April 2025

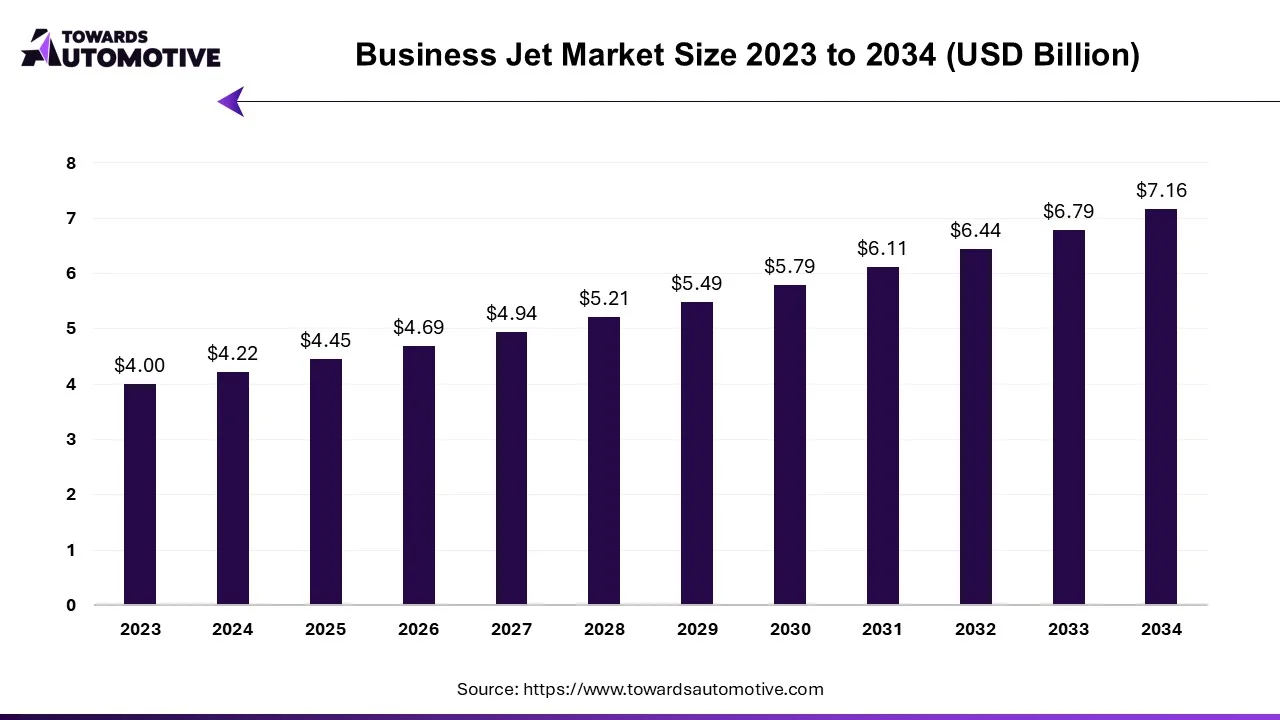

The business jet market is forecasted to expand from USD 4.45 billion in 2025 to USD 7.16 billion by 2034, growing at a CAGR of 5.43% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

