April 2025

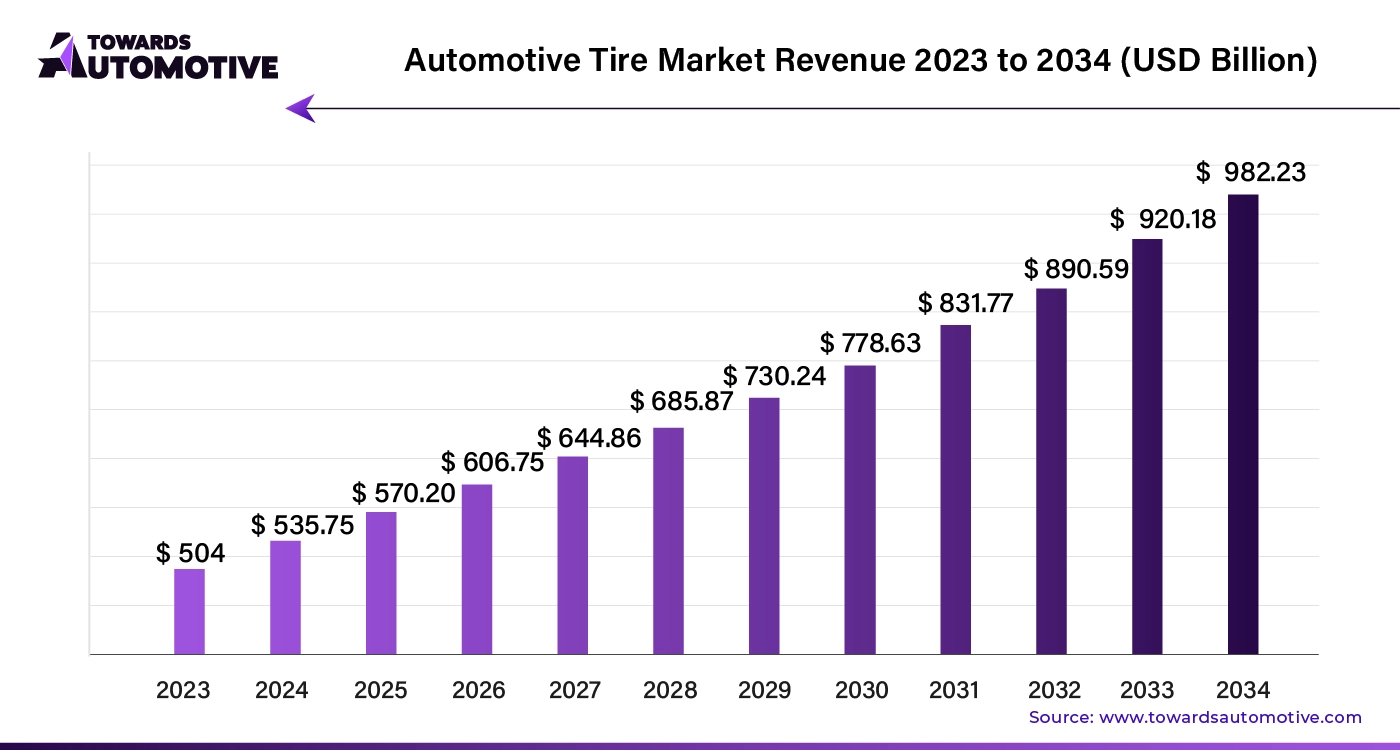

The global automotive tire market size is calculated at USD 535.75 billion in 2024 and is expected to be worth USD 982.23 billion by 2034, expanding at a CAGR of 6.36% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive tire market is an important industry of the automotive domain. This industry is expanding rapidly as demand for vehicles continues to rise globally. Manufacturers are innovating to meet the diverse needs of consumers, from fuel efficiency and durability to enhanced safety features. Advances in tire technology, such as improved tread designs and the use of eco-friendly materials, are driving growth in this sector. The growing popularity of electric and hybrid vehicles is also influencing tire design, with a focus on reducing rolling resistance and increasing energy efficiency. Additionally, the rise of connected and autonomous vehicles is pushing the development of smart tires equipped with sensors that monitor tire pressure, wear, and performance in real-time. As these innovations continue to evolve, the automotive tire market is set to experience sustained growth, driven by the need for high-performance, safe, and sustainable tires that cater to the changing demands of modern vehicles.

