February 2025

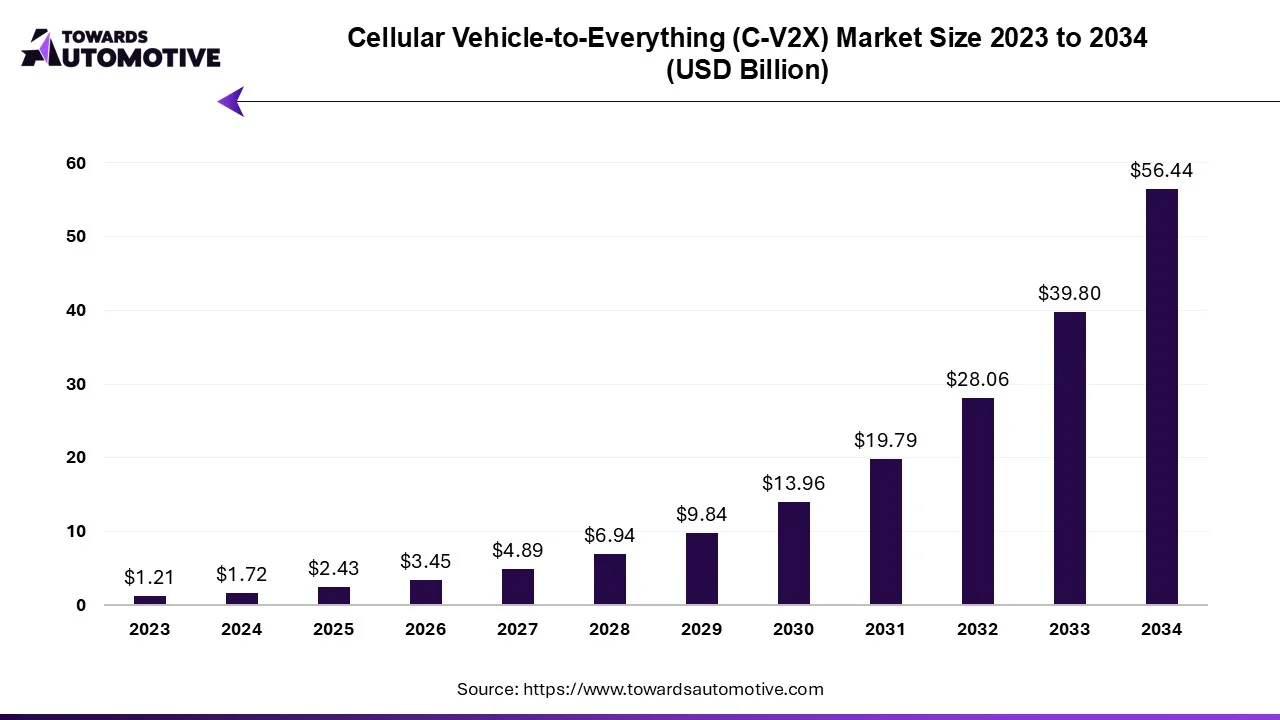

The cellular vehicle-to-everything (C-V2X) market is forecasted to expand from USD 2.43 billion in 2025 to USD 56.44 billion by 2034, growing at a CAGR of 41.81% from 2025 to 2034.

The cellular vehicle-to-everything (C-V2X) technology serves as a comprehensive connectivity solution aimed at providing vehicles with seamless vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-pedestrian (V2P) communication capabilities. By interconnecting individual vehicles, C-V2X holds the promise of revolutionizing the delivery of information and safety services both on highways and within urban areas, thereby elevating the overall travel experience.

The C-V2X market has been gaining momentum due to the increasing demand for connected and autonomous vehicles (CAVs) and the need for advanced driver assistance systems (ADAS). It utilizes cellular networks such as 4G LTE and upcoming 5G networks to enable high-speed, low-latency communication between vehicles and their surroundings.

