March 2025

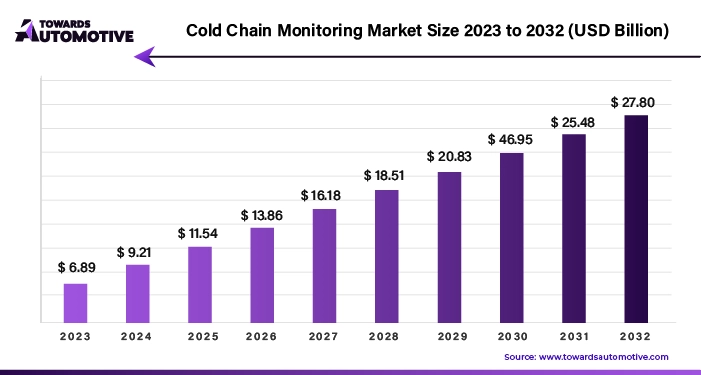

The cold chain monitoring market is forecasted to expand from USD 9.39 billion in 2025 to USD 37.92 billion by 2034, growing at a CAGR of 16.77% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

According to data from the Investment Authority of India, the pharmaceutical industry in India currently stands at a value of $50 billion. Projections indicate a substantial growth trajectory, with estimates suggesting a rise to $65 billion by 2024 and a further surge to $130 billion by 2030. This expansion is propelled by the increasing demands of both the pharmaceutical and food sectors, necessitating reliable and efficient cooling solutions to safeguard products from production to consumption.

The integration of Internet of Things (IoT) technology and advanced sensor technology has revolutionized the capabilities of wireless remote monitoring solutions. Through IoT-enabled devices and sensors, real-time monitoring, data collection, and analysis have vastly improved, enhancing the ability to detect and control fluctuations in temperature. For instance, in February 2023, Danfoss announced a collaborative venture with North American retailers to deploy Lizard Monitoring technology, aimed at reducing food loss across the region.

The Lizard sensor network seamlessly integrates with Danfoss' Alsense monitoring suite, enabling continuous temperature monitoring throughout the supply chain. Moreover, the healthcare sector has seen significant growth in the adoption of cold chain monitoring solutions, particularly concerning the transportation and storage of temperature-sensitive drugs, vaccines, and medical equipment.

These technological advancements play a pivotal role in preventing temperature excursions, minimizing waste, and enhancing overall product quality, thereby fueling the rapid expansion of the cold chain monitoring industry. However, it's essential to acknowledge that the initial investment and ongoing operational costs associated with implementing these cooling systems can be substantial. For many businesses, especially smaller entities with limited budgets, the cost implications may pose a significant barrier to adoption.

The retail air conditioning industry has been profoundly affected by the COVID-19 pandemic, primarily due to the heightened demand for dependable electronic control systems for both heating and cooling purposes. With the global distribution of vaccines and antiviral medications, there has been a surge in the requirement for sophisticated testing mechanisms to guarantee the safety of heat-sensitive products during their storage and transportation phases.

Moreover, the industry's emphasis on energy efficiency has served as a catalyst for innovation and expansion. This focus has accelerated the adoption of cold chain monitoring technology, which plays a crucial role in ensuring the integrity of temperature-sensitive goods throughout the supply chain. As a result, the retail air conditioning sector is witnessing significant growth driven by the urgent need for reliable temperature control solutions amidst the evolving landscape of health and safety concerns.

The incorporation of blockchain technology into cold chain monitoring systems is poised for growth. Blockchain offers enhanced traceability and accountability by providing immutable and transparent records of transactions and temperature data exchanged between devices. This model aligns with the critical need for transparency and reliability in the transportation and storage of temperature-sensitive goods.

Additionally, we anticipate an increased adoption of artificial intelligence (AI) and machine learning (ML) in influenza surveillance. These advanced technologies have the capability to analyze vast amounts of data from sensors and historical patterns to predict and preempt temperature fluctuations, thereby mitigating the risk of product spoilage. The synergy between AI and ML has the potential to optimize the performance of cooling systems by making informed decisions and fine-tuning the temperature control process for optimal efficiency.

On an equipment basis, the hardware market is projected to experience a Compound Annual Growth Rate (CAGR) of 11% over the forecast period. This growth is fueled by the increasing recognition of technology's vital role in safeguarding the integrity of heat-sensitive products. Hardware components such as sensors, RFID devices, network equipment, remote computing systems, and others facilitate comprehensive monitoring of the entire supply chain by providing real-time data on environmental conditions. As businesses prioritize quality, compliance, and assurance, there is a rising demand for sustainable solutions that enhance the reliability and efficiency of cold chain monitoring systems.

In terms of end-users, the refrigeration monitoring market within the food and beverage industry is anticipated to reach approximately $3 billion by 2022. This growth is driven by the pressing need to manage product quality, safety, and compliance effectively. Stringent regulations and heightened customer expectations necessitate stringent temperature control measures throughout the product lifecycle to prevent spoilage and ensure food safety. Cold chain monitoring systems offer rapid insights and intervention capabilities to mitigate temperature fluctuations. With the industry's increasing reliance on global sourcing and distribution, there is a critical need for inspection solutions and technological advancements that uphold the integrity of perishable goods and enhance overall equipment efficiency.

