April 2025

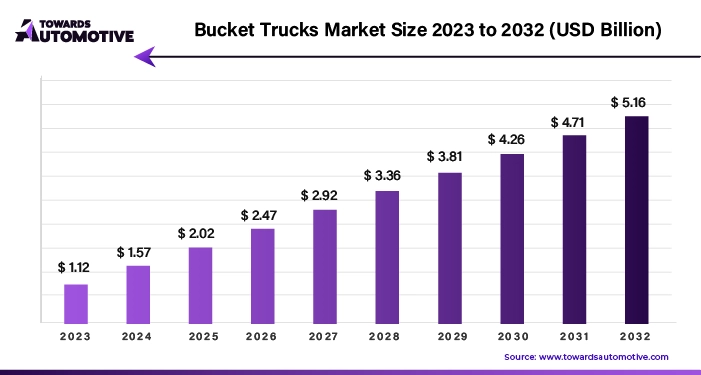

The bucket trucks market is forecasted to expand from USD 1.46 billion in 2025 to USD 4.80 billion by 2034, growing at a CAGR of 14.14% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The global economy relies heavily on the development and maintenance of infrastructure, which encompasses a wide range of projects such as roads, bridges, and public facilities. As countries invest in infrastructure projects to accommodate urbanization and economic growth, the demand for trucks, especially specialized ones like bucket trucks, is on the rise. These trucks play a crucial role in various tasks such as lighting installation, power line maintenance, and repair work in elevated areas.

The expansion and improvement of cities, coupled with the initiation of new infrastructure projects, continue to drive the growth of the truck market. As urban areas expand and new construction projects emerge, there is a growing need for trucks equipped to handle specialized tasks efficiently and safely.

One of the primary drivers of the increasing demand for trucks is the rising vehicle sales, particularly in sectors such as construction, service, and maintenance. As companies expand their fleets to meet growing operational needs, there is a corresponding need for specialized vehicles like trucks. For example, data from the Association of Indian Automobile Manufacturers highlights the significant domestic sales of automobiles in India, indicating a substantial demand for vehicles to support infrastructure development efforts.

However, despite the growing demand, the high initial cost of trucks presents a significant challenge for many businesses, especially small enterprises and startups. The substantial investment required to acquire these specialized vehicles can pose financial constraints and hinder business growth. To address this issue, companies and financial institutions often offer leasing and financing options, making trucks more accessible to potential buyers. These financing solutions help mitigate the barrier posed by high upfront costs, thereby stimulating demand and facilitating business expansion in the truck market.

Despite the challenges brought about by the COVID-19 pandemic, the bucket trucks market has shown resilience and even experienced positive trends. The pandemic underscored the critical role of essential services, leading to a heightened demand for utility maintenance and emergency repair works, which are often performed using bucket trucks. Furthermore, in response to the economic downturn caused by the pandemic, many governments around the world expedited infrastructure projects as part of their stimulus measures, further fueling the demand for bucket trucks.

Moreover, the heightened focus on safety and hygiene during the pandemic has accelerated the adoption of contactless and automated features in bucket trucks. These innovative technologies not only enhance operational efficiency but also minimize the risk of exposure to infectious agents, contributing to the overall safety of workers.

Overall, despite the initial setbacks posed by the pandemic, the bucket trucks market has adapted to the evolving circumstances and even thrived amidst adversity, driven by the essential nature of its services and the continued emphasis on infrastructure development and safety.

The increasing implementation of grid projects is significantly contributing to the demand for bucket trucks. These specialized vehicles play a crucial role in the construction, upkeep, and repair of electrical infrastructure, particularly in the context of grid expansion initiatives. As more grid projects are launched globally to address the escalating energy demands, the need for bucket trucks continues to grow.

A notable example is the groundbreaking super grid project initiated by The Gulf Cooperation Council Interconnection Authority (GCCIA) in June 2023. This ambitious project aims to establish a robust grid network connecting the GCC countries with southern Iraq, facilitating the transmission of 500 megawatts (MW) of power to meet the electricity requirements of the region. Bucket trucks are indispensable for efficiently installing power lines, conducting repairs, and performing routine maintenance, thus playing a pivotal role in supporting grid expansion endeavors.

Furthermore, the phenomenon of rapid urbanization is another key driver propelling the bucket trucks market forward. As urban areas expand and evolve, there is a surge in demand for essential services such as utility maintenance, streetlight installation, and tree trimming. Bucket trucks are instrumental in facilitating these tasks, enabling safe and efficient operations at elevated heights. Given the continuous need for maintenance and upgrades in urban environments, the demand for bucket trucks remains robust, making them indispensable assets in urban development and maintenance initiatives worldwide.

In 2022, the non-insulated segment dominated the bucket trucks market, holding over 80% of the market share. This segment's growth is primarily fueled by the increasing emphasis on forestry management activities. With efforts to manage forests becoming more pronounced, there is a growing demand for specialized vehicles capable of efficiently handling tasks such as tree trimming and maintenance.

