February 2025

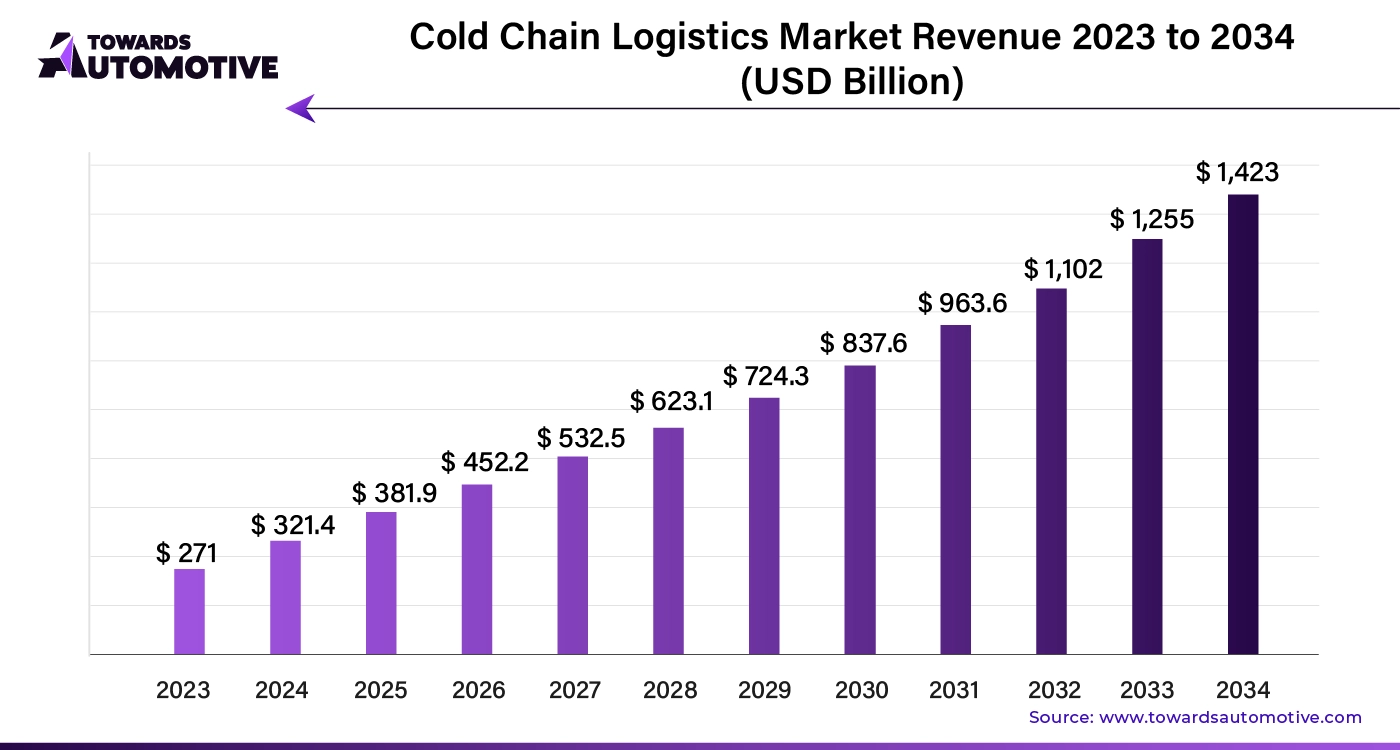

The global cold chain logistics market size is calculated at USD 321.4 billion in 2024 and is expected to be worth USD 1,423 billion by 2034, expanding at a CAGR of 18.95% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The cold chain logistics market is a crucial segment within the global supply chain, focusing on the transportation and storage of temperature-sensitive products that require strict control of temperature and humidity throughout the supply chain. This market encompasses a range of industries, including pharmaceuticals, food and beverages, chemicals, and biotechnology, where maintaining specific environmental conditions is essential to preserving the quality and safety of products. As global trade and consumer demand for perishable goods increase, the cold chain logistics market is experiencing significant growth, driven by advancements in technology, regulatory requirements, and evolving consumer expectations.

The expansion of the cold chain logistics market is propelled by several factors. The rise in e-commerce and online grocery shopping has heightened the need for efficient and reliable cold chain solutions to ensure timely delivery of fresh and frozen products. Additionally, the pharmaceutical industry's growth, particularly in the distribution of vaccines and biologics, demands highly controlled environments to maintain product efficacy. Technological innovations, such as IoT-based temperature monitoring systems, automated warehousing solutions, and advanced refrigeration technologies, are enhancing the efficiency and accuracy of cold chain operations.

