April 2025

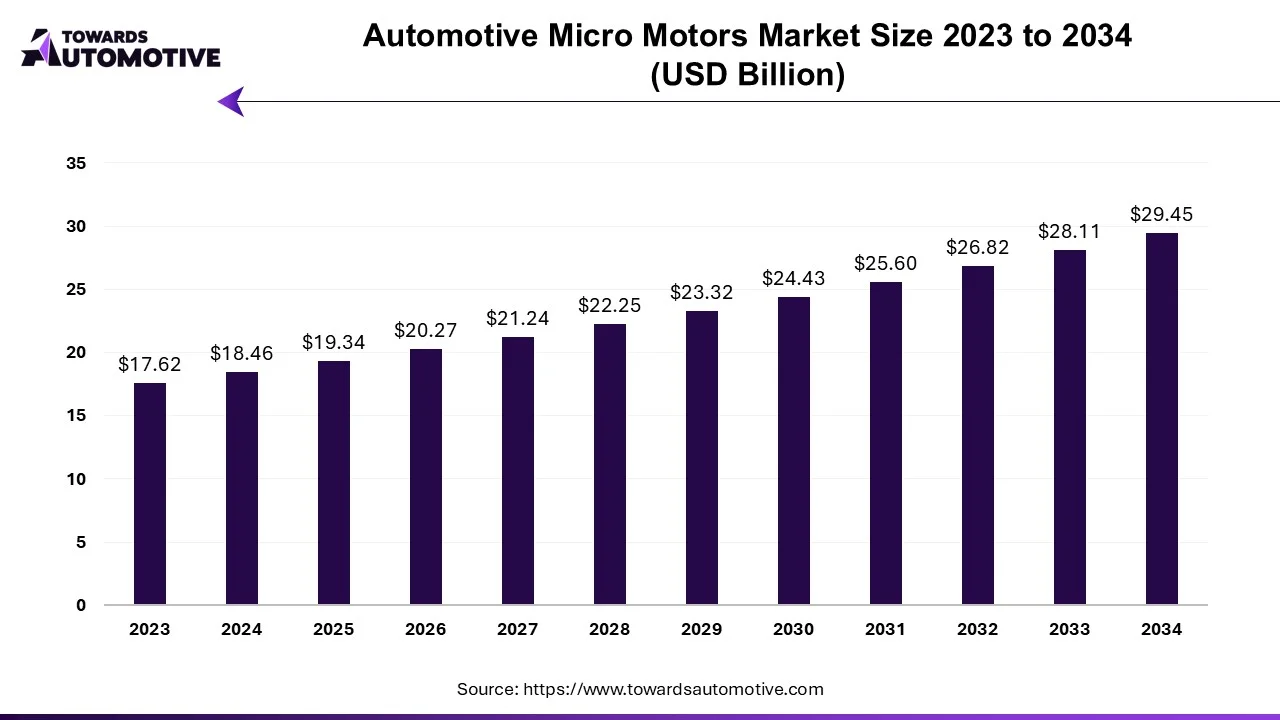

The automotive micro motors market is forecasted to expand from USD 19.34 billion in 2025 to USD 29.45 billion by 2034, growing at a CAGR of 4.78% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

In the long term, the global micro motor industry is experiencing growth driven by increasing consumer preferences for luxury products, government support for electric vehicles to reduce carbon emissions, and advancements in brushless micromotor technology. This growth extends to various automotive applications such as automotive micro motors, solar panels, and power antennas. As disposable incomes rise, consumer interest in car models equipped with advanced features like solar energy is increasing, contributing to the expansion of the automotive micromotor market.

The COVID-19 pandemic has disrupted global supply chains due to quarantines, travel restrictions, reduced production capacity, and increased transportation costs. This disruption affects the production and supply of micro motors, impacting industries such as automobiles, electronics, construction, aerospace, and defense. However, the demand for medical equipment like respirators, pumps, and diagnostic devices surged during the pandemic, positively impacting micromotor manufacturers supplying ventilators.

The growing demand for automation across industries significantly influences the micromotor industry's growth. Micro motors play a crucial role in providing movement and control for small machines and automation equipment in production facilities. Additionally, they are widely utilized in various automotive components such as fans, water pumps, wipers, anti-lock braking system (ABS) pumps, sunroofs, clutch actuators, alternators, capacitors, and steering wheels, enhancing vehicle performance, safety, comfort, and energy efficiency.

