April 2025

Senior Research Analyst

Reviewed By

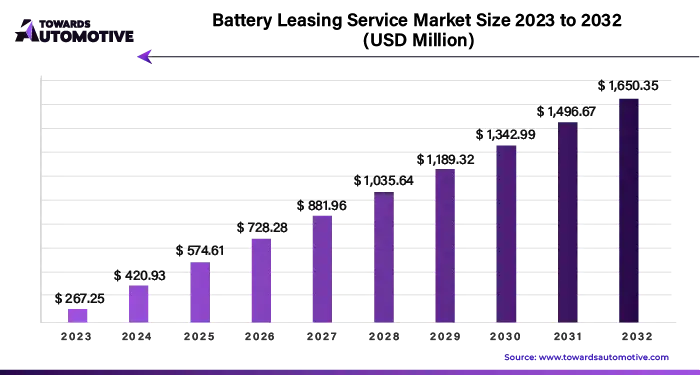

The battery leasing service market is projected to reach USD 1419.03 million by 2034, growing from USD 362.03 million in 2025, at a CAGR of 16.39% during the forecast period from 2025 to 2034.

The burgeoning growth of the automotive industry, particularly in the electric vehicle (EV) segment, has sparked a parallel increase in the demand for battery services. One notable development in this realm is the emergence of partnerships focusing on the rental of electric taxis equipped with environmentally friendly renewable electric (EV) batteries for energy storage (ESS). This innovative approach not only promotes sustainable transportation solutions but also addresses the pressing need for efficient energy storage systems.

One of the key drivers behind the adoption of battery leasing services is the rapid advancement of battery technology in the EV sector. As battery technology continues to evolve at a rapid pace, consumers face the dilemma of investing in a vehicle equipped with the latest battery technology. Battery leasing offers a compelling solution to this dilemma by providing EV owners with the flexibility to upgrade to newer, more efficient batteries as they become available. This not only enhances the performance and versatility of their vehicles but also eliminates the need for costly and environmentally impactful replacements of entire vehicles.

However, despite the promising prospects of battery leasing services, significant challenges remain that may impede the growth of this industry. One such challenge is the need for substantial investment and meticulous transport planning to ensure equitable access to battery services across regions, cities, rural areas, and countries. Overcoming logistical hurdles such as land acquisition, zoning regulations, and compliance with housing standards can be time-consuming and resource-intensive, posing significant barriers to the expansion of battery service infrastructure.

Addressing these challenges will require concerted efforts from stakeholders across the automotive and energy sectors, as well as policymakers and urban planners. By overcoming logistical barriers and fostering a supportive regulatory environment, the battery service industry can unlock its full potential and play a pivotal role in driving the transition towards sustainable transportation and energy systems.

The COVID-19 pandemic has left an indelible mark on various industries, including the battery service sector. While the initial disruptions in the global supply chain and production processes led to temporary setbacks in some battery applications, the pandemic served as a catalyst for highlighting the critical importance of efficient and adaptable transportation solutions.

Amidst the challenges posed by the pandemic, governments and consumers worldwide have increasingly turned their attention to pressing environmental issues. This heightened awareness has fueled a surge in interest in electric vehicles (EVs) and associated services, including battery rental programs. As the world grapples with the urgent need to curb carbon emissions and mitigate the effects of climate change, EVs have emerged as a promising solution to reduce reliance on fossil fuels and transition towards more sustainable mobility options.

The battery service industry has thus witnessed a notable uptick in demand, driven by the growing preference for electric vehicles and the desire for flexible battery solutions. Battery rental programs offer consumers the opportunity to access cutting-edge battery technology without the financial burden of upfront investment, thereby facilitating the widespread adoption of EVs.

Looking ahead, the battery service industry is poised for further expansion as governments implement supportive policies and incentives to promote electric vehicle adoption and sustainable transportation solutions. As society continues to prioritize environmental sustainability, battery rental services are expected to play an increasingly pivotal role in facilitating the transition towards a greener and more energy-efficient future.

The growing awareness of climate change and its associated environmental impacts has spurred heightened interest in adopting sustainable transportation solutions. One significant manifestation of this trend is the increasing demand for battery electric vehicles (BEVs), which offer a cleaner and more environmentally friendly alternative to traditional internal combustion engine vehicles.

Driven by concerns about climate change and air pollution, consumers are increasingly seeking ways to reduce their carbon footprint and minimize their impact on the environment. This shift in consumer preferences has fueled tremendous growth in the BEV market, as individuals and businesses alike prioritize the adoption of electric vehicles as part of their sustainability efforts.

