April 2025

Senior Research Analyst

Reviewed By

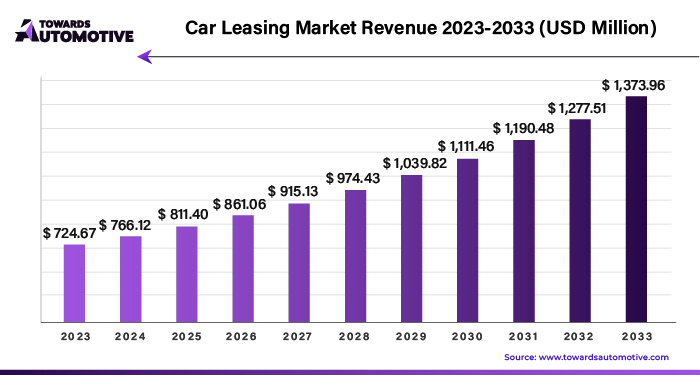

The global car leasing market size is calculated at USD 0.77 billion in 2024 and is expected to be worth USD 1.48 billion by 2034, expanding at a CAGR of 6.71% from 2024 to 2034.

The car leasing market is experiencing robust growth, driven by increasing consumer preference for flexible vehicle ownership options and the rising cost of purchasing new vehicles. Leasing allows individuals and businesses to access the latest car models without the financial burden of full ownership, making it an attractive option in today’s economy. In particular, the market is benefiting from the shift towards electric vehicles (EVs), as leasing provides a lower-risk option for consumers eager to try new technologies but hesitant to commit to buying an EV outright. Additionally, leasing companies often offer comprehensive maintenance packages, which appeal to both individual and corporate customers seeking convenience and cost predictability.

Corporate leasing, or fleet leasing, is another key segment, as businesses look for cost-effective solutions to manage their fleets. The flexibility of lease terms, reduced capital outlay, and potential tax benefits make leasing an attractive option for companies. Moreover, the rise of mobility-as-a-service (MaaS) and subscription models is expanding the market further by catering to consumers who value convenience and flexibility over ownership.

Technological advancements, including digital platforms and AI-powered fleet management solutions, are also enhancing the customer experience, making leasing more accessible and personalized. As a result, the car leasing market is expected to continue growing, driven by evolving consumer preferences, corporate demand, and technological innovation, offering a viable alternative to traditional car ownership.

AI plays a transformative role in the car leasing market, driving efficiency, personalization, and customer satisfaction. One of its primary applications is in data analysis and predictive modeling, where AI helps leasing companies assess customer preferences, driving habits, and financial profiles to offer tailored leasing options. By analyzing large datasets, AI can predict which car models, leasing terms, or features are most suitable for a particular customer, ensuring a more personalized experience. This leads to higher customer satisfaction and retention rates.

In addition, AI-powered chatbots and virtual assistants enhance customer service by providing 24/7 support, answering queries, and guiding customers through the leasing process. This reduces the need for human intervention and improves response times. AI also optimizes fleet management for corporate leasing, using advanced algorithms to monitor vehicle usage, predict maintenance needs, and recommend fleet adjustments to minimize costs and downtime.

Furthermore, AI enhances risk management by assessing a customer's credit history, driving behavior, and other factors in real-time, helping companies make informed decisions on leasing approvals and reducing the likelihood of defaults. AI can also help monitor compliance with leasing agreements by tracking vehicle usage patterns.

Finally, AI-driven solutions aid in automating administrative tasks such as document processing, contract generation, and payment management, making the leasing process faster and more efficient. In the evolving car leasing market, AI is key to improving operations, customer experience, and business outcomes.

