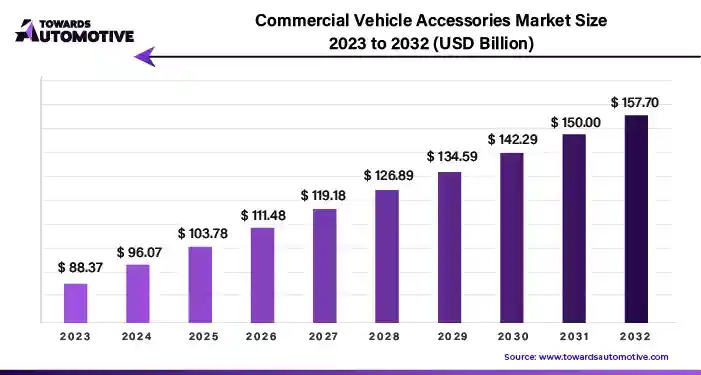

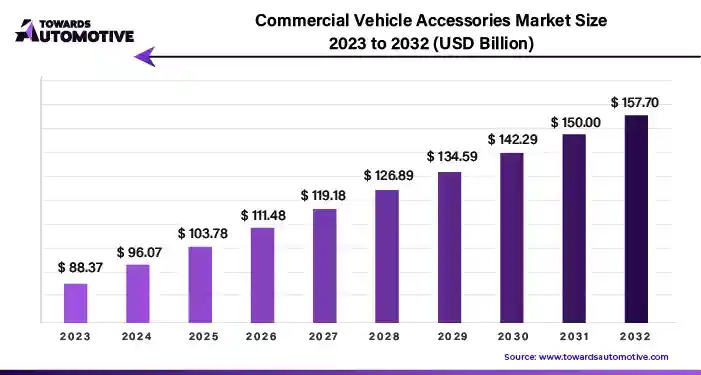

Commercial Vehicle Accessories Market Size and Growth Forecast

The commercial vehicle accessories market is projected to reach USD 179.42 billion by 2034, growing from USD 100.51 billion in 2025, at a CAGR of 6.65% during the forecast period from 2025 to 2034.

The commercial vehicle accessories market is witnessing robust growth, driven by the increasing demand for efficiency, safety, and customization in commercial fleets. With the rise of e-commerce, last-mile delivery, and logistics services, commercial vehicles play a vital role in supporting economic activities worldwide.

The commercial vehicle accessories market is poised for substantial growth, driven by the increasing demand for efficiency, safety, and customization in commercial fleets. With technological advancements, regulatory mandates, and evolving customer preferences shaping the market landscape, commercial vehicle accessory manufacturers and suppliers need to innovate, collaborate, and adapt to changing market dynamics to capitalize on emerging opportunities and maintain a competitive edge in the global marketplace.

The commercial vehicle accessories market is experiencing a period of transformation, driven by factors such as urbanization, digitalization, and sustainability initiatives. Commercial vehicle accessories encompass a wide range of products and solutions designed to enhance vehicle performance, functionality, and aesthetics. From safety equipment and cargo management systems to telematics solutions and aftermarket upgrades, commercial vehicle accessories cater to diverse needs and requirements across different industries.

Key Components and Functions of Commercial Vehicle Accessories

- Safety and Security Systems: Commercial vehicle safety accessories include advanced driver assistance systems (ADAS), collision avoidance technologies, and telematics solutions designed to enhance driver awareness, prevent accidents, and improve overall vehicle safety. These systems leverage sensors, cameras, and communication networks to provide real-time alerts, monitor driver behavior, and facilitate fleet management.

- Cargo Management Solutions: Cargo management accessories such as racks, shelves, and storage compartments optimize cargo space utilization, streamline loading and unloading processes, and improve operational efficiency in commercial vehicles. These solutions enable fleet operators to organize and secure cargo effectively, minimizing damage, loss, and theft during transit.

- Comfort and Convenience Features: Commercial vehicle accessories also include comfort and convenience features such as ergonomic seating, climate control systems, and entertainment systems designed to enhance driver comfort and productivity on long-haul journeys. These accessories contribute to driver satisfaction, reduce fatigue, and improve overall job satisfaction in the transportation industry.

