December 2025

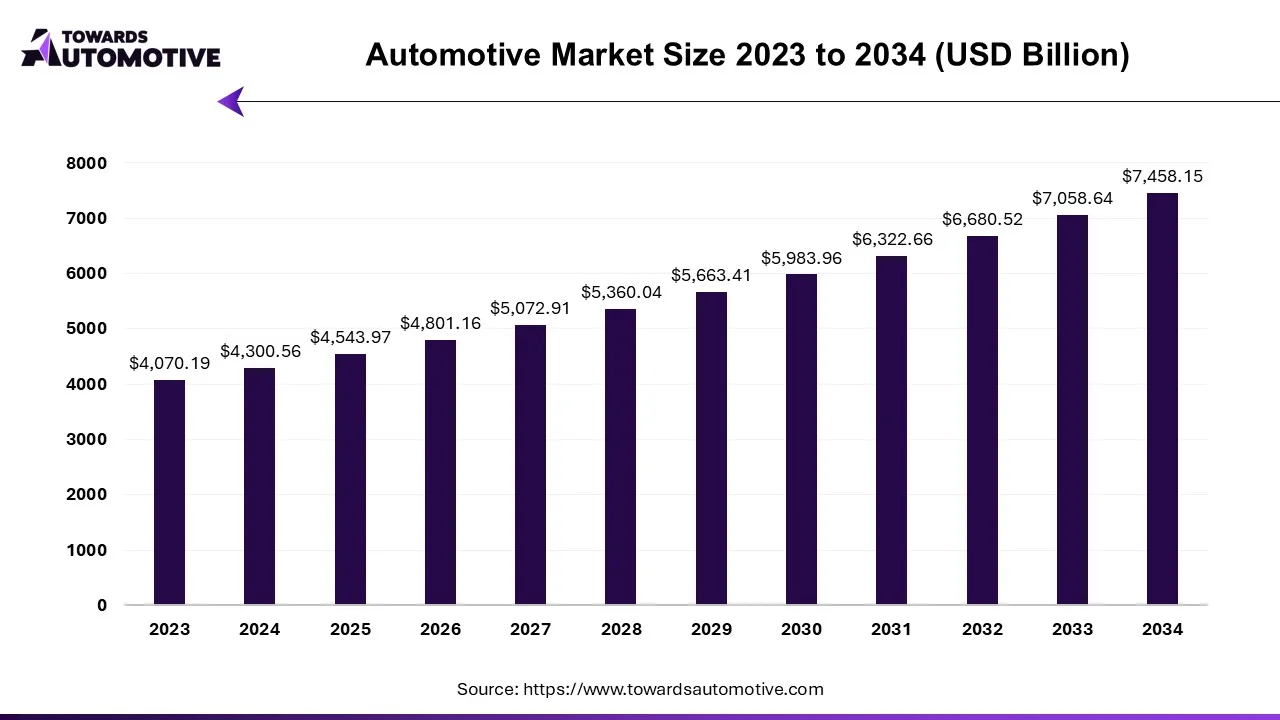

The automotive market is forecast to grow from USD 4543.97 billion in 2025 to USD 7458.15 billion by 2034, driven by a CAGR of 5.66% from 2025 to 2034. The growing demand for mid-range hatchbacks in developing nations coupled with rapid investment by automotive companies for manufacturing EVs has driven the market expansion.

Additionally, rise in number of automotive startups in India, Vietnam, China, Canada and some others along with constant research and development for developing powerful car-engines is further adding to the industrial growth. The integration of ADAS in vehicles as well as technological advancements in solid-state batteries is expected to create ample growth opportunities for the market players in the future.

The automotive market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of vehicles in different parts of the world. There are several types of vehicles developed in this sector consisting of passenger cars, commercial vehicles, electric vehicles, two-wheelers and some others. These vehicles are powered using different types of fuel comprising of gasoline, diesel, electric and hydrogen. It is available in a well-established sales channel including direct sales, dealerships and online platforms. The rising sales of luxury vehicles in developed nations has boosted the market expansion. This market is expected to rise significantly with the growth of the electric vehicle industry across the globe.