Regulatory compliance, including stringent food safety standards and pharmaceutical guidelines, further drives the market, as companies must adhere to rigorous temperature control measures to avoid costly penalties and ensure product safety. The cold chain logistics market is also supported by increasing investments in infrastructure, including temperature-controlled warehouses, refrigerated transport fleets, and advanced tracking systems, which collectively enhance the reliability and scalability of cold chain solutions.

Overall, the cold chain logistics market is evolving rapidly, with technological advancements and regulatory demands shaping its growth trajectory and driving the need for innovative and efficient temperature-controlled logistics solutions.

AI plays a transformative role in the cold chain logistics market by enhancing efficiency, accuracy, and decision-making throughout the supply chain. AI-powered systems enable real-time monitoring and predictive analytics, crucial for managing temperature-sensitive goods. Advanced sensors and IoT devices integrated with AI algorithms continuously track and analyze environmental conditions, ensuring that products remain within specified temperature ranges. This proactive approach helps prevent spoilage, reduce waste, and maintain product quality.

AI also optimizes route planning and fleet management by analyzing traffic patterns, weather conditions, and historical data to recommend the most efficient delivery routes. This reduces transit times and improves fuel efficiency, contributing to cost savings and environmental sustainability.

Moreover, AI-driven demand forecasting models predict fluctuations in product demand, allowing for better inventory management and reducing the risk of overstocking or stockouts. This leads to more efficient use of storage space and resources.

In warehouse management, AI automates inventory tracking, streamlines sorting processes, and enhances warehouse layout optimization, improving operational efficiency. Additionally, AI enhances decision-making through predictive maintenance, identifying potential equipment failures before they occur, thereby reducing downtime and maintenance costs.

Overall, AI integration in cold chain logistics streamlines operations, enhances product integrity, and drives cost efficiencies, supporting the growing demand for reliable and efficient temperature-controlled supply chains.

