April 2025

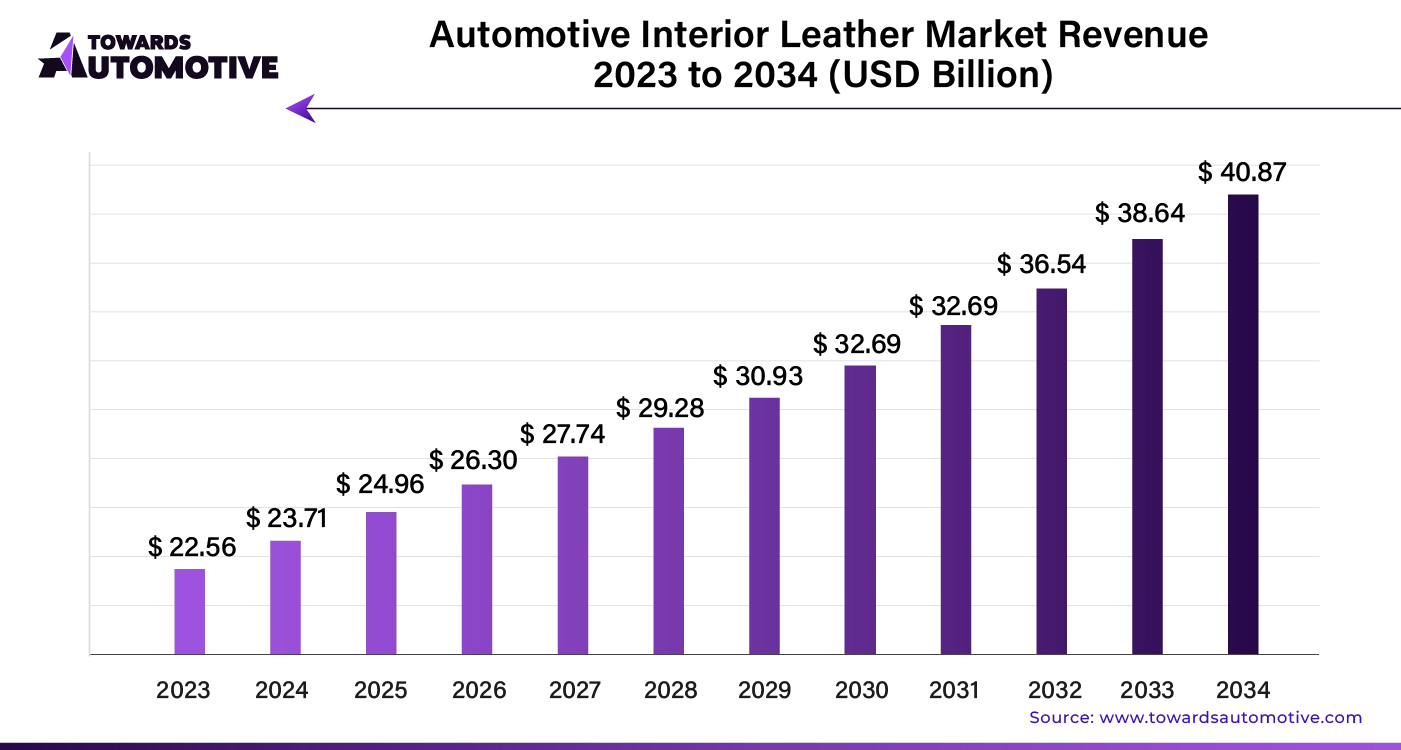

The automotive interior leather market is anticipated to grow from USD 24.96 billion in 2025 to USD 40.87 billion by 2034, with a compound annual growth rate (CAGR) of 5.12% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive interior leather market is experiencing significant growth, primarily fueled by the increasing production and sales of vehicles, especially in the luxury and premium segments. Consumers are increasingly prioritizing upscale, comfortable, and visually appealing interiors, which has led to a surge in demand for high-quality leather materials. The trend toward customization in vehicle design further amplifies this demand, as car buyers seek personalized and luxurious interiors.

Technological advancements in leather processing and manufacturing are enhancing the quality of automotive interior leather. Innovations in these techniques are improving the durability and overall performance of leather used in vehicles, making it a more attractive option for both manufacturers and consumers.

Moreover, the automotive industry is expanding rapidly in emerging economies. This growth is driven by rising disposable incomes and changing lifestyles, which are expected to create significant opportunities for market players. As these regions become more affluent, the demand for premium automotive interiors, including high-quality leather, is likely to increase.

