October 2025

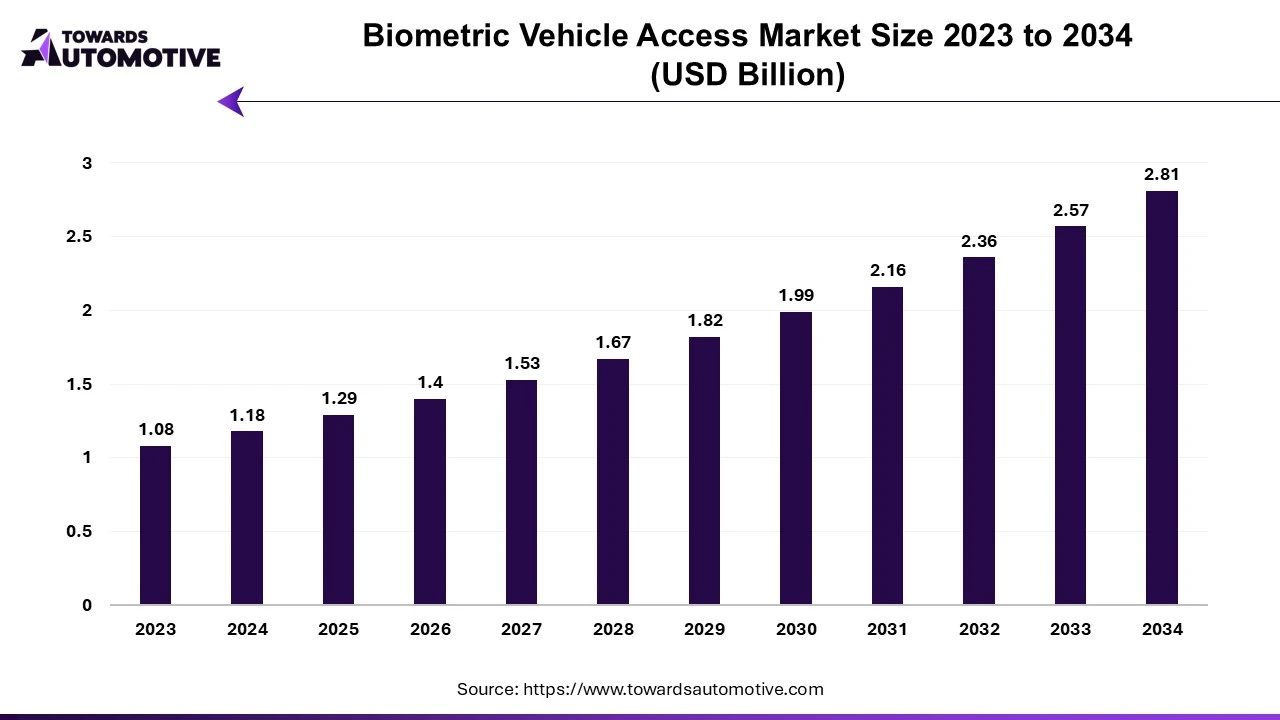

The biometric vehicle access market is anticipated to grow from USD 1.29 billion in 2025 to USD 2.81 billion by 2034, with a compound annual growth rate (CAGR) of 9.05% during the forecast period from 2025 to 2034.

The biometric vehicle access market is at the forefront of transforming how drivers and passengers interact with vehicles, offering advanced solutions that enhance security, convenience, and personalization. This market leverages biometric technologies such as fingerprint recognition, facial recognition, voice authentication, and iris scanning to provide seamless and secure access to vehicles. These innovations eliminate the need for traditional keys or fobs, significantly reducing the risks of theft and unauthorized access. The growing adoption of biometric systems in vehicles reflects the rising consumer demand for technologically advanced, user-friendly, and secure solutions in the automotive sector.

The increasing integration of connected and smart vehicle technologies has accelerated the adoption of biometric systems, especially in premium and luxury vehicles. Moreover, government regulations emphasizing vehicle security and anti-theft measures have driven automakers to incorporate biometric access as a standard or optional feature. The market is also benefitting from advancements in artificial intelligence (AI) and machine learning, which enhance the accuracy and efficiency of biometric systems, making them more robust and adaptable to various use cases.

As the automotive industry shifts toward electrification and autonomous driving, the demand for advanced access and authentication systems is expected to grow. The biometric vehicle access market stands poised to benefit from these trends, offering significant opportunities for innovation and expansion across global automotive markets.

Artificial intelligence (AI) plays a transformative role in the biometric vehicle access market, driving innovation and enhancing system efficiency, accuracy, and security. By leveraging AI, biometric systems such as facial recognition, voice authentication, and fingerprint scanning can process vast amounts of data in real time, improving their ability to accurately verify users even in challenging conditions. AI algorithms continuously learn and adapt to variations in user behavior, environmental factors, and physical changes, ensuring reliable authentication over time.

