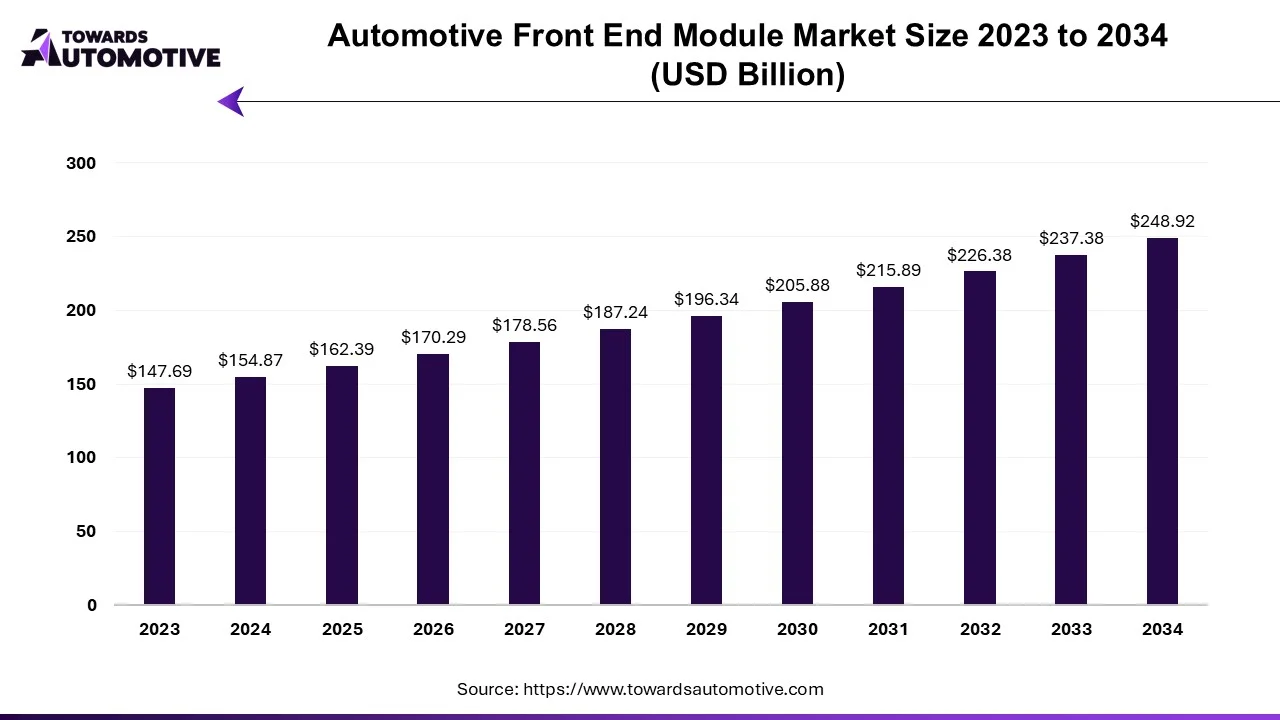

The automotive front end module market is forecasted to expand from USD 162.39 billion in 2025 to USD 248.92 billion by 2034, growing at a CAGR of 4.86% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive industry is witnessing a shift towards FEM modularization, which offers notable advantages in terms of cost, time, and labor savings during the manufacturing process for OEMs. Traditionally, OEMs assembled all parts of the FEM on the assembly line, resulting in prolonged production timelines and increased costs. However, with the adoption of modularization, OEMs can now outsource these activities, leading to cost savings of approximately 20% to 30% compared to traditional front-end systems. Modularization allows for flexibility in design, with options for different styles achieved through variations in materials, colors, and surface treatments.

Moreover, modularization facilitates the addition of FEM later in the assembly process, thereby enhancing assembly line ergonomics and reducing assembly time. This approach also improves the fit and finish of the front of the car by integrating headlights, bumpers, instrument panels, and grilles into a single package. The latest compact, lightweight, modular, and integrated FEM designs are directly mounted onto the vehicle, further streamlining the manufacturing process.

While the original design of FEM consisted of heavy metal components, the industry has increasingly turned to composite materials to reduce vehicle weight and enhance fuel efficiency and performance. Thermoplastic resins like polypropylene (PP) and nylon are commonly used in composite FEMs. Initially, glass fiber thermoplastic composites were prevalent, but to reduce costs, these have been replaced by injection-molded granular long fiber thermoplastics (LFT) and inline composite (ILC) injection or compression molded direct LFT (D-LFT).

However, heavy vehicles often require steel or composite materials for strength and durability. The choice of materials for FEM depends on factors such as overall cost and specific vehicle requirements.

Market research for the automotive front-end modules industry employs a bottom-up approach, utilizing various sources such as company reports, trade publications, industry databases, and expert interviews to estimate market size and analyze trends. Despite the challenges posed by the COVID-19 pandemic, the industry is expected to rebound in the medium term, driven by the expansion of the automotive sector, increasing awareness of automobile safety, and advancements in technology such as ADAS and driverless vehicles.