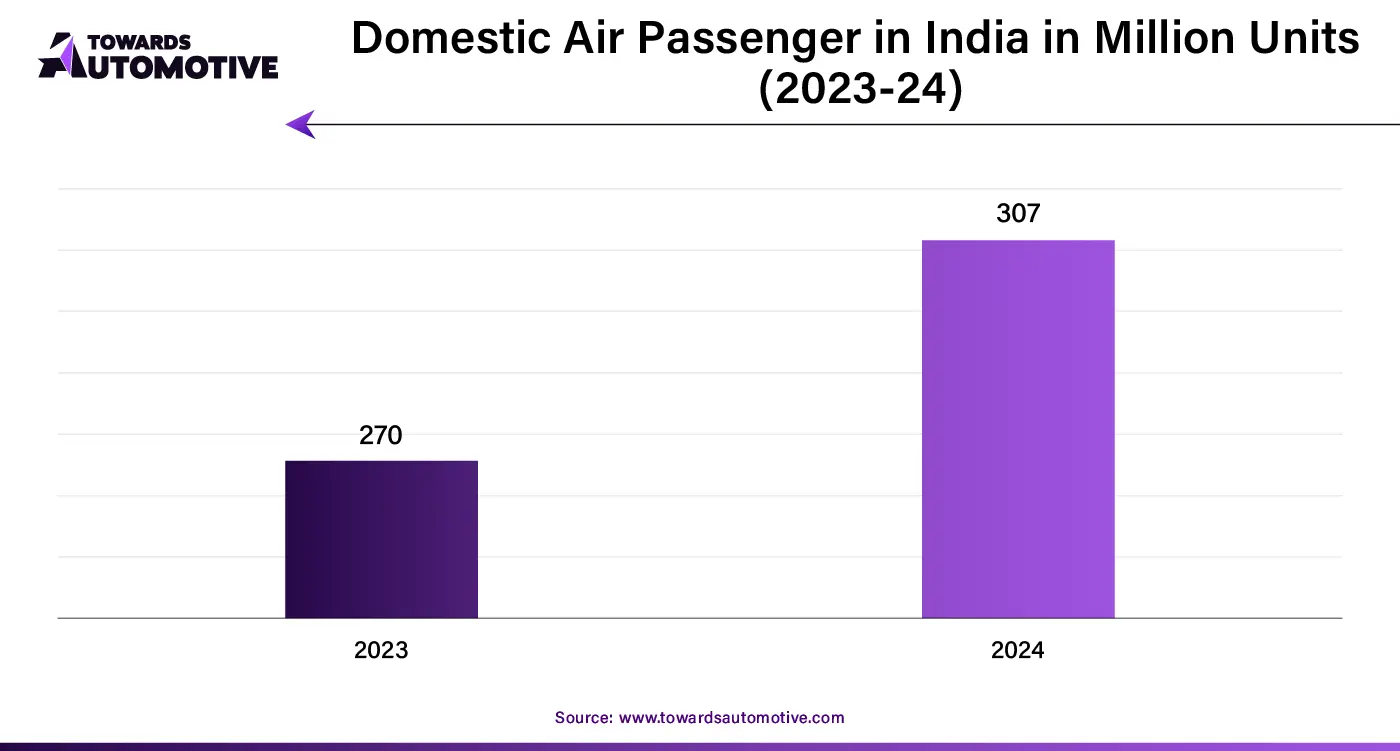

The business jet market is a prominent segment of the aviation industry. This industry deals in production and distribution of business jets around the world. There are different types of jets developed in this sector consisting of light business jet, mid-size business jet, large business jet and others. These jets are integrated with various systems comprising of aerostructures, avionics, aircraft systems, cabin interiors, doors, windows and some others. It is designed for numerous end-users such as private users and operators. The rise in number of domestic passengers in different parts of the world is driving the market growth. This market is expected to rise significantly with the growth of the aerospace and defense sector across the globe.

In October 2024, David Murray, the vice president at Bombardier’s exec announced that, “The manufacturing process for what will be the industry’s fastest business jet, … has begun, Our engineering and production teams continue to demonstrate unmatched levels of expertise, pride and innovation, qualities that are an intrinsic part of Bombardier’s DNA. Our people’s mastery is behind the progress we are making at our production sites and underscores Bombardier’s culture of excellence, as well as our commitment to elevating the world of aviation.”

North America held the highest share of the market. The market is generally driven by the presence of several aviation companies in this region. Moreover, the rising disposable income of the people coupled with increasing preference of air transportation is shaping the industry in a positive direction. The U.S. is the major contributor of this region due to the rise in number of private jet operators along with the growing consumer interest towards luxurious air journeys.

