Box Truck Market Size Competitive Landscape & Future Outlook

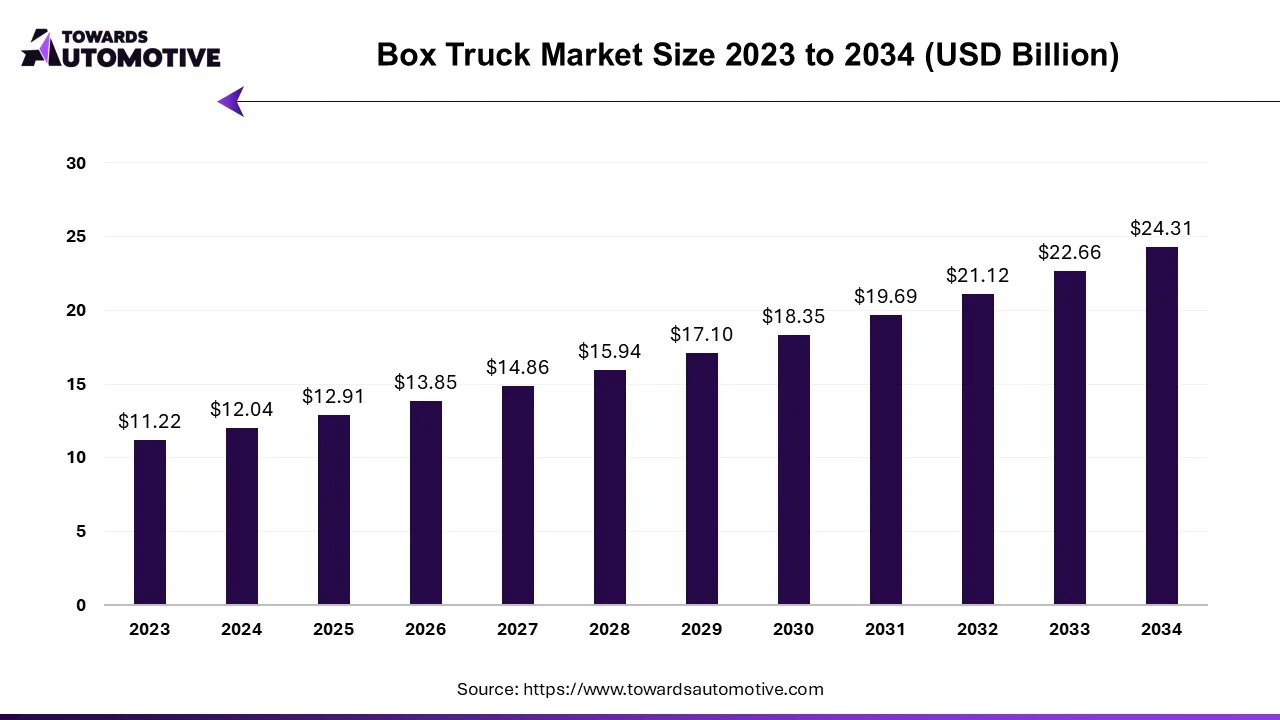

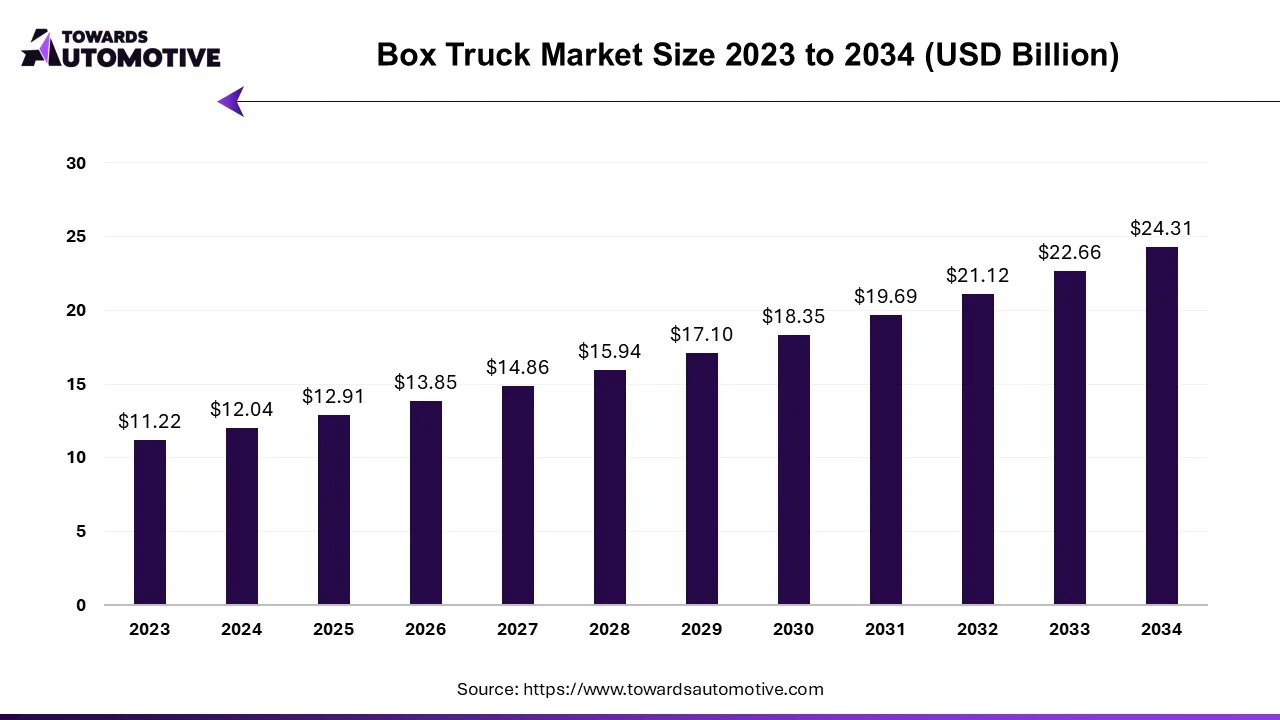

The box truck market is expected to grow from USD 12.91 billion in 2025 to USD 24.31 billion by 2034, with a CAGR of 7.28% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The box truck market is experiencing significant growth, driven by increasing demand for efficient and versatile commercial vehicles for transportation and logistics applications.

Meeting the Demand for Efficient Transportation Solutions

Box trucks, also known as cube vans or straight trucks, are versatile commercial vehicles equipped with an enclosed cargo area for transporting goods and materials. These vehicles offer several advantages, including ample cargo space, ease of loading and unloading, and maneuverability in urban environments, making them indispensable for a wide range of businesses and industries.

Key Components and Functions of Box Trucks

- Vehicle Manufacturers: Leading manufacturers in the box truck market design and produce a variety of vehicles tailored to specific applications and customer requirements. These manufacturers offer innovative solutions, including lightweight materials, aerodynamic designs, and advanced safety features, to optimize vehicle performance, fuel efficiency, and driver comfort.

- Cargo Box Designs: Box trucks feature various cargo box designs to accommodate different types of cargo and loading requirements. Standard box truck configurations include dry van bodies, refrigerated (reefer) bodies, flatbed bodies, and specialized bodies for specific industries such as moving and delivery services, food and beverage distribution, and parcel delivery.

- Chassis and Powertrain Options: Box trucks are built on various chassis platforms, including light-duty, medium-duty, and heavy-duty truck chassis, depending on payload capacity and application requirements. Powertrain options range from gasoline and diesel engines to hybrid and electric propulsion systems, offering customers flexibility in selecting the most suitable configuration for their transportation needs.

Market Dynamics and Trends

- E-commerce Boom: The rapid growth of e-commerce and online retailing is driving demand for box trucks, which play a critical role in last-mile delivery and urban logistics. With the rise of same-day and next-day delivery expectations, businesses require efficient and reliable transportation solutions to meet customer demands, spurring investment in modern box truck fleets equipped with advanced telematics, routing optimization, and cargo tracking systems.

