Automotive Wiring Harness Market Size,Trends and Growth

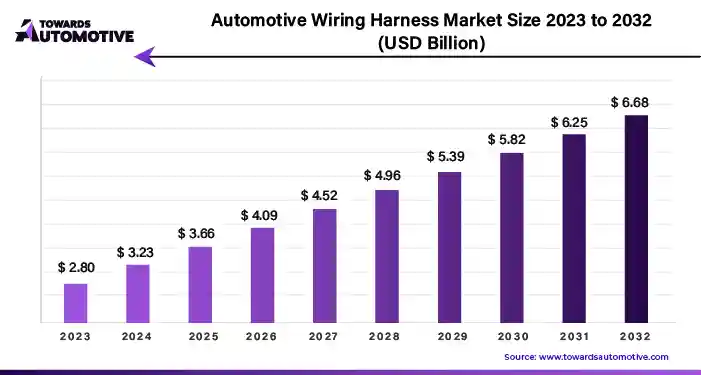

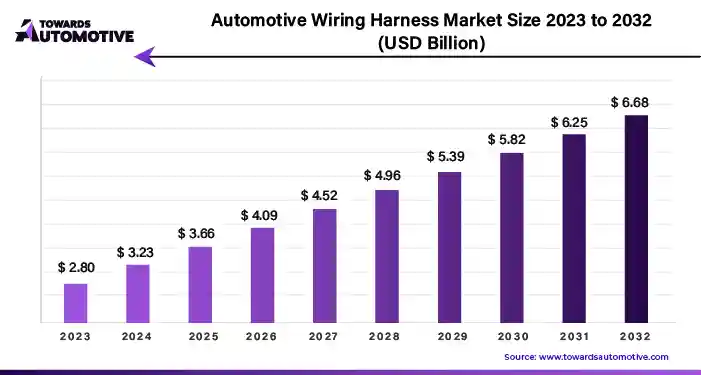

The automotive wiring harness market is projected to reach USD 8.10 billion by 2034, growing from USD 3.40 billion in 2025, at a CAGR of 10.14% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive wiring harness market is experiencing rapid growth and transformation, driven by the increasing complexity of vehicle electronics, advancements in automotive safety and connectivity features, and the rising demand for electric and hybrid vehicles. Automotive wiring harnesses play a critical role in facilitating the transmission of electrical signals and power within vehicles, connecting various components and subsystems to enable reliable connectivity and functionality. As automotive OEMs continue to prioritize vehicle electrification, connectivity, and autonomous driving technologies, the automotive wiring harness market is poised for substantial expansion, with opportunities for innovation and investment in advanced wiring harness solutions tailored to the evolving needs of the automotive industry and the demands of modern vehicle architectures.

The automotive wiring harness market is witnessing significant growth, driven by the increasing complexity of vehicle electronics, advancements in automotive safety and connectivity features, and the rising demand for electric and hybrid vehicles. Automotive wiring harnesses play a crucial role in facilitating the transmission of electrical signals and power within vehicles, connecting various components such as sensors, actuators, control units, and infotainment systems. As automotive manufacturers continue to prioritize vehicle electrification, connectivity, and autonomous driving technologies, the automotive wiring harness market is poised for substantial expansion in the coming years.

The automotive wiring harness market is experiencing robust growth, propelled by factors such as the electrification of vehicles, the integration of advanced safety and infotainment systems, and the adoption of lightweight and high-performance materials. Automotive wiring harnesses serve as the nervous system of modern vehicles, enabling the transmission of electrical signals and power between different vehicle components and subsystems. As vehicles become more electrified and connected, the demand for sophisticated wiring harness solutions is expected to increase, driving innovation and investment in the automotive wiring harness market.

Key Components and Functions of Automotive Wiring Harnesses

- Electrical Wires and Cables: Automotive wiring harnesses consist of electrical wires and cables made from copper, aluminum, or high-performance materials such as aluminum alloy or copper-clad aluminum (CCA). These wires and cables transmit electrical signals, power, and data between various vehicle components, ensuring reliable connectivity and functionality of vehicle systems.

- Connectors and Terminals: Automotive wiring harnesses feature connectors and terminals that facilitate the connection and termination of electrical wires and cables to vehicle components such as sensors, switches, relays, and electronic control units (ECUs). Connectors and terminals ensure secure and reliable electrical connections, enabling quick installation, maintenance, and repair of vehicle wiring harnesses.

- Protective Coverings and Insulation: Automotive wiring harnesses are typically encased in protective coverings and insulation materials such as PVC, cross-linked polyethylene (XLPE), or thermoplastic elastomers (TPE). These materials provide mechanical protection, electrical insulation, and resistance to heat, moisture, and chemical exposure, ensuring the durability and reliability of wiring harnesses in harsh automotive environments.

