April 2025

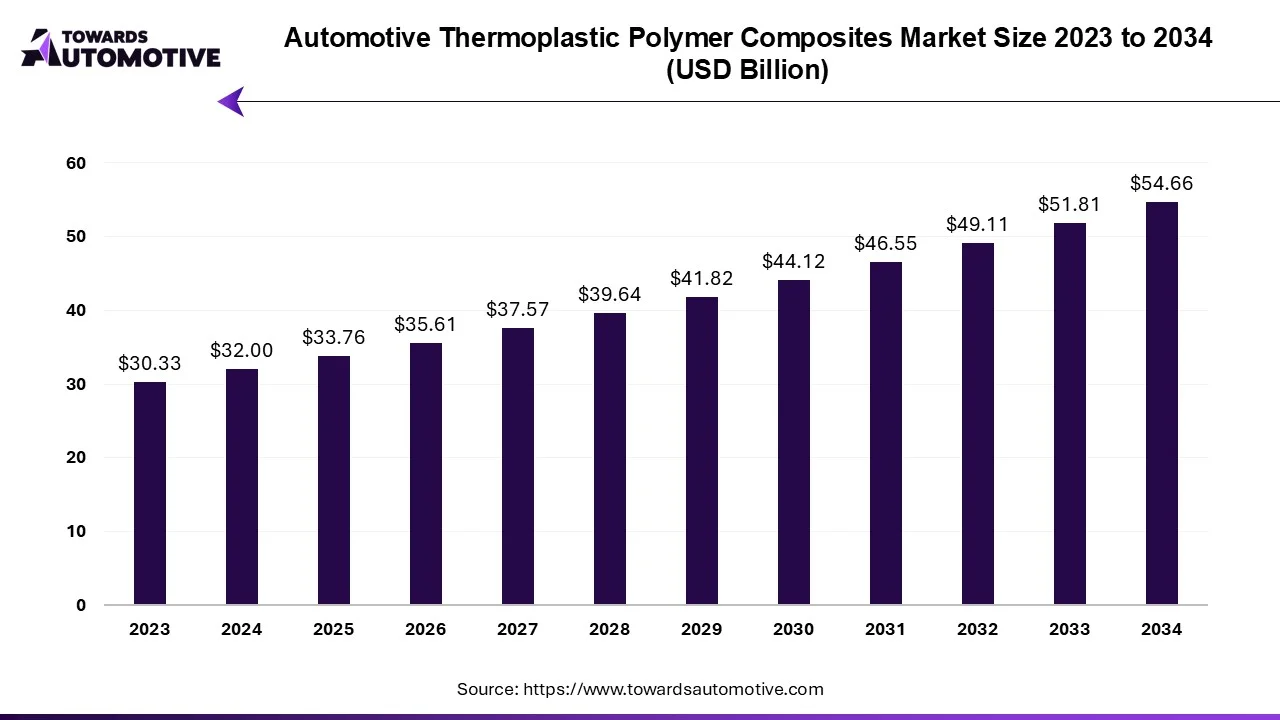

The automotive thermoplastic polymer composites market is forecasted to expand from USD 33.76 billion in 2025 to USD 54.66 billion by 2034, growing at a CAGR of 5.50% from 2025 to 2034. Unlock Infinite Advantages: Subscribe to Annual Membership

Thermoplastic fiberglass form was first introduced in the 1970s. Effective construction materials, GMT composites are injection moldable, discontinuous (long or short) glass fibers, reinforced composites, and advanced thermoplastics with many fiber structures.

It has many advantages:

Although GMT is available in a variety of polymer matrices, propylene-based composites predominate due to their low cost. This material can compete with other materials, especially at temperatures of 110 °C.

Glass fiber mats thermoplastic composites have found a need in the product market mix. They are easy to use and have excellent mechanical properties.

Innovations and greater market penetration are expected to increase the demand for glass fiber mat thermoplastic composites during the forecast period.

Corporate Average Fuel Economy (CAFÉ) standards force companies in the automotive sector to produce vehicle models using high-performance materials. The weight of the vehicle directly affects driving, fuel consumption and speed. A 10% reduction in vehicle weight can save up to 5-7% on fuel.

From 2020, the EU will now require all European car manufacturers to achieve an emission level of CO2 emissions per kilometer. kilometer. . 130 gr.

Focusing on reducing carbon emissions and improving fuel economy, primarily by reducing vehicle weight, increases the demand for thermoplastic materials.

Continuous fiber reinforced thermoplastic composites (CFRTP) is one of the important materials that can solve the increasing concern of heavy vehicles. CFRTP composites, along with steel, will become part of many materials used in automobile construction in the future. Materials are designed and assembled with recyclability and sustainability in mind. Automotive industry standards will also help change the performance characteristics of CFRTP.