AI also enhances the integration of biometric access systems with other advanced vehicle technologies. For example, AI-powered biometric systems can work seamlessly with in-car infotainment, navigation, and safety features to personalize the driving experience. Once a user is authenticated, AI can adjust seat positions, climate control, and entertainment settings to match individual preferences, creating a tailored and comfortable environment for the driver or passenger.

Furthermore, AI contributes to the security of biometric vehicle access systems by detecting potential spoofing attempts or unauthorized access. Through advanced pattern recognition and anomaly detection, AI ensures that biometric systems remain secure against evolving threats.

In the era of connected and autonomous vehicles, AI enables biometric access to function as a critical component of the broader ecosystem. From enabling hands-free entry to ensuring secure vehicle-to-network communication, AI enhances the convenience and safety of biometric access solutions. This technology not only meets the growing consumer demand for secure and personalized vehicle access but also aligns with automakers’ goals to offer cutting-edge, intelligent vehicle solutions.

The growing demand for luxury cars is significantly driving the growth of the biometric vehicle access market, as these vehicles are increasingly equipped with advanced technologies that prioritize security, convenience, and personalized experiences. Luxury car buyers often seek cutting-edge features that offer enhanced safety and superior user experience, and biometric vehicle access systems, such as fingerprint, facial recognition, and voice authentication, cater to these preferences by providing seamless and secure methods of entry and ignition.

As automakers focus on differentiating their premium models, biometric systems are becoming a key selling point, offering high-tech features that appeal to tech-savvy consumers. Luxury vehicles often integrate multiple biometric technologies to ensure that only authorized users can access the vehicle, thereby reducing the risk of theft or unauthorized use. Additionally, biometric access systems provide a unique level of personalization, as they can adjust settings such as seat position, mirrors, climate control, and entertainment preferences based on the authenticated user’s profile. This enhances the driving experience and provides a greater sense of comfort and convenience.

Furthermore, the adoption of biometrics aligns with the growing trend of connected and autonomous vehicles, which prioritize secure and seamless interaction between the driver and the vehicle. The increasing focus on user-centric technologies, coupled with the premium placed on security and privacy in the luxury vehicle segment, makes biometric vehicle access an attractive option. As the luxury car market continues to expand globally, particularly in regions like North America, Europe, and Asia Pacific, the demand for innovative biometric solutions is expected to rise, further propelling market growth.

The biometric vehicle access market faces restraints such as high implementation costs and complex integration processes, which limit adoption, particularly in cost-sensitive regions. Concerns over data privacy and the potential for biometric data breaches create hesitation among consumers and manufacturers. Additionally, the reliance on advanced infrastructure and technology poses challenges in regions with underdeveloped digital ecosystems. Environmental factors, such as extreme temperatures or dirt, can also impact the reliability of biometric systems, further hindering widespread deployment and acceptance in the market.

Advancements in voice recognition technology are creating significant opportunities in the biometric vehicle access market by enhancing security, convenience, and user experience. Modern voice recognition systems leverage artificial intelligence (AI) and machine learning (ML) to achieve high levels of accuracy in identifying unique voice patterns, even amidst background noise or diverse accents. This makes voice-based authentication a reliable and user-friendly option for vehicle access, eliminating the need for physical keys or manual authentication processes.

Voice recognition systems enable personalized vehicle settings, allowing drivers to control various features, such as seat positions, climate controls, and infotainment preferences, simply by using their voice. This level of customization not only enhances comfort but also provides a seamless and intuitive driving experience. Additionally, voice commands integrated with smart assistant technologies, such as Amazon Alexa or Google Assistant, further elevate the functionality of biometric vehicle systems, aligning with the growing consumer demand for connected and intelligent vehicles.

Moreover, advancements in voice biometrics significantly improve security by using multi-layered authentication protocols that are challenging to replicate or forge. This is particularly important as automotive thefts and cybersecurity threats rise. The development of robust algorithms capable of detecting fraudulent voice patterns ensures enhanced protection against unauthorized access.

The increasing adoption of electric and autonomous vehicles provides a fertile ground for voice recognition technologies to thrive, as these vehicles prioritize advanced, non-intrusive user interfaces. As manufacturers continue to invest in R&D to enhance voice biometrics, regulatory compliance and supportive policies in markets like North America and Europe further boost adoption. Consequently, the integration of advanced voice recognition systems is poised to play a pivotal role in driving innovation and expanding the biometric vehicle access market in the future.

The fingerprint segment held a dominant share of the market. The fingerprint segment plays a pivotal role in driving the growth of the biometric vehicle access market due to its widespread acceptance, ease of use, and advanced security features. Fingerprint recognition is increasingly becoming the preferred biometric technology for vehicle access systems as it provides a seamless and personalized user experience. This technology enables vehicle owners to unlock doors, start engines, and customize in-car settings simply by scanning their fingerprint, offering both security and convenience. The rising adoption of smart and connected vehicles has further accelerated the integration of fingerprint recognition systems.

