April 2025

Senior Research Analyst

Reviewed By

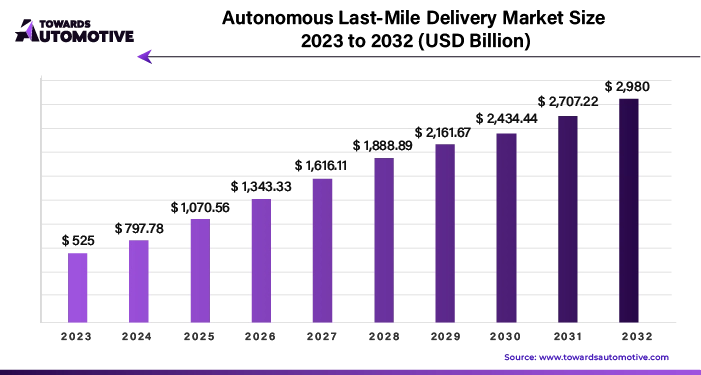

The autonomous last mile delivery market is forecasted to expand from USD 772.21 million in 2025 to USD 4,383.70 million by 2034, growing at a CAGR of 21.28% from 2025 to 2034.

The autonomous last mile delivery market is rapidly transforming the logistics and transportation landscape, driven by technological advancements, increasing e-commerce penetration, and the demand for efficient, contactless delivery solutions. This market focuses on automating the final leg of the delivery process, where goods are transported from a distribution hub to the customer's doorstep using autonomous technologies such as drones, robots, and self-driving vehicles. As urbanization intensifies and consumer preferences shift towards faster and more convenient delivery options, companies are embracing autonomous solutions to enhance operational efficiency and reduce costs.

Key factors fueling the growth of the autonomous last mile delivery market include advancements in artificial intelligence (AI), machine learning, and robotics, which enable precise navigation, obstacle detection, and seamless integration into urban environments. Rising labor shortages and increasing delivery costs have further accelerated the adoption of autonomous delivery systems, as they offer a cost-effective alternative to traditional methods. Additionally, heightened focus on sustainability has prompted companies to deploy electric-powered autonomous vehicles, aligning with global efforts to reduce carbon emissions.

The market also benefits from supportive government regulations and pilot programs aimed at fostering innovation in autonomous technologies. However, challenges such as high initial costs, regulatory hurdles, and consumer acceptance remain critical considerations. Despite these obstacles, the autonomous last mile delivery market holds immense potential to revolutionize supply chain dynamics, offering a glimpse into a future where delivery is faster, smarter, and more sustainable. As technology continues to evolve, this market is poised for significant growth, reshaping how goods are delivered worldwide.

Artificial Intelligence (AI) plays a transformative role in the Autonomous Last Mile Delivery Market by enhancing efficiency, reducing operational costs, and improving delivery accuracy. AI algorithms are integral to enabling autonomous vehicles, drones, and robots to navigate and perform deliveries seamlessly. AI-driven systems use advanced technologies like machine learning (ML), computer vision, and deep learning to process real-time data, ensuring that delivery vehicles can autonomously map routes, avoid obstacles, and optimize delivery schedules.

AI also enhances the decision-making process in autonomous delivery systems, allowing for dynamic routing. By analyzing factors such as traffic conditions, weather, and real-time package tracking, AI systems can adjust delivery paths on the fly, ensuring faster and more reliable service. AI-driven predictive analytics can also optimize inventory management and demand forecasting, reducing delays and improving overall customer satisfaction.

Furthermore, AI contributes to the development of self-learning systems that improve over time. The more an AI system interacts with the environment, the more accurate and efficient it becomes, minimizing errors and enhancing reliability in last-mile delivery operations. Additionally, AI enables vehicle-to-vehicle communication and vehicle-to-infrastructure communication, allowing for safer and more coordinated movements, especially in urban environments.

The increased adoption of autonomous ground delivery vehicles is a key driver in the growth of the autonomous last mile delivery market. As e-commerce continues to flourish, businesses are seeking efficient, cost-effective solutions to meet the growing demand for fast and reliable last-mile delivery. Autonomous ground delivery vehicles, including self-driving cars, electric delivery vans, and robots, offer a transformative solution to these challenges. These vehicles provide significant advantages over traditional delivery methods, such as reduced labor costs, faster delivery times, and enhanced operational efficiency.

