April 2025

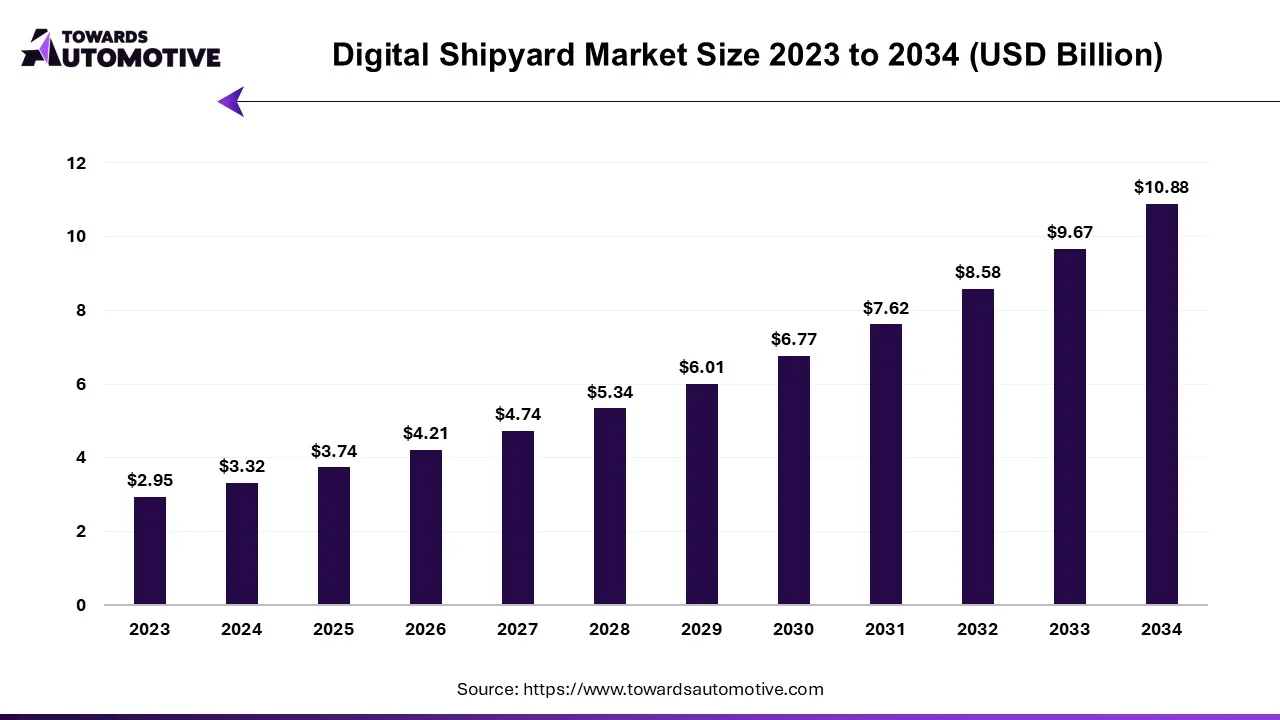

The digital shipyard market is expected to grow from USD 3.32 billion in 2024 to USD 10.88 billion by 2034, with a CAGR of 12.6% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The digital shipyard market is witnessing substantial growth as the maritime industry embraces technological advancements to improve efficiency, productivity, and safety. Digital shipyard refer to the integration of digital technologies, including automation, Artificial Intelligence (AI), Internet of Things (IoT), and data analytics, into the shipbuilding and repair processes. This transformation enables shipyards to streamline operations, reduce costs, enhance decision-making, ans are revolutionizing the way ships are designed, constructed, and maintained. Digital shipyard facilitate real-time monitoring, predictive maintenand provide better outcomes for customers. With a growing demand for more sophisticated and environmentally sustainable vessels, digital technologiece, and optimized resource management, all of which contribute to reduced operational downtime and improved project delivery times.

Additionally, the implementation of digital tools allows shipyards to collaborate more effectively with suppliers and partners, ensuring smoother communication throughout the shipbuilding process. This market is being driven by increasing demand for smarter, more efficient ships, rising labor costs, and the need to meet stricter environmental regulations. Furthermore, the growing focus on sustainability and reducing carbon emissions is pushing shipyards to adopt innovative, energy-efficient technologies. As shipbuilding becomes more complex and demands for quicker turnaround times intensify, digital shipyard offer a competitive edge, leading to their widespread adoption across the globe. The market's expansion is supported by increased investments in R&D, advanced manufacturing technologies, and smart automation, which are reshaping the future of the global shipbuilding industry.

AI plays a transformative role in the Digital shipyard market by enhancing operational efficiency, predictive capabilities, and decision-making processes within shipbuilding and maintenance. The integration of AI technologies enables shipyards to leverage advanced data analytics, machine learning, and automation for a wide range of applications.

One of the key roles of AI is in predictive maintenance, where machine learning algorithms analyze vast amounts of sensor data from machinery and equipment to predict potential failures before they occur. This helps reduce downtime and minimize maintenance costs, ensuring that shipyards maintain optimal operational conditions and avoid costly repairs.