To capitalize on these trends, companies in the automotive interior leather market are focusing on several key strategies. These include investing in product innovation to meet evolving consumer preferences, pursuing sustainability initiatives to appeal to environmentally conscious buyers, and forming strategic collaborations to enhance their market position.

Luxury car interiors are evolving with technology that transforms leather seats into high-tech experiences. Modern vehicles now feature leather interiors equipped with heating and cooling functions, controlled through sophisticated infotainment systems. This innovation not only enhances comfort but also creates a more personalized driving environment, allowing drivers to adjust their seat settings for optimal relaxation.

The demand for eco-friendly options is reshaping the automotive leather market. Consumers are increasingly seeking sustainably sourced leather and chrome-free tanning methods that minimize environmental impact. In response, the industry is adopting these greener practices to appeal to environmentally conscious luxury car buyers who prioritize sustainability without compromising on quality.

As the market for animal-free alternatives grows, vegan leather is emerging as a popular choice for luxury car interiors. Made from innovative materials such as mushrooms or recycled plastic, vegan leather offers a sophisticated and ethical alternative to traditional leather. This shift caters to vegan 0consumers and those seeking sustainable, animal-free options, providing a luxurious yet guilt-free interior experience.

Personalization is becoming a major focus in luxury car interiors. Manufacturers are now offering a range of customization options, from unique stitching patterns and laser-etched designs to dual-tone color schemes. This trend allows car owners to create a distinctive and tailored driving environment, reflecting their personal style and preferences.

The latest advancements in leather treatment have led to the development of high-performance leathers that combine luxury with durability. These new materials are designed to resist stains, scratches, and fading, ensuring that luxury car interiors remain pristine over time. This durability not only maintains the aesthetic appeal of the interiors but also provides lasting value for consumers.

In the quest for fuel efficiency, the automotive industry is turning to lightweight materials. Thin-treated leathers are engineered to deliver the same level of softness and quality as traditional leathers while reducing overall weight. This innovation contributes to improved vehicle performance and fuel efficiency, aligning with the industry's ongoing efforts to enhance sustainability and efficiency.

AI integration is poised to transform the automotive interior leather market by enhancing design, quality, and production efficiency. Advanced AI algorithms enable manufacturers to create highly customized leather interiors tailored to consumer preferences. By analyzing vast amounts of data, AI can predict trends and automate design processes, leading to innovative patterns and textures that appeal to modern consumers.

AI-driven quality control systems ensure superior product standards by detecting defects and inconsistencies in real time. This proactive approach reduces waste and minimizes the need for manual inspections, thereby accelerating production cycles and lowering costs. Additionally, AI-powered predictive maintenance helps prevent equipment failures by analyzing performance data and scheduling timely interventions.

Furthermore, AI enhances customer experience through virtual reality (VR) and augmented reality (AR) applications, allowing consumers to visualize and personalize their automotive interiors before making a purchase. This immersive technology not only improves customer satisfaction but also boosts sales by offering a more interactive shopping experience.

In the automotive interior leather market, the supply chain operates through a well-coordinated process that ensures the smooth delivery of high-quality materials. It begins with raw material suppliers who provide hides and skins to leather tanneries. These tanneries process the raw materials into finished leather, adhering to stringent quality standards. Once processed, the leather is shipped to automotive manufacturers or component suppliers who incorporate it into various interior parts, such as seats, dashboards, and door panels.

The automotive manufacturers then assemble these components into vehicles. The entire process requires close collaboration between suppliers, tanneries, and manufacturers to ensure timely delivery and consistent quality. Effective inventory management and logistics play a crucial role in minimizing delays and reducing costs. Additionally, strong relationships with suppliers and transparent communication channels help in managing supply disruptions and meeting market demands efficiently. By optimizing each link in the supply chain, companies can enhance their competitive edge, meet customer expectations, and drive growth in the automotive interior leather market.

The Automotive Interior Leather market thrives on several critical components and influential companies. At its core, the market comprises premium leather materials, including natural and synthetic variants, used in car seats, dashboards, and trim. Companies like Lear Corporation and Adient are pivotal, offering advanced leather seating solutions that enhance vehicle aesthetics and comfort. These companies utilize cutting-edge technologies and sustainable practices to produce high-quality leather that meets automotive standards.

Additionally, BASF and Covestro contribute significantly with their innovative synthetic leather alternatives, which provide durability and flexibility while reducing environmental impact. Their materials often feature in eco-friendly and luxury vehicle interiors.