- Customization and Branding Options: Customization accessories allow fleet operators to personalize their vehicles with company logos, branding graphics, and aesthetic enhancements that reflect their brand identity and corporate image. These accessories contribute to brand visibility, customer engagement, and brand loyalty, creating a distinct market presence for commercial vehicle operators.

Market Dynamics and Trends

- E-commerce Boom: The rapid growth of e-commerce and online retailing is driving demand for commercial vehicles equipped with advanced accessories such as refrigeration units, parcel delivery systems, and real-time tracking solutions. Commercial vehicle operators are investing in technology-enabled solutions to meet the growing demand for efficient and reliable last-mile delivery services, contributing to market growth.

- Regulatory Compliance: Stringent regulations and safety standards governing commercial vehicles are driving the adoption of safety and compliance accessories such as electronic logging devices (ELDs), tire pressure monitoring systems (TPMS), and rear-view cameras. Commercial vehicle operators are investing in regulatory-compliant solutions to ensure compliance with industry regulations and minimize the risk of fines and penalties.

- Electric Vehicle Integration: The transition towards electric commercial vehicles is reshaping the commercial vehicle accessories market, with a growing focus on electric propulsion systems, battery management solutions, and charging infrastructure. Commercial vehicle operators are investing in electric vehicle accessories to optimize vehicle performance, extend battery life, and enhance charging efficiency, supporting the electrification of transportation fleets.

- Data-Driven Insights: Telematics solutions and connected vehicle technologies are driving data-driven insights and predictive analytics in the commercial vehicle accessories market. Fleet operators are leveraging telematics data to optimize route planning, monitor vehicle health, and improve fuel efficiency, leading to cost savings, reduced downtime, and enhanced operational efficiency across fleets.

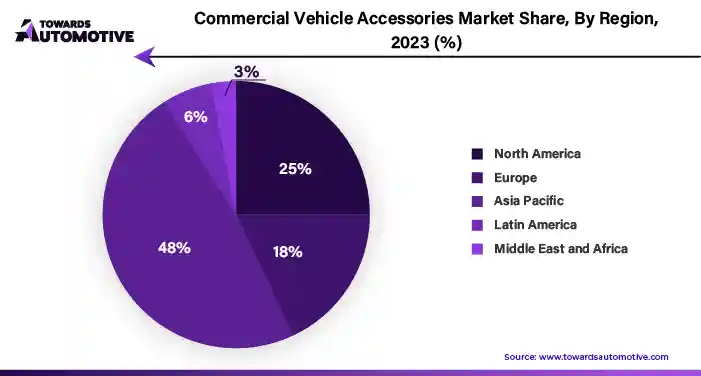

Global Trends and Market Outlook

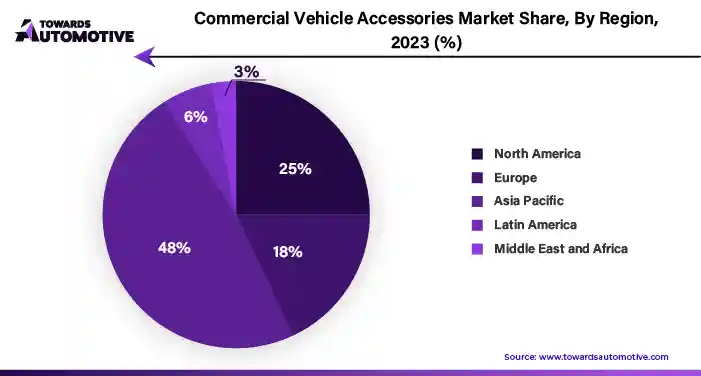

- Asia-Pacific Emerging as a Key Market: Asia-Pacific is witnessing significant growth in the commercial vehicle accessories market, driven by urbanization, infrastructure development, and rising demand for logistics and transportation services. Countries such as China, India, and Southeast Asian nations are investing in commercial vehicle accessories to support the expansion of e-commerce, manufacturing, and urban mobility solutions.

