April 2025

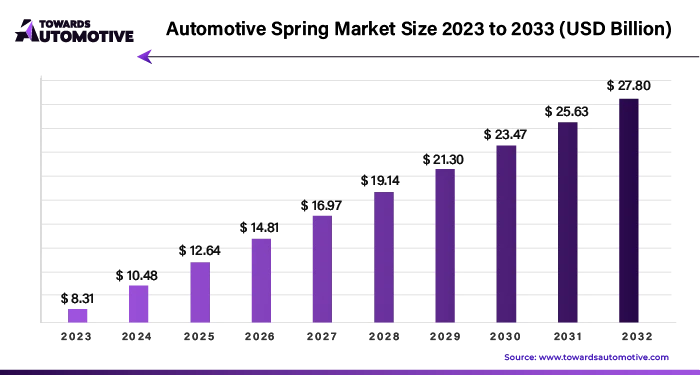

The automotive spring market is predicted to expand from USD 10.32 billion in 2025 to USD 27.38 billion by 2034, growing at a CAGR of 11.45% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive spring market has experienced significant impacts due to various factors, including the transition to electric vehicles (EVs), rapid urbanization, and fluctuations in global automotive production. The rise of EVs, with their distinct weight distribution and driving characteristics, has necessitated the development of specialized springs tailored to their unique requirements. These springs must provide a comfortable and balanced ride while accommodating the constant demand for electricity and addressing potential energy-related challenges faced by EVs.

Moreover, the surge in urbanization and disposable income in many countries has fueled the demand for both passenger and commercial vehicles, particularly trucks. This trend has led to increased investments from global automotive companies, resulting in a rise in vehicle production and aftermarket sales, including automotive springs. Additionally, the presence of robust manufacturing ecosystems and low labor costs in certain regions has further stimulated investments and production in the automotive sector.

The growth in automobile production is intricately linked to the demand for automotive springs, as these components are essential for suspension, chassis, and other applications. Original equipment manufacturers (OEMs) and automakers require durable automotive parts to meet the evolving needs of consumers and to ensure the reliability and performance of their vehicles.

However, despite these growth opportunities, the automotive spring industry faces challenges stemming from business uncertainty and changing customer preferences. Business performance in this sector closely mirrors the overall health of the automotive industry, making it susceptible to fluctuations and disruptions. Furthermore, evolving customer needs and market dynamics necessitate continuous adaptation and innovation within the automotive spring market to remain competitive and resilient in the face of uncertainty.

The COVID-19 pandemic has had a profound impact on the automotive industry, including the automotive spring sector, leading to both short-term disruptions and potential long-term changes. One significant challenge faced by the automotive industry during the pandemic was the reliance on international suppliers for components and materials. Quarantines, restrictions, and disruptions imposed on factories in various countries disrupted the supply chain, causing delays in the production of automobiles and related products, such as trucks.

As a result of these disruptions, the supply of essential components like automotive springs to automakers was affected, leading to shortages and production delays. The inability to procure necessary parts in a timely manner hindered the production process, further exacerbating the challenges faced by automotive manufacturers.

Moreover, the pandemic-induced economic downturn and reduced consumer demand for vehicles also contributed to the decline in automotive production and sales. Uncertainty surrounding the duration and severity of the pandemic further complicated the situation, making it challenging for automotive companies to forecast demand and plan production schedules effectively.

While the automotive industry has begun to recover from the initial shock of the pandemic, the lingering effects continue to impact the supply chain and production processes. Automotive spring manufacturers are adapting to the new normal by implementing measures to enhance resilience, such as diversifying suppliers, streamlining production processes, and investing in technologies to improve flexibility and agility in responding to future disruptions.

COVID-19 pandemic has underscored the importance of building resilience and flexibility into supply chains and production systems within the automotive industry. It has prompted automotive spring manufacturers to reevaluate their business strategies and practices to better withstand future challenges and ensure continuity in operations.

The growing emphasis on safety and comfort in the automotive industry has prompted manufacturers to prioritize partnerships with spring companies capable of delivering reliable and high-performance equipment. These partnerships with automotive original equipment manufacturers (OEMs) offer spring manufacturers the opportunity to establish themselves as trusted suppliers, fostering long-term collaborations and expanding their business prospects. As a result, the quest for enhanced comfort and safety has emerged as a significant driver of growth in the automotive spring market.

Manufacturers are leveraging advancements in spring technology to develop new, high-performance models designed to enhance ride quality, stability, and overall safety. By incorporating innovative materials, design techniques, and manufacturing processes, spring manufacturers can create products that meet the stringent safety standards and performance requirements of modern vehicles. These advanced springs not only improve the driving experience for consumers but also contribute to the overall reputation and competitiveness of automotive OEMs in the market.

As consumer awareness regarding the importance of safety features continues to increase, automotive OEMs are under pressure to integrate cutting-edge technologies and components into their vehicles to meet evolving customer expectations. Springs play a crucial role in ensuring vehicle safety and performance, making them a focal point for collaboration between OEMs and spring manufacturers. By partnering with reputable spring companies, automotive OEMs can access expertise and resources to develop innovative suspension systems that enhance vehicle dynamics, handling, and crashworthiness.