Automakers are capitalizing on the popularity of fingerprint biometrics by incorporating them into their latest models, particularly in mid-range and premium vehicles. These systems eliminate the risks associated with traditional keys or fobs, such as theft or duplication, making them appealing to safety-conscious consumers. Additionally, the cost-effectiveness of fingerprint scanners compared to other biometric modalities, such as facial or iris recognition, makes them a viable option for large-scale implementation in passenger cars.

Technological advancements, including AI and machine learning, have enhanced the accuracy and reliability of fingerprint recognition systems, even in challenging conditions such as dirt, moisture, or changes in the user’s physical attributes. These improvements boost consumer confidence and adoption rates. Furthermore, the increasing use of fingerprint biometrics in electric and autonomous vehicles, which emphasize cutting-edge features, is expanding market opportunities. This combination of affordability, security, and convenience positions the fingerprint segment as a key driver of growth in the biometric vehicle access market.

The passenger cars segment led the industry. The passenger cars segment is a major driver of growth in the biometric vehicle access market, driven by increasing consumer demand for advanced security and convenience features in vehicles. With the rising adoption of passenger cars globally, automakers are increasingly integrating biometric technologies such as fingerprint recognition, facial recognition, and iris scanning to enhance the user experience. These systems offer seamless and secure vehicle access, eliminating the need for traditional keys or fobs, which aligns with the growing consumer preference for smart and connected vehicles.

The passenger cars segment also benefits from the increasing penetration of electric and hybrid vehicles, which are often equipped with cutting-edge technologies, including biometric systems, as part of their high-tech appeal. Automakers are leveraging these features to differentiate their offerings in a competitive market, catering particularly to tech-savvy and safety-conscious customers. Luxury and premium car manufacturers are leading the adoption of biometric access systems, but mid-range car models are also starting to incorporate these technologies, broadening the market scope.

Furthermore, the integration of biometric systems in passenger cars is supported by advancements in artificial intelligence (AI) and machine learning, which enhance the functionality and accuracy of these systems. For example, AI-driven biometrics can adapt to changes in user behavior or physical appearance, ensuring reliable performance over time. This blend of security, convenience, and technological sophistication is making biometric systems a key selling point in the passenger car segment, driving their market growth.

According to the International Organization of Motor Vehicle Manufacturers, in Europe, Germany produced maximum units of passenger cars in Europe in 2023 with 4109371 followed by France (1026690) and Italy (541953).

North America dominated the biometric vehicle access market. The biometric vehicle access market in North America is experiencing significant growth, driven by an increasing focus on vehicle security, the growing adoption of connected and autonomous vehicles, and supportive government regulations and standards. Vehicle theft and unauthorized access remain persistent concerns in the region, prompting consumers and manufacturers to prioritize advanced security solutions. Biometric vehicle access systems, with their ability to provide personalized and highly secure authentication methods, have become an essential component of modern vehicles, catering to this demand effectively.

The widespread adoption of connected and autonomous vehicles in North America further accelerates the need for robust access systems. Biometric technologies such as fingerprint, facial, and iris recognition integrate seamlessly with connected vehicle ecosystems, enabling enhanced user authentication, personalized settings, and a superior driving experience. As autonomous vehicles gain traction, biometric systems are pivotal in ensuring secure user access and control, creating a significant growth opportunity.

Moreover, supportive government regulations and standards in North America play a crucial role in driving market adoption. Regulatory bodies are encouraging the implementation of advanced safety and security measures, including biometrics, to improve vehicle security and combat theft. These measures, coupled with incentives for incorporating innovative technologies, have propelled investments in biometric vehicle access systems.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The biometric vehicle access market in Asia-Pacific (APAC) is witnessing robust growth, fueled by the increasing demand for luxury and premium vehicles, technological advancements in biometric systems, and rising vehicle ownership across the region. As consumer preferences shift toward high-end vehicles equipped with advanced safety and convenience features, automakers are integrating biometric access systems to enhance the premium experience. Features like fingerprint, facial, and iris recognition cater to the growing demand for secure, personalized, and seamless vehicle access, particularly in markets like China, Japan, and South Korea, where luxury car sales are surging.

Technological advancements in biometric systems further drive market expansion in APAC. Innovations such as multimodal biometrics, which combine multiple recognition methods for enhanced security and accuracy, are increasingly being adopted. Additionally, integration with artificial intelligence (AI) enables adaptive systems capable of learning user behavior, thereby improving functionality and user satisfaction. These advancements align with the region's reputation as a hub for technological innovation, bolstering the adoption of cutting-edge biometric solutions.

The rise in vehicle ownership, driven by economic growth and increasing disposable income, also contributes significantly to market growth. As first-time and repeat vehicle buyers in countries like India, Indonesia, and Vietnam demand advanced security and convenience features, biometric vehicle access systems emerge as a key differentiator. This combination of rising luxury vehicle demand, technological progress, and expanding vehicle ownership is solidifying APAC’s position as a dynamic growth region for the biometric vehicle access market.

By Authentication Technology

By Technology

By Vehicle Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us