April 2025

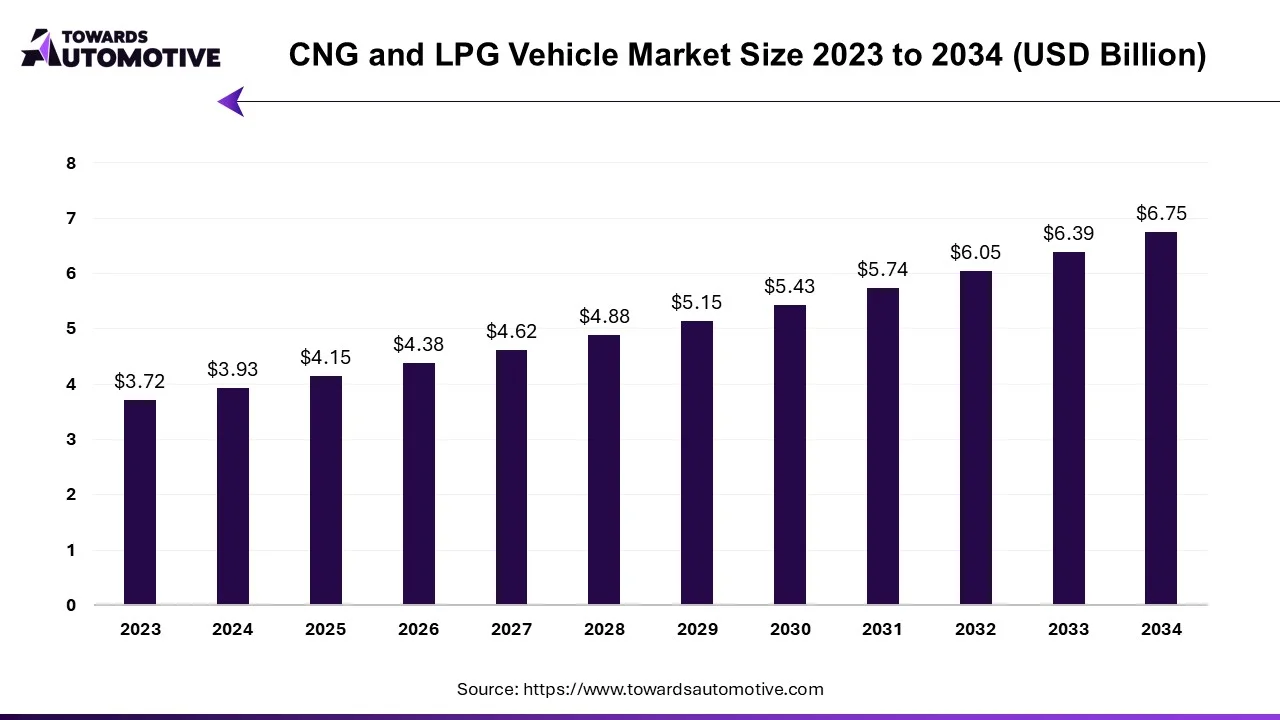

The CNG and LPG vehicle market is expected to grow from USD 4.15 billion in 2025 to USD 6.75 billion by 2034, with a CAGR of 4.93% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The CNG and LPG vehicle industry experienced setbacks due to production disruptions, shutdowns, and business restrictions during the COVID-19 pandemic. This was compounded by low automobile production and labor shortages, significantly impacting the market. However, the latter half of 2020 saw automakers resuming operations as vehicle sales picked up in countries less affected by COVID-19, leading to market growth in the latter part of the year, a trend expected to continue into 2021.

Moreover, stringent emission regulations, escalating fuel prices, and heightened consumer awareness are driving demand for alternative gas vehicles. Notably, CNG vehicle sales in India surged from 41,572 units in 2020 to 163,696 units in 2021.

Increasing global warming concerns have sparked protests against gasoline and diesel usage, prompting stricter emission standards in certain regions. This has necessitated significant investments to bring vehicles up to standard, leading to financial strain for diesel generators, key drivers of the CNG and LPG vehicle market.

Rising fuel prices further bolster the growth of the CNG and LPG vehicle market. For instance, as economies gradually reopen and recover, oil prices saw a 12% increase in 2021 compared to 2020, according to the International Monetary Fund, driven by energy demand amid ongoing epidemic conditions.