The rise in the number of road accidents is likely to contribute to the growth of the market for safety technologies such as cellular vehicle-to-everything (C-V2X). According to World Health Organization, annually, about 1.19 million individuals lose their lives due to road traffic accidents; while an additional 20 to 50 million sustain non-fatal injuries, often resulting in disabilities. If the frequency of road accidents increases, there is a sharp awareness among governments, regulatory bodies, automotive manufacturers, and consumers regarding the need for advanced safety solutions. This increased focus on road safety drives investment and innovation in technologies like C-V2X, which offer real-time communication and collision avoidance capabilities.

C-V2X facilitates instantaneous exchange of information between vehicles, notifying drivers about potential collisions or hazards. For example, if a vehicle abruptly decelerates or a pedestrian crosses the road unexpectedly, C-V2X can issue alerts to nearby vehicles, enabling them to take pro-active action and mitigate the risk of accidents. Furthermore, through C-V2X, vehicles can communicate with traffic signals and other infrastructure at intersections, optimizing traffic flow and minimizing congestion. This technology fosters improved coordination among vehicles, ensuring safer traversal through intersections and reducing the probability of collisions.

Setting up new infrastructure entails significant upfront costs, including land acquisition, construction materials, labor expenses, and equipment procurement. These initial investments represent a considerable portion of the total deployment cost and can pose financial challenges for project sponsors and stakeholders. As highlighted by the U.S. Department of Transportation (DOT). Estimates suggest that the average cost ranges from $6,000 to $7,000 per intersection, encompassing expenses such as intersection mapping, procurement of Road side Units (RSUs), and their installation in the field.

Furthermore, on-board hardware costs pose another financial challenge, particularly for Original Equipment Manufacturers (OEMs). Currently, OEMs bear the burden of covering the expenses for the On-board Unit (OBU). However, they encounter a dilemma the limited adoption of Vehicle-to-Vehicle (V2V) applications hampers the realization of benefits. Consequently, consumers exhibit reluctance to pay for C-V2X functionalities. If OEMs fail to generate profits, they may reduce investment in C-V2X, impeding its development progress.

Moreover, there are additional costs associated with vehicle hardware. According to ITS America, integrating C-V2X within an existing telematics control unit incurs costs ranging from $160 to $170 per vehicle for the On-board Unit (OBU). These financial challenges may deter investment in new infrastructure projects, limit the scope of development initiatives, and impede progress in addressing critical infrastructure needs.

Governments are recognizing the importance of fostering innovation and technological advancement to drive economic growth and address societal challenges. As a result, they are allocating more resources towards research and development (R&D) initiatives, infrastructure projects, and incentive programs to support industries such as automotive, telecommunications, and transportation. Similarly, manufacturers are ramping up their investment in R&D, product development, and market expansion strategies to stay competitive and meet evolving consumer demands.

For instance,

This increased investment from government and manufacturers can lead to the creation of more advanced on-board units (OBUs), roadside units (RSUs), and communication protocols. This can result in improved performance, reliability, and interoperability of C-V2X systems, enhancing their appeal to consumers and driving the market adoption in future.

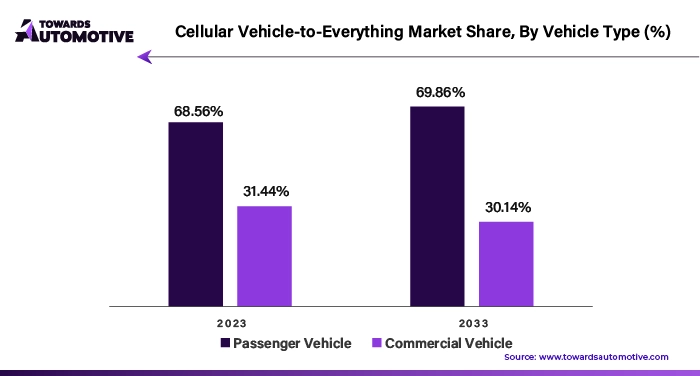

The passenger car segment captured a substantial market share of 68.56% in 2023. The passenger vehicles represent the largest segment of the automotive market globally, with a substantial consumer base and diverse vehicle types ranging from sedans to SUVs and electric vehicles. This widespread adoption of passenger vehicles translates into a larger addressable market for C-V2X technology. Additionally, there is a growing emphasis on safety, convenience, and connectivity features in passenger vehicles, fueled by increasing consumer demand for advanced driver assistance systems (ADAS) and infotainment solutions.

