April 2025

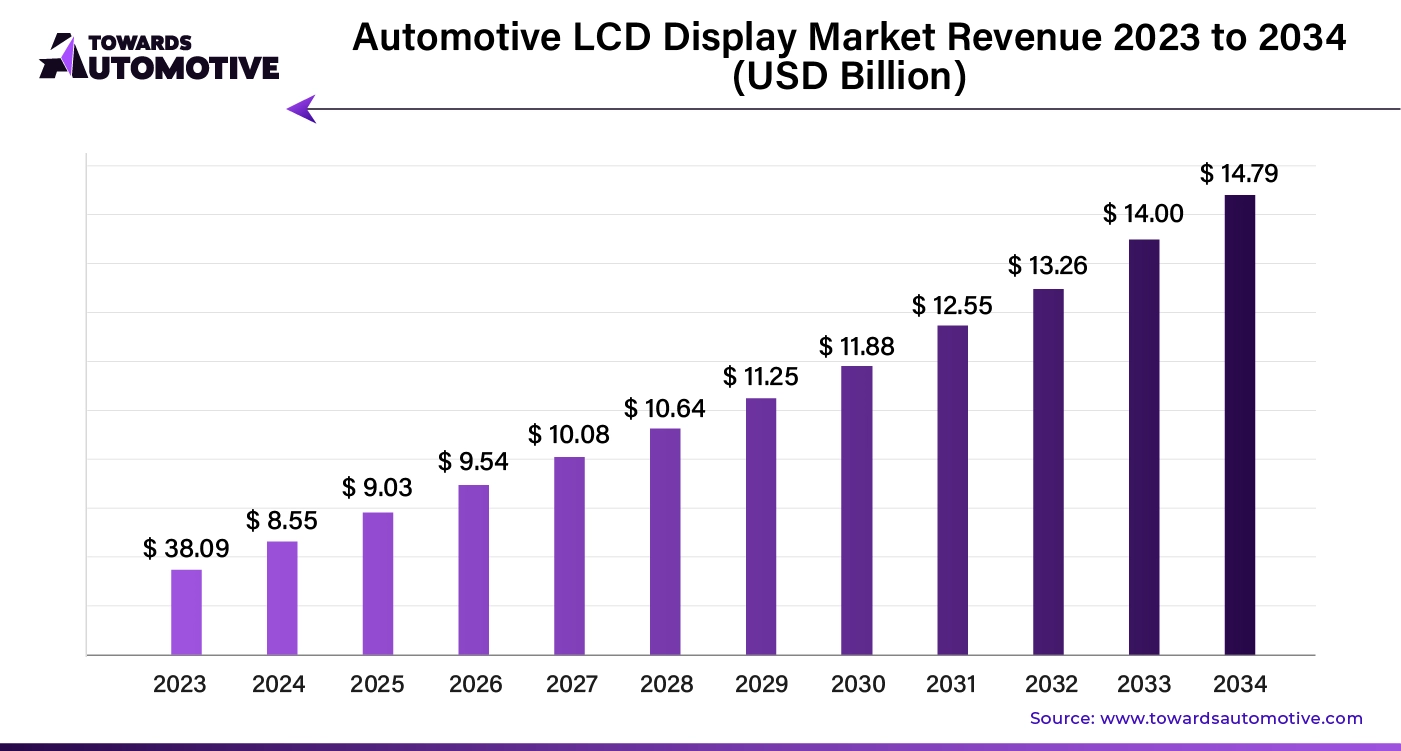

The global automotive lcd display market size is calculated at USD 8.55 billion in 2024 and is expected to be worth USD 14.79 billion by 2034, expanding at a CAGR of 5.64% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive LCD display market is experiencing substantial growth, driven by advancements in technology and increasing consumer demand for enhanced in-car experiences. Automotive LCD displays, which include instrument clusters, infotainment systems, and head-up displays, are becoming integral components in modern vehicles. These displays offer a range of features such as real-time navigation, multimedia entertainment, and vehicle performance monitoring, significantly improving driver convenience and safety.

Technological advancements, particularly in display resolution and touch-screen capabilities, are fueling the market’s expansion. High-definition (HD) and 4K displays provide crisp and clear visuals, enhancing user interaction with vehicle systems. The integration of multi-touch and gesture controls further enhances usability, allowing drivers to access various functions with ease and minimal distraction.