- Branches, Bundles, and Branching Points: Automotive wiring harnesses may feature branches, bundles, and branching points to accommodate the routing of electrical wires and cables to different vehicle subsystems and components. Branches and bundles organize and manage the routing of wires within the vehicle architecture, optimizing space utilization, minimizing interference, and reducing the risk of electrical faults or failures.

Key Market Dynamics and Trends

- Electrification of Vehicles: The electrification of vehicles, including hybrid, plug-in hybrid (PHEV), and battery electric vehicles (BEV), is driving the demand for automotive wiring harnesses. Electric and hybrid vehicles require sophisticated wiring harness solutions to transmit power between batteries, motors, inverters, and other electrical components, supporting the transition to cleaner and more sustainable transportation solutions.

- Integration of Advanced Safety Systems: The integration of advanced safety systems such as advanced driver assistance systems (ADAS), collision avoidance systems, and autonomous driving technologies is increasing the complexity and sophistication of automotive wiring harnesses. Wiring harnesses play a critical role in connecting sensors, cameras, radars, and ECUs to enable real-time detection, analysis, and response to traffic conditions and hazards on the road.

- Connectivity and Infotainment Features: The demand for connectivity and infotainment features such as in-vehicle entertainment, navigation, telematics, and wireless connectivity is driving innovation in automotive wiring harnesses. Wiring harnesses enable the integration of multimedia interfaces, communication protocols, and network connectivity solutions, providing drivers and passengers with seamless access to information, entertainment, and communication services while on the move.

- Lightweight and High-Performance Materials: Automotive wiring harness manufacturers are increasingly using lightweight and high-performance materials such as aluminum alloy, copper-clad aluminum (CCA), and advanced polymers to reduce weight, improve fuel efficiency, and enhance electrical performance. Lightweight materials offer advantages such as reduced mass, increased flexibility, and enhanced thermal conductivity, enabling the development of compact and efficient wiring harness solutions for modern vehicles.

Global Trends and Market Outlook

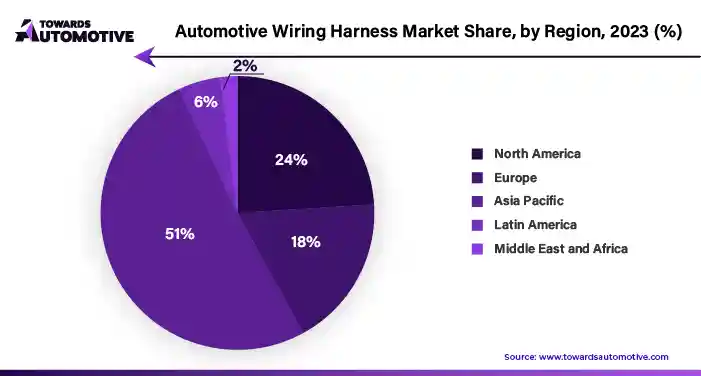

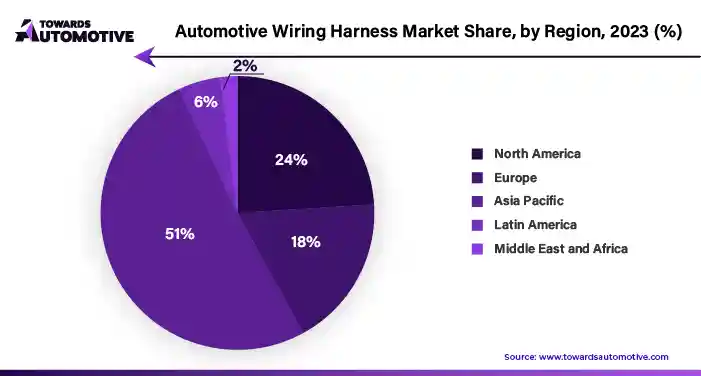

- Asia-Pacific Dominating Market Share: Asia-Pacific is the largest market for automotive wiring harnesses, driven by the presence of leading automotive manufacturers, rapid urbanization, and increasing vehicle production. Countries such as China, Japan, South Korea, and India are witnessing significant investments in automotive wiring harness manufacturing capacity, technology innovation, and supply chain optimization to meet the growing demand for vehicles with advanced electronic systems.

- North America and Europe Emphasizing Safety and Connectivity: North America and Europe are focusing on safety and connectivity features in automotive wiring harnesses, driven by stringent regulations, consumer preferences, and technological advancements. Automotive OEMs in these regions are investing in ADAS, infotainment, and connected vehicle technologies, driving demand for sophisticated wiring harness solutions capable of supporting advanced functionalities and enhancing the overall driving experience.