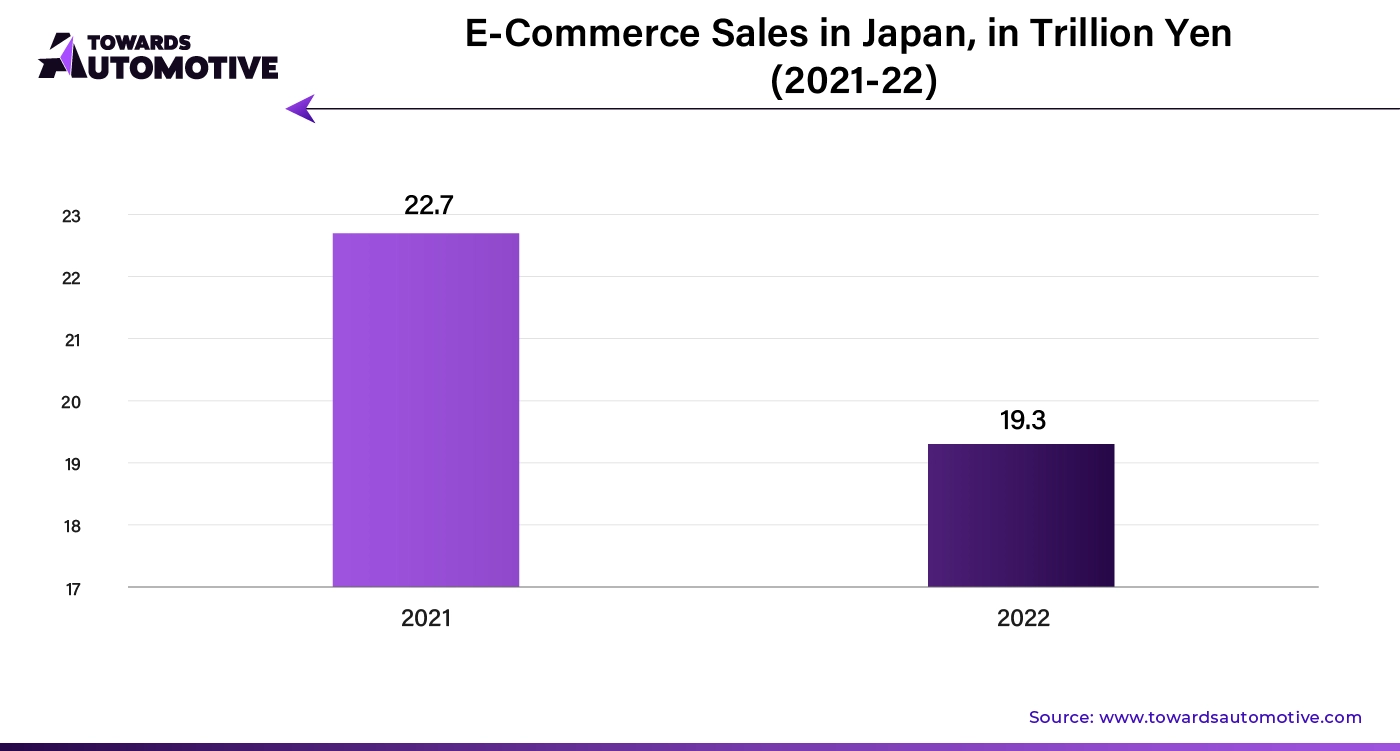

The rapid growth of e-commerce sales is significantly boosting the cold chain logistics market, driven by the increasing demand for online grocery shopping, pharmaceuticals, and other temperature-sensitive products. As consumers increasingly turn to online platforms for purchasing fresh and frozen goods, the need for efficient, reliable cold chain solutions becomes paramount. E-commerce retailers require robust cold chain logistics to ensure that perishable items, such as groceries and medications, are delivered in optimal condition, maintaining quality and safety from warehouse to doorstep.

The expansion of e-commerce has led to a surge in the volume of goods that need to be handled within temperature-controlled environments. This has spurred investments in advanced cold storage facilities, refrigerated transport fleets, and real-time monitoring systems to manage and maintain required temperatures throughout the supply chain. Companies are adopting sophisticated technologies, such as IoT sensors and AI-driven analytics, to enhance tracking and ensure compliance with stringent.

The cold chain logistics market faces several restraints, including high operational costs associated with temperature-controlled storage and transportation. Maintaining consistent temperature conditions requires significant investment in specialized equipment and energy, which can be prohibitive for smaller companies. Additionally, regulatory compliance with stringent food safety and pharmaceutical standards adds complexity and cost. Inefficiencies in infrastructure and supply chain disruptions can further impact reliability and increase costs. These challenges collectively constrain the market's growth and operational efficiency.

Predictive analytics is creating substantial opportunities in the cold chain logistics market by transforming how companies manage and optimize their temperature-sensitive supply chains. Leveraging data-driven insights, predictive analytics allows businesses to anticipate and address potential disruptions before they impact operations. By analyzing historical data, weather patterns, traffic conditions, and equipment performance, predictive analytics can forecast demand fluctuations, optimize inventory levels, and improve route planning, thereby enhancing overall efficiency and reducing costs.

One of the primary applications of predictive analytics in cold chain logistics is in optimizing temperature control. By forecasting potential temperature deviations and identifying patterns that might lead to equipment failures or supply chain disruptions, companies can take preemptive actions to maintain product quality and compliance with regulatory standards. This capability helps minimize spoilage, reduce waste, and ensure that perishable goods arrive at their destinations in optimal condition.

Additionally, predictive analytics enables better management of energy consumption and operational costs. By predicting peak demand periods and identifying inefficiencies, businesses can adjust their cooling systems and logistics operations to operate more efficiently, leading to significant cost savings and a reduced environmental footprint.

The integration of predictive analytics also enhances decision-making by providing actionable insights into supply chain performance. This enables companies to refine their strategies, improve service levels, and respond more effectively to market changes and consumer demands. As the cold chain logistics market continues to grow and evolve, predictive analytics will play a crucial role in driving innovation, optimizing operations, and creating competitive advantages for companies across the industry.

The storage segment dominated the market. The storage segment is a fundamental driver of growth in the cold chain logistics market, reflecting the critical role of temperature-controlled storage in managing perishable and sensitive products. As global demand for fresh and frozen goods rises, the need for sophisticated cold storage facilities becomes increasingly important. These facilities are essential for maintaining the integrity and safety of products such as pharmaceuticals, food items, and chemicals, which require precise temperature and humidity control to prevent spoilage and ensure quality.

The growth of e-commerce and online grocery shopping has further amplified the demand for advanced cold storage solutions. Retailers and distributors are investing in state-of-the-art refrigerated warehouses to accommodate high volumes of temperature-sensitive products and meet consumer expectations for fast, reliable delivery. This includes the development of high-capacity storage facilities equipped with the latest technologies in temperature monitoring and inventory management.