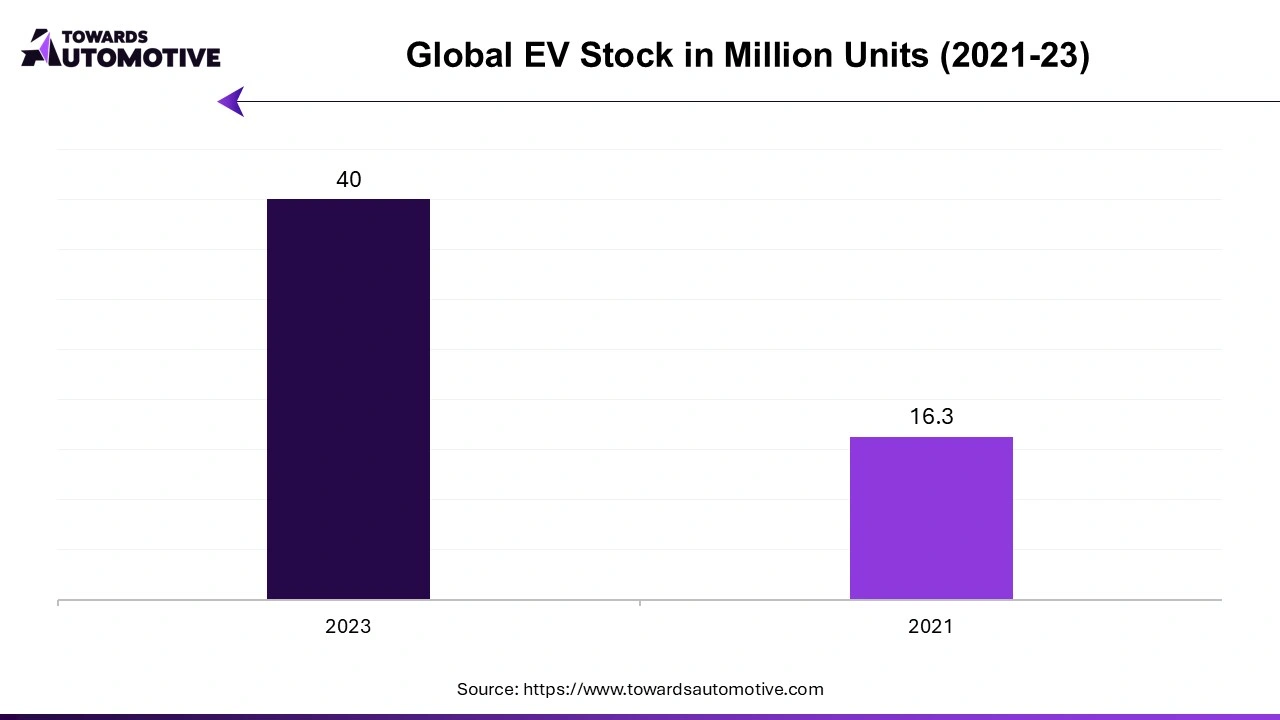

The rising trend of electric vehicles (EVs) is significantly driving the growth of the car leasing market, offering a sustainable and flexible solution for consumers looking to transition to greener transportation. As environmental concerns and government regulations surrounding emissions intensify, the demand for EVs has surged, prompting consumers to explore leasing options that offer lower upfront costs and reduced financial risk compared to purchasing. Leasing an EV allows individuals to experience the benefits of electric mobility, including reduced fuel costs, minimal maintenance, and lower carbon footprints, without committing to long-term ownership or the rapid depreciation associated with EVs.

One of the major advantages of leasing EVs is the ability to upgrade to newer models as technology evolves. The EV market is advancing rapidly, with automakers consistently introducing models with longer ranges, faster charging times, and improved features. Leasing offers consumers the flexibility to drive the latest EV models without being tied to older technologies, making it an attractive option for tech-savvy individuals who prioritize innovation and efficiency. This also alleviates concerns about battery degradation, a key issue for EV ownership, as lessees can switch to newer vehicles before battery performance declines.

Moreover, leasing companies are increasingly integrating EVs into their fleets to meet the growing consumer demand for eco-friendly transportation. Businesses, too, are capitalizing on the trend, using leased EVs to reduce their carbon footprints and meet sustainability targets. Fleet managers can transition to electric vehicles without bearing the full cost of ownership, benefitting from government incentives for EVs and contributing to corporate social responsibility goals.

As governments worldwide continue to promote EV adoption through incentives, tax credits, and infrastructure development, the car leasing market is well-positioned to grow. The flexibility, affordability, and access to the latest technologies make EV leasing a compelling choice for individuals and businesses alike, fostering further expansion in the market.