- North America and Europe Leading Innovation: North America and Europe remain at the forefront of innovation in the commercial vehicle accessories market, with a focus on safety, sustainability, and connectivity solutions. Cities such as New York, Los Angeles, London, and Paris serve as hubs for commercial vehicle innovation, with a growing emphasis on zero-emission vehicles, autonomous technologies, and smart logistics solutions.

Challenges and Opportunities

- Supply Chain Disruptions: Supply chain disruptions, including raw material shortages, logistics bottlenecks, and geopolitical uncertainties, pose challenges to commercial vehicle accessory manufacturers and suppliers. To mitigate risks and ensure business continuity, companies need to diversify their supplier base, optimize inventory management, and implement agile manufacturing strategies to adapt to changing market conditions.

- Technological Innovation: Technological innovation remains a key driver of growth and competitiveness in the commercial vehicle accessories market, with ongoing advancements in safety, connectivity, and sustainability solutions. Companies investing in research and development (R&D) to develop innovative accessories, enhance product performance, and meet evolving customer needs gain a competitive edge in the market, positioning themselves as industry leaders and innovators.

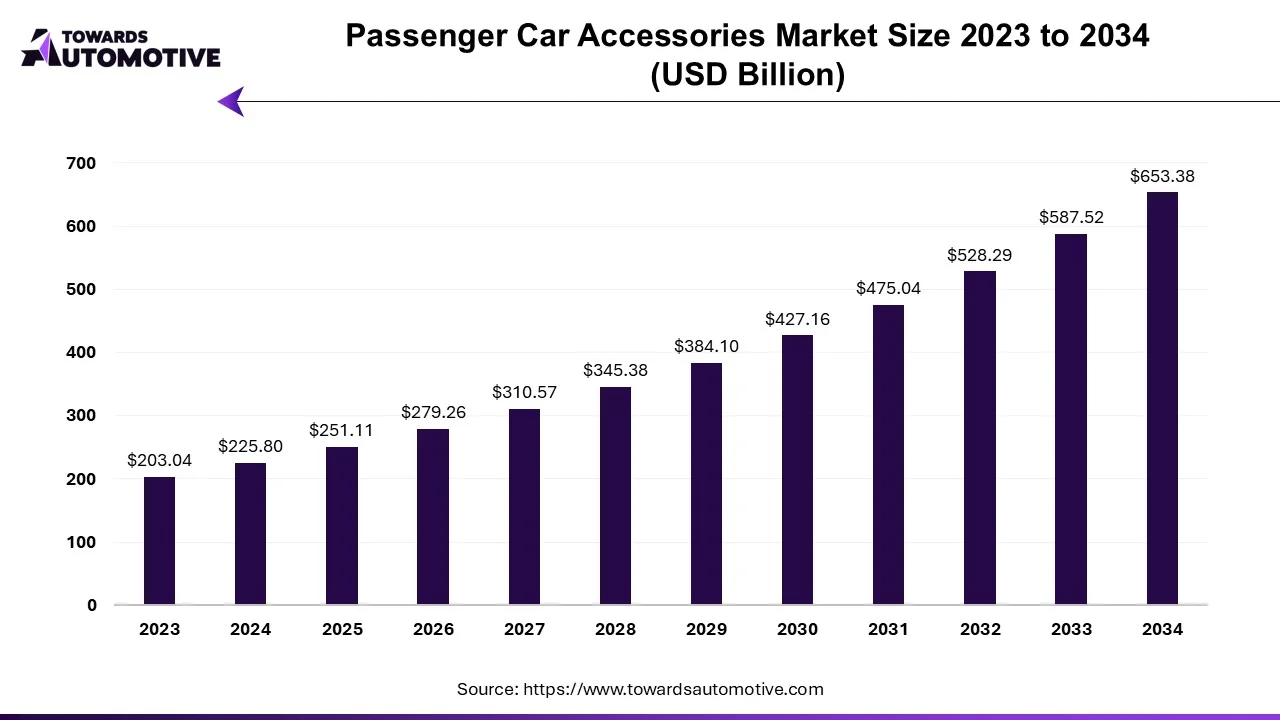

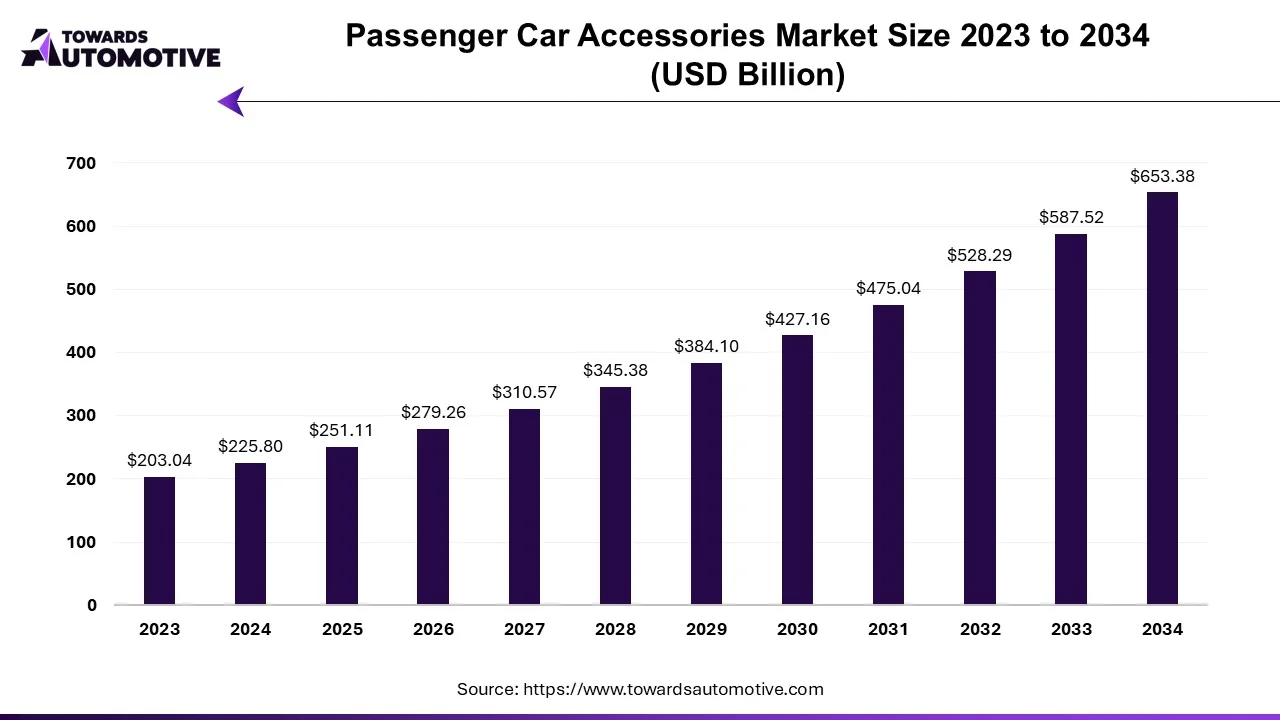

Future of Passenger Car Accessories Market

The passenger car accessories market is expected to grow from USD 251.11 billion in 2025 to USD 653.38 billion by 2034, with a CAGR of 11.21% throughout the forecast period from 2025 to 2034.

Key markets such as the US, China, and India have witnessed growth in auto sales, attributed to the economic recovery from Covid-19. For instance, in 2021, US light vehicle sales reached 14.9 million units, marking a 2.5% increase compared to 2020. Additionally, companies are implementing contingency plans and cost reduction measures to navigate through the uncertainties in the automobile industry.