Autonomous ground vehicles are capable of operating 24/7, ensuring that deliveries can be made at any time without the constraints of human working hours. This capability is especially crucial for industries such as e-commerce and food delivery, where speed is essential to meet customer expectations. Additionally, the ability to navigate traffic more efficiently allows these vehicles to avoid delays, providing faster and more reliable service.

Furthermore, autonomous ground delivery vehicles are increasingly seen as a sustainable alternative to traditional delivery methods. They typically rely on electric power, contributing to reduced carbon emissions and a smaller environmental footprint, aligning with growing consumer preferences for sustainable practices.

As regulatory frameworks evolve to accommodate these technologies, and consumer confidence in autonomous systems grows, the adoption of autonomous ground delivery vehicles is expected to rise significantly. This adoption will drive the expansion of the autonomous last mile delivery market, making it an essential part of the future of logistics and transportation.

The growth of the autonomous last mile delivery market faces several restraints, primarily related to regulatory challenges, technological limitations, and public acceptance. Strict regulations regarding the testing and deployment of autonomous vehicles hinder market expansion, particularly in urban areas. Additionally, the complexity of real-time navigation, safety concerns, and the high cost of advanced technologies pose challenges. Public reluctance towards fully autonomous systems, combined with potential job displacement issues, further limits widespread adoption, slowing the market growth.

Drone delivery systems present significant opportunities in the autonomous last mile delivery market by offering a faster, more efficient method of transportation, particularly for short-distance deliveries. Drones can bypass traditional road traffic, enabling quicker deliveries in urban environments and hard-to-reach areas, such as rural locations or congested city centers. Their ability to deliver small packages quickly and efficiently opens up new opportunities, especially in sectors like e-commerce, healthcare, and food delivery, where speed and convenience are crucial.

Moreover, drones are highly cost-effective compared to traditional delivery methods, reducing last-mile delivery costs and improving overall logistics efficiency. With technological advancements, drones are becoming more reliable, with enhanced payload capacities, improved battery life, and better navigational systems, making them a viable solution for a broader range of delivery services. Regulatory support and the growing acceptance of drone technology from governments and consumers alike also create a favorable environment for their integration into delivery fleets.

As drone delivery systems continue to evolve, they will become a core component of autonomous last-mile logistics, creating new revenue streams and transforming delivery operations. By providing eco-friendly, fast, and cost-effective solutions, drone technology is expected to play a vital role in shaping the future of the autonomous last-mile delivery market.

The services segment led the industry. The services segment plays a crucial role in driving the growth of the autonomous last mile delivery market. As businesses increasingly adopt autonomous delivery solutions, they require comprehensive services to ensure efficient operations, maintenance, and management of these advanced systems. Autonomous vehicle fleet management services are in high demand as they help optimize routes, manage vehicle performance, and ensure regulatory compliance, making them vital to the smooth operation of last mile delivery networks. These services are essential for businesses to scale their autonomous delivery capabilities and maintain cost efficiency.

Additionally, maintenance and repair services for autonomous vehicles are vital for ensuring the reliability and safety of these systems. As autonomous vehicles rely on complex sensors, AI, and communication networks, regular upkeep and troubleshooting are necessary to prevent system failures. The demand for skilled technicians and service providers to maintain these vehicles is expected to increase, driving growth in this segment.

Moreover, data analytics and consulting services are gaining importance in the autonomous last mile delivery market. Companies need to analyze delivery patterns, customer preferences, and operational data to fine-tune their strategies and optimize the delivery process. With the growing reliance on data-driven insights, consulting firms offering expertise in AI, logistics, and route optimization are expanding, further fueling the market growth.

The food and beverage segment held the largest share of the market. The food and beverage segment significantly drives the growth of the autonomous last mile delivery market by increasing the demand for fast, efficient, and cost-effective delivery solutions. The rise of online food ordering and the need for on-demand delivery services are key factors propelling the adoption of autonomous vehicles in this sector. With consumers seeking quicker and more reliable food delivery, businesses are turning to autonomous delivery systems to ensure timely deliveries while maintaining food quality. Autonomous vehicles can operate round the clock, reducing delivery time and helping restaurants and food delivery services meet the growing demand for instant gratification.

The food and beverage industry is particularly suited to benefit from autonomous last mile delivery due to the increasing reliance on contactless delivery and delivery-as-a-service models, especially post-pandemic. Autonomous vehicles, including drones and robots, are used to navigate urban areas and efficiently deliver food and beverages directly to consumers' doorsteps, avoiding traditional traffic congestion and delays. These autonomous systems also lower operational costs by eliminating the need for human drivers and reducing labor-related expenses.

