December 2025

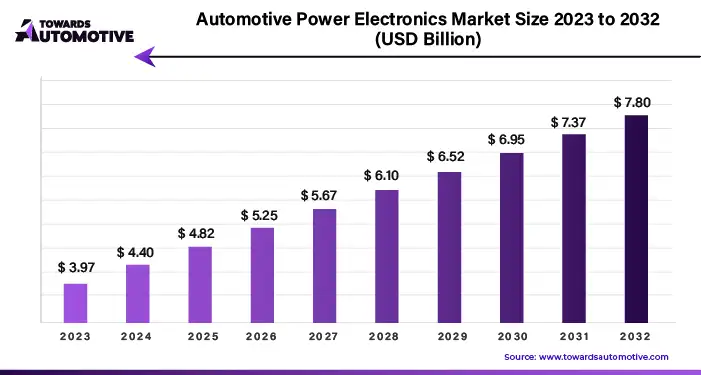

The automotive power electronics market is projected to reach USD 9.06 billion by 2034, expanding from USD 4.61 billion in 2025, at an annual growth rate of 7.79% during the forecast period from 2025 to 2034.

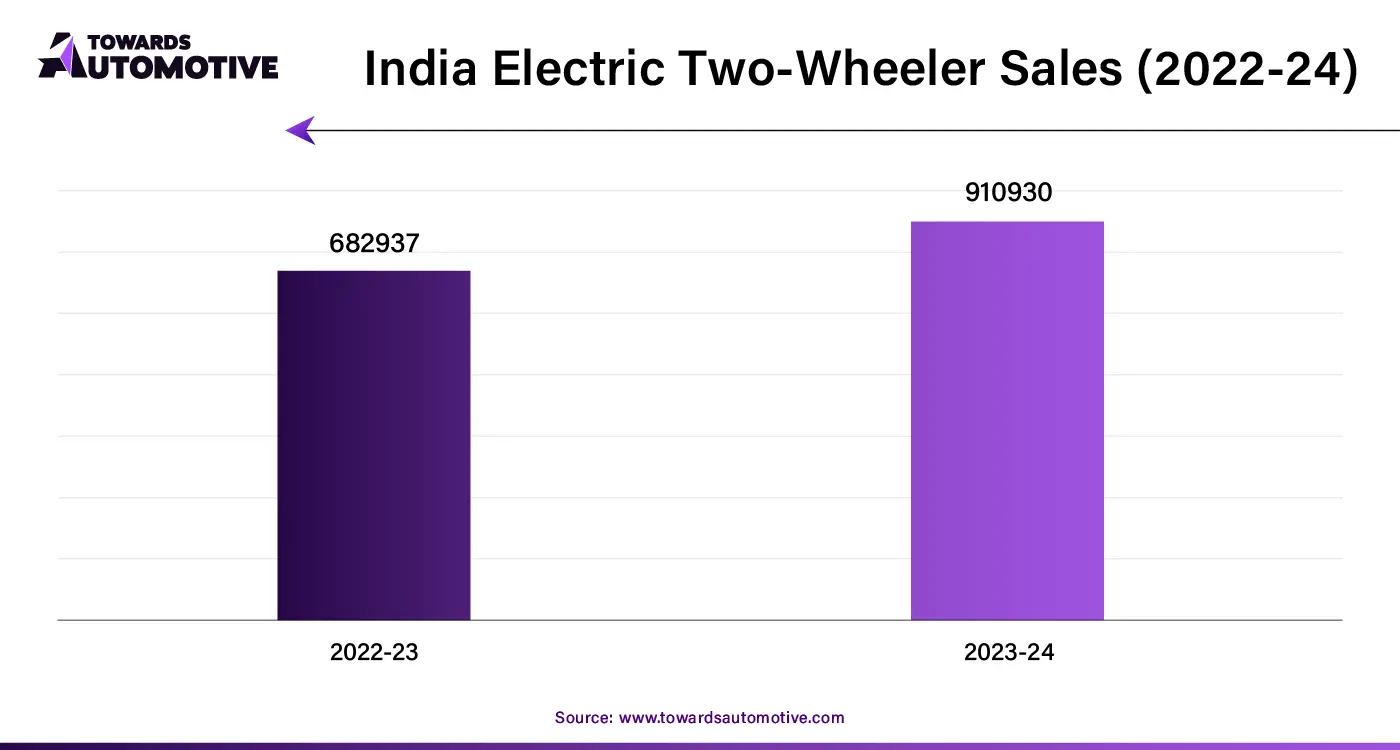

The automotive power electronics market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of automotive power electronics in different parts of the world. There are various types of power electronics developed in this sector comprising of power supply modules, motor drives, battery management systems, on-board chargers and some others. These electronics are integrated with numerous components such as power modules, converters, controllers, switches and some others. It is designed for numerous types of vehicles consisting of passenger cars, commercial vehicles, two-wheelers and heavy-duty vehicles. The increasing sales of two-wheelers in different parts of the world has contributed to the industrial expansion. This market is projected to rise significantly with the growth of the electric vehicle industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 4.28 Billion |

| Projected Market Size in 2034 | USD 9.06 Billion |

| CAGR (2025 - 2034) | 7.79% |

| Market Segmentation | By Type, By Component, By Vehicle Type, By Application and By Region |

| Top Key Players | NXP Semiconductors, STMicroelectronics, Microsemi Corporation, Vishay Intertechnology Inc. |

The electric vehicles segment held the largest share of the market. The growing sales and production of electric vehicles in different parts of the world has boosted the market expansion. Also, the rising application of DC-DC converters, inverters, onboard chargers and some others in BEVs is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by government for developing the EV infrastructure coupled with the increasing sales of LCEVs is driving the growth of the automotive power electronics market.