Advancements in automotive technology, including features like automatic electric port movement to prevent pipeline damage, front and rear mirror controls, and seat adjustments, drive the need for automotive micro motors and components. Companies like Mabuchi Motor are developing innovative micromotor solutions tailored for light electric vehicles, emphasizing attributes like lightness, compactness, high efficiency, and reliability.

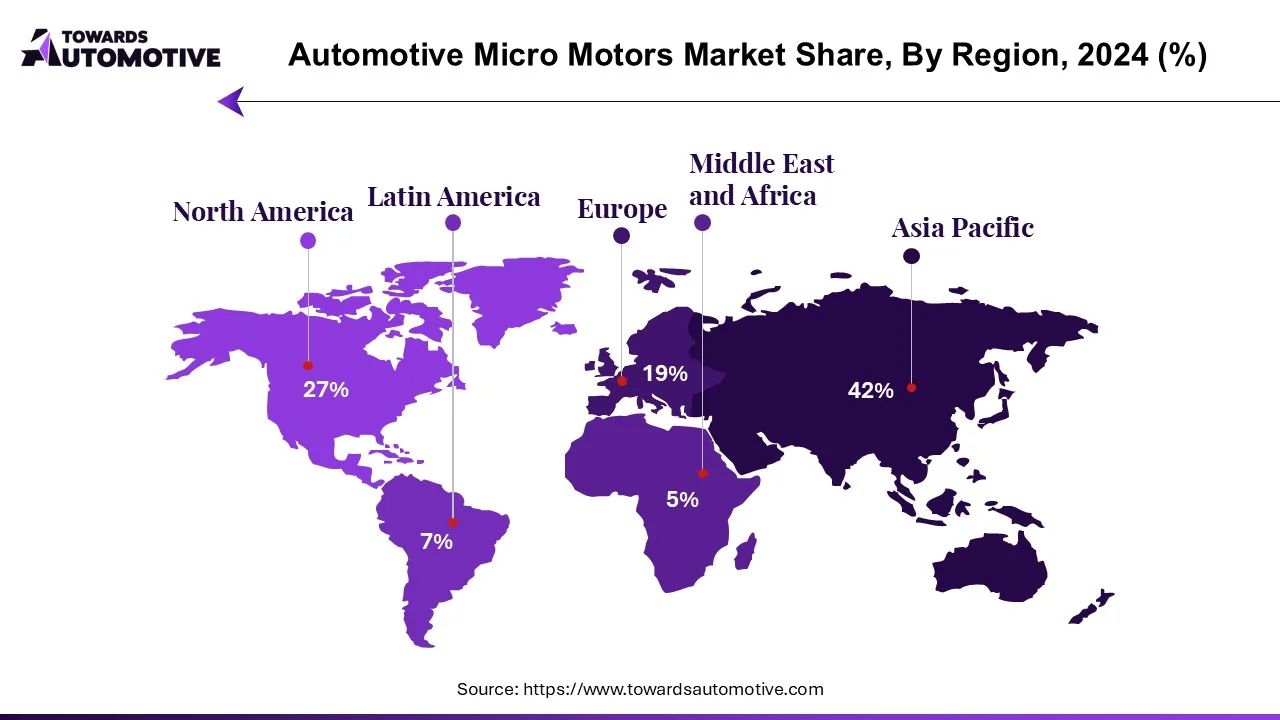

Regionally, the Asia-Pacific region is poised to emerge as the largest market for automotive micro motors due to the rising demand for electric vehicles and luxury vehicles like SUVs. Recent progress in compact and efficient power generation presents opportunities for the automotive industry. Additionally, North America and Europe are expected to witness increased demand for automotive micro motors, particularly in applications such as solar power. Moreover, automakers' demand for lightweight solutions is driving the introduction of advanced brushless DC micro motors in the market.

There is significant demand for micro motors from major automobile manufacturers worldwide, driven by the increasing adoption of automotive products across various applications. The demand for both DC and brushed micro motors is rising, particularly in applications such as car seats equipped with massage functions, electric windows, and electric side mirrors (ORVM). As smart technology continues to evolve in the automotive industry, the demand for micro motors is expected to further increase.