The growing trend towards connected vehicles and autonomous driving is also contributing to the demand for advanced automotive LCD displays. As vehicles become more connected, the need for sophisticated displays that can provide real-time information, vehicle diagnostics, and seamless integration with mobile devices is increasing. Additionally, the shift towards electric vehicles (EVs) and hybrid vehicles, which often feature high-tech interiors, is further driving the adoption of advanced display technologies.

Consumer preferences for aesthetically pleasing and intuitive interfaces are pushing automakers to invest in cutting-edge display technologies. As a result, the automotive LCD display market is set to continue its growth trajectory, with innovations in display technology and increasing vehicle digitization playing key roles in shaping its future.

Artificial Intelligence (AI) plays a transformative role in the automotive LCD display market by enhancing functionality, improving user experience, and driving innovation. AI algorithms analyze driver behavior, preferences, and usage patterns to customize the display interface. This personalization can include adjusting the layout of controls, providing tailored navigation suggestions, and integrating personalized content, making the driving experience more intuitive and user-friendly.

AI integrates with automotive LCD displays to support ADAS features. For instance, AI-powered displays can provide real-time alerts about road conditions, traffic, and potential hazards. They can also enhance the effectiveness of head-up displays (HUDs) by overlaying critical information directly onto the windshield, improving driver awareness and safety.

AI-driven voice and gesture recognition systems enable hands-free interaction with the vehicle’s display. Drivers can control various functions, such as navigation, media, and phone calls, through voice commands or gestures, reducing distractions and enhancing safety.

AI analyzes data from various vehicle sensors and systems displayed on LCD screens to predict potential issues before they become major problems. This predictive maintenance capability helps in timely servicing, reducing downtime, and improving overall vehicle reliability.

AI enhances the visual quality of automotive LCD displays by optimizing image processing and resolution. This results in sharper, clearer graphics and better integration of augmented reality (AR) elements, which are increasingly used in navigation and driver assistance.

AI adjusts the brightness and contrast of displays based on ambient lighting conditions and driver preferences. This ensures optimal visibility and reduces eye strain, enhancing the overall driving experience.

Advanced infotainment systems are significantly driving the growth of the automotive LCD display market by elevating the in-car experience and increasing the demand for high-quality displays. Modern infotainment systems, which integrate navigation, entertainment, communication, and vehicle control functions, rely heavily on sophisticated LCD displays to deliver a seamless user experience. These systems offer features such as high-definition graphics, multi-touch controls, and real-time updates, all of which require advanced display technology to function effectively.

As vehicles become more connected, the role of infotainment systems in managing various functions and providing real-time information grows, leading to a higher demand for larger, more responsive displays. High-resolution LCD screens are essential for displaying complex data, such as navigation maps, media content, and vehicle diagnostics, in a clear and accessible manner. The evolution of infotainment systems towards more interactive and customizable interfaces drives the need for innovative display solutions that can accommodate advanced graphics and user inputs.

Additionally, the integration of infotainment systems with other vehicle technologies, such as Advanced Driver Assistance Systems (ADAS) and smartphone connectivity, further fuels the demand for high-performance LCD displays. These displays are crucial for providing integrated control and monitoring of various vehicle systems, enhancing the overall functionality and convenience for drivers and passengers.

As automakers increasingly focus on creating advanced infotainment systems that offer a richer, more immersive experience, the automotive LCD display market is poised for continued growth. The demand for cutting-edge display technologies that can support these sophisticated systems is driving innovation and expanding opportunities within the market.

The automotive LCD display market faces several restraints, including high manufacturing costs and technological complexities. Advanced displays, such as high-resolution and touch-sensitive screens, require substantial investment in research and development, which can raise production costs. Additionally, the integration of sophisticated display technologies with vehicle systems demands high precision and technical expertise, leading to potential design and manufacturing challenges. Market players also contend with rapidly evolving technology, which can result in short product life cycles and the need for continuous innovation to stay competitive.

Augmented Reality (AR) integration is creating significant opportunities in the automotive LCD display market by revolutionizing how information is presented to drivers and passengers. AR technology enables the overlay of digital information onto the physical world, enhancing traditional displays with interactive and contextually relevant data. In automotive applications, AR is primarily utilized in head-up displays (HUDs), where it projects navigation prompts, safety alerts, and vehicle diagnostics directly onto the windshield. This integration allows drivers to access critical information without diverting their gaze from the road, thereby improving safety and reducing distraction.