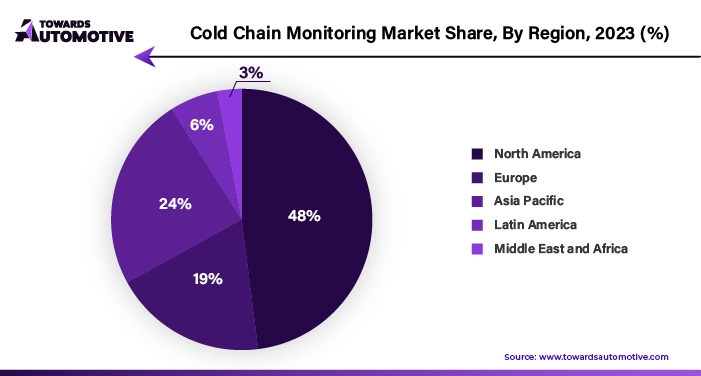

The North American cold chain inspection market is poised to capture 37% of the revenue share in 2022. Of particular interest within this market is the pharmaceutical industry, which significantly contributes to the overall cold chain sector. Notably, the stringent regulations set forth by the U.S. Food and Drug Administration (FDA) underscore the critical importance of maintaining precise temperature control during the transportation of pharmaceutical products. This emphasis on regulatory compliance has propelled the demand for advanced cold chain inspection solutions tailored to meet the specific needs of the pharmaceutical industry.

The increasing demand for fresh and frozen foods, coupled with the burgeoning e-commerce sector, is fueling the requirement for efficient cold delivery systems across North America. The proliferation of online grocery shopping and direct-to-consumer food delivery services has heightened the need for reliable cold chain logistics to ensure the quality and safety of perishable goods during transit.

The ongoing distribution efforts related to the COVID-19 vaccine have further highlighted the indispensable role of advanced testing and monitoring technologies within the healthcare sector throughout North America. As the region continues to navigate the complexities of vaccine distribution and storage, there is a growing imperative for robust cold chain inspection solutions capable of maintaining the integrity and efficacy of temperature-sensitive medical supplies.

North American cold chain inspection market is shaped by a convergence of factors, including stringent regulatory requirements, evolving consumer preferences, and the ongoing healthcare challenges posed by the COVID-19 pandemic. These dynamics underscore the critical importance of advanced testing and monitoring technologies in safeguarding the integrity of temperature-sensitive products across various industries within the region.

Major companies operating in the cold chain monitoring industry are:

Emerson Electric Company and Descartes Systems Group Inc. are key players in the cooling maintenance industry, leveraging various strategies to enhance their market presence and influence. Through initiatives such as technological collaborations, strategic acquisitions, and the introduction of innovative products, these companies have solidified their positions within the sector.

One of the focal points for both companies is the integration of Internet of Things (IoT) technology, which enables real-time data analysis and enhances the efficiency of cooling maintenance operations. By leveraging IoT-enabled solutions, Emerson Electric Company and Descartes Systems Group Inc. aim to optimize equipment performance, preemptively identify maintenance needs, and streamline operational workflows. This proactive approach to maintenance not only improves system reliability but also contributes to cost savings and enhanced customer satisfaction.

Furthermore, both companies recognize the value of collaboration with service providers to offer comprehensive solutions that meet the evolving needs of customers. By partnering with industry experts and leveraging their expertise, Emerson Electric Company and Descartes Systems Group Inc. can deliver tailored cooling maintenance services that address specific challenges and requirements across various sectors.

In an ever-changing economic landscape, characterized by technological advancements and shifting consumer demands, the ability to adapt and innovate is crucial for maintaining competitiveness. By embracing IoT integration, fostering strategic partnerships, and continuously investing in research and development, Emerson Electric Company and Descartes Systems Group Inc. are well-positioned to navigate the challenges and capitalize on the opportunities within the cooling maintenance industry. Through these efforts, they aim to drive operational efficiency, enhance profitability, and deliver value-added solutions to their customers.

In September 2023, ColdEX, a leading cold chain logistics company in India, announced the acquisition of a state-of-the-art cold storage facility in Mumbai from Frost Logistics. As part of the acquisition, ColdEX unveiled plans to upgrade the facility's infrastructure and implement advanced temperature monitoring systems to enhance operational efficiency and ensure product integrity.

In October 2023, Lineage Logistics Holdings, LLC, a global leader in temperature-controlled logistics solutions, completed the acquisition of a cold storage warehouse network in Spain from Frigotecnica Industrial, S.L. Lineage Logistics plans to modernize the acquired facilities, investing in automation and energy-efficient technologies to optimize storage capacity and improve service offerings to customers.

FreshLogistics, a prominent cold chain logistics provider in South Korea, announced in November 2023 its acquisition of a cold storage facility in Seoul from CoolTech Solutions. FreshLogistics intends to expand the capacity of the facility and implement advanced inventory management systems to meet the growing demand for temperature-controlled storage solutions in the region.

Nordic Cold Storage, a leading provider of cold storage and distribution services in Scandinavia, revealed in December 2023 its acquisition of a cold storage warehouse complex in Copenhagen, Denmark, from Frigidaire Logistics. Nordic Cold Storage plans to modernize the acquired facility, integrating cutting-edge refrigeration technology and automated storage systems to enhance operational efficiency and meet the evolving needs of customers.

ColdStar Logistics, a major player in the cold chain industry in India, announced in January 2024 its acquisition of a cold storage facility in Bangalore from FrostFree Solutions. ColdStar Logistics plans to invest in infrastructure upgrades and deploy advanced cold chain management software to optimize temperature monitoring and ensure seamless operations within the facility.

By Component

By Temperature Type

By Logistics

By End User

By Geography

March 2025

February 2025

September 2024

September 2024

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us