AI is also instrumental in optimizing the design and manufacturing processes. With AI-driven design tools, shipyards can create more efficient, environmentally friendly, and cost-effective ship designs by simulating various scenarios and identifying potential design improvements. This leads to reduced production time and enhanced quality control during the shipbuilding process.

Additionally, AI-powered robotics and automation systems are improving assembly line efficiency. Automated machines, guided by AI, can handle tasks like welding, painting, and material handling with greater precision, reducing human error and increasing throughput.

AI also enhances supply chain management in digital shipyard by predicting demand, managing inventory, and optimizing procurement schedules. By processing real-time data, AI systems can streamline logistics and reduce delays, contributing to faster delivery times and lower operational costs.

Cloud-based maintenance systems are playing a crucial role in driving the growth of the digital shipyard market by offering efficient, real-time monitoring and predictive maintenance capabilities. These systems enable shipyards to manage and track the condition of vessels, predict potential failures, and schedule maintenance proactively, reducing downtime and increasing operational efficiency. By using cloud technology, shipyards can centralize maintenance data, making it accessible to various stakeholders, improving collaboration and decision-making processes. Moreover, cloud-based systems can store vast amounts of historical data, which can be analyzed for insights to optimize maintenance strategies and reduce costs. These systems also allow for remote monitoring and diagnostics, which helps shipyards reduce the need for on-site inspections and lower labor costs.

As the shipping industry focuses on sustainability and operational efficiency, cloud-based maintenance systems provide shipyards with the tools to enhance fleet management, improve vessel performance, and extend the lifespan of ships. The increasing demand for such systems, coupled with advancements in IoT and data analytics, is expected to accelerate their adoption, further propelling the growth of the digital shipyard market. Additionally, the scalability and flexibility offered by cloud-based solutions make them appealing to shipyards of all sizes, from large commercial facilities to smaller, specialized operators. As the global shipping industry continues to embrace digital transformation, cloud-based maintenance systems are expected to be a key enabler of efficiency and cost-effectiveness.

The digital shipyard market faces several restraints, including the high initial investment required for advanced technologies, such as digital twins, AI, and automation systems. The integration of these technologies into traditional shipyard operations can be complex and time-consuming, requiring skilled personnel and extensive training. Additionally, data security concerns and the risk of cyberattacks on digital systems pose significant challenges. Lastly, the slow adoption of digital technologies by smaller shipyards, due to budget constraints or lack of infrastructure, limits market growth.

Advancements in digital twin technology are creating significant opportunities in the digital shipyard market by revolutionizing how ships are designed, built, and maintained. A digital twin is a virtual replica of a physical asset, in this case, a ship, that simulates its performance and behavior in real time. With the increasing complexity of modern vessels and the rising demand for precision and efficiency, shipyards are leveraging digital twins to optimize every stage of the shipbuilding process. Digital twins allow shipbuilders to create detailed, accurate models of ships before construction begins, enabling better design, testing, and modification without the need for physical prototypes. This reduces time, cost, and resources, ultimately leading to faster delivery times and higher-quality vessels.

Furthermore, digital twin technology aids in predictive maintenance, enabling shipyards to monitor the condition and performance of vessels throughout their lifecycle. By simulating real-world operating conditions, digital twins provide insights into potential maintenance needs, allowing for proactive repairs and reducing unplanned downtime. This capability is crucial for shipowners who rely on operational efficiency and cost-effectiveness. Additionally, digital twins facilitate the integration of smart technologies like IoT sensors and AI into shipbuilding processes, enhancing automation, real-time decision-making, and operational efficiency. The growing adoption of digital twin solutions in shipyards not only streamlines design and construction but also supports sustainability efforts by optimizing fuel efficiency and reducing environmental impact, creating new opportunities for growth in the digital shipyard market in the upcoming days.

The hardware segment led the industry. The hardware segment plays a crucial role in driving the growth of the digital shipyard market by providing the foundational components required to support digital transformation in shipbuilding. Hardware solutions, including advanced sensors, robotics, and automation systems, enable shipyards to improve operational efficiency, precision, and safety throughout the shipbuilding process. These technologies facilitate real-time monitoring, predictive maintenance, and enhanced accuracy in production, allowing shipyards to streamline workflows and minimize errors. Robotics and automation systems are particularly important in performing repetitive tasks such as welding, painting, and assembly, improving productivity while reducing human labor costs and the risk of accidents.

Additionally, hardware components like IoT sensors and wearable devices allow for better monitoring of vessel conditions and workforce health, enhancing safety standards and improving decision-making in the shipbuilding process. The rise of smart shipyard operations is also fueled by hardware solutions, such as digital twins, which replicate the physical shipyard environment in a virtual space for real-time simulations and optimization. Moreover, advancements in hardware technology, such as augmented reality (AR) glasses and virtual reality (VR) systems, are enabling workers to perform tasks more efficiently, enhancing training, and reducing errors. The growing adoption of these hardware solutions across digital shipyard is essential for improving production capabilities, meeting tight deadlines, and ensuring quality compliance. As the demand for more efficient and automated shipbuilding processes rises, the hardware segment continues to drive substantial growth in the digital shipyard market.