AI plays a transformative role in the automotive tire market by enhancing tire design, production, and performance monitoring. Manufacturers use AI-driven analytics to optimize tire designs, improving factors like tread patterns and material composition to boost efficiency, durability, and safety. In production, AI helps automate quality control, detecting defects with high precision and ensuring consistent product quality. Additionally, AI-powered predictive maintenance tools are revolutionizing tire management for both individual consumers and fleet operators. These systems analyze data from sensors embedded in tires to monitor wear, pressure, and temperature in real time, predicting when maintenance or replacements are needed. This not only extends tire life but also enhances safety by reducing the risk of tire-related accidents. Moreover, AI supports the development of smart tires that can adjust performance based on road conditions, further driving innovation in the market. Overall, AI is a key driver of efficiency, safety, and innovation in the automotive tire industry.

The rising demand for tubeless tires is significantly driving the growth of the automotive tire market. Tubeless tires, known for their superior safety, durability, and performance, are becoming the preferred choice for many vehicle owners. Unlike traditional tube tires, tubeless tires are less prone to sudden air loss, reducing the risk of blowouts and enhancing overall vehicle safety. This safety feature is particularly appealing to consumers, especially in regions with diverse and challenging road conditions.

Additionally, tubeless tires offer better fuel efficiency due to lower rolling resistance, which is a key factor as fuel costs rise and environmental concerns grow. The convenience of easy repairs and longer lifespan also makes tubeless tires an attractive option for cost-conscious consumers. As more automotive manufacturers recognize these benefits, they are increasingly equipping new vehicles with tubeless tires, further fueling market growth.

This shift in consumer preference is driving tire manufacturers to focus on the development and production of tubeless tires, leading to innovations that enhance performance and durability even further. As a result, the growing demand for tubeless tires is not only expanding the market but also pushing advancements that benefit the entire automotive tire industry.

The automotive tire market faces restraints due to fluctuating raw material costs, which directly impact tire prices and profitability. Additionally, the environmental concerns associated with tire disposal and the challenges in recycling tires pose significant hurdles. Strict regulations on emissions and material usage also add pressure on manufacturers, potentially slowing down innovation and increasing production costs.

Smart tires are creating significant opportunities in the automotive tire market by revolutionizing how tires interact with vehicles and drivers. Equipped with advanced sensors, smart tires monitor real-time data such as pressure, temperature, and tread wear, providing valuable insights that enhance safety and performance. These tires can alert drivers to potential issues before they become critical, reducing the risk of accidents and improving overall vehicle maintenance. For fleet operators, smart tires offer the ability to optimize tire usage, extend tire life, and reduce operational costs through predictive maintenance. Additionally, the data collected from smart tires can be used to improve tire designs and performance, driving innovation in the industry. As the demand for connected vehicles and advanced driver-assistance systems (ADAS) grows, smart tires are increasingly becoming a key component, opening up new market segments and driving the expansion of the automotive tire industry.

The passenger vehicle segment dominated the market with a share of 57.1%. Passenger vehicles are a major driving force in the growth of the automotive tire market. As the global demand for cars continues to rise, particularly in emerging economies, the need for high-quality tires has surged. Consumers are increasingly prioritizing safety, fuel efficiency, and comfort, leading to a greater demand for advanced tire technologies. This demand is pushing tire manufacturers to innovate, creating tires that offer better grip, reduced rolling resistance, and improved durability.

The growth of electric and hybrid vehicles is also influencing the tire market, as these vehicles require specialized tires that enhance energy efficiency and provide a quieter ride. Additionally, the trend towards SUVs and crossovers, which typically require larger and more robust tires, is further expanding the market.

As passenger vehicles evolve with features like advanced driver-assistance systems (ADAS) and smart technology, the role of tires becomes even more critical. Manufacturers are developing tires that can interact with these systems, improving vehicle performance and safety. This ongoing demand for new and improved tires in the passenger vehicle segment is a key factor driving the overall growth of the automotive tire market, as consumers seek products that meet the evolving needs of modern vehicles.

The radial segment held a dominant share of the market with a share of 86%. Radial tires are a major driver of growth in the automotive tire market due to their superior performance characteristics and widespread adoption. Radial tires, with their distinctive construction featuring layers of steel belts running perpendicular to the direction of travel, offer several advantages over traditional bias-ply tires. They provide better traction, improved handling, and enhanced fuel efficiency, which are crucial for modern vehicles. Their design allows for a larger contact patch with the road, improving grip and stability, especially at high speeds.