Another key player, Faurecia, integrates smart technology into their leather products, adding features like climate control and integrated sensors. This innovation elevates user experience and comfort.

Overall, the market ecosystem benefits from a blend of traditional leather craftsmanship and modern technological advancements. Each company's unique contribution helps shape the future of automotive interiors, balancing luxury, functionality, and sustainability in their offerings.

PU leather is poised to remain the leading choice in automotive interior leather, capturing approximately 31.00% of the market in 2024. This significant share is attributed to PU leather’s durability, affordability, and its ability to closely resemble genuine leather.

The advantages of PU leather include its cost-effectiveness relative to natural leather while still providing a premium appearance. As automotive manufacturers look to enhance vehicle interiors, PU leather’s versatility and economic benefits make it an appealing option. Advances in PU leather technology and increasing vehicle production are contributing to its steady market growth. The rising trend of personalizing vehicle interiors and a growing focus on sustainable materials further boost the demand for PU leather.

With ongoing improvements in production techniques and design capabilities, PU leather is expected to remain a dominant force in the automotive interior leather market.

In terms of distribution, OEMs (Original Equipment Manufacturers) are forecasted to hold a substantial 57.00% share of the automotive interior leather market in 2024. OEMs are central to the direct supply of automotive interior leather, delivering it directly from vehicle manufacturers to consumers.

This sector’s robust growth is driven by higher vehicle production and the inclusion of premium interior features to differentiate automotive products. OEMs are focused on enhancing the driving experience with superior interior materials, and their strategic collaborations with leather suppliers, combined with advancements in manufacturing and logistics, strengthen their market position.

OEMs are crucial in responding to evolving consumer preferences for automotive interior design, maintaining their role as the primary channel for distributing automotive interior leather. Their commitment to offering high-quality and customizable interiors underscores their ongoing leadership in the market.

United States

The automotive interior leather market in the United States is projected to grow at a compound annual growth rate (CAGR) of approximately 3.20% through 2034. This growth rate reflects a mature market with steady progress, largely driven by established luxury brands such as Cadillac and Lincoln. These brands have a strong consumer base that values premium leather interiors. The market is also seeing increased interest in innovations such as tech-integrated and vegan leather options. Despite these developments, the adoption of new materials remains cautious compared to faster-expanding markets.

United Kingdom

In the United Kingdom, the automotive interior leather market is anticipated to grow at a CAGR of around 2.60% until 2034. This figure indicates a market deeply rooted in tradition, dominated by iconic brands like Bentley and Rolls-Royce. These brands are renowned for their classic and enduring designs. Consequently, the market's acceptance of new trends, such as unconventional leather colors, is relatively slow. British consumers tend to prefer timeless designs and materials that uphold long-standing luxury values.