The car leasing market faces several restraints that could hinder its growth. One key challenge is the high upfront costs and monthly payments associated with leasing, which may deter budget-conscious consumers. Additionally, mileage restrictions imposed by leasing contracts can limit the appeal for individuals who drive extensively. The residual value risk, where the estimated value of the car at the end of the lease term may be lower than expected, also poses challenges for leasing companies. Moreover, economic downturns and fluctuating interest rates can impact consumer spending, reducing demand for leased vehicles in uncertain financial climates.

The growing trend of subscription models in the car leasing market is creating substantial opportunities for both consumers and businesses. Unlike traditional car leasing, subscription models offer a more flexible and user-centric approach, allowing individuals to access a wide variety of vehicles without being locked into long-term contracts. This trend is largely driven by changing consumer preferences, particularly among younger generations who prioritize flexibility, convenience, and access over ownership. Subscription services typically include insurance, maintenance, and registration costs, offering an all-inclusive package that simplifies vehicle usage for the consumer.

One of the key opportunities created by this trend is the ability for leasing companies to tap into a broader audience. Subscription models appeal to those who may not have considered traditional leasing due to its longer-term commitment. Consumers now have the option to switch between different car models depending on their needs, such as choosing a larger vehicle for family vacations and a smaller one for daily commutes. This increased flexibility attracts a diverse customer base, from urban dwellers needing short-term solutions to professionals who prefer regular vehicle upgrades without the financial burdens of ownership.

For businesses, especially in the corporate and fleet management sectors, subscription models offer opportunities for optimizing mobility solutions. Companies can manage vehicle fleets more efficiently, adjusting the number of vehicles based on demand without the risks associated with vehicle depreciation or high upfront costs. This is especially valuable for businesses operating in industries with fluctuating transportation needs, such as ride-sharing, delivery services, and logistics.

Additionally, the integration of electric vehicles (EVs) into subscription models provides an avenue for consumers to experiment with EVs without a long-term commitment, encouraging a shift towards more sustainable transportation. As governments continue to support eco-friendly vehicle options, leasing companies can leverage subscription services to promote green mobility solutions.

The commercial segment led the market. The commercial segment is a key driver of growth in the car leasing market, fueled by the increasing demand from businesses seeking cost-effective and flexible fleet management solutions. Companies, both large and small, are turning to leasing as an alternative to purchasing vehicles outright, as it offers numerous financial and operational benefits. Leasing allows businesses to access the latest vehicle models without the upfront capital investment, freeing up funds for other critical areas of their operations. Moreover, leasing contracts typically include maintenance, insurance, and repair services, reducing the burden of fleet management and ensuring predictability in operational costs.

Leasing also provides flexibility in fleet composition, enabling businesses to scale their fleet size up or down according to changing operational needs. This is particularly valuable for industries with fluctuating demand, such as logistics, e-commerce, and transportation, where the ability to quickly adjust fleet size without the hassle of asset disposal or acquisition offers a competitive advantage. Additionally, leasing vehicles allows businesses to refresh their fleets more frequently, ensuring access to the latest fuel-efficient models or electric vehicles (EVs), which helps meet sustainability goals and lower operational costs through improved fuel efficiency and reduced emissions.

The rise of corporate mobility solutions and the increasing popularity of mobility-as-a-service (MaaS) further drive demand for leasing in the commercial sector, as businesses look for flexible transportation options for their employees. With many organizations also focusing on cost optimization and reducing capital expenditures, leasing offers a strategic solution for fleet management, contributing significantly to the overall growth of the car leasing market. This trend is expected to continue as businesses increasingly prioritize financial flexibility, operational efficiency, and sustainability.

The operating lease segment held a dominant share of the market. The operating lease segment plays a significant role in driving the growth of the car leasing market, primarily due to the financial flexibility and reduced risks it offers to both businesses and individual consumers. Operating leases allow lessees to use vehicles without the burden of ownership, providing access to the latest models for a fixed period and at a predetermined cost. Unlike finance leases, where the lessee has an option to purchase the vehicle at the end of the lease term, operating leases typically involve returning the vehicle to the lessor, making them an attractive option for those looking for short- to medium-term vehicle usage.

