Automotive Stainless Steel Market Size, Forecast and Insights

The automotive stainless steel market is forecasted to expand from USD 3.93 billion in 2025 to USD 6.62 billion by 2034, growing at a CAGR of 5.97% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Stainless steel has emerged as a vital material in the automotive industry, offering exceptional strength, corrosion resistance, and aesthetic appeal. As automotive manufacturers seek to enhance vehicle performance, durability, and design, the demand for stainless steel components continues to rise, driven by factors such as technological advancements, regulatory requirements, and consumer preferences for high-quality, long-lasting vehicles.

Key Applications and Advantages of Automotive Stainless Steel

- Exhaust Systems: Automotive stainless steel is extensively used in exhaust system components, including mufflers, pipes, and catalytic converters, due to its superior corrosion resistance and high-temperature strength. Stainless steel exhaust systems offer enhanced durability, corrosion resistance, and acoustic performance compared to traditional materials such as mild steel or aluminum, ensuring long-term reliability and compliance with emission standards in modern vehicles.

- Automotive Body Panels: Stainless steel is employed in automotive body panels and trim components to enhance corrosion resistance, dent resistance, and aesthetic appeal. Stainless steel body panels offer superior durability, scratch resistance, and formability, allowing for intricate designs and surface finishes while providing long-lasting protection against rust, corrosion, and environmental damage in harsh operating conditions.

- Structural Components: Automotive stainless steel is utilized in structural components such as chassis, frame rails, and suspension parts to improve strength, stiffness, and crashworthiness. Stainless steel structural components offer lightweight construction, high tensile strength, and fatigue resistance, enabling optimized vehicle performance, handling, and safety while reducing weight and fuel consumption in passenger cars, trucks, and SUVs.

- Interior and Exterior Trim: Stainless steel is employed in interior and exterior trim applications such as door handles, window trims, and grille surrounds to enhance visual appeal, durability, and corrosion resistance. Stainless steel trim components offer premium aesthetics, sleek finishes, and weatherproof performance, adding elegance and sophistication to vehicle design while withstanding exposure to sunlight, moisture, and environmental pollutants in outdoor and indoor environments.

Market Dynamics and Trends

- Lightweighting and Fuel Efficiency: The trend towards lightweighting and fuel efficiency drives the adoption of automotive stainless steel, as vehicle manufacturers seek lightweight, durable materials to reduce vehicle weight, improve fuel economy, and meet regulatory emissions standards. Advanced stainless steel alloys offer high strength-to-weight ratios, enabling lightweight construction of automotive components and systems while enhancing performance, safety, and sustainability in modern vehicles.

- Electric and Hybrid Vehicles: The transition towards electric and hybrid vehicles (EVs and HEVs) creates new opportunities for automotive stainless steel, as electric drivetrains and battery systems require lightweight, corrosion-resistant materials for structural components and enclosures. Stainless steel offers excellent properties for EV battery housings, chassis components, and structural reinforcements, providing robust protection, thermal management, and electromagnetic shielding for advanced electric vehicle architectures and powertrain systems.

- Autonomous Driving Technologies: The integration of autonomous driving technologies and advanced driver assistance systems (ADAS) drives the demand for automotive stainless steel, as autonomous vehicles require reliable, durable materials for sensor integration, connectivity, and structural reinforcement. Stainless steel components offer robust protection, electromagnetic compatibility, and crashworthiness for ADAS sensors, LiDAR systems, radar modules, and onboard electronics, enabling safe, reliable operation and real-time data processing in autonomous vehicles.

- Customization and Personalization: Consumer demand for customization and personalization options in vehicle design and styling fuels the adoption of automotive stainless steel, as vehicle owners seek premium, distinctive finishes and accents for their vehicles. Stainless steel trim accessories, decorative inserts, and aftermarket upgrades offer endless customization possibilities, allowing vehicle owners to express their individuality, lifestyle, and brand preferences through unique stainless steel enhancements and embellishments.