Moreover, AR integration opens up opportunities for advanced driver assistance systems (ADAS) by providing real-time visual cues and highlighting important road features, such as lane markings and obstacles. This technology also supports the development of immersive infotainment experiences, where AR can enhance navigation with dynamic route guidance and interactive entertainment options. As automakers increasingly seek to differentiate their vehicles with cutting-edge technology, AR integration in automotive LCD displays offers a competitive edge by delivering innovative, user-friendly, and safety-enhancing features, driving market growth and expansion.

The passenger car segment dominated the industry. Passenger cars are driving significant growth in the automotive LCD display market due to their increasing reliance on advanced display technologies for enhanced in-car experiences. Modern passenger vehicles are equipped with a range of LCD displays, including instrument clusters, infotainment systems, and central control panels, which are crucial for providing drivers and passengers with information, entertainment, and connectivity. As consumer expectations evolve towards more sophisticated and interactive vehicle interiors, the demand for high-quality LCD displays in passenger cars continues to rise.

Automakers are integrating larger, high-resolution screens and advanced features such as touch interfaces and multi-function displays to improve usability and aesthetic appeal. These displays facilitate access to navigation, multimedia, and vehicle diagnostics, contributing to a more seamless and enjoyable driving experience. Additionally, the shift towards connected and electric vehicles further boosts the need for advanced LCD displays, as these vehicles often feature complex information systems and require enhanced visual interfaces to manage various functions. As passenger cars increasingly adopt these technologies to meet consumer preferences and regulatory requirements, the growth of the automotive LCD display market is significantly accelerated.

The 7-inch segment held the largest share of the market. The 7-inch segment is a key driver of growth in the automotive LCD display market, offering a balance between size, functionality, and affordability. This screen size is widely adopted for various in-car applications, including infotainment systems, instrument clusters, and navigation displays. The 7-inch display strikes a practical compromise, providing ample screen real estate for clear and detailed visuals while fitting seamlessly into diverse vehicle interiors without overwhelming the dashboard layout.

Its versatility makes the 7-inch display ideal for a range of functions, from basic vehicle information and multimedia controls to more advanced features like real-time navigation and connectivity interfaces. As automakers strive to enhance the user experience and integrate more technology into vehicles, the demand for 7-inch displays continues to rise. This segment caters to both high-end and budget-conscious vehicles, contributing to its widespread adoption. Furthermore, advancements in display technology, such as improved resolution and touch capabilities, enhance the appeal of 7-inch screens, driving their continued popularity in the automotive industry. As a result, the growth of the 7-inch segment is significantly contributing to the overall expansion of the automotive LCD display market.

Asia Pacific dominated the automotive LCD display market. Technological advancements, the rise of electric and autonomous vehicles, and a heightened focus on safety and driver assistance technologies are key drivers of the automotive LCD display market’s growth in Asia Pacific. Technological innovations, such as high-resolution displays, OLED screens, and advanced touch interfaces, are transforming in-car experiences. These advancements enable the integration of more interactive and detailed displays, enhancing navigation, infotainment, and vehicle diagnostics, which are increasingly sought after by consumers in the region.

The proliferation of electric vehicles (EVs) in Asia Pacific is also significantly boosting demand for sophisticated LCD displays. EVs often come equipped with state-of-the-art display systems to manage battery information, energy consumption, and infotainment functions, necessitating advanced and reliable display technologies. Similarly, the growth of autonomous vehicles in the region requires cutting-edge display solutions to present real-time data from various sensors and systems, ensuring safe and effective operation. These vehicles demand high-quality LCD displays for comprehensive driver interfaces and advanced driver assistance systems (ADAS).

Additionally, the region’s strong emphasis on safety and driver assistance technologies is driving market growth. As governments and manufacturers prioritize enhanced safety features, the integration of advanced displays becomes crucial. LCD screens are central to the functionality of head-up displays (HUDs), digital instrument clusters, and other safety-related technologies, which provide drivers with essential information and alerts in an easily accessible format. This focus on safety and innovation aligns with Asia Pacific's growing automotive market, propelling the demand for advanced LCD display solutions that support both evolving technology and consumer expectations.