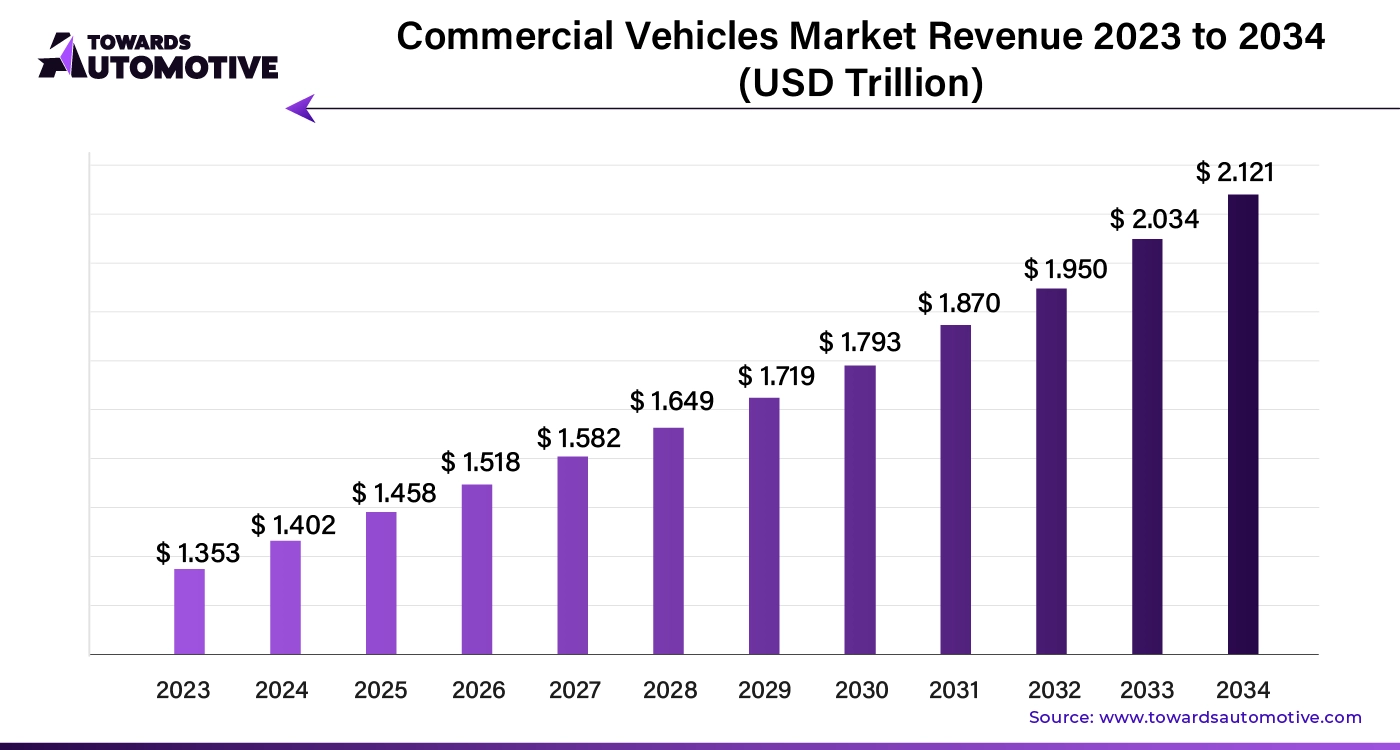

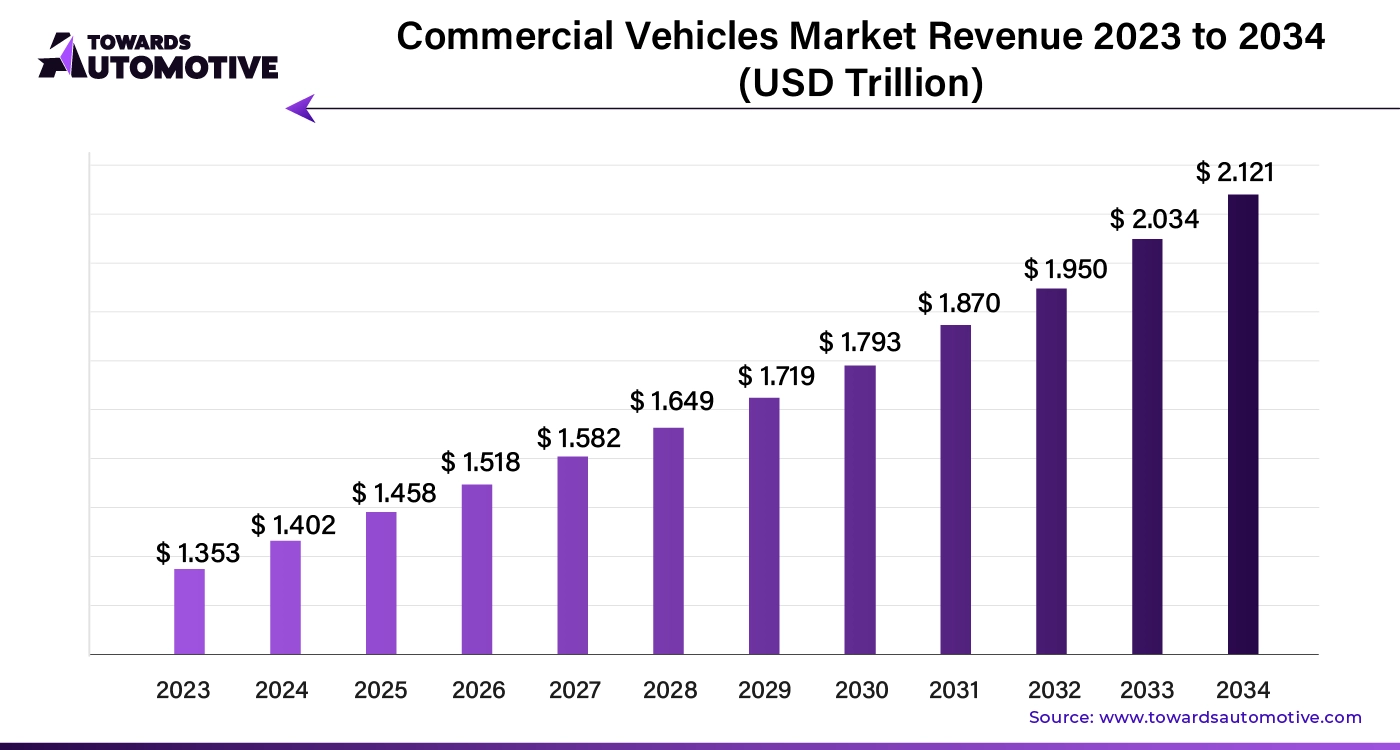

Future of Commercial Vehicles Market

The commercial vehicles market is expected to increase from USD 1.458 trillion in 2025 to USD 2.121 trillion by 2034, growing at a CAGR of 3.75% throughout the forecast period from 2025 to 2034. The growing focus of automotive companies on developing a wide range of commercial vehicles along with rapid adoption of electric trucks by e-commerce brands for operating their daily activities has driven the market expansion.

Additionally, the rising investment by automotive brands for opening new production facilities coupled with numerous government initiatives aimed at developing the public transportation infrastructure is playing a vital role in shaping the industrial landscape. The integration of ADAS and telematics solutions in commercial vehicles is expected to create various growth opportunities for the market players in the future.

The commercial vehicles market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of commercial vehicles in different parts of the world. There are several types of vehicles developed in this sector comprising of light commercial vehicles (LCVs), heavy trucks, buses & coaches and some others. It finds application in numerous end-use sectors consisting of industrial, mining and construction, logistics, passenger transportation, and some others. This market is expected to rise significantly with the growth of the EV industry around the globe.

