December 2025

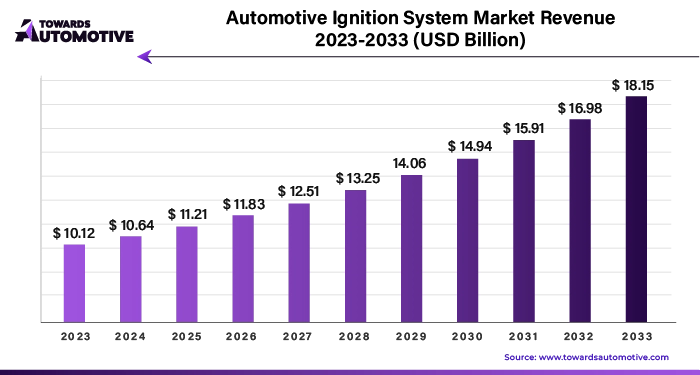

The automotive ignition system market is set to grow from USD 11.39 billion in 2025 to USD 19.43 billion by 2034, with an expected CAGR of 6.11% over the forecast period from 2025 to 2034. The increasing sales of passenger vehicles in the APAC region coupled with rise in number of automotive startups has boosted the market expansion.

Additionally, the rapid investment by automotive companies to manufacture a wide range of automotive components along with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape. The integration of smart technologies in automotive ignition systems is expected to create ample growth opportunities for the market players in the upcoming years to come.

The automotive ignition system market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of automotive ignition systems across the world. There are numerous types of ignition systems developed in this sector comprising of conventional systems, electronic systems, distributor-less systems and some others. These ignition systems are comprised of different components including ignition switch, spark plug, glow plug, ignition coil and some others. It is designed for various types of vehicles consisting of passenger cars, commercial vehicles, two-wheelers and some others. This market is expected to rise significantly with the growth of the commercial vehicle industry in different parts of the world.

The major trends in this market consists of partnerships, business expansions and rising sales of commercial vehicles.

Numerous automotive brands are partnering with technology providers to develop smart ignition systems for the passenger cars.

The market players are investing heavily for constructing new production centers to enhance the manufacturing of ignition components in different parts of the world.

The sales of commercial vehicles has increased rapidly in various countries such as Germany, the U.S., India and some others, thereby rising the demand for advanced ignition systems.