| Metric | Details |

| Market Size in 2025 | USD 4543.97 Billion |

| Projected Market Size in 2034 | USD 7458.15 Billion |

| CAGR (2025 - 2034) | 5.66% |

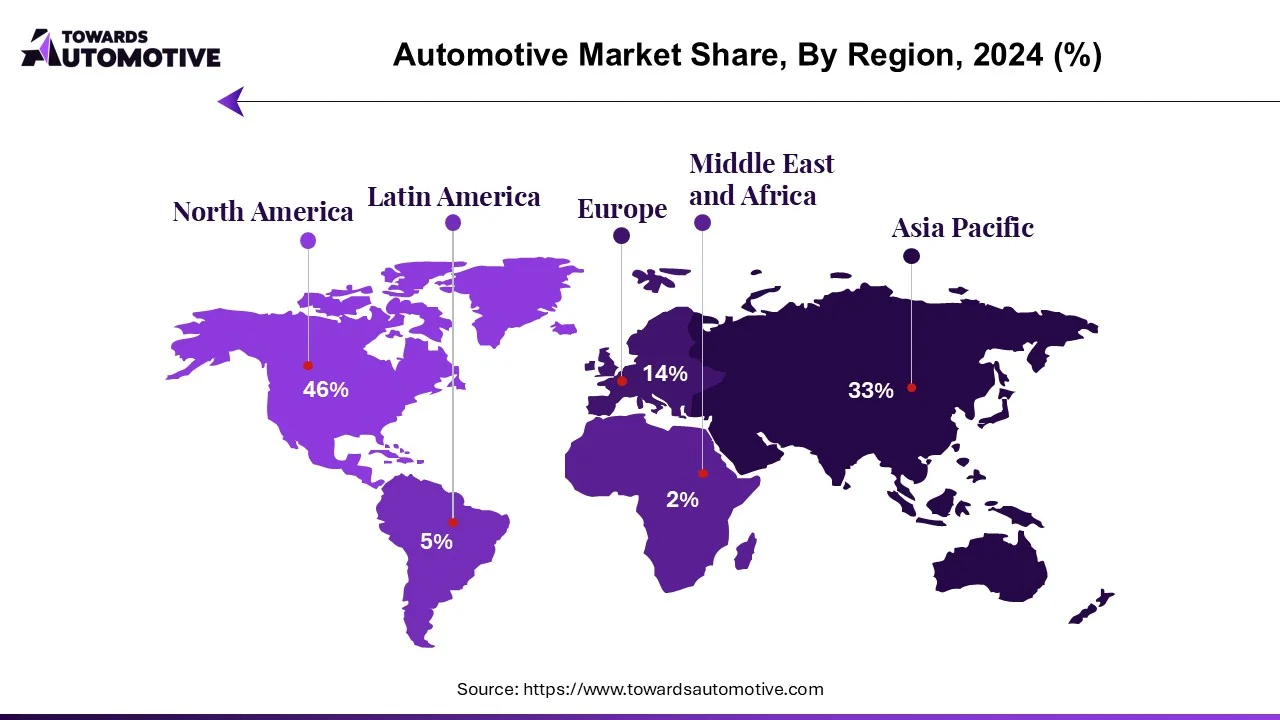

| Leading Region | North America |

| Market Segmentation | By Type, By Fuel Type, By Sales Channel, By Vehicle Size and By Region |

| Top Key Players | Volkswagen Group, General Motors, Daimler, Honda, Stellantis, FCA, Toyota, Tesla, SAIC Motor |

The major trends in this market consists of partnerships, government initiatives and rising production of vehicles.

Numerous automotive brands are partnering with each other to develop new vehicles to gain maximum consumer attention. For instance, in June 2025, Faissner Petermeier Fahrzeugtechnik AG announced partnership with Mullen. This partnership is done for launching ultra-high-performance Mullen FIVE RS EV Crossover for the consumers of Germany. (Source: GlobeNewswire)

Government of various countries such as India, China, the U.S. and some others are launching new initiatives to increase the adoption of EVs. For instance, in June 2025, the government of Germany launched a new initiative to boost EV adoption across the country. This initiative aims at lowering vehicular emission across this nation. (Source: European Commission)

The market players are investing heavily for enhancing the manufacturing output of different vehicles to cater the needs of the end-users. According to the International Organization of Motor Vehicle Manufacturers, around 2549595 vehicles were produced in Brazil during 2024. (Source: OICA)

The passenger cars segment dominated the market. The growing production of passenger cars in several countries such as India, China, Germany and some others has boosted the market expansion. Also, rapid adoption of electric crossover vehicles coupled with rising disposable income of the people has boosted the market expansion. Moreover, the increasing demand for luxury cars in developed nations is expected to drive the growth of the automotive market.

The commercial vehicles segment is expected to grow with the highest CAGR during the forecast period. The growing sales of LCEVs in developing nations such as India, Thailand, Vietnam and some others has boosted the market expansion. Additionally, the integration of advanced technologies such as ADAS and AI in fleet management platforms to track commercial vehicles is further adding to the industrial growth. Moreover, the rising demand for high-performance trucks to operate heavy-duty applications is expected to boost the growth of the automotive market.

The internal combustion engine segment dominated the market. The growing demand for powerful diesel vehicles in several industries such as logistics, transportation, e-commerce, mining and some others has boosted the market expansion. Also, lack of well-established charging infrastructure in sub-urban areas coupled with technological advancements in automotive engines is contributing to the industrial growth. Moreover, the rising sales of petrol vehicles due to their less maintenance cost and superior performance is expected to propel the growth of the automotive market.

The electric segment is expected to expand with the fastest CAGR during the forecast period. The increasing adoption of electric vehicles in several countries such as India, China, the U.S., Germany and some others to reduce vehicular emission has boosted the market expansion. Also, numerous government initiatives aimed at developing the EV industry coupled with proliferation of EV startups is contributing to the industrial growth. Moreover, rapid investment by automotive brands for constructing new EV production facilities is expected to boost the growth of the automotive market.

North America led the automotive market. The growing adoption of electric vehicles in the U.S. and Canada to reduce vehicular emission has driven the market expansion. Additionally, the rise in number of high-net-worth individuals coupled with increasing consumer preference towards purchasing luxury cars is contributing to the industrial growth. Moreover, the presence of several market players such as Tesla, Rivian, General Motors and some others is expected to propel the growth of the automotive market in this region.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The increasing demand for hybrid vehicles from several nations such as China, Japan, India, South Korea and some others has driven the market expansion. Also, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rising production of passenger vehicles is further adding to the industrial growth. Moreover, the presence of numerous market players such as Toyota, BYD, Tata Motors, Honda and some others is expected to drive the growth of the automotive market in this region.

The automotive market is a highly competitive industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Volkswagen Group, General Motors, Daimler, Honda, Stellantis, FCA, Toyota, Tesla, SAIC Motor, Hyundai, Groupe Renault, Ford, BMW, Nissan, Volkswagen and some others. These companies are constantly engaged in developing various types of vehicles and adopting numerous strategies such as business expansions, partnerships, joint ventures, acquisitions, product launches, collaborations and some others to maintain their dominance in this industry.

By Type

By Fuel Type

By Sales Channel

By Vehicle Size

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us