The popularity of radial tires has led to their widespread use in passenger cars, trucks, and commercial vehicles. As consumers and fleet operators increasingly prioritize safety and performance, the demand for radial tires continues to grow. Additionally, advancements in radial tire technology, such as improved rubber compounds and tread designs, are driving further innovation in the market. The shift towards radial tires supports the broader trend of upgrading vehicle components to enhance overall driving experience and efficiency. As the automotive industry evolves, radial tires remain a key factor in shaping the future of tire technology and driving the growth of the automotive tire market.

United States is expected to grow with a CAGR of 5.45% during the forecast period. The automotive tire market in the USA is driven by several key factors that are shaping its growth and evolution. Increasing vehicle ownership and rising miles driven contribute significantly to the demand for new and replacement tires. As Americans continue to prioritize vehicle safety, they are seeking high-performance tires that offer better traction, handling, and durability. Innovations in tire technology, such as improved rubber compounds and smart tire systems, are also driving growth by enhancing performance and safety features.

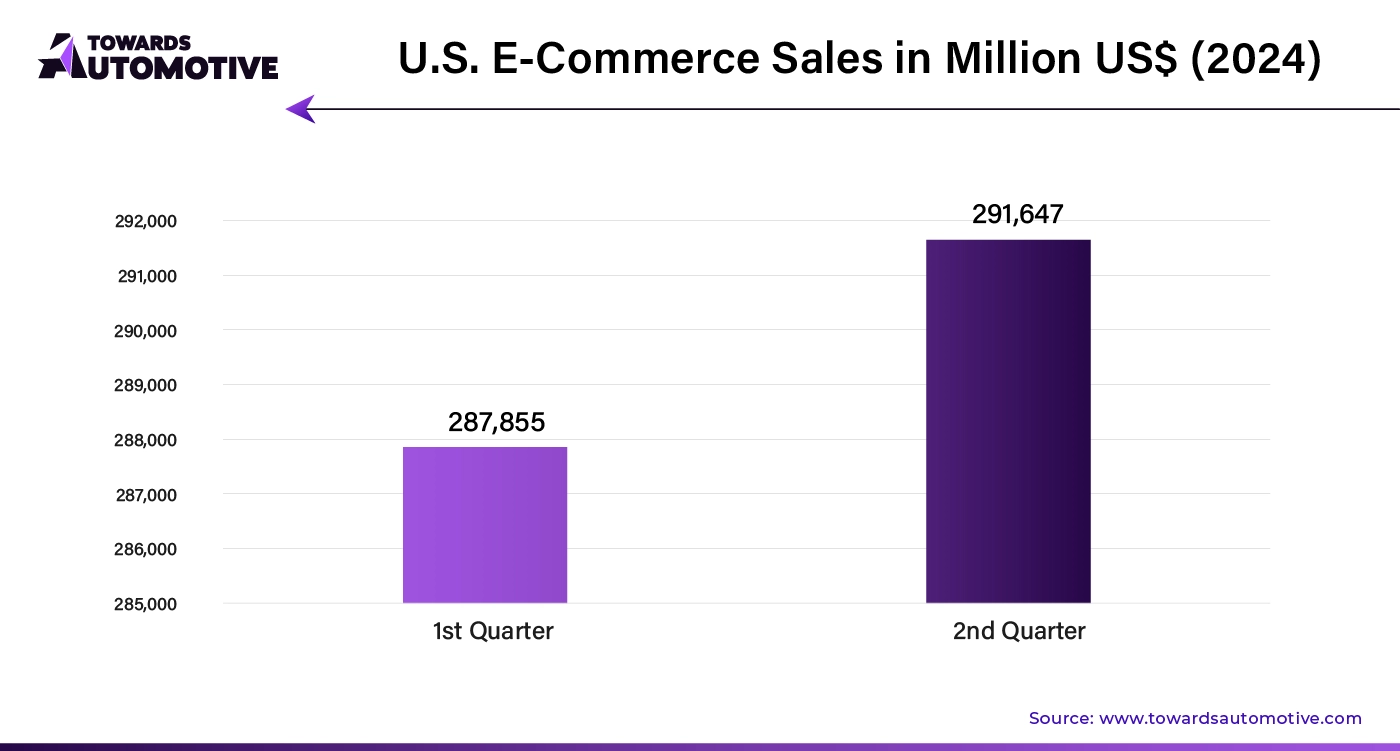

The rising popularity of electric and hybrid vehicles creates a need for specialized tires that improve energy efficiency and accommodate different driving dynamics. Additionally, the shift towards larger vehicles like SUVs and trucks, which require more robust and durable tires, further stimulates market demand. Government regulations and standards for tire performance and safety also drive innovation and market growth. Lastly, the expansion of e-commerce platforms for tire sales and the increase in tire service centers contribute to greater accessibility and convenience for consumers. These combined factors are propelling the automotive tire market forward in the USA, making it a dynamic and evolving sector.