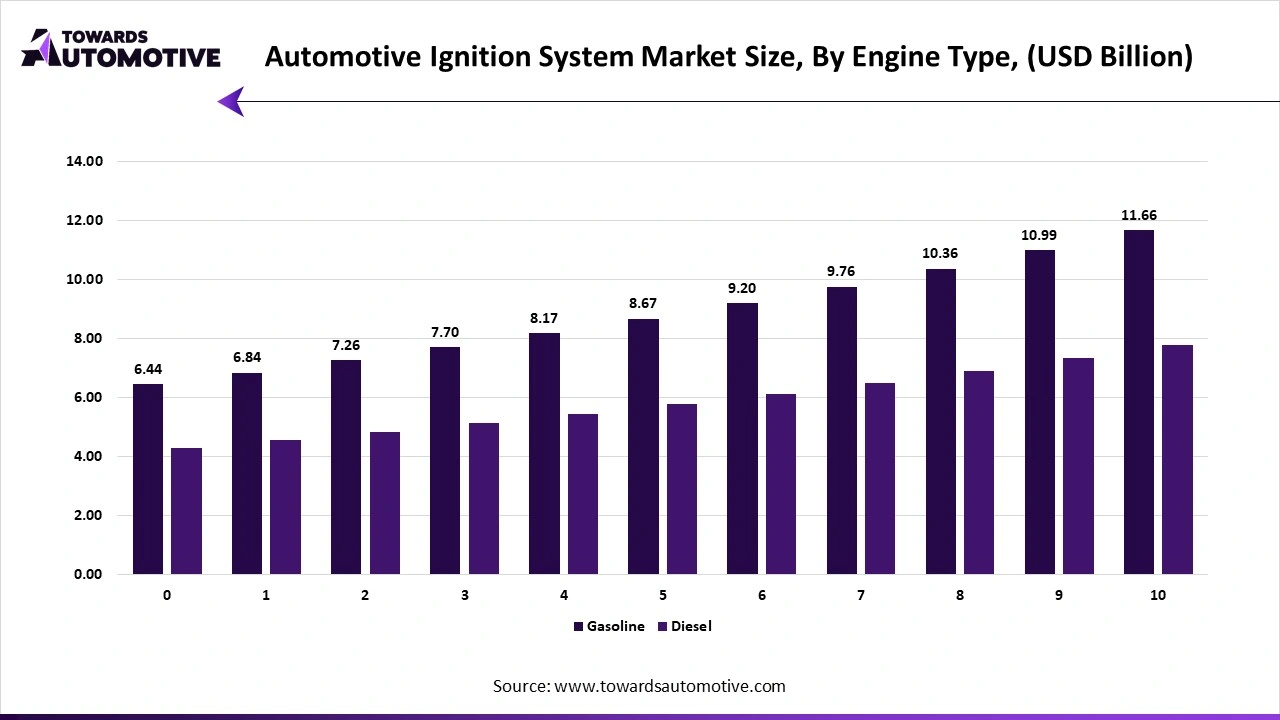

The gasoline segment led the market. The growing demand for high-performance petrol vehicles among youths has boosted the market expansion. Additionally, integration of advanced technologies in gasoline engines to deliver superior performance and high mileage is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for integrating gasoline-engines in modern cars is expected to boost the growth of the automotive ignition system market.

The diesel segment is expected to expand with a notable CAGR during the forecast period. The rising demand for heavy-duty diesel trucks from several sectors including e-commerce, logistics, mining and some others has boosted the market growth. Additionally, rising emphasis of engine manufacturers to develop high-quality diesel engines is playing a vital role in shaping the industry in a positive direction. Moreover, collaborations among market bus companies and automotive component manufacturers to develop high-performance diesel-engine for buses is expected to propel the growth of the automotive ignition system market.