A key factor driving this growth is the recognition that BEVs can play a crucial role in mitigating carbon emissions and transitioning towards a greener future. By replacing fossil fuel-powered vehicles with electric alternatives, society can significantly reduce its reliance on non-renewable energy sources and curb greenhouse gas emissions, thereby contributing to global efforts to combat climate change.

Moreover, the expanding availability of BEVs and advancements in battery technology have helped alleviate concerns about battery costs, making electric vehicles more accessible and appealing to a broader range of consumers. As battery prices continue to decline and infrastructure for electric vehicle charging becomes more widespread, the adoption of BEVs is expected to accelerate further, driving continued growth in the market and facilitating the transition towards a more sustainable transportation ecosystem.

The single-charged models segment of the market is poised to generate approximately $35 million in revenue by the year 2023. This projection reflects the growing popularity of the pay-as-you-go battery service model, which offers customers the convenience of using a vehicle without the need to purchase it outright. In this innovative model, the vehicle is owned by the service provider, and customers pay for the usage of the vehicle as they go, similar to a subscription service.

One of the key advantages of the pay-as-you-go battery service model is the significant reduction in costs for consumers, as they no longer need to bear the upfront expense of purchasing a vehicle. Instead, they can access a vehicle whenever needed, paying only for the time or distance traveled. This model also offers increased transparency, as customers have a clear understanding of the costs associated with vehicle usage, with no surprises or hidden fees.

Furthermore, the pay-as-you-go battery service model eliminates the need for customers to adhere to maintenance schedules, as the service provider is responsible for the upkeep and maintenance of the vehicles. This alleviates a significant burden for consumers, allowing them to enjoy the benefits of electric vehicle ownership without the associated hassles.

Lithium-ion batteries have emerged as the preferred choice for electric vehicles due to their superior performance, safety, and reliability. Many automotive companies, including industry leader Tesla, have adopted lithium-ion batteries to power their electric vehicle models. In October 2023, Tesla made a strategic shift by transitioning from nickel-cobalt-aluminum batteries to lithium-ion batteries across its model lineup. This transition is expected to further enhance battery performance and efficiency, driving continued growth and adoption of electric vehicles powered by lithium-ion technology.

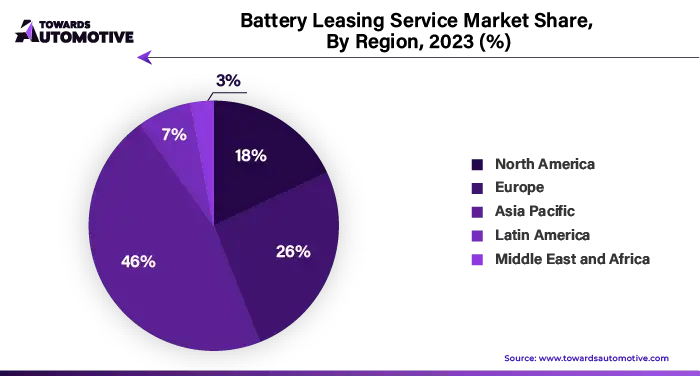

The Asia-Pacific region emerges as the dominant force in the global battery services market, surpassing revenues of over US$50 million in the year 2023. This remarkable growth can be attributed to several factors contributing to the region's robust adoption of battery technology.

Firstly, there is a significant public interest in energy-related initiatives within the Asia-Pacific region. As concerns over environmental sustainability and energy efficiency continue to rise, consumers and businesses alike are increasingly turning to battery solutions as a means of addressing these challenges. This heightened awareness and interest in energy-related issues serve as a driving force behind the widespread adoption of battery technology across various sectors.

Moreover, government-supported initiatives aimed at tackling battery-related challenges and promoting energy growth play a pivotal role in driving the adoption of battery services in the Asia-Pacific region. Governments in several countries within the region have implemented policies and incentives to incentivize the adoption of battery technology, including subsidies for electric vehicles and investments in renewable energy infrastructure. These proactive measures create a conducive environment for the rapid expansion of battery services and propel the region's energy growth trajectory forward.

Overall, the Asia-Pacific region's dominance in the global battery services market underscores its commitment to embracing innovative solutions to address energy challenges and drive sustainable development. With continued public interest and government support, the region is poised to maintain its leadership position in the battery services market and play a key role in shaping the future of energy technologies on a global scale.

The major players operating in the battery leasing service market include:

By Business Model

By Battery Type

By Vehicle Type

By Geography

April 2025

April 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us