Japan

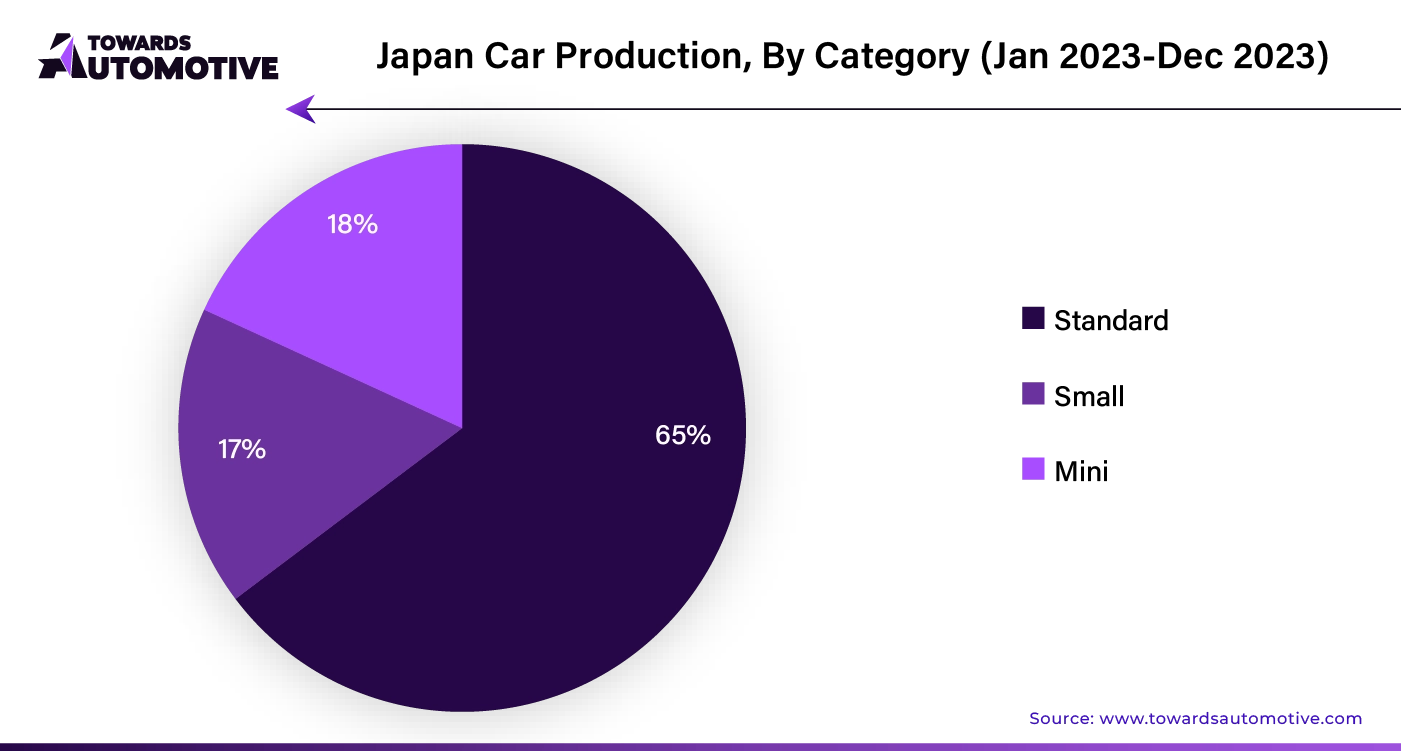

Japan's automotive interior leather market is expected to grow at a notable CAGR of 5.70% until 2034. This growth is driven by a focus on high-quality materials and established luxury brands. Japanese consumers place a high value on durability and longevity in car interiors, leading to a more measured approach to leather consumption compared to emerging markets. While the demand for luxury car interiors remains strong, the emphasis is on material quality and reliability rather than fleeting trends.