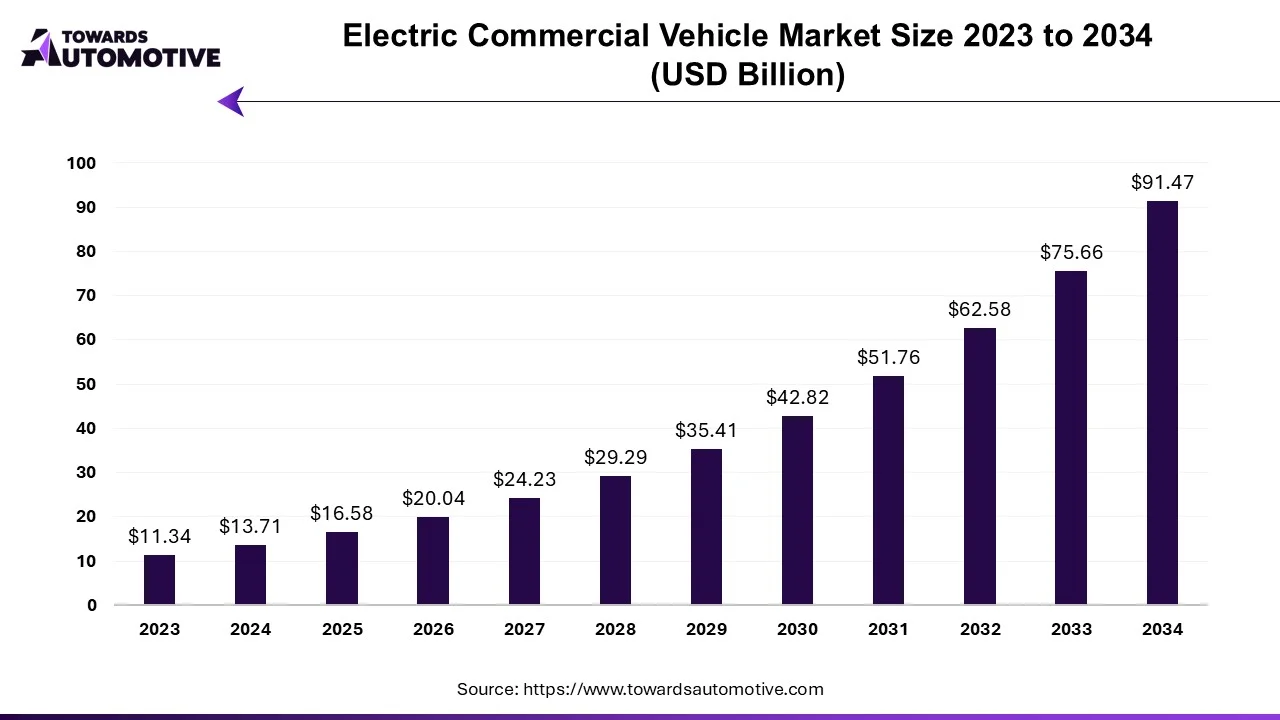

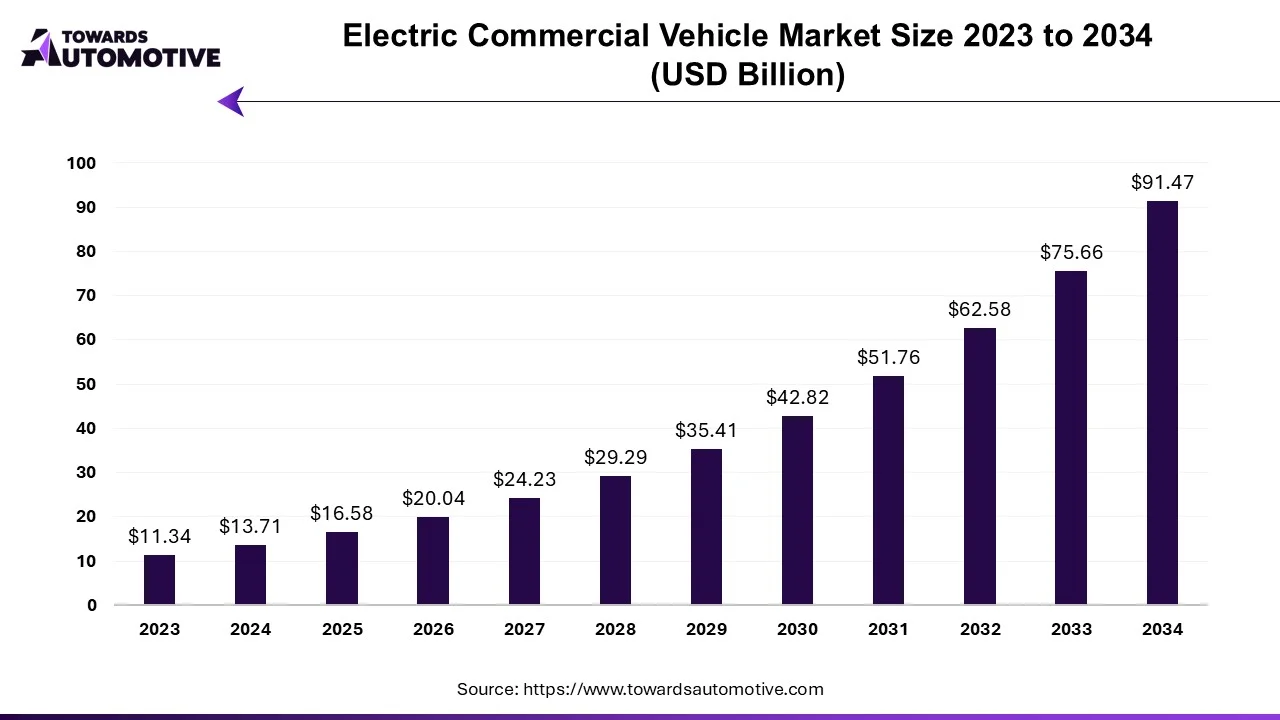

Future of Electric Commercial Vehicle Market

The electric commercial vehicle market is set to grow from USD 16.58 billion in 2025 to USD 91.47 billion by 2034, with an expected CAGR of 20.90% over the forecast period from 2025 to 2034.

The electric commercial vehicle market is a crucial sector of the automotive industry. This market deals in manufacturing and distribution of commercial vehicles that are powered by electricity. This industry manufactures various types of vehicles comprising of bus, trucks and some others. These commercial vehicles are available in different propulsion such as BEV, PHEV, FCEV. There are various components of these vehicles consisting of electric motor, electric vehicle battery, hydrogen fuel cell and some others. The growing demand for electric trucks in different parts of the world has fostered the market growth. This market is predicted to rise significantly with the growth of the EV sector around the world.

Key Players in the Commercial Vehicle Accessories Market

The commercial vehicle accessories market comprises a diverse ecosystem of manufacturers, suppliers, distributors, and technology providers.

Some of the prominent players in the market include:

- Thule Group

- WABCO Holdings Inc.

- Hella GmbH & Co. KGaA

- Stoneridge, Inc.

- AL-KO Vehicle Technology

- Yakima Products, Inc.

- ProGauge Technologies Ltd.

- Truck-Lite Co., LLC

- Magna International Inc.

- Webasto Group

Market Segmentation and Regional Outlook

By Product Type

- Safety and Security Systems

- Cargo Management Solutions

- Comfort and Convenience Features

- Customization and Branding Options

By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Medium Commercial Vehicles (MCVs)

- Heavy Commercial Vehicles (HCVs)

By End-Use Industry

- Logistics and Transportation

- Construction and Infrastructure

- Food and Beverage

- Retail and E-commerce

- Others

By Region

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle-East and Africa