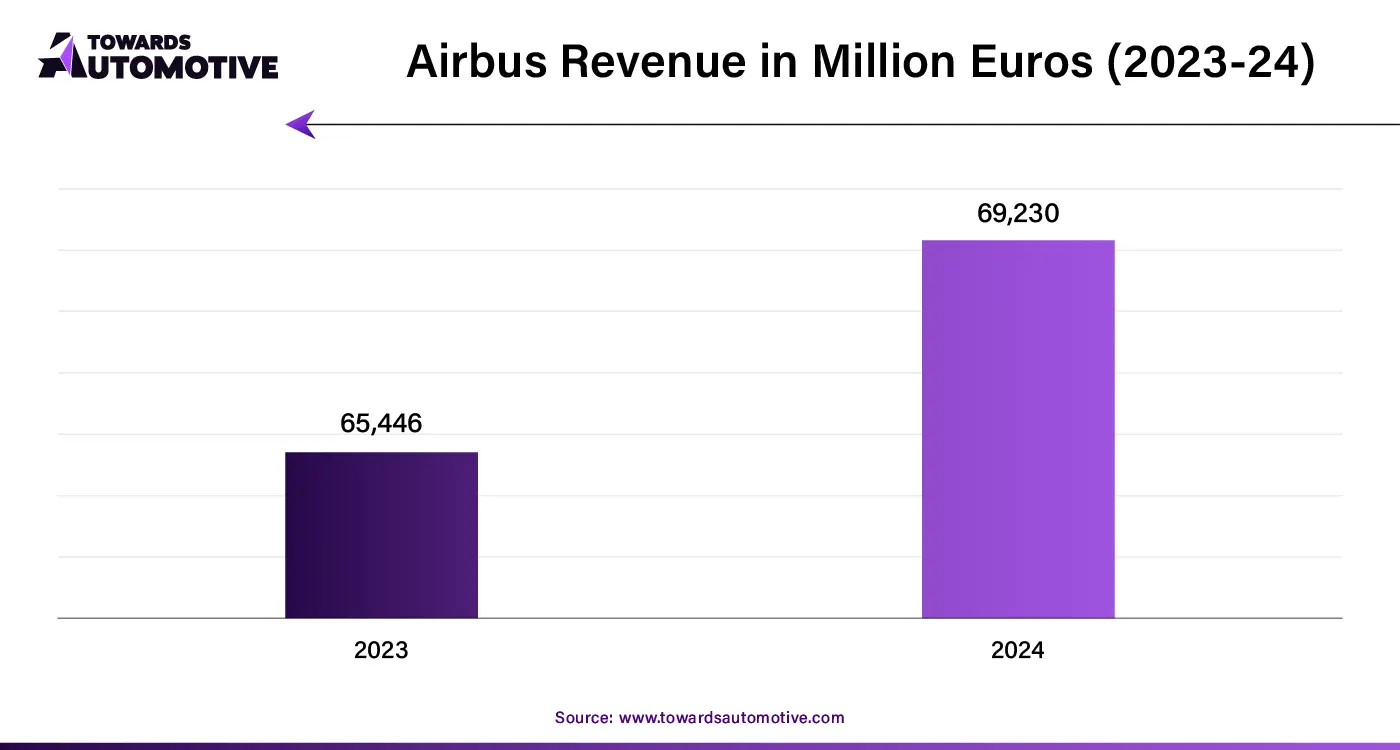

The business jet market is a fragmented industry with the presence of several dominating players. Some of the crucial players in this industry consists of Airbus SAS (Netherlands), The Boeing Company (U.S.), Bombardier (Canada), Dassault Aviation (France), Embraer SA (Brazil), Gulfstream Aerospace Corporation (U.S.), HondaJet (U.S.) and some others. These companies are constantly engaged in developing advanced business jet and adopting numerous strategies to maintain their dominant position in this industry.

By Business Jet Type

By System

By End-user

By Ownership

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us