- Sustainability Initiatives: Increasing environmental awareness and government regulations are driving the adoption of eco-friendly box trucks powered by alternative fuels such as compressed natural gas (CNG), liquefied natural gas (LNG), and electricity. Electric box trucks, in particular, offer zero-emission operation, reduced operating costs, and quieter operation, making them ideal for urban delivery routes and environmentally sensitive areas.

- Technological Advancements: Technological advancements in vehicle connectivity, telematics, and autonomous driving technologies are reshaping the box truck market, enabling fleet operators to improve vehicle utilization, optimize route planning, and enhance driver safety and productivity. Advanced driver assistance systems (ADAS) such as lane departure warning, collision avoidance, and automatic emergency braking are becoming standard features in modern box trucks, reducing the risk of accidents and improving road safety.

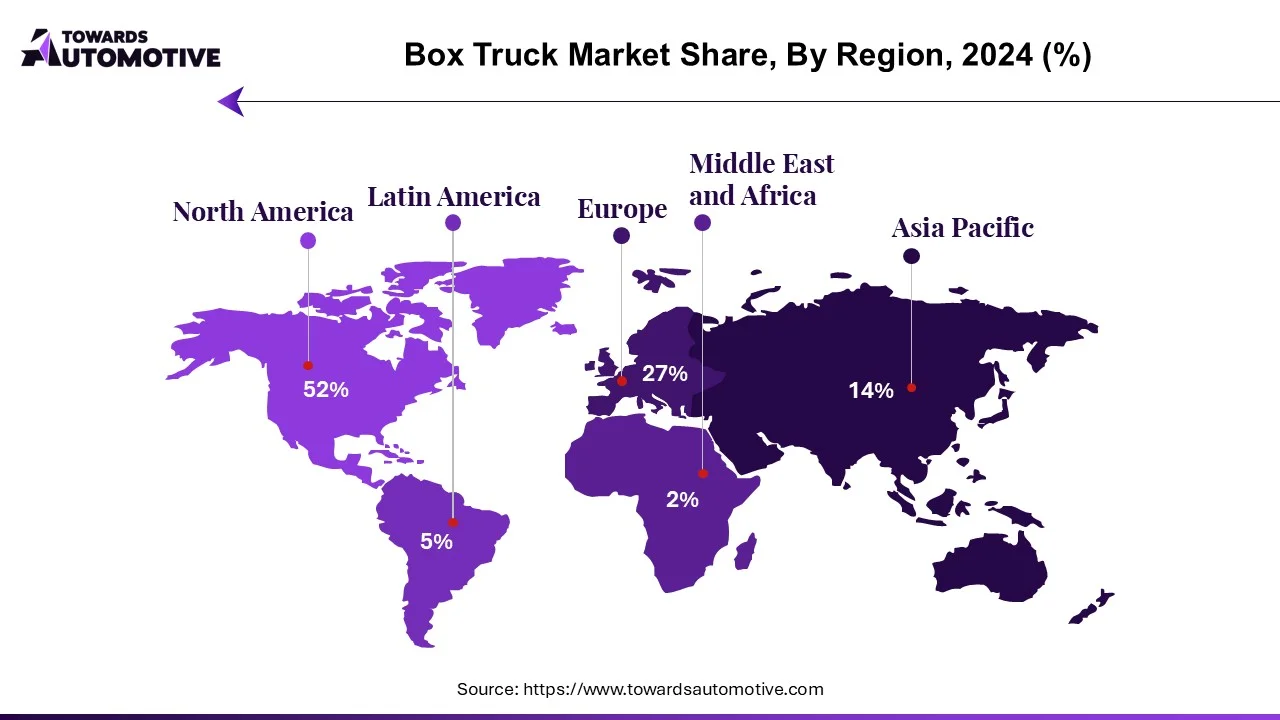

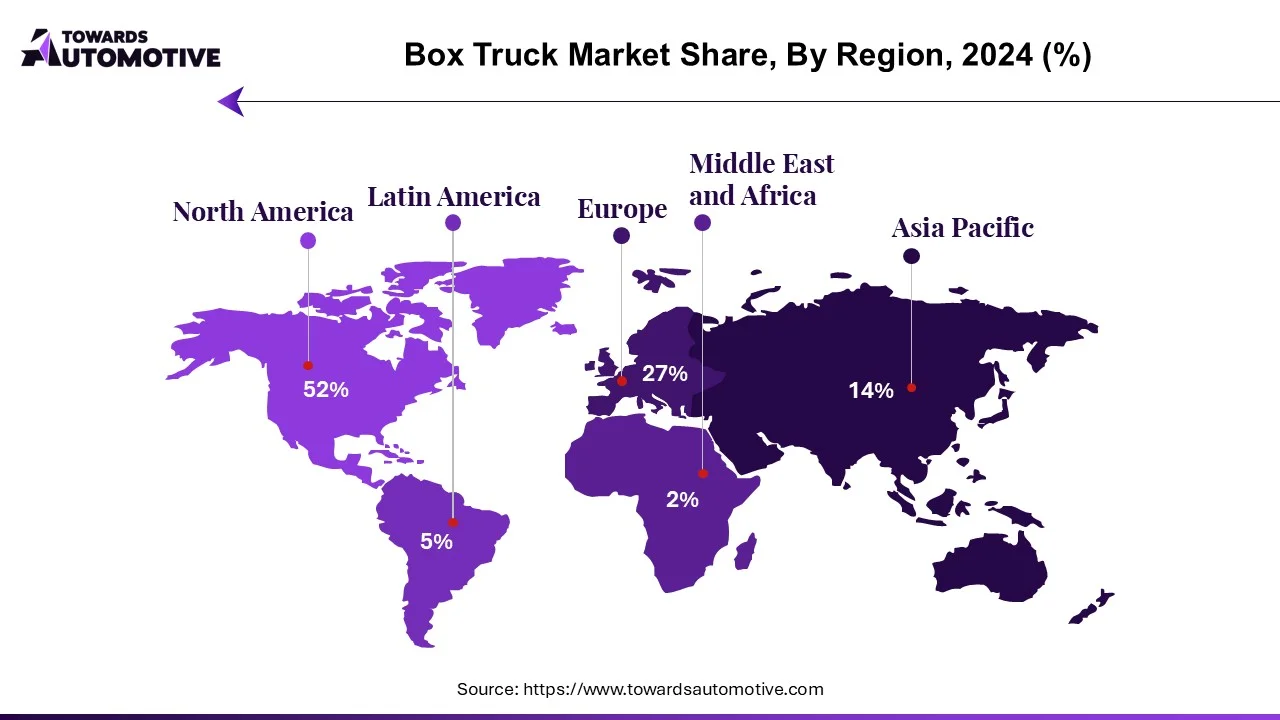

North America is Expected to Grow

In the bustling landscape of North America's transportation industry, the container truck market is poised to claim a significant portion of revenue, with projections indicating a substantial 24% share by the year 2023. This surge in market share is underpinned by a confluence of factors driving the demand for efficient goods delivery, particularly within major urban centers.