Recent Developments in the Commercial Vehicle Accessories Market

- In December 2023, Thule Group introduced its latest range of cargo management solutions for commercial vehicles, featuring lightweight racks, adjustable shelving systems, and modular storage compartments. The new cargo management solutions optimize cargo space utilization, improve loading efficiency, and enhance operational flexibility for fleet operators in logistics and transportation sectors.

- In November 2023, WABCO Holdings Inc. unveiled its next-generation safety and security systems for commercial vehicles, including advanced driver assistance systems (ADAS), collision mitigation technologies, and tire pressure monitoring systems (TPMS). The new safety solutions leverage radar, lidar, and camera sensors to provide real-time alerts, enhance driver awareness, and prevent accidents in diverse operating conditions.

- In October 2023, Hella GmbH & Co. KGaA launched its innovative comfort and convenience features for commercial vehicles, including climate control systems, ergonomic seating solutions, and entertainment systems. The new comfort features improve driver comfort, reduce fatigue, and enhance overall job satisfaction, leading to increased productivity and retention rates in the transportation industry.

- In September 2023, Stoneridge, Inc. introduced its customizable branding options for commercial vehicles, offering fleet operators the ability to personalize their vehicles with company logos, branding graphics, and promotional messages. The new branding options enhance brand visibility, customer engagement, and market differentiation for commercial vehicle operators in competitive markets.

- In August 2023, AL-KO Vehicle Technology announced its collaboration with ProGauge Technologies Ltd. to develop integrated fuel management solutions for commercial vehicles. The new fuel management systems combine AL-KO's expertise in chassis technology with ProGauge's fuel monitoring technology to optimize fuel efficiency, reduce operating costs, and improve environmental sustainability in commercial fleets.