- Electric and Hybrid Vehicles Driving Growth: The electrification of vehicles, including electric and hybrid vehicles, is expected to drive significant growth in the automotive wiring harness market. Electric vehicles require specialized wiring harness solutions to transmit high-voltage power between batteries, motors, inverters, and charging systems, presenting opportunities for wiring harness manufacturers to develop innovative solutions tailored to the unique requirements of electric propulsion systems.

Challenges and Opportunities

- Design Complexity and Integration Challenges: The increasing complexity of vehicle electronics, including advanced safety systems, connectivity features, and autonomous driving technologies, poses challenges for automotive wiring harness design, integration, and testing. Addressing design complexity and integration challenges requires collaboration between automotive OEMs, wiring harness manufacturers, and technology suppliers to develop scalable, modular, and interoperable solutions that meet the evolving needs of vehicle architectures and platforms.

- Electromagnetic Interference (EMI) and Signal Integrity: Electromagnetic interference (EMI) and signal integrity issues can affect the performance and reliability of automotive wiring harnesses, leading to potential safety hazards and system failures. Mitigating EMI and signal integrity challenges requires the use of shielded cables, grounding techniques, and noise suppression measures to minimize electromagnetic interference and ensure the integrity of electrical signals in high-frequency and high-speed automotive applications.

- Supply Chain Disruptions and Material Shortages: The automotive wiring harness industry is susceptible to supply chain disruptions, material shortages, and price fluctuations due to factors such as geopolitical tensions, trade policies, and natural disasters. Managing supply chain risks and diversifying sourcing strategies are essential for automotive wiring harness manufacturers to maintain continuity of operations, ensure product availability, and mitigate the impact of disruptions on customer delivery schedules and production timelines.

- Technological Innovation and Differentiation: Technological innovation and differentiation are key drivers of competitive advantage in the automotive wiring harness market. Harnessing emerging technologies such as artificial intelligence (AI), machine learning, and digital twin simulation can enable automotive wiring harness manufacturers to optimize design processes, enhance manufacturing efficiency, and deliver customized solutions tailored to specific customer requirements and application scenarios.

Key Players in the Automotive Wiring Harness Market

The automotive wiring harness market comprises a diverse ecosystem of automotive OEMs, wiring harness manufacturers, component suppliers, and technology providers collaborating to develop and deliver innovative solutions for vehicle electrification, connectivity, and automation.

Some of the prominent players in the market include:

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- Aptiv PLC

- Lear Corporation

- Furukawa Electric Co., Ltd.

- Leoni AG

- Delphi Technologies (Now part of BorgWarner Inc.)

- TE Connectivity Ltd.

- Fujikura Ltd.

- Nexans SA

Market Segmentation and Regional Outlook

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric and Hybrid Vehicles

By Application

- Body Wiring Harness

- Chassis Wiring Harness

- Engine Wiring Harness

- HVAC Wiring Harness

- Others

By Region

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Turkey

- Egypt

Recent Developments in the Automotive Wiring Harness Market

- In December 2023, Sumitomo Electric Industries, Ltd. announced the development of a new lightweight and high-flexibility automotive wiring harness solution for electric vehicles (EVs). The new wiring harness features advanced materials and design optimization techniques to reduce weight, improve space utilization, and enhance thermal management, supporting the electrification of vehicles and the transition to cleaner and more sustainable transportation solutions.

- In November 2023, Yazaki Corporation introduced a new modular and scalable automotive wiring harness platform for connected and autonomous vehicles. The new wiring harness platform enables automotive OEMs to integrate advanced safety, connectivity, and automation features into vehicle architectures, supporting the development of next-generation vehicles with enhanced functionality and performance.

- In October 2023, Aptiv PLC announced the expansion of its manufacturing capacity for automotive wiring harnesses in key growth markets such as China and India. The expansion initiatives include the establishment of new production facilities, technology investments, and workforce development programs to meet the growing demand for wiring harness solutions in electric and hybrid vehicles, as well as connected and autonomous vehicles.

- In September 2023, Lear Corporation unveiled a new high-voltage wiring harness solution for electric and hybrid vehicles, supporting the transmission of power between batteries, motors, inverters, and charging systems. The new wiring harness features advanced insulation materials, electromagnetic shielding, and safety features to ensure reliable performance and compliance with regulatory requirements for electric propulsion systems.

- In August 2023, Furukawa Electric Co., Ltd. announced strategic partnerships with automotive OEMs and technology providers to develop innovative wiring harness solutions for autonomous driving applications. The partnerships focus on integrating sensors, cameras, radars, and LiDAR systems into vehicle architectures, enabling real-time perception, analysis, and decision-making capabilities for autonomous vehicles operating in complex urban environments.