Global Trends and Market Outlook

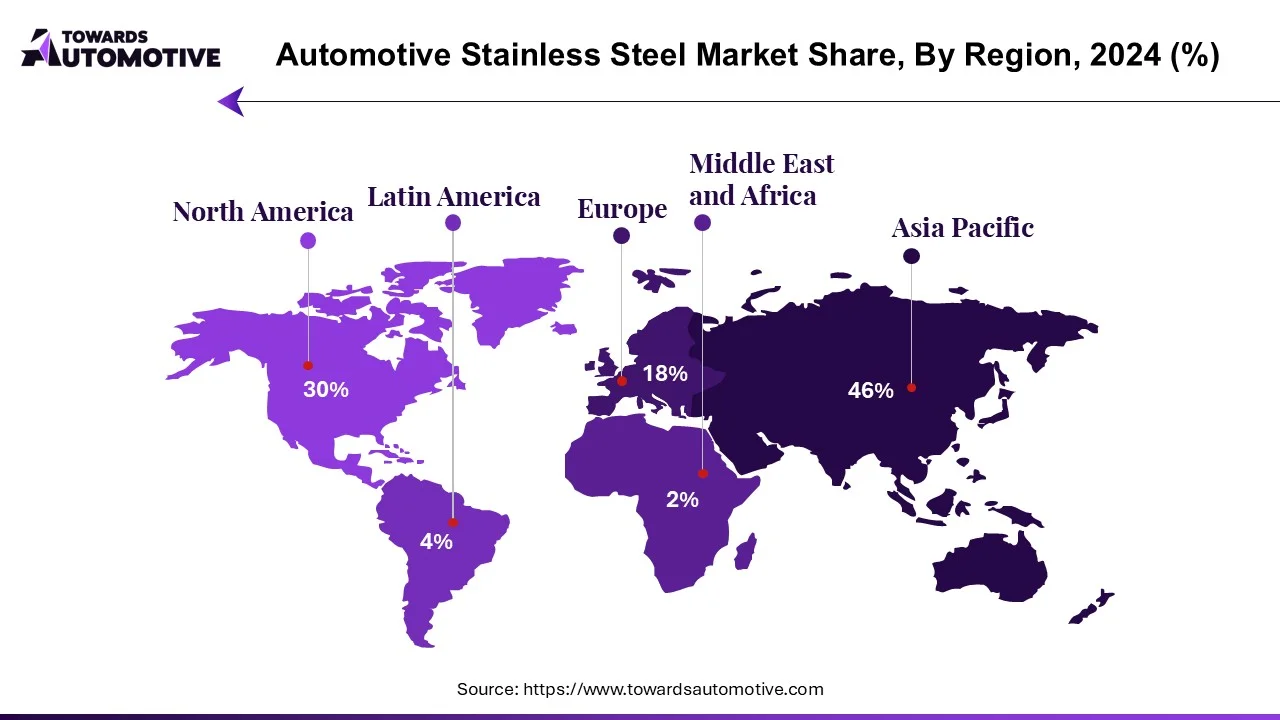

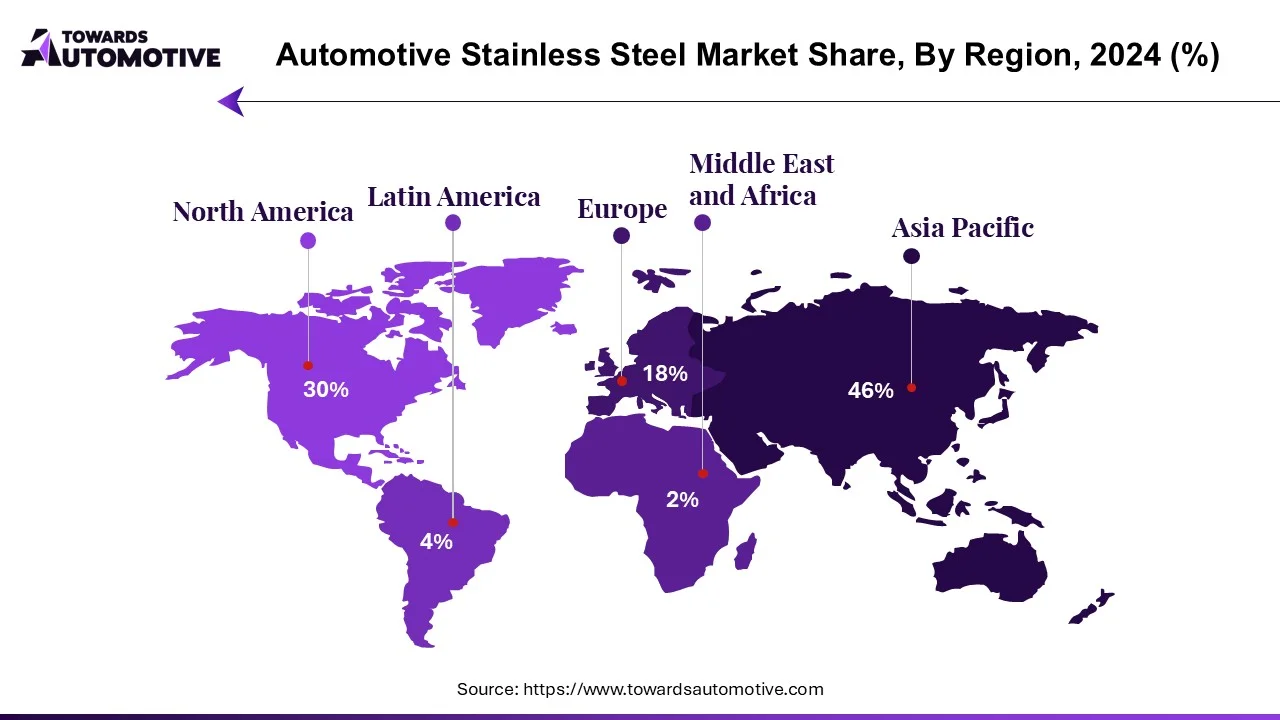

- Asia-Pacific Dominance in Automotive Stainless Steel: Asia-Pacific emerges as a key market for automotive stainless steel, driven by factors such as rapid industrialization, urbanization, and automotive production growth in countries such as China, India, Japan, and South Korea. Asia-Pacific leads the automotive stainless steel market in terms of production, consumption, and export of stainless steel materials and products for automotive applications, supported by a well-established manufacturing base, technological expertise, and investment in research and development (R&D) to address evolving customer needs, regulatory standards, and market trends in the region.

- North America and Europe Market Growth: North America and Europe witness steady growth in the automotive stainless steel market, fueled by factors such as technological innovation, automotive innovation, and regulatory compliance in the automotive industry. North America and Europe are major markets for automotive stainless steel, where automotive OEMs, tier suppliers, and specialty steel producers collaborate on product development, innovation, and application engineering to address customer needs, regulatory requirements, and market opportunities in automotive body structures, powertrain components, and exterior trim applications.

Challenges and Opportunities

- Material Performance and Cost Management: Material performance and cost management are critical considerations for automotive stainless steel, as vehicle manufacturers and suppliers require high-quality, cost-effective materials that meet stringent performance specifications and cost targets for mass production. However, opportunities exist in material optimization, alloy development, and process innovation to enhance material properties, formability, and cost competitiveness, enabling automotive stainless steel companies to develop customized solutions that meet evolving customer needs, industry standards, and regulatory requirements in automotive applications.

- Supply Chain Resilience and Sustainability: Supply chain resilience and sustainability pose challenges to automotive stainless steel manufacturers and suppliers, as fluctuating raw material prices, supply chain disruptions, and environmental regulations impact production costs, availability, and environmental footprint in the automotive industry. However, opportunities exist in supply chain diversification, circular economy initiatives, and green manufacturing practices to mitigate risks, reduce costs, and enhance sustainability, enabling automotive stainless steel companies to adopt responsible sourcing, recycling, and waste management strategies that align with corporate sustainability goals, regulatory compliance, and customer expectations in the global automotive market.