Fueling this growth is the rapid expansion of the economy and the transportation sector, which have catalyzed heightened demand for the swift and reliable delivery of goods to urban hubs. Container trucks emerge as indispensable players in the intricate web of urban logistics, serving as lifelines that ferry goods to businesses, residential enclaves, and sprawling distribution centers with precision and efficiency.

However, the evolving landscape of the container truck market is not solely defined by traditional factors of demand and supply. Rather, it is increasingly shaped by the transformative power of technology, which holds the promise of revolutionizing industry norms and practices. The integration of cutting-edge technology into container trucks heralds a new era characterized by enhanced safety, operational efficiency, and cost-saving opportunities.

Amidst this technological renaissance, manufacturers and logistics organizations across the United States are spearheading pioneering efforts in autonomous driving technology. By embracing autonomous solutions, stakeholders aim to address pressing workforce shortages while simultaneously elevating fleet performance to unprecedented levels of efficacy and reliability.

Moreover, the burgeoning interest in sustainability has emerged as a driving force reshaping the contours of the container truck market. With the meteoric rise of e-commerce and the advent of electric and hybrid propulsion technologies, there is a palpable shift towards more environmentally conscious modes of transportation. This evolving paradigm underscores the imperative for sustainable practices within the industry, propelling innovations that minimize carbon footprints and champion eco-friendly initiatives.