For example, in August 2023, the Georgia Forestry Commission announced several funding opportunities aimed at supporting community forestry management and tree planting initiatives. These grants, designed to protect and enhance the benefits of urban forests, highlight the importance of specialized equipment like non-insulated bucket trucks. These vehicles offer versatility and cost-effectiveness, making them essential for forestry management tasks. As such initiatives continue to gain momentum, the demand for non-insulated bucket trucks is expected to grow significantly in the forecast period.

On the other hand, in terms of application, the utility segment accounted for 47% of the bucket trucks market share in 2022. Technological advancements play a crucial role in driving the growth of utility applications in the market. Innovations such as advanced hydraulic systems, user-friendly control interfaces, and automation features have substantially improved the efficiency, safety, and precision of utility-related tasks.

These technological enhancements enable utility companies to carry out maintenance, repairs, and installations more effectively, thereby reducing downtime and enhancing overall productivity. Moreover, the integration of smart technologies and capabilities further streamlines operational processes, making bucket trucks equipped with these features highly sought-after for utility applications. Consequently, the utility segment is experiencing significant growth driven by technological advancements and the need for enhanced operational efficiency in utility-related tasks.

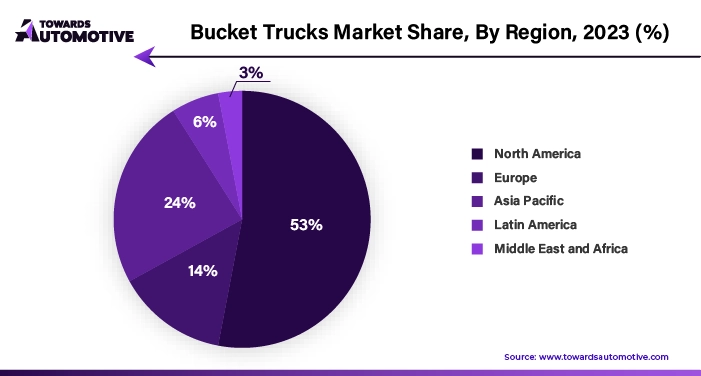

In 2022, North America emerged as a dominant player in the bucket trucks market, capturing over 40% of the revenue share. This substantial market share was driven by several factors, including robust infrastructure development initiatives and the aging utility systems prevalent in the region.

One of the primary drivers of market growth in North America is the ongoing investments in construction projects and utility maintenance. With governments and private entities continuously investing in infrastructure development, there is a consistent demand for bucket trucks. These specialized vehicles are instrumental in tasks such as electrical line installations and upgrades, which are essential components of infrastructure projects.

Additionally, the pressing need to upgrade aging utility infrastructure also contributes significantly to market expansion in North America. As utility systems across the region reach the end of their operational lifespan, there is a growing reliance on bucket trucks for routine maintenance and repairs. These vehicles enable utilities to conduct inspections, repairs, and upgrades safely and efficiently, thereby ensuring the reliability and resilience of the infrastructure.

Moreover, stringent safety regulations in North America play a pivotal role in driving market growth. With safety being a top priority in the region, utilities and construction companies are compelled to adhere to modern safety standards and regulations. Bucket trucks, equipped with advanced safety features and technologies, offer a reliable solution that meets regulatory requirements, further fueling their adoption.

Overall, the North America bucket trucks market is characterized by the convergence of infrastructure development initiatives, aging utility systems, and stringent safety regulations. These factors collectively contribute to the sustained growth and expansion of the market in the region, making North America a key market for bucket trucks.

Major companies operating in the bucket trucks industry are:

Major players in the bucket truck market are actively pursuing various inorganic growth strategies to maintain competitiveness in the market. One such strategy involves forming strategic partnerships and alliances with other organizations, allowing companies to leverage complementary strengths and resources for mutual benefit. These collaborations often result in joint product development initiatives, expanded distribution networks, and shared research and development efforts, thereby enhancing the overall competitiveness of the companies involved.

By partnering with other organizations, companies in the bucket truck market can access new markets and customer segments that may have previously been inaccessible. Additionally, strategic alliances enable companies to combine their expertise and resources to develop innovative solutions that address evolving customer needs and market trends. This collaborative approach fosters synergy between companies, leading to enhanced product offerings and improved market positioning.

Furthermore, strategic partnerships and alliances can provide companies with access to specialized technologies, intellectual property, or manufacturing capabilities that may not be available in-house. By leveraging these external resources, companies can accelerate product development timelines and reduce costs, ultimately driving greater efficiency and competitiveness in the market.

Overall, forming strategic partnerships and alliances is a key strategy employed by major players in the bucket truck market to enhance their competitive advantage, expand their market reach, and drive innovation. By collaborating with other organizations, companies can position themselves for long-term success in an increasingly dynamic and competitive market landscape.

By Product

By Type

By Application

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us