The collision avoidance segment dominated the market with share of 33.94% in 2023. The advancements in automotive safety technologies and regulatory mandates aimed at reducing road accidents have propelled the demand for collision avoidance systems. These systems leverage C-V2X technology to enable real-time communication between vehicles, allowing them to exchange critical information about speed, direction, and proximity. For instance, in congested urban areas or high-speed highways, collision avoidance systems can alert drivers about potential hazards such as sudden braking, lane changes, or pedestrian crossings, thereby mitigating the risk of accidents.

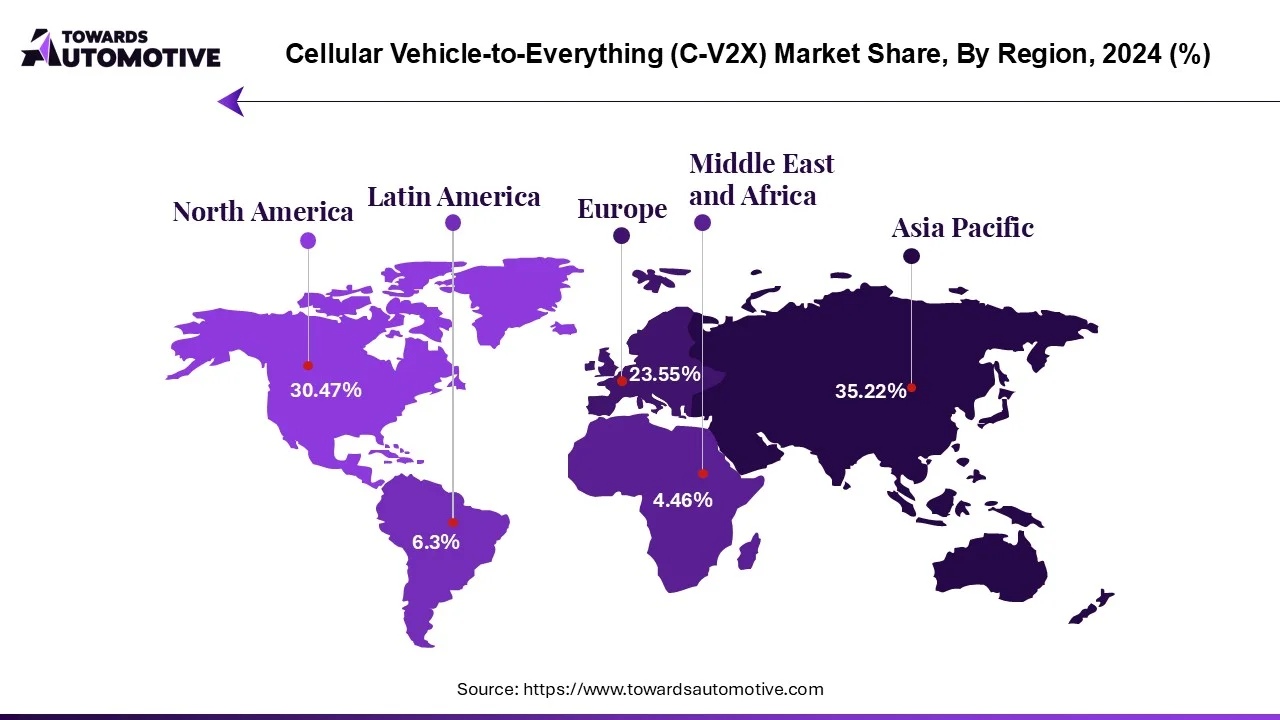

North America is likely to grow at a considerable CAGR of 41.99% during the forecast period. C-V2X is seeing increased adoption in the United States owing to the increasing number of trials taking place in the economy.