For businesses, operating leases are particularly advantageous because they allow for fleet management without large upfront capital expenditures. This is especially important for companies that want to maintain cash flow and allocate their resources to other areas of growth. Additionally, since the lessor retains ownership of the vehicles, companies can avoid depreciation risks, which can be significant in industries with high vehicle turnover rates, such as logistics and transportation. The regular, predictable payments associated with operating leases help businesses manage their budgets more efficiently.

In the consumer market, operating leases attract those who prefer flexibility and lower monthly payments compared to financing or purchasing a vehicle. This option is especially appealing in the growing electric vehicle (EV) segment, where consumers may want to experience new technology without the long-term commitment of ownership, especially as EV technology continues to evolve rapidly.

Moreover, the operating lease segment is supported by advancements in digital platforms, which streamline the leasing process and enhance customer experience. These benefits, combined with the ability to update to newer models and avoid ownership responsibilities, make operating leases a major driver of growth in the car leasing market.

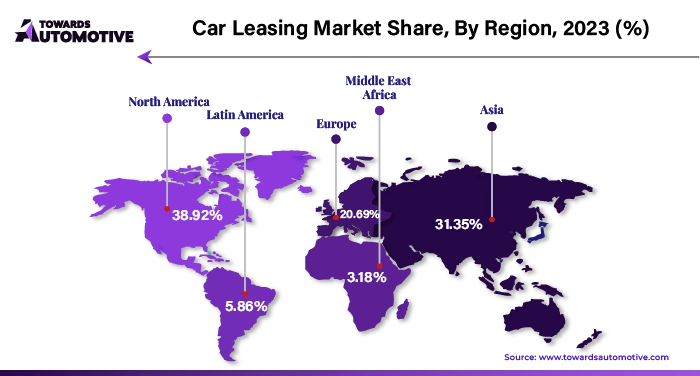

North America dominated the car leasing market. The growth of the car leasing market in North America is driven by several key factors, including increased demand for cost-efficient mobility solutions, technological advancements and the growing preference for flexible vehicle ownership options. One of the primary drivers is the rising cost of vehicle ownership. As vehicle prices continue to rise due to inflation, supply chain disruptions, and increasing demand for advanced safety and comfort features, consumers and businesses alike are seeking more affordable alternatives. Leasing offers lower monthly payments, reduced maintenance costs, and the ability to drive newer models without the burden of ownership, making it an attractive option for many.

In addition, the increasing focus on corporate mobility solutions and fleet management is contributing to the growth of the leasing market in the region. Businesses are recognizing the financial benefits of leasing, such as avoiding large capital expenditures, improving cash flow, and benefiting from tax advantages. This trend is especially strong in industries like logistics, delivery, and ride-sharing services, where companies need to maintain large fleets of vehicles.

Technological advancements are also playing a crucial role in driving the car leasing market in North America. Digital platforms and apps have streamlined the leasing process, making it easier for customers to compare options, apply for leases, and manage their contracts online. Additionally, the rise of electric vehicles (EVs) is bolstering the leasing market as more consumers and companies explore EVs without the long-term commitment of ownership, given the rapid pace of advancements in battery technology and infrastructure.

Additionally, the increasing adoption of mobility-as-a-service (MaaS) solutions and car subscription models is further driving growth, providing consumers and businesses with greater flexibility, convenience, and access to modern vehicles without the responsibility of ownership.