Key Players in the Automotive Stainless Steel Market

The automotive stainless steel market comprises a diverse ecosystem of stainless steel producers, automotive OEMs, tier suppliers, and end users offering a wide range of stainless steel materials and solutions for automotive applications.

Some of the prominent players in the market include

- AK Steel Corporation (Now part of Cleveland-Cliffs Inc.)

- Outokumpu Oyj

- Thyssenkrupp AG

- ArcelorMittal S.A.

- JFE Steel Corporation

- Pohang Iron and Steel Company (POSCO)

- Nippon Steel Corporation

- Tata Steel Limited

- Voestalpine AG

- Allegheny Technologies Incorporated (ATI)

Market Segmentation and Regional Outlook

By Grade

- Austenitic Stainless Steel

- Ferritic Stainless Steel

- Martensitic Stainless Steel

- Duplex Stainless Steel

By Product Form

- Sheets and Plates

- Strips and Coils

- Tubes and Pipes

- Wire Rods and Bars

By Application

- Exhaust Systems

- Body Panels and Trim

- Structural Components

- Interior and Exterior Accents

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle-East and Africa

Automotive Stainless Steel Market Recent Development

- January 2024: Thyssenkrupp Stainless GmbH has introduced a new series of high-strength stainless steel grades specifically tailored for automotive structural applications. These advanced stainless steels offer superior corrosion resistance, crashworthiness, and lightweighting potential, enabling automakers to design safer and more fuel-efficient vehicles.

- February 2024: Outokumpu Oyj has launched a sustainable stainless steel solution for automotive exhaust systems. This eco-friendly stainless steel grade is manufactured using recycled materials and features enhanced heat resistance and corrosion protection, contributing to reduced emissions and improved environmental performance in vehicle exhaust systems.

- March 2024:  AK Steel Corporation has developed a specialized stainless steel coating technology for automotive brake components. This innovative coating formulation provides exceptional frictional performance, wear resistance, and thermal stability, prolonging the service life of brake rotors and improving braking performance in vehicles.