In the long term, the growth of CNG and LPG vehicles can be attributed to increased fuel efficiency, cost-effectiveness, and emission control measures in the automotive industry. Rapid adoption of CNG and LPG vehicles is witnessed in developing countries due to soaring petroleum prices and relatively lower CNG and LPG costs. Additionally, these vehicles are considered environmentally friendly alternatives to traditional gasoline-powered vehicles.

The expansion of CNG buses for public transportation in developing economies, along with government initiatives in countries like India, Mexico, Africa, and Brazil to bolster public transport and reduce crude oil imports, further propels market growth. For example, in March 2022, China's Anhui Ankai Automobile Co., Ltd., exported 800 CNG buses to Mexico as part of the Silk Road initiative to enhance public transport in Monterrey, Mexico.

Major players are also introducing new products to capitalize on market opportunities. For instance, in November 2022, Toyota Kirloskar Motor Pvt., a subsidiary of Toyota Motor Corporation, launched the CNG version of the premium hatchback Toyota Glanza in India. Similarly, Iveco, the commercial vehicle division of CNH Industrial, a subsidiary of Stellantis N.V., introduced CNG versions of its S-WAY and Tector trucks in Brazil, set for release by the end of 2023.

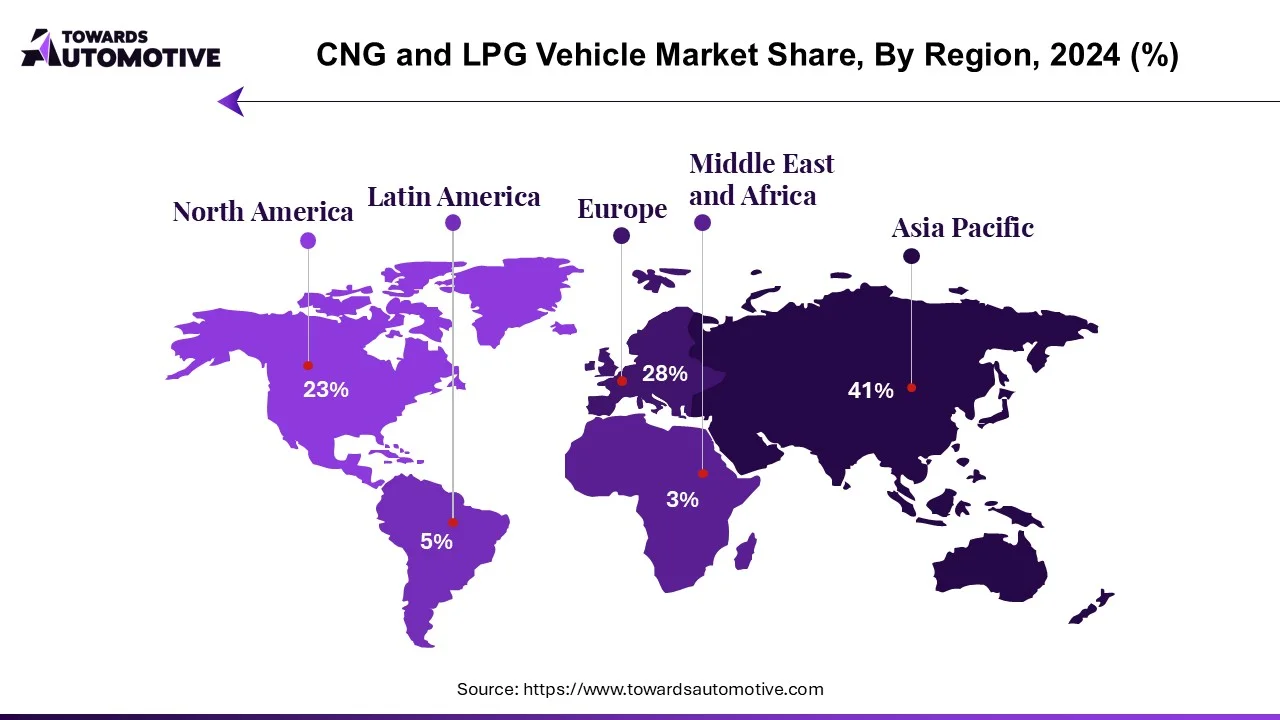

Despite slow economic growth in China, the world's largest automobile market, the Asia-Pacific region is expected to witness growth in the CNG and LPG automobile market during the forecast period. Hence, the convergence of the aforementioned factors is projected to significantly drive global CNG and LPG vehicle market growth in the coming years.