Germany is predicted to grow at a CAGR of 7.3% during the forecast period. The automotive tire market in Germany is driven by several influential factors that are shaping its growth. As one of Europe's largest automotive markets, Germany's high vehicle ownership rates and extensive road networks create a steady demand for both new and replacement tires. German consumers and fleet operators prioritize performance, safety, and fuel efficiency, leading to increased demand for high-quality tires that offer improved traction, durability, and handling.

The rise of electric and hybrid vehicles in Germany is also driving the market, as these vehicles require specialized tires that support their unique performance needs and energy efficiency goals. Additionally, Germany’s stringent environmental regulations and focus on reducing emissions are pushing for innovations in tire technology, such as low rolling resistance tires and eco-friendly materials.

The country’s commitment to advancing automotive technology, coupled with the strong presence of automotive manufacturers and suppliers, fosters continuous innovation in tire design and production. As e-commerce platforms and tire service centers expand, they enhance accessibility and convenience for consumers. These factors collectively drive the growth and evolution of the automotive tire market in Germany, ensuring it remains competitive and responsive to market demands.

China is assumed to grow at a CAGR of 7% during the forecast period. The automotive tire market in China is propelled by several key drivers shaping its rapid growth. As China continues to experience significant economic development and urbanization, the increasing number of vehicles on the road creates a substantial demand for both new and replacement tires. The growing middle class and rising disposable incomes are driving consumer preferences for higher-quality tires that offer enhanced safety, performance, and comfort.

The rise of electric and hybrid vehicles in China further stimulates the market, as these new vehicle types require specialized tires that improve energy efficiency and handle unique performance characteristics. Additionally, the expansion of infrastructure and road networks across the country supports the need for durable and high-performance tires that can withstand diverse driving conditions.

Government policies aimed at reducing emissions and promoting sustainable transportation also drive innovation in tire technology, such as low rolling resistance and eco-friendly materials. The growth of e-commerce platforms and tire service centers enhances market accessibility and convenience for consumers. These combined factors contribute to the dynamic expansion of the automotive tire market in China, positioning it as a major player in the global industry.

India is likely to grow at a CAGR of 7.1% during the forecast period. The automotive tire market in India is experiencing robust growth driven by several key factors. As India’s vehicle ownership continues to rise, both due to economic growth and increasing urbanization, the demand for new and replacement tires expands significantly. Consumers are seeking tires that offer improved safety, performance, and fuel efficiency, spurring manufacturers to innovate and meet these needs.

The rapid growth of the automotive sector, including the increasing popularity of SUVs and two-wheelers, drives demand for various tire types. Additionally, the rise of electric and hybrid vehicles in India creates a niche market for specialized tires that support energy efficiency and specific driving dynamics.

Government initiatives aimed at enhancing road infrastructure and safety standards further stimulate market growth, as well as policies promoting environmental sustainability, which push for advancements in tire technology such as low rolling resistance and eco-friendly materials. The expansion of e-commerce platforms and tire service centers also improves consumer access and convenience. Together, these drivers are shaping a vibrant and evolving automotive tire market in India, catering to a diverse and growing consumer base.

The United Kingdom is expected to grow with a CAGR of 7.5% during the forecast period. The automotive tire market in the United Kingdom is driven by several key factors that fuel its growth. The UK's high vehicle ownership rates and busy road networks create a steady demand for both new and replacement tires. As consumers and fleet operators seek enhanced safety and performance, there is a growing preference for high-quality tires that offer improved traction, handling, and durability.

The rise of electric and hybrid vehicles in the UK further stimulates market growth, as these vehicles require specialized tires designed for energy efficiency and optimal performance. Additionally, the UK’s stringent environmental regulations and commitment to reducing carbon emissions drive the demand for innovative tire technologies, such as low rolling resistance and eco-friendly materials.

Government initiatives and incentives supporting sustainable transportation also contribute to the market’s expansion. The growth of digital platforms and tire service networks enhances accessibility and convenience for consumers. These combined factors are shaping a dynamic and competitive automotive tire market in the United Kingdom, addressing the evolving needs of modern vehicles and drivers.

By Type

By Tire Structure

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us