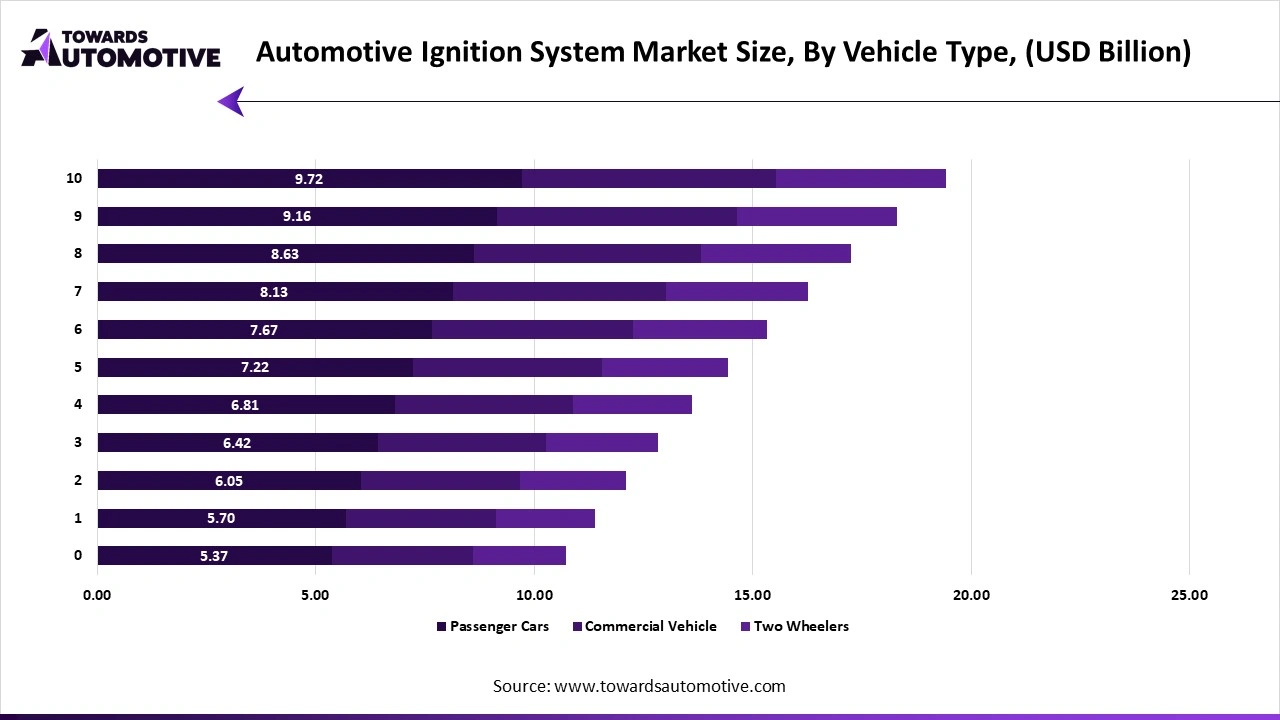

The passenger cars segment held the largest share of the market. The increasing sales and production of passenger cars in several countries such as China, Germany, the U.S. and some others has boosted the market expansion. Additionally, the growing use of high-quality ignition systems in luxury vehicles coupled with rapid investment by market players to manufacture a wide variety of ignition components to cater the needs of passenger vehicles is playing a vital role in shaping the industrial landscape. Moreover, collaborations among automotive brands and ignition system providers to develop advanced ignition systems for passenger cars is expected to boost the growth of the automotive ignition system market.

The two-wheelers segment is expected to rise with a considerable CAGR during the forecast period. The increasing use of high-performance spark plugs in superbikes has boosted the market expansion. Additionally, the availability of numerous two-wheeler ignition components in several e-commerce platforms such as Ebay, Amazon, Walmart and some others is contributing to the industry in a positive direction. Moreover, rapid investment by component manufacturers for opening new production facilities to cater the needs of two-wheelers is expected to propel the growth of the automotive ignition system market.