In the pharmaceutical sector, the demand for cold storage is driven by the distribution of vaccines, biologics, and other temperature-sensitive medical products. Regulatory requirements mandate strict temperature controls during storage to ensure product efficacy and safety, leading to increased investment in specialized storage solutions that meet these stringent standards.

Technological advancements, such as IoT-based monitoring systems and energy-efficient refrigeration, are enhancing the efficiency and effectiveness of cold storage facilities. These innovations enable real-time tracking of environmental conditions, predictive maintenance, and optimized energy use, contributing to lower operational costs and improved reliability.

Overall, the storage segment's expansion is a crucial factor driving growth in the Cold Chain Logistics Market, addressing the increasing need for secure, efficient, and compliant temperature-controlled storage solutions across various industries.

The (-18°C to -25°C) segment held the largest share of the market. The (-18°C to -25°C) segment is a key driver of growth in the cold chain logistics market, reflecting the increasing demand for storage and transportation solutions tailored to this specific temperature range. This temperature range is critical for preserving a wide array of perishable goods, including frozen foods, pharmaceuticals, and certain chemicals, which require consistent low temperatures to maintain their quality and safety. As consumer preferences shift towards frozen products and as the pharmaceutical industry expands, the need for effective cold chain solutions within this temperature range has grown significantly.

In the food industry, frozen foods such as meat, seafood, and ice cream require storage and transport at temperatures between -18°C and -25°C to ensure freshness and prevent spoilage. The rise in demand for convenience foods and the expansion of global food trade drive investments in refrigerated storage facilities and transport solutions designed to operate within this temperature range. Additionally, the growth of online grocery shopping and food delivery services has heightened the need for reliable cold chain logistics to handle frozen products efficiently.

The pharmaceutical sector also contributes to the growth of this segment. Vaccines, biologics, and other temperature-sensitive medical products often require storage at temperatures between -18°C and -25°C to ensure their efficacy and safety. Regulatory requirements for maintaining precise temperature conditions further drive the demand for specialized cold storage facilities and transportation solutions.

Technological advancements, such as energy-efficient refrigeration systems and real-time monitoring technologies, enhance the reliability and efficiency of cold chain operations within this temperature range, supporting the segment's expansion and meeting the growing needs of various industries.

The food & beverages segment held the dominant share of the market. The food and beverages segment is a significant driver of growth in the cold chain logistics market, reflecting the essential role of temperature-controlled logistics in maintaining the quality and safety of perishable products. As global demand for fresh, frozen, and processed food products continues to rise, the need for effective cold chain solutions has become increasingly critical. This segment encompasses a broad range of products, including fruits, vegetables, meat, dairy, seafood, and beverages, all of which require precise temperature control throughout the supply chain to prevent spoilage and extend shelf life.

The growth of the food and beverages segment is largely driven by changing consumer preferences, including an increased demand for convenience foods and online grocery shopping. Retailers and distributors are investing heavily in advanced cold storage facilities, refrigerated transport, and real-time monitoring systems to meet these demands and ensure timely delivery of fresh and frozen products. Innovations such as automated warehouses, high-efficiency refrigeration systems, and smart packaging are enhancing the efficiency and reliability of cold chain operations.

Additionally, the rise in global trade and the expansion of international food supply chains require robust cold chain logistics to handle diverse products and meet varying regulatory standards. The need to comply with food safety regulations and maintain product integrity throughout transportation and storage further fuels investment in cold chain infrastructure.

Technological advancements, including IoT-based tracking and AI-driven analytics, are also playing a crucial role in optimizing cold chain logistics for the food and beverages sector. These technologies improve operational efficiency, reduce waste, and ensure that products are delivered in optimal condition, driving the continued growth and evolution of the cold chain logistics market.

North America dominated the cold chain logistics market share by 35% in 2023. The cold chain logistics market in North America is driven by several key factors that are reshaping the industry. Firstly, the rapid growth of e-commerce and online grocery shopping has significantly increased the demand for efficient and reliable cold chain solutions. As consumers increasingly expect fresh and perishable goods delivered quickly, retailers and suppliers are investing in advanced cold chain infrastructure to ensure product quality and safety during transit.

The adoption of IoT-based monitoring systems, AI-driven analytics, and automation enhances the efficiency and accuracy of cold chain operations. These technologies enable real-time temperature tracking, predictive maintenance, and optimized route planning, leading to reduced operational costs and improved service levels.

Several government regulations and initiatives aimed at improving food safety and reducing waste contribute to the growth of the cold chain logistics market. Compliance with stringent regulations necessitates investment in state-of-the-art cold storage and transportation solutions, further fueling market expansion.