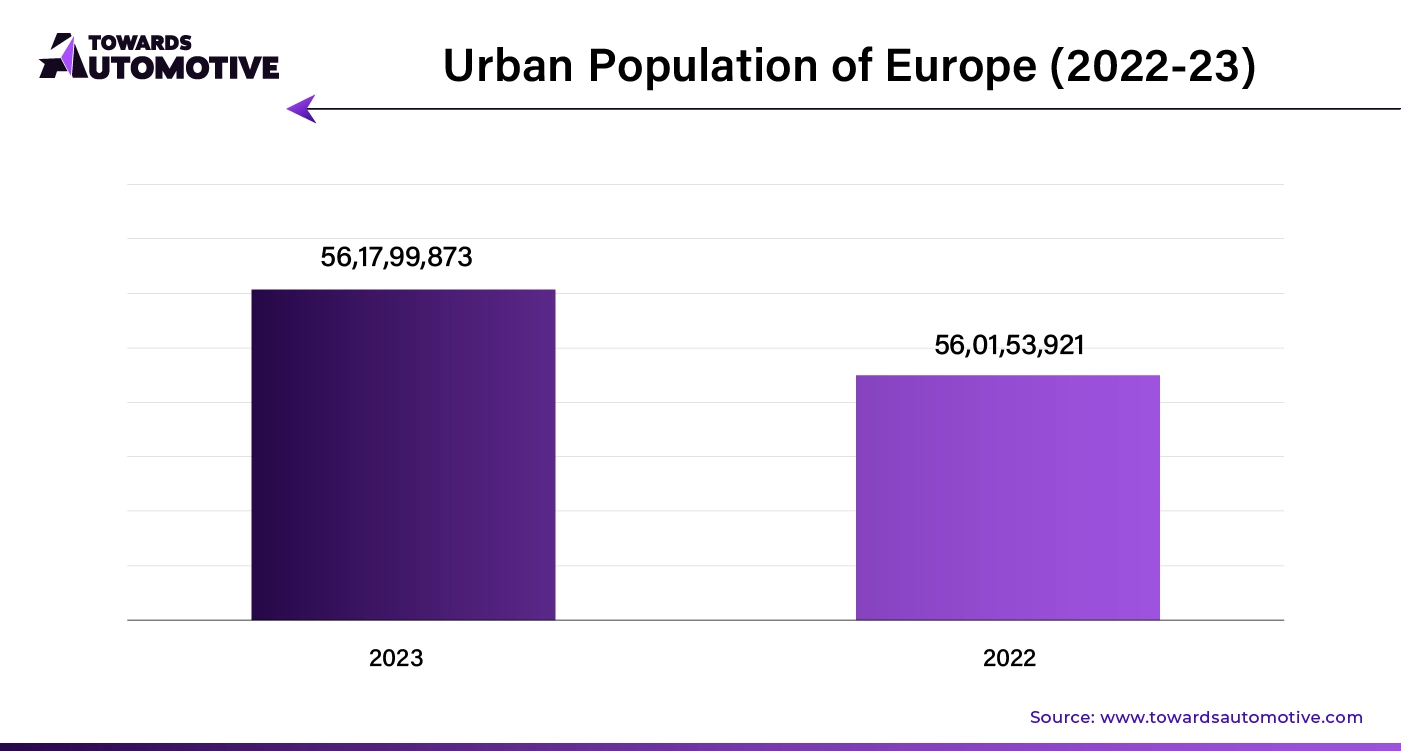

Europe is expected to grow with a notable CAGR during the forecast period. The growth of the automotive LCD display market in Europe is being driven by the expansion of automotive manufacturing, rapid urbanization, and technological advancements. The expansion of automotive manufacturing in Europe, with numerous leading car manufacturers and suppliers operating in the region, fuels demand for high-quality LCD displays. As these manufacturers strive to offer more advanced and feature-rich vehicles, the integration of cutting-edge LCD displays becomes essential. This trend supports the incorporation of advanced infotainment systems, digital instrument clusters, and other display technologies into a wide range of vehicle models.

Rapid urbanization across European cities is also contributing to market growth. As urban areas expand and vehicle ownership increases, there is a rising demand for advanced in-car technologies that enhance the driving experience and ensure better navigation and connectivity. LCD displays play a critical role in meeting these needs, providing clear and interactive interfaces for navigation, traffic information, and vehicle diagnostics. The need for improved urban mobility solutions and smarter vehicle technologies drives the adoption of sophisticated displays that support both driver convenience and safety.

Technological advancements are another significant factor driving the growth of the automotive LCD display market in Europe. Innovations such as high-resolution screens, OLED technology, and flexible displays are transforming vehicle interiors, making them more engaging and user-friendly. These advancements enable automakers to offer more advanced and aesthetically pleasing display solutions, which are increasingly sought after by consumers. As Europe continues to embrace new technologies and strives for excellence in automotive design and functionality, the demand for advanced LCD displays is expected to grow, driving the market forward.

By Display Size

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us