Against this backdrop of dynamic change and innovation, the North American container truck market presents a landscape ripe with promise and potential. As stakeholders navigate the complexities of an ever-evolving industry, the fusion of technological advancement, sustainability imperatives, and burgeoning economic growth sets the stage for a future defined by unprecedented progress and prosperity.

Market Segmentation and Regional Outlook

By Box Type

- Dry Van Bodies

- Refrigerated (Reefer) Bodies

- Flatbed Bodies

- Specialized Bodies (e.g., Moving, Delivery)

By Payload Capacity

- Light-Duty Box Trucks

- Medium-Duty Box Trucks

- Heavy-Duty Box Trucks

By End-Use Industry

- Transportation and Logistics

- Retail and E-commerce

- Food and Beverage

- Construction and Contracting

- Utilities and Municipal Services

By Region

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle-East and Africa

Challenges and Opportunities

- Urbanization and Congestion: Urbanization and population growth in major cities pose challenges for box truck operators, including traffic congestion, limited parking, and restricted access to delivery zones. However, opportunities exist to leverage technology solutions such as route optimization, vehicle tracking, and alternative delivery methods (e.g., micro-fulfillment centers, electric cargo bikes) to mitigate congestion and improve delivery efficiency in urban environments.

- Infrastructure Development: The expansion and modernization of transportation infrastructure, including roads, bridges, and intermodal facilities, are essential for the growth of the box truck market. Investment in infrastructure projects such as road widening, bridge rehabilitation, and port development can enhance connectivity, reduce transportation costs, and facilitate the movement of goods and materials, driving demand for box trucks and related transportation services.

Key Players in the Box Truck Market

The box truck market comprises a diverse ecosystem of manufacturers, suppliers, fleet operators, and logistics service providers.

Some of the prominent players in the market include:

- Daimler AG

- Volvo Group

- PACCAR Inc.

- Isuzu Motors Ltd.

- Ford Motor Company

- General Motors Company

- FCA Group (Fiat Chrysler Automobiles)

- Hyundai Motor Company

- Tata Motors Limited

- Mitsubishi Fuso Truck and Bus Corporation

Recent Developments in the Box Truck Market

- In December 2023, Daimler AG unveiled its next-generation electric box truck, the Mercedes-Benz eActros LongHaul, featuring a high-capacity battery pack, long-range capability, and advanced driver assistance systems for autonomous driving on highways. The eActros LongHaul offers emission-free operation, reduced total cost of ownership, and enhanced driver comfort, making it ideal for long-distance transportation applications.

- In November 2023, Volvo Group announced its collaboration with logistics partners and technology providers to develop a fully autonomous box truck solution for urban delivery applications. The autonomous box truck integrates Volvo's proprietary autonomous driving technology with advanced sensors, cameras, and artificial intelligence algorithms to navigate urban environments, execute delivery tasks, and interact safely with pedestrians and cyclists.

- In October 2023, PACCAR Inc. introduced its new Kenworth T680e electric box truck model, equipped with a zero-emission powertrain, high-energy battery pack, and regenerative braking system for enhanced efficiency and range. The Kenworth T680e offers quiet operation, low maintenance costs, and seamless integration with existing fleet operations, providing customers with a sustainable transportation solution for urban delivery and distribution.

- In September 2023, Isuzu Motors Ltd. unveiled its N-Series electric box truck lineup, featuring various payload capacities, body configurations, and battery options to meet diverse customer requirements. The Isuzu N-Series electric box trucks offer zero-emission operation, reduced operating costs, and reliable performance in urban delivery, logistics, and municipal services applications, contributing to sustainable transportation solutions and environmental stewardship.

- In August 2023, Ford Motor Company announced its investment in electric vehicle (EV) charging infrastructure to support the deployment of electric box trucks and commercial vehicles. Ford's charging infrastructure initiative includes the installation of fast-charging stations at key logistics hubs, distribution centers, and urban delivery depots, enabling fleet operators to charge their electric box trucks quickly and conveniently, maximizing uptime and productivity.