For instance,

The trials' objective, as articulated, is to exhibit the capabilities of C-V2X technologies, encompassing support for enhanced automotive safety, automated driving, and traffic efficiency. Additionally, the trials are expected to explore advanced vehicle communication functionalities, including real-time mapping updates and event notifications, facilitated through AT&T's cellular network and Nokia Cloud infrastructure.

Asia Pacific held significant share of 35.22% in 2023 in the cellular vehicle-to-everything market. The Chinese government and the transportation ecosystem, comprising over 100 automotive and technology firms participating in China's 2020 C-V2X cross-industry and large-scale pilot plugfest, are leading the charge in advancing C-V2X technology and laying the groundwork for global deployments. A widespread deployment is projected in China by 2025, with C-V2X scheduled to be integrated into half of all new vehicles.

For instance,

Certain European countries are also positioned at the forefront of adopting this technology. In February 2017, Orange and PSA Group announced the successful conclusion of initial C-V2X field trials in France. These trials delved into two specific use cases "see through" communication between two connected vehicles on a road and "emergency vehicle approaching."

Similar trials are also underway in Germany, where Audi, Ericsson, Qualcomm, SWARCO Traffic Systems, and the University of Kaiserslautern collaborated to establish the ConVeX (Connected Vehicle to Everything of Tomorrow) initiative. Co-funded by the participating entities and the German Federal Ministry of Transportation and Digital Infrastructure, ConVeX has integrated C-V2X direct communications, utilizing the 5.9GHz ITS spectrum, into an Ericsson 5G test network spanning highways, roads, and urban areas in Germany.

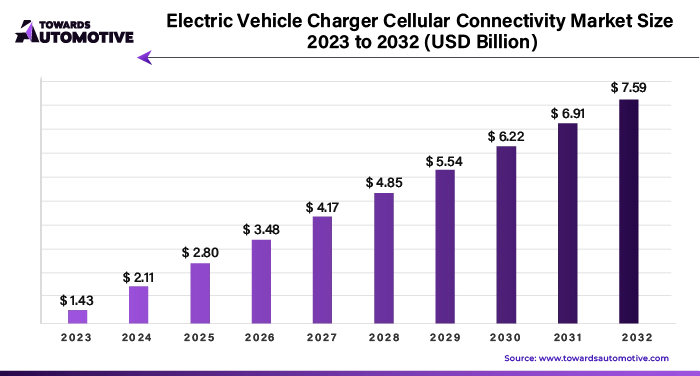

The electric vehicle (EV) charger cellular connectivity market is forecasted to expand from USD 2.07 billion in 2025 to USD 11.00 billion by 2034, growing at a CAGR of 20.38% from 2025 to 2034.

The electric vehicle (EV) charger cellular connectivity market is experiencing remarkable growth, driven by the global transition towards electric mobility, advancements in connectivity technologies, and the increasing demand for efficient charging infrastructure.

EV charger cellular connectivity plays a crucial role in enabling convenient, reliable, and intelligent charging solutions for electric vehicles, facilitating remote monitoring, data analytics, and energy management capabilities. Cellular connectivity allows EV chargers to communicate with central management systems, cloud platforms, and mobile applications, providing real-time status updates, billing information, and remote access for EV drivers, operators, and grid operators. By leveraging cellular networks, EV chargers offer enhanced interoperability, scalability, and efficiency, supporting the transition towards electric mobility and sustainable transportation solutions.

Some of the key players in cellular vehicle-to-everything market are Qualcomm Technologies, Inc., Continental AG, Technologies, Nokia Corporation, Huawei Technologies Co., Ltd., Infineon Technologies AG, Quectel Wireless Solutions Co., Ltd., Intel Corporation, Keysight Rohde & Schwarz GmbH & Co. KG, NTT DOCOMO, Inc., Savari, Inc., Shenzhen Genvict Technologies Co., Ltd., and ZTE Corporation, among others.

By Component

By Communication Type

By Vehicle Type

By Application

By Region

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us