China

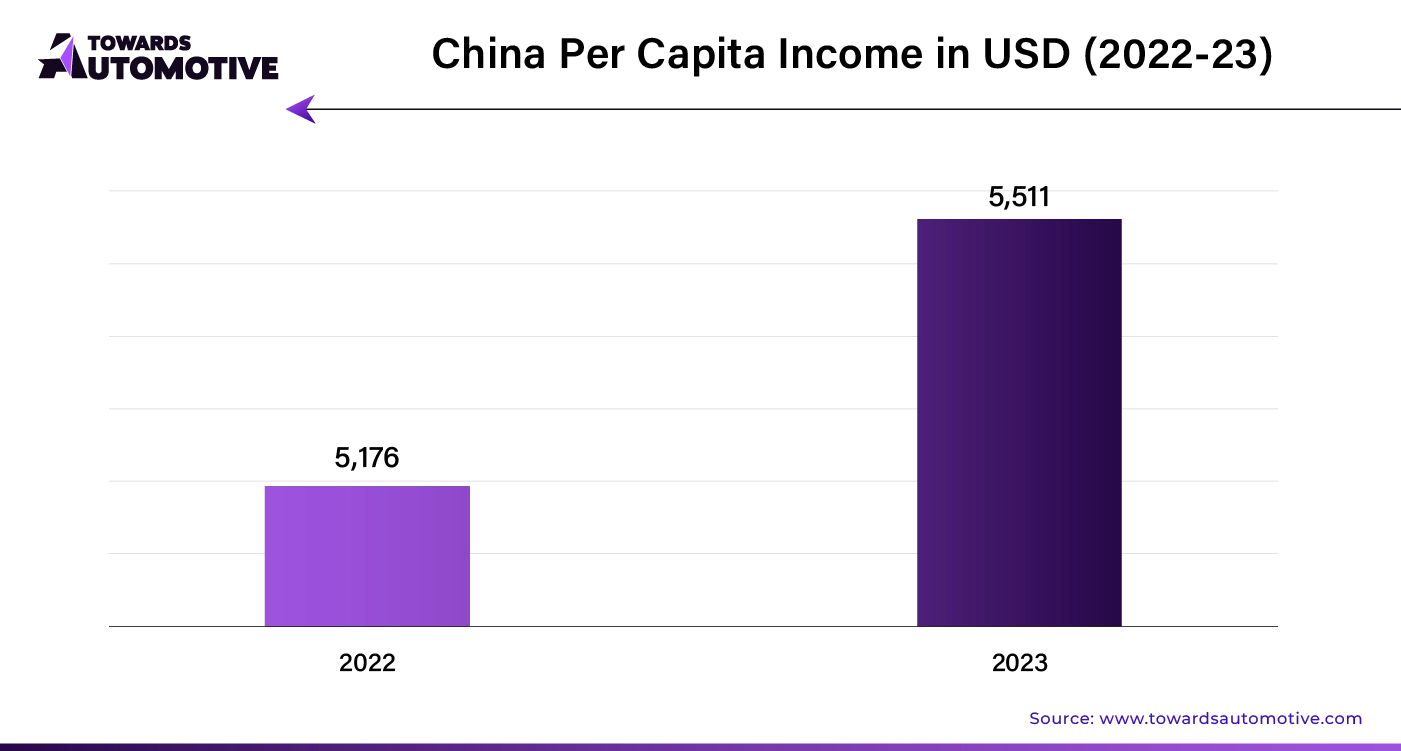

China's automotive interior leather market is experiencing significant growth, with a CAGR of approximately 6.50% through 2034. This impressive expansion is driven by the rising income levels of the middle class and their increasing demand for premium car features. Leather interiors are highly valued as symbols of luxury and status, boosting market attractiveness. As the middle class continues to grow and seek high-end car amenities, the demand for leather interiors is expected to rise substantially.

India

India's automotive interior leather market is projected to grow at a CAGR of around 6.10% until 2034, reflecting the substantial growth potential in the region. The expanding middle class and a flourishing automobile industry are key drivers of this trend. As more consumers seek luxury vehicles, the demand for premium leather interiors is also increasing. However, the adoption of leather, particularly for backseats, may be slower compared to China. Cultural and religious factors, including a higher inclination towards vegetarianism and meatless products, play a role in shaping consumer preferences and influencing the leather market's growth.

The automotive interior leather industry, traditionally dominated by established giants, is now experiencing a wave of innovation driven by emerging startups. These new entrants are addressing various gaps in the market, aiming to reshape the industry's landscape with fresh, disruptive ideas.

One major area of focus for these startups is the development of eco-friendly and sustainable leather alternatives. Many of these companies are pioneering plant-based leathers made from materials such as mushrooms and other plant sources. By utilizing recycled materials or exploring new plant-based options, these startups align with the growing consumer demand for environmentally friendly products. This approach not only reduces waste but also eliminates the need for animal testing, catering to a market increasingly concerned with ethical and sustainable practices.

In addition to sustainability, technology is another key focus for these startups. Innovations in this area include self-cleaning leathers and temperature-regulating fabrics that enhance comfort and convenience. Some companies are even integrating their products with in-car technology to create a more personalized driving experience. These technological advancements aim to provide drivers with a more functional and enjoyable vehicle interior, setting a new standard for automotive luxury and practicality.

By introducing these groundbreaking products and ideas, startups are challenging the status quo and offering automakers new options that could potentially disrupt the market. These innovations promise to deliver environmentally sustainable, technologically advanced, and potentially more affordable leather solutions, transforming how we think about and experience automotive interiors.

The automotive interior leather market is currently dominated by major players such as Lear Corporation and Adient, who hold significant shares and maintain strong relationships with original equipment manufacturers (OEMs) and luxury car brands. These companies are renowned for their expertise in leather procurement and processing, ensuring a steady supply of high-quality leather trims that are essential for premium vehicles.

As consumer preferences shift towards sustainability, new players are making their mark in the industry. Companies like MycoWorks, which specializes in producing leather alternatives from mushrooms, are gaining traction. These eco-friendly and ethical options appeal to environmentally conscious consumers and car manufacturers striving to reduce their ecological footprint.

Established brands are also adapting to these trends. For instance, DuPont is investing in research and development of bio-based leather substitutes, underscoring a commitment to sustainable practices in the industry. This evolving market landscape suggests that traditional leather giants must innovate and adapt to stay competitive alongside emerging players offering new, environmentally friendly alternatives.

These developments highlight the dynamic nature of the automotive interior leather market, where established companies are adapting to new trends and emerging players are introducing innovative, sustainable products.

By Material Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us