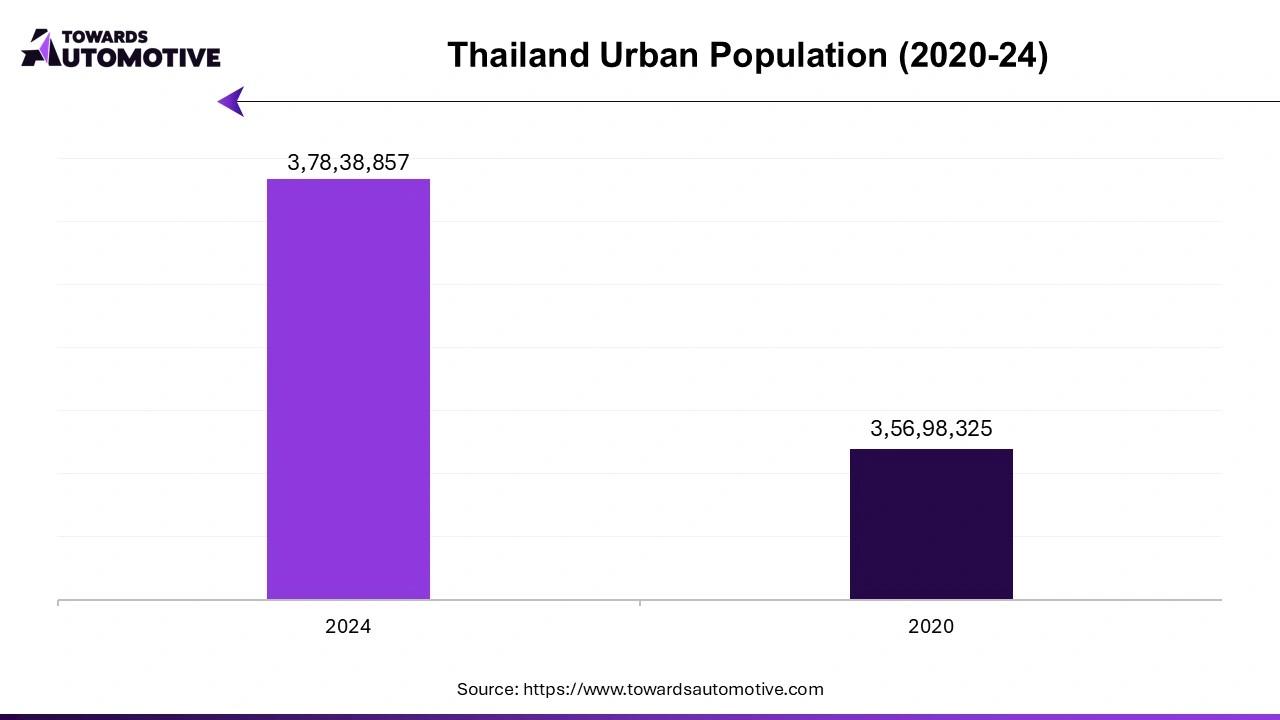

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The car leasing market in the Asia-Pacific (APAC) region is experiencing significant growth due to several key factors, including rising urbanization, the growing demand for flexible mobility solutions, and increasing corporate adoption of leasing options. One of the primary growth drivers is the rapid urbanization in countries like China, India, and Southeast Asian nations, which is fueling demand for vehicles to meet the transportation needs of expanding urban populations. Car leasing offers an attractive solution, especially in congested cities where ownership may be less practical due to limited parking spaces and high maintenance costs.

The increasing demand for cost-effective mobility solutions is also a major factor contributing to the growth of the leasing market in APAC. Consumers and businesses are increasingly recognizing the financial advantages of leasing compared to traditional vehicle ownership. Leasing provides access to newer vehicles with lower upfront costs, making it an appealing option for those looking to avoid large capital expenditures. Additionally, leasing offers the flexibility to upgrade to newer models more frequently, which is particularly attractive in a region where technological advancements in vehicle safety, efficiency, and connectivity are rapidly evolving.

Corporate adoption of car leasing is another key driver in the region, especially for businesses in the logistics, ride-sharing, and corporate fleet sectors. Leasing allows companies to manage large vehicle fleets more efficiently by reducing maintenance costs and depreciation risks, while offering tax benefits. This trend is especially prevalent in countries like Japan and South Korea, where businesses are increasingly opting for leasing solutions to meet their mobility and fleet management needs.

Furthermore, the growing popularity of electric vehicles (EVs) is also playing a role in driving the leasing market in APAC. As governments in the region introduce policies and incentives to promote EV adoption, leasing provides an accessible entry point for consumers and businesses to explore electric mobility without the long-term commitment of ownership. This aligns with the region’s push toward greener and more sustainable transportation options.

By Application

By Lease Type

By Region

April 2025

March 2025

February 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us