Furthermore, the ability of autonomous delivery systems to handle temperature-sensitive deliveries, such as hot meals or refrigerated items, is a significant advantage in the food and beverage industry. By ensuring precise temperature control during transportation, autonomous vehicles enhance the customer experience and food quality. As the demand for delivery services continues to grow, particularly in urban areas, the food and beverage segment is expected to remain a key driver of the autonomous last mile delivery market's expansion.

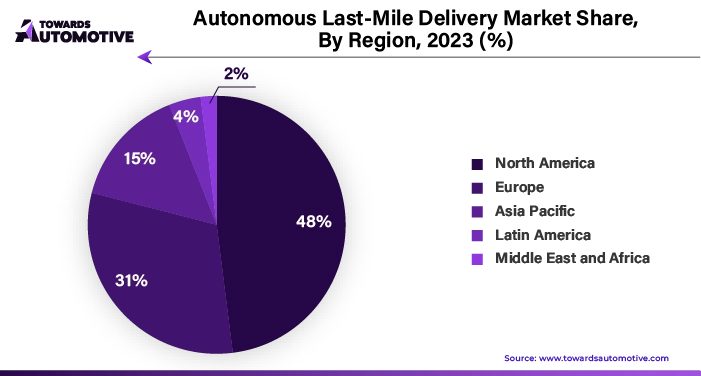

North America dominated the autonomous last mile delivery market. Technological advancements, e-commerce growth, and urbanization are key drivers propelling the growth of the autonomous last mile delivery market in North America. Technological advancements in AI, robotics, and machine learning have significantly improved the capabilities of autonomous delivery vehicles, making them more efficient, reliable, and cost-effective. Innovations such as autonomous drones and self-driving delivery vans are increasingly being used for last-mile deliveries, especially in urban settings where traditional methods are less effective. These technologies not only enhance delivery speed but also optimize routes, reduce operational costs, and improve overall service quality.

The e-commerce growth in North America is another major factor contributing to the expansion of the autonomous last mile delivery market. As online shopping continues to surge, particularly post-pandemic, consumers expect faster and more convenient delivery options. Autonomous delivery solutions, with their ability to operate 24/7, offer a perfect solution to meet the growing demand for quick and reliable deliveries, especially in dense urban areas. Additionally, e-commerce giants like Amazon are investing heavily in autonomous delivery technology to streamline their operations and meet customer expectations.

Urbanization also plays a crucial role in driving the adoption of autonomous last mile delivery solutions. With more people living in cities, the demand for efficient and environmentally-friendly delivery methods has risen. Autonomous delivery vehicles, which can navigate traffic and urban infrastructure more effectively, are seen as a solution to the challenges posed by congestion, high labor costs, and environmental concerns. Thus, these factors are accelerating the growth of the autonomous last mile delivery market in North America.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Consumer demand for convenience and speed, regulatory support and government initiatives, and labor shortages are significant drivers of the autonomous last mile delivery market in the Asia-Pacific (APAC) region. Consumer demand for faster and more convenient delivery options, particularly in urban areas, is on the rise as e-commerce continues to expand. With more consumers seeking quicker deliveries, especially for small packages, autonomous delivery solutions like drones and self-driving vehicles offer a viable way to meet these expectations by reducing delivery times and operating efficiently in high-density areas.

Regulatory support and government initiatives are also fueling market growth. Several APAC countries, including China, Japan, and Singapore, have begun implementing policies and infrastructure improvements that encourage the adoption of autonomous delivery technologies. Governments are actively supporting innovation in logistics to enhance efficiency, reduce traffic congestion, and cut emissions, making autonomous last mile delivery an attractive solution for both urban and rural areas. These initiatives include creating regulatory frameworks for testing autonomous vehicles and providing incentives for companies adopting green delivery solutions.

Labor shortages are another key factor driving growth in the region. With increasing challenges in the logistics workforce due to aging populations, especially in countries like Japan and South Korea, autonomous delivery systems are seen as a way to fill labor gaps and improve operational efficiency. Autonomous vehicles help companies maintain service quality without relying on human labor, which is crucial in meeting the growing demand for fast and reliable deliveries. The above-mentioned factors are propelling the growth of the autonomous last mile delivery market in APAC.

By Platform

By Solution

By Range

By End-Use

By Region

April 2025

April 2025

April 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us