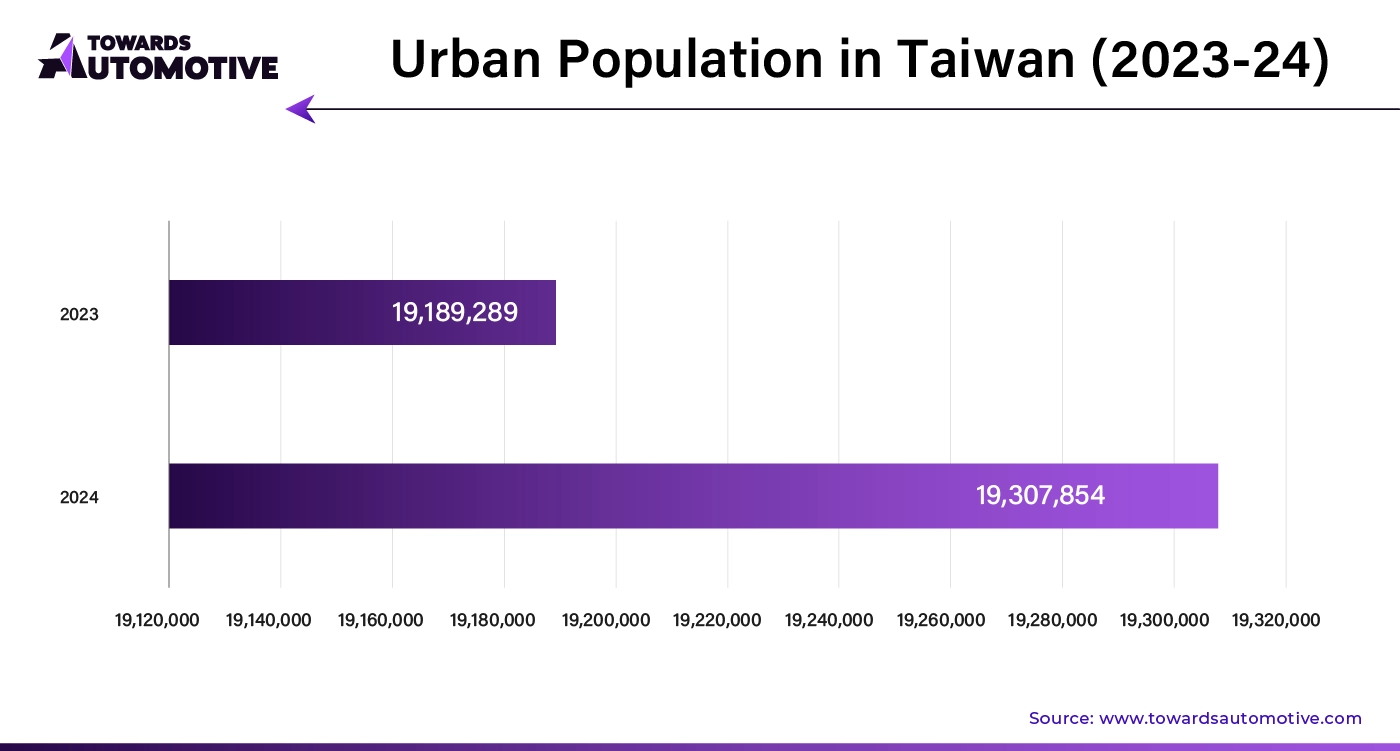

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The cold chain logistics market in Asia Pacific is experiencing robust growth driven by several dynamic factors. Firstly, the rapid urbanization and increasing disposable incomes in the region are fueling demand for fresh and high-quality perishable goods, such as fruits, vegetables, dairy products, and meat. The expansion of the middle class in countries such as China and India led to a surge in online grocery shopping and an increased focus on food safety, driving investments in efficient and reliable cold chain infrastructure.

The pharmaceutical industry in Asia Pacific is also a significant growth driver. The rising demand for vaccines, biologics, and other temperature-sensitive medical products necessitates stringent cold chain solutions to ensure product efficacy and regulatory compliance. This has led to increased investments in advanced cold storage facilities and temperature-controlled transportation networks.

Additionally, the focus on sustainability and energy efficiency is driving the adoption of eco-friendly refrigeration technologies and practices. As the region grapples with environmental challenges, the demand for green cold chain solutions is growing, contributing to the overall expansion of the cold chain logistics market in Asia Pacific.

By Type

By Temperature Range

By Application

By Region

February 2025

February 2025

February 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us