The United Nations Committee on Climate Change reports that transportation contributes to 25% of all greenhouse gas (GHG) emissions, making it a primary driver of global warming and climate change. To combat air pollution and safeguard public health, countries worldwide are enacting stricter traffic standards, prioritizing cleaner roads.

In 2014, the European Union implemented Euro 6 standards, which levy taxes on vehicles based on their emissions standards and carbon emissions per capita. Compliance with stringent Euro 6 standards has raised the cost of diesel vehicles due to the need for exhaust gas recirculation and particulate filtration systems. Consequently, replacing old fleets with new diesel vehicles has become financially burdensome for fleet owners. As a result, many public transport operators and trucking companies are turning to CNG/LNG-powered vehicles as a more affordable and environmentally friendly alternative. This shift has significantly contributed to the growth of CNG/LNG vehicle sales in Europe. For example, Iveco secured an order to supply 1,064 CNG-powered S-WAY trucks to Amazon in Europe in November 2021.

CNG vehicles utilize methane as their primary combustion fuel, which is the cleanest hydrocarbon found in nature. Unlike gasoline vehicles, CNG vehicles do not emit unburned or partially burned carbon monoxide, resulting in water vapor as the end product in CNG vehicle exhaust.

While electric vehicles (EVs) offer a nearly pollution-free solution, they are often more expensive to purchase than CNG vehicles and face various challenges, including limited financing options, hindering their sales potential in developing countries like India. Consequently, many car owners in these regions prefer CNG cars over electric ones.

Despite the advantages of gasoline vehicles and government incentives promoting electric vehicle adoption, the CNG and LPG vehicle market continues to expand globally. For instance, in November 2022, the cost of 1 kg of CNG in New Delhi was INR 78.61 (94 US cents) per liter, while gasoline and diesel cost INR 96.72 (US$ 1.16) and INR 96.67 (US$ 1.16) per liter, respectively. The significant price difference between CNG and gasoline/diesel, coupled with the higher mileage of CNG vehicles compared to gasoline/diesel vehicles, has nearly doubled CNG vehicle sales in India in recent years.

Many governments are also taking proactive measures to expand their national CNG filling station networks, further fueling the growth of CNG vehicle sales in these countries. Consequently, the combination of these factors is expected to drive the global CNG and LPG vehicle market over the next five years.

The Asia Pacific region is anticipated to emerge as the world's largest CNG and LPG vehicle market, primarily driven by India. India is poised to lead global CNG vehicle adoption due to factors such as high gasoline and LPG prices, stringent diesel vehicle standards, and widespread use of CNG in buses, taxis, and auto rickshaws. Additionally, the availability of numerous CNG/LPG conversion kits and the costliness of replacing old gasoline and diesel vehicles with CNG/LPG alternatives contribute to this trend, as does the limited popularity of electric vehicles.

Regulatory bodies across India are actively developing infrastructure to support electric vehicle growth. For instance, in July 2022, the Indian government inaugurated 166 new CNG stations across 14 states and announced plans to establish 3,500 CNG stations nationwide within the next two years. These initiatives are expected to sustain India's dominance in the CNG and LPG vehicle market throughout the forecast period.

Europe and North America are projected to follow Asia Pacific as the second-largest markets due to factors such as relatively lower fuel prices and stringent energy consumption standards.

The CNG and LPG vehicle market is characterized by fragmentation and is dominated by various international and local players. Key players in this market include Hyundai Motor Co., Suzuki Motor Corp., Nissan Motor Co., Ltd., Volkswagen AG, and Honda Motor Co. These major companies are continuously introducing new products and forging partnerships to expand their business operations.

For instance,

CNG vehicles utilize compressed natural gas (CNG) as a propulsion source. Unlike gasoline-powered vehicles, where energy is derived from burning methane and oxygen, CNG vehicles produce carbon dioxide and water vapor as byproducts.

In a CNG fuel system, pressurized fuel is delivered from the tank through fuel lines to the regulator, which reduces the pressure to a level compatible with the engine's fuel injection. The fuel is then introduced into the engine's electronic system, where it mixes with air, undergoes compression, and is ignited by a spark.

CNG vehicles are equipped with CNG tanks to store the gas, along with controls, pressure pipes, fittings, pressure gauges, hoses, and clamps. The fuel is transmitted to the engine through CNG-specific equipment.

Moreover, CNG vehicles feature two driving modes, allowing drivers to switch between petrol/diesel and CNG mode using a button, offering flexibility in fuel usage.

By Fuel Type

By Vehicle Type

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us