The hybrid vehicles segment is anticipated to rise with a significant CAGR during the forecast period. The rising adoption of PHEVs and HEVs due to the increasing awareness for lowering emission has boosted the market growth. Additionally, rapid advancements in hybrid powertrains along with numerous government initiatives for aimed at adopting eco-friendly vehicles is adding to the overall industrial expansion. Moreover, several partnerships and collaborations among automotive brands and powertrain manufacturers is anticipated to propel the growth of the automotive power electronics market.

The power supply modules segment dominated this industry. The growing use of power supply modules in electric vehicles has boosted the market expansion. Additionally, several electronics companies are partnering with automotive brands for developing PDMs is further adding to the industrial growth. Moreover, the increasing usage of numerous types of power supply modules including linear modules, switched-modules, and battery-based modules in automotives for operating different functions is expected to foster the growth of the automotive power electronics market.

The on-board chargers segment is predicted to rise with a considerable CAGR during the forecast period. The growing adoption of EVs due to the rising need to lower environmental emission has boosted the market expansion. Additionally, the increasing application of on-board chargers in PHEVs and BEVs is further contributing to the industrial growth. Moreover, rapid investment by market players for developing bi-directional on-board chargers is adding to the growth of the automotive power electronics market.

The passenger cars segment led the industry. The growing demand for electric SUVs in high-income countries such as US, UK, Germany, France and some others is driving the market growth. Additionally, increasing sales of affordable hatchbacks in Asian nations such as India, China, Indonesia and some others has further contributed to the industrial expansion. Moreover, rapid investment by automotive brands for developing futuristic passenger cars is expected to foster the growth of the automotive power electronics market.

The two-wheelers segment is likely to grow with a significant rate during the forecast period. The rising demand for superbikes among youths has boosted the market growth. Also, rapid adoption of two-wheelers for short-distance commute along with constant research and development associated with development of fuel-efficient motorcycles is further adding to the industrial expansion. Moreover, the growing sales of electric bikes and electric scooters is projected to propel the growth of the automotive power electronics market.

North America held the highest share of the automotive power electronics market. The growing demand for luxury cars in several countries such as Canada and the U.S. has boosted the market expansion. Additionally, the rapid adoption of electric trucks in e-commerce companies such as Amazon, Walmart, Ebay and some others is likely to shape the industrial landscape. Moreover, the presence of several automotive power electronics brands such as Texas Instruments Incorporated, Microsemi Corporation, Broadcom and some others is anticipated to foster the growth of the automotive power electronics market in this region.

U.S. is dominated this region. The rising sales of superbikes along with technological advancements in automotive sector has driven the market growth. Additionally, the presence of various automotive brands such as Tesla, Ford, General Motors and some others is shaping the industrial landscape.

In October 2024, Yamaha launched R9 superbike in the U.S. This superbike is equipped with a 3-cylinder engine that delivers a power output of around 119.0PS.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The rising sales and production of passenger vehicles in several countries such as India, China, South Korea, Japan and some others has driven the market growth. Also, the growing demand for electric vehicles along with rapid developments in automotive components industry is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of various automotive companies such as Tata Motors, BYD, XPENG, Suzuki, Toyota, Mitsubishi and some others is expected to boost the growth of the automotive power electronics market in this region.

China is the major contributor of this region. In China, the market is generally driven by the growing demand for electric buses along with availability of semiconductors. Moreover, the presence of several power electronics companies such as BOE Technology Group Co., Ltd, Shanghai Belling, Bright Power Semiconductor and some others is driving the market growth in this nation.

The automotive power electronics market is a rapidly developing industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Texas Instruments Incorporated, Renesas Electronics Corporation, NXP Semiconductors, STMicroelectronics, Microsemi Corporation, Vishay Intertechnology Inc., Semiconductor Components Industries LLC, Toyota Industries Corporation and some others. These companies are constantly engaged in developing power electronics for the automotive sector and adopting numerous strategies such as acquisitions, joint ventures, business expansions, collaborations, launches, partnerships, and some others to maintain their dominant position in this industry. For instance, in May 2025, NXP launched S32R47 imaging radar processors. These processors are designed to enhance the capabilities of ADAS in autonomous vehicles. Also, in April 2024, Delta joined hands with Texas Instruments (TI). This joint venture is done for developing advanced power systems for electric vehicles.

By Type

By Component

By Vehicle Type

By Application

By Region

The automotive infotainment testing platform market size is calculated at $2.02 billion in 2024 is to hit $3.93 billion by 2034. AI revolutionizes aut...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us