The commercial segment held the largest share of the market. The commercial segment plays a pivotal role in driving the growth of the digital shipyard market by increasing the demand for advanced shipbuilding technologies and digital transformation solutions. As commercial shipping continues to expand, there is a growing need for shipyards to adopt digital tools that enhance efficiency, reduce costs, and meet the increasing regulatory standards. Commercial shipowners and operators are increasingly investing in technologically advanced vessels, such as large cargo ships, oil tankers, and container ships, that require precision and innovation in their construction. Digital shipyard, utilizing automation, robotics, and digital twin technologies, offer a significant advantage in building and maintaining these large-scale commercial vessels by optimizing design, production, and maintenance processes. The commercial segment also drives demand for sustainable and fuel-efficient ships, prompting shipyards to integrate digital tools that help design and produce vessels that meet environmental regulations, such as energy efficiency and emissions reduction.

Furthermore, the increasing complexity of ship designs and the need for faster delivery times are pushing shipyards to adopt digital solutions that streamline operations and enhance collaboration across the design and manufacturing stages. The adoption of digital technologies, such as predictive maintenance systems, IoT sensors, and real-time data analytics, also helps commercial shipbuilders reduce downtime and improve vessel reliability, which is crucial for fleet owners. The growing commercial shipping market’s demand for innovative, efficient, and environmentally compliant ships ensures continued growth and investment in digital shipyard technologies, driving the market in a positive direction.

North America dominated the digital shipyard market. Technological advancements, government support, and the focus on operational efficiency and cost reduction are key drivers of the Digital shipyard market in North America. Technological innovations such as automation, robotics, and artificial intelligence (AI) are transforming shipbuilding processes by enhancing precision, optimizing production schedules, and enabling predictive maintenance. These advancements allow shipyards to streamline operations, reduce errors, and accelerate construction timelines. Additionally, the integration of digital technologies like IoT, digital twins, and advanced design software enables shipyards to design more efficient vessels and optimize resource usage.

Government support and investment further fuel market growth in North America. Initiatives aimed at modernizing the shipbuilding sector and boosting technological innovation have been pivotal. For example, the U.S. government has launched programs to promote the adoption of smart manufacturing technologies, including in the maritime sector. Such investments help shipyards access funding and resources to implement digital solutions that improve productivity and sustainability.

Furthermore, the focus on operational efficiency and cost reduction is a significant factor driving digital transformation in North American shipyards. With increasing pressure to maintain profitability, shipyards are adopting digital technologies to streamline production, reduce waste, and optimize labor utilization. These solutions not only lower operational costs but also enable shipyards to remain competitive in the global market by offering faster, more efficient production capabilities. Collectively, these factors are propelling the growth of the Digital shipyard market in North America, making it a key region for innovation and investment in the maritime industry.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The growth of the digital shipyard market in the Asia Pacific (APAC) region is significantly driven by the increasing demand for smart ships, environmental regulations, and the expanding shipbuilding industry. The rise in demand for smart ships, equipped with advanced technologies such as IoT, AI, and autonomous navigation, is pushing shipbuilders to integrate digital solutions into their operations for improved performance, safety, and operational efficiency. This shift towards smarter ships necessitates digital transformation in shipyards, enabling them to meet the evolving requirements of the industry.

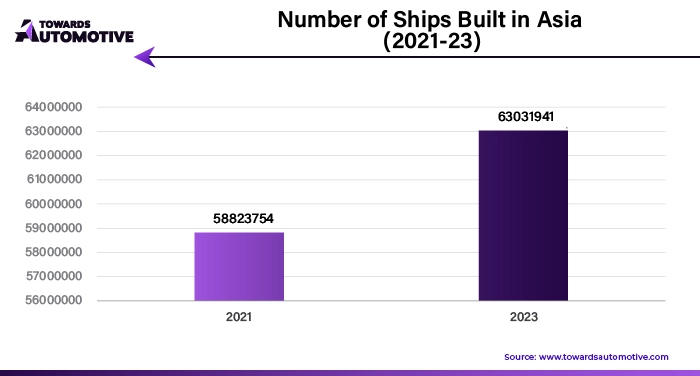

Additionally, stringent environmental regulations aimed at reducing emissions and improving fuel efficiency are prompting shipyards to adopt digital tools that can help in optimizing designs, enhancing operational processes, and minimizing environmental impact. The implementation of digital technologies such as simulation, virtual prototyping, and digital twins supports compliance with these regulations. Furthermore, the growth of the shipbuilding industry in APAC, particularly in countries like China, Japan, and South Korea, is a major driver of digital shipyard adoption. These countries are renowned for their strong shipbuilding capabilities and are investing heavily in digital transformation to maintain competitiveness. Digital solutions enable shipyards to enhance productivity, reduce lead times, and improve overall quality, thereby boosting growth in the region.

By Solution

By Shipyard Type

By Capacity

By Technology

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us