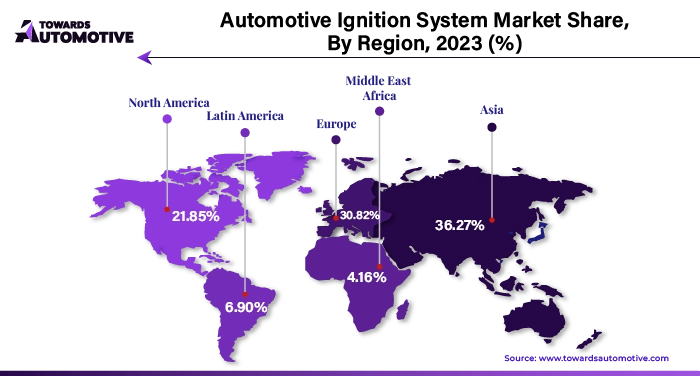

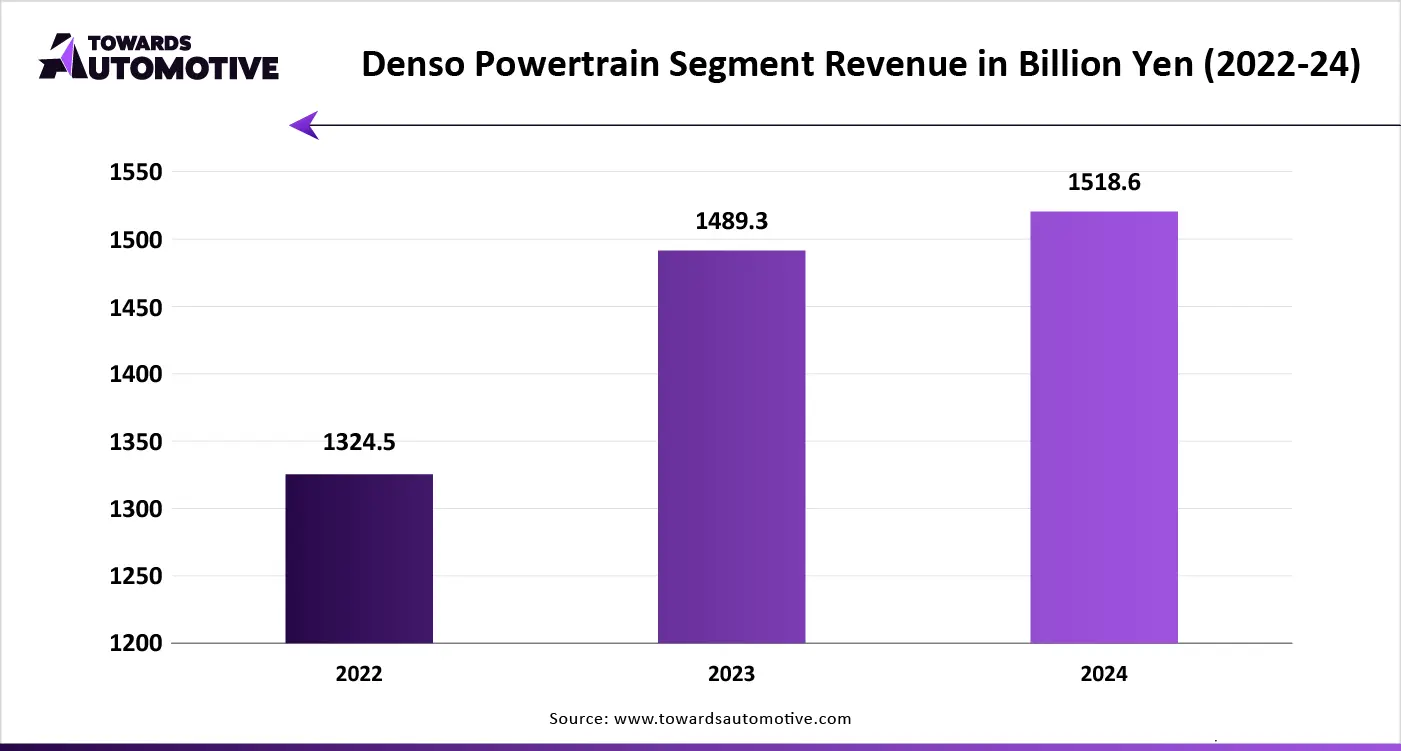

Asia Pacific dominated the automotive ignition system market. The growing sales and production of commercial vehicles in several countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, rapid investment by startup companies to open new automotive components manufacturing centers coupled with increasing demand for sports bikes is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several market players such as Denso Corporation, Hitachi Automotive Systems Ltd., UNO Minda, Mitsubishi Electric and some others is expected to boost the growth of the automotive ignition system market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The rising demand for luxury passenger vehicles from the HNIs in the U.S. and Canada has boosted the market expansion. Additionally, partnerships among car brands and automotive component manufacturers to develop a wide range of ignition systems coupled with rapid proliferation of automotive e-commerce platforms is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as BorgWarner, Federal-Mogul Corporation, Dayco, Dorman Products, Inc and some others is expected to drive the growth of the automotive ignition system market in this region.

The automotive ignition system market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Federal-Mogul Corporation, Delphi Automotive, Robert Bosch, DENSO, Borgwarner, Mitsubishi Electric Corporation, Continental AG, Hitachi Automotive Systems, Diamond Electric and some others. These companies are constantly engaged in developing high-quality ignition systems for the automotive sector and adopting numerous strategies such as collaborations, business expansions, acquisitions, joint ventures, launches, partnerships, and some others to maintain their dominance in this industry.

By Components

By Ignition Type

By Engine Type

By Vehicle Type

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us