The emphasis on safety and comfort in the automotive industry presents significant opportunities for spring manufacturers to establish themselves as key partners in the supply chain. Through strategic collaborations and investments in technology and product development, spring companies can position themselves as leaders in providing high-quality, high-performance springs that meet the evolving needs of automotive OEMs and consumers alike.

The automotive coil spring market is poised to reach a revenue milestone of approximately $1 billion by 2022. Coil springs play a vital role in automotive suspension systems, and a prominent trend in this sector is the escalating demand for advanced materials and manufacturing techniques. With the proliferation of electric and non-electric vehicles, coil spring manufacturers are innovating to address the unique requirements of these vehicles, including designing springs that can accommodate varied weight distribution, operate alongside electric powertrains, and integrate seamlessly with autonomous driving sensors.

The automotive spring industry encompasses three primary categories based on material composition: steel springs, composite springs, and plastic springs. Steel springs have historically dominated the automotive landscape due to their favorable properties and cost-effectiveness. An ongoing focus within the industry is the continuous refinement of high-strength and lightweight steel alloys. Both automobile manufacturers and spring manufacturers are actively exploring new steel compositions and heat treatment methods to enhance spring performance while simultaneously reducing weight. This emphasis aligns with the industry's overarching goals of enhancing fuel efficiency and curbing vehicle emissions.

Segmented by vehicle type, the automotive spring market caters to passenger vehicles, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and two-wheelers. Within the passenger vehicle segment, there is a substantial market devoted to enhancing comfort and handling characteristics while simultaneously reducing vehicle weight. Manufacturers are developing advanced suspension systems featuring improved coil springs and shock absorbers to deliver a more refined and elevated driving experience for motorists. Moreover, the rise of electric and hybrid vehicles necessitates specialized springs capable of accommodating the specific weight distributions and operational dynamics of these powertrains.

In terms of end-use applications, the automotive spring market encompasses suspension systems, engine valves, clutch assemblies, and transmission systems. The suspension systems segment is poised for significant growth until 2032, propelled by advancements in suspension technology for both passenger and commercial vehicles. Manufacturers are introducing innovative springs such as air springs and adaptive shock absorbers to enhance comfort and handling across conventional and electric vehicle platforms. Furthermore, the burgeoning demand for luxury and premium vehicles has spurred the adoption of high-performance springs to cater to discerning consumers seeking an enhanced driving experience.

Establishing robust sales channels in collaboration with original equipment manufacturers (OEMs) is integral to success in the automotive spring market. As OEMs strive to differentiate their vehicles and adhere to increasingly stringent requirements, they rely on spring manufacturers to deliver tailored solutions and engine components that align with evolving industry standards and consumer preferences. This symbiotic relationship underscores the importance of ongoing collaboration and innovation within the automotive supply chain.

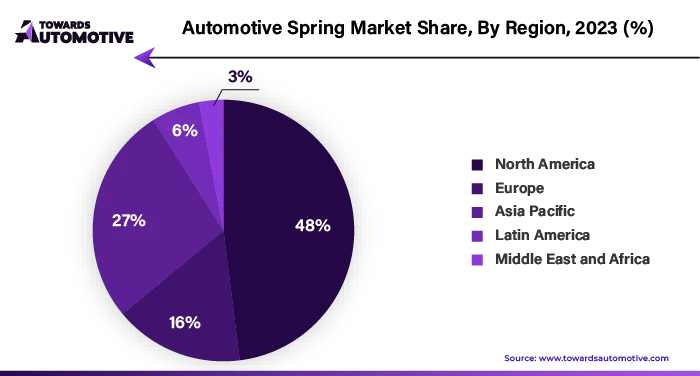

The American automotive spring market is poised to surpass the $950 million mark by 2022. A key driving force behind market growth in North America is the emphasis on quality and customization. The region boasts a robust car enthusiast culture alongside substantial business and sporting activities, fostering a heightened demand for performance-oriented solutions aimed at enhancing vehicle handling, comfort, and overall performance.

Enthusiasts, in particular, are keen on personalized options such as lowered springs and adjustable coilovers, which allow them to tailor their vehicle's suspension to suit their individual preferences and driving style. This trend reflects a broader consumer shift towards personalized automotive solutions, as drivers seek to imbue their vehicles with unique characteristics that align with their lifestyle and driving aspirations. Additionally, the pursuit of superior performance and driving dynamics remains a driving force within the North American automotive landscape, further fueling the demand for high-quality springs and suspension components that deliver exceptional performance and reliability.

Some of the major market players operating in the automotive spring market are:

The key players in the automotive spring market are prioritizing joint ventures, product innovation, and marketing efforts to drive business expansion. By forming strategic partnerships and collaborations, these companies aim to leverage complementary strengths and resources, allowing them to penetrate new markets and diversify their product offerings. Furthermore, continuous investment in research and development is a core focus area for these players, as they strive to develop cutting-edge products that meet evolving customer needs and technological advancements. By staying at the forefront of innovation, they can differentiate themselves in the market and maintain a competitive edge. Additionally, robust marketing strategies are employed to enhance brand visibility, increase market penetration, and drive customer engagement. Through targeted marketing campaigns and effective communication strategies, these players aim to position themselves as industry leaders and capture a larger share of the market.

By Type

By Material

By Vehicle Type

By End-Use

By Sales Channel

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us