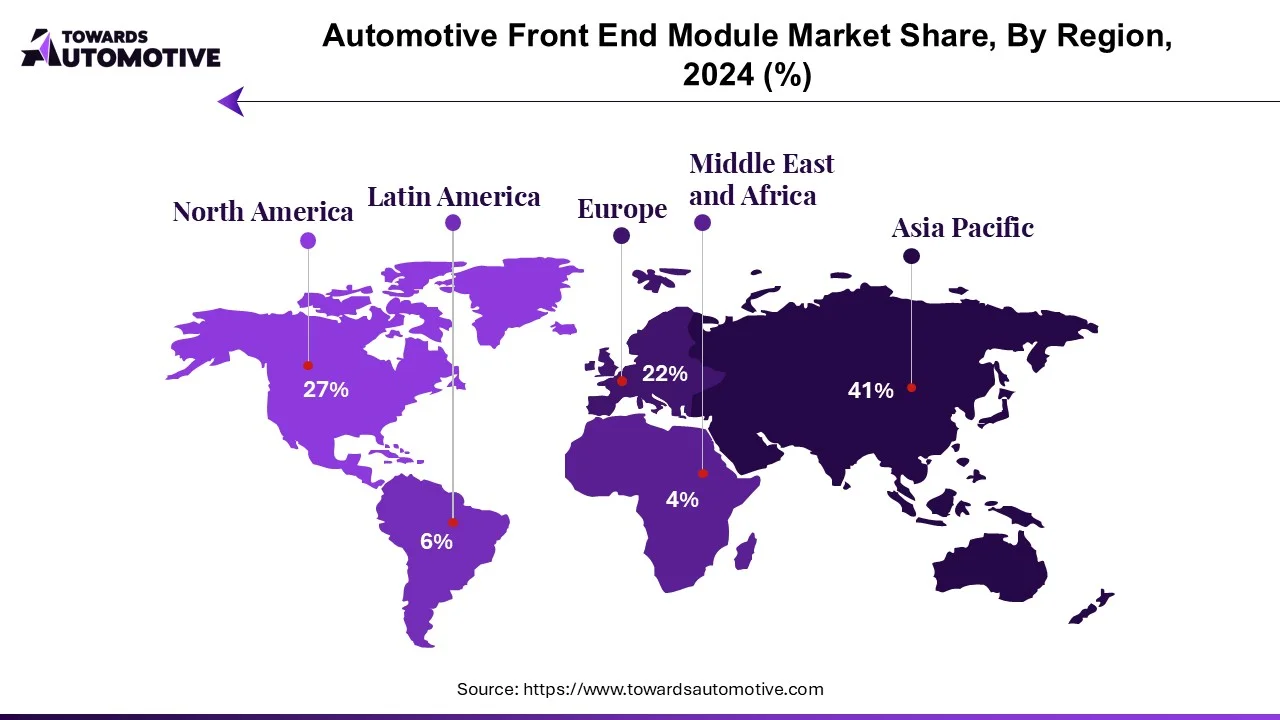

Regions such as Asia Pacific, Europe, and North America are poised to witness significant growth, fueled by the installation of passenger cars and commercial vehicles, as well as new front-end module upgrades announced by major automotive OEMs and manufacturers.

The automotive front end module (FEM) market is experiencing a surge in demand, driven by various factors including the need for lightweight vehicle components to reduce CO2 emissions and costs. Governments worldwide are enforcing regulations such as Corporate Average Fuel Economy (CAFE) standards and BS-VI regulations, prompting automotive OEMs to adopt lightweight materials like metals, composites, and plastics in FEMs. By experimenting with front-end components, vehicle weight can be reduced by 20% to 30%.

Currently, the trend is shifting towards the use of lightweight materials instead of heavy equipment, as heavy equipment contributes to fuel consumption and vehicle development costs. Thermoplastics like polypropylene and nylon are widely utilized for their lightweight properties.

For Instance,

Hybrid composite/metal structures are favored in heavy vehicles, driven by environmental regulations and consumer preferences for green projects and digital lifestyles. Vehicles equipped with composite front-end modules are increasingly being introduced, featuring innovative designs that consolidate work, reduce assembly time, and enhance overall efficiency.

Technological advancements and market developments are prompting companies to offer new solutions to customers, driving growth in the FEM market. Modularization of FEMs is gaining momentum as it enables OEMs to save costs, time, and labor during production. Modularization allows for flexibility in design, materials, colors, and surface treatments, while also improving assembly line ergonomics and efficiency.

Like all automotive components, FEM parts have a lifespan and require regular replacement to maintain optimal performance. Factors such as corrosion, material degradation, and long-term use contribute to wear and tear, necessitating periodic replacements. As the market continues to evolve, it is expected that the distance between FEM components will increase, further driving innovation and growth in the automotive industry.

Asia Pacific is poised to dominate the automotive front-end module (FEM) market, driven by the robust presence of major manufacturers in countries like Japan, South Korea, China, and India. The region benefits from significant automobile production in key countries and the concentration of various automotive components in manufacturing processes.

For Instance,

In addition to China, India, and South Korea, Japan plays a significant role in the automotive industry, with major players like Nissan contributing to the market. The automotive FEM market in the region is expected to register a double-digit Compound Annual Growth Rate (CAGR), supported by business needs, expansion strategies of key players, and the expansion of production facilities.

For example,

These developments are anticipated to contribute to a positive outlook for the market throughout the forecast period, underscoring the region's pivotal role in the automotive FEM market landscape.

The automotive front-end module market exhibits a high level of consolidation, with key players such as Denso, Faurecia, Magna International, and Yas Omnium dominating the majority of the market share. These major players are actively engaged in various strategies to maintain their competitive edge in the market, including investments in new research and development (R&D) projects, as well as forming joint ventures and collaborations.

For Instance,

These strategic initiatives underscore the competitive landscape of the automotive front-end module market, with major players continuously striving to innovate and expand their product offerings to meet the evolving demands of the automotive industry.

Automotive front-end modules are assembly pieces that integrate various components into a single unit. These components include forward lighting, radiators, cooling fans, grille-opening reinforcement panels, air conditioning condensers, crumple zones, hood latches, bumpers, and electronics wiring.

By Vehicle Type

By Raw Material Type

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us