The automotive industry is experiencing major changes. As companies explore options to meet future needs, partnerships are proving to be a great way to grow and find new ways to invest risk. The most interesting thing is to work with strategies that are effective in all assets.

In 2019, SABIC announced a new announcement at JEC World 2019: The company's technology uses UDMAX tape, a unidirectional fiber-reinforced thermoplastic Lightweight, cost-effective and composite to create reusable car panels. Designed to replace steel and thermoset panels in the interior and exterior of the car, the new technology will soon be commercialized in the compartments of light commercial vehicles (LCVs) worldwide.

In the case of partitions, replacing conventional metal parts with UDMAX tape lamination reduces the size of the application by 35%. The low weight also makes it easier to work with large compartments, which helps keep the car assembled.

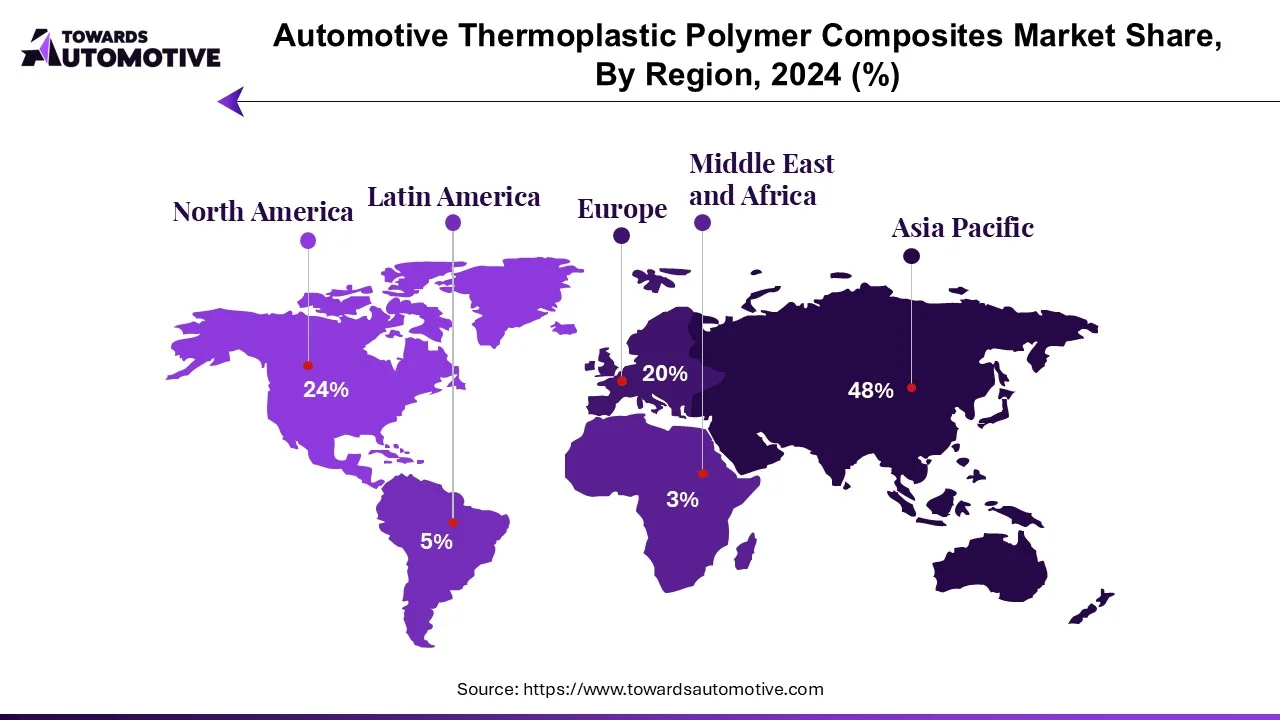

Asia Pacific is the largest thermoplastic composites market worldwide and is expected to record the highest CAGR. Domestic demand pressure for thermoplastic materials in materials and electronics in the following sectors: transportation, aerospace, and defense. This has encouraged the Asia-Pacific region to become a leader in commercial thermoplastic composites. Due to COVID-19, Toray Industries, Ltd. Major thermoplastic companies such as (Japan) are operating under adverse conditions in compliance with all COVID-19-related laws. In addition, with the revival of thermoplastic composites in all industries and high-performance thermoplastic composites, the demand for thermoplastic composites in the region will increase after 2020.

The automotive thermoplastic polymer composite industry has undergone consolidation, with only a few companies operating. Some of the key players in the market include 3B-Fiberglass, Base Group, BASF, BMW, Cytec Industries, etc. It is located.

By Production Type

By Application Type

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us