Major companies are increasingly focusing on producing DC micro motors due to their lower power consumption compared to other types. DC micro motors are favored in the automotive industry for their fast response times and high starting power. Additionally, their compatibility with various voltage models and simple installation processes have fueled demand for these products. The integration and advancement of brushless DC micro motors are expected to gain attention in the coming years due to potential cost savings. Brushless micro motors offer advantages in automotive applications such as windshield wipers, power windows, and power seats, driving demand in this segment.

DC micro motors are commonly utilized in luxury cars by automotive manufacturers. Therefore, the increasing demand for luxury vehicles like SUVs and MPVs, along with the growing popularity of electric vehicles, is anticipated to positively contribute to the growth of the automotive micromotor sector. The global car population is projected to reach 190,000 units in 2022, up from 155,000 units in 2021. With the introduction of luxury models, the demand for the DC micromotor market is expected to thrive during the forecast period.

Urbanization, coupled with the rising per capita income of consumers in the Asia-Pacific region, is fueling the expansion of the luxury car market, thereby driving the demand for automotive micro motors and alternative energy sources like solar power. Furthermore, the growing popularity of electric vehicles in countries like India and China is amplifying the need for micro motors, which are essential for power windows, power seats, and various other features that enhance customer convenience.

Recent years have seen a surge in automobile production, particularly in countries such as China, attributed to lower production costs. China has also emerged as one of the largest exporters of automobiles and auto parts globally. The uptick in automobile manufacturing in the region is expected to bolster the demand for passenger cars, subsequently contributing positively to the growth of the automotive micromotor market. According to data from the International Energy Agency, electric vehicle sales in China are projected to reach 6 million units in 2022, marking an 81.8% annual increase from 2021 to 2022, compared to 3.3 million units in 2021. Consequently, the automotive micromotor market in the Asia-Pacific region is poised for substantial growth, driven by the uptake of electric vehicles and shifting consumer preferences toward luxury automobiles.

Furthermore, Japan is poised to leverage its advantages within the Asia-Pacific region following China's lead. As home to major players like Nidec Corporation, Mabuchi Motors Corporation, and Mitsuba Corporation, Japan is expected to play a pivotal role in supporting growth across the region. Additionally, emerging markets such as India and ASEAN (Association of Southeast Asian Nations) are anticipated to contribute to the global demand for micro motors, further fueling market expansion.

The micromotor industry is characterized by high fragmentation and intense competition, driven by the presence of numerous international and domestic players in the market ecosystem. Key players include Bühler Electric Co., Ltd., Constar MicroMotor, Johnson Electric Holdings Co., Ltd., Mitsuba Corporation, Nidec Corporation, Mabuchi Electric, Maxon Motors, and Assun Motor. These companies boast robust research and development capabilities to cater to global demand. Moreover, their extensive product portfolios and distribution networks bolster their market presence.

In April 2023, Honda recognized Mitsuba Corporation, a specialist manufacturer in engine and micromotor production, for its excellence and timely delivery throughout 2022. Mitsuba Corporation noted that this recognition underscores its commitment to supporting automakers in scaling up production for 2022.

In October 2022, Mabuchi Motor, a micromotor and small electric motor company, unveiled its "five control zones" strategy aimed at enhancing and expanding its production processes worldwide. The company seeks to augment its production capacity for micro motors and small electric motors across the ASEAN region as part of this initiative.

The market is poised to witness the introduction of various professional-grade brushless DC micro motors, driven by rapid technological advancements and players' endeavors to capture market share.

The brushed DC micromotor segment is poised to dominate the DC micromotor market, capturing approximately 54% market share in 2022. Brushed motors are favored for their ease of installation and lower cost compared to brushless motors. These motors typically operate within the range of 1,000 to 10,000 rpm and find applications in various vehicle systems such as air conditioners, power windows, and cooling fans. While brushed DC micro motors are more susceptible to damage and have a shorter lifespan, lasting around 10,000 hours, they are preferred for their lower maintenance requirements and higher output per shaft. On the other hand, brushless motors, despite being more complex and having a higher initial cost, are gaining traction due to their longer lifespan.

Automotive micro motors exhibit a compact structure, lightweight design, easy operation, low power consumption, and minimal electromagnetic interference. These characteristics make them ideal for integration into small, intricate areas with limited power budgets, particularly in modern electrical and electronic systems within the automotive industry.

By Power Consumption

By Motor Type

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us