February 2025

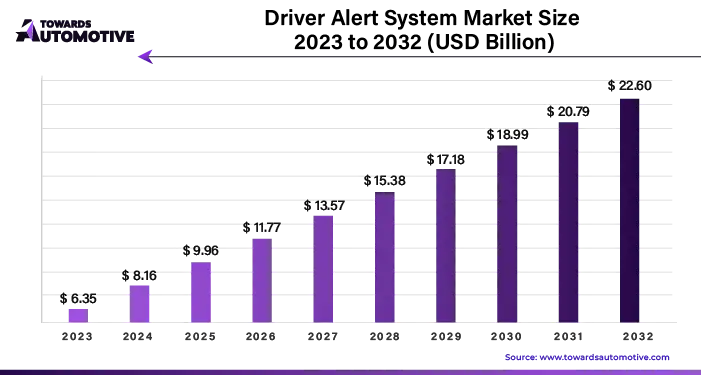

The driver alert system market was valued at USD 6.35 billion in 2023 and is expected to grow USD 22.6 billion by 2032 at a CAGR of around 11.99% from 2024 to 2032.

Unlock Infinite Advantages: Subscribe to Annual Membership

The integration of artificial intelligence (AI) and machine learning (ML) into automobiles represents a significant advancement in automotive technology, particularly in the realm of Advanced Driver Assistance Systems (ADAS). These systems leverage AI and ML algorithms to provide more sophisticated warnings and alerts to drivers, as well as to analyze driving behavior in real-time.

This integration has led to a notable increase in consumer interest in vehicles equipped with ADAS features, which enhance both drivability and safety on the roads. According to statistics from the NSC Injury Facts, ADAS technology has the potential to prevent a substantial number of fatalities annually, with estimates suggesting it could prevent up to 20,841 deaths per year, accounting for approximately 62% of all road fatalities.

Recent research projections indicate a significant growth trajectory for autonomous or semi-autonomous vehicles, with expectations of approximately 8 million such vehicles on the road by 2025. This growth is fueled by advancements in AI and ML technologies, which enable vehicles to perform increasingly complex tasks autonomously, such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking.

However, despite the promising outlook for ADAS-equipped vehicles, the market growth may face some constraints, particularly related to regulatory restrictions and consumer adoption. Regulatory frameworks and safety standards may impose limitations on the adoption and deployment of certain ADAS features, potentially slowing down the absorption rate of these products into the market.

Integration of AI and ML technologies into automobiles represents a pivotal development in the automotive industry, promising enhanced safety, efficiency, and convenience for drivers and passengers alike. As these technologies continue to evolve and mature, they are expected to play an increasingly significant role in shaping the future of transportation.

The COVID-19 pandemic has indeed had a significant adverse effect on the driver alert system market, primarily due to the overall decline in travel and mobility. With widespread travel restrictions and the implementation of remote work policies, people's movement has been severely curtailed, leading to a reduction in the demand for driver alert systems.

Moreover, the pandemic-induced economic downturn has resulted in constrained research and development (R&D) budgets for many companies, including those involved in developing driver alert technologies. This has slowed down the pace of innovation and the introduction of new and advanced driver alert solutions.

Despite these challenges, there has been a growing recognition of the importance of traffic safety, particularly during the pandemic when emergency services and healthcare systems are already strained. As a result, there has been an increased interest in technology, including driver alert systems, that can contribute to enhancing road safety and reducing the risk of accidents.

While the immediate impact of the pandemic on the driver alert system market has been negative, there are opportunities for recovery and growth as travel restrictions ease and economic conditions improve. Additionally, the heightened focus on road safety may lead to increased investments and initiatives aimed at deploying advanced driver alert technologies in vehicles to mitigate the risks associated with distracted or fatigued driving.

The ongoing support from governments and regulatory bodies, such as the World Health Organization (WHO) and the United Nations, aimed at reducing accidents and fatalities through improved safety measures, is expected to have a positive impact on the growth of the driver alert system market. These initiatives underscore the importance of leveraging technology to enhance road safety and mitigate risks associated with distracted or fatigued driving.

For instance, in March 2023, the Delaware Department of Transportation (DelDOT) implemented a wrong-way driving and warning system aimed at preventing and correcting instances of wrong-way driving before vehicles enter the highway. Such implementations highlight the increasing adoption of advanced driver alert systems to address specific safety concerns and enhance overall traffic safety.

Moreover, the growing utilization of driver alert systems to predict and mitigate driver fatigue and distraction is anticipated to drive further expansion within the market. This includes the development and deployment of IoT-based smart alert systems capable of detecting signs of driver fatigue in real-time, thereby enabling timely interventions to prevent potential accidents.

Overall, the collaborative efforts of governments, regulatory agencies, and industry stakeholders to prioritize road safety and invest in innovative safety technologies are expected to fuel the growth of the driver alert system market, driving advancements in safety solutions and contributing to the overall improvement of road safety standards.

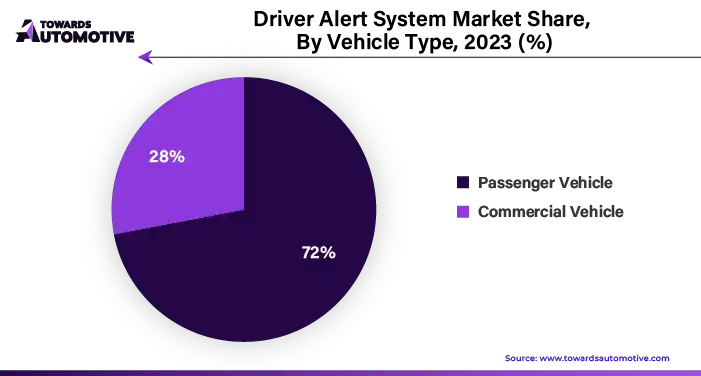

The passenger segment projection underscores the growing recognition of the critical role that driver alert technologies play in enhancing safety, particularly within passenger vehicles.

For instance, the Indian government has unveiled plans to establish standards mandating the installation of "sleepy alert technology" across buses, cars, and trucks. This technology is designed to provide audible alerts to drivers in the event of drowsiness or fatigue behind the wheel. Such initiatives reflect a concerted effort to leverage driver alert systems to mitigate the risks associated with driver fatigue and reduce the incidence of accidents on roadways.

Moreover, increasing consumer interest and awareness regarding the benefits of driver alert systems are expected to drive growth within the passenger segment. As consumers become more cognizant of the potential safety enhancements offered by these technologies, there is a corresponding rise in demand for vehicles equipped with advanced driver alert functionalities.

Overall, the passenger segment represents a significant growth opportunity within the driver alert system market, driven by regulatory mandates, technological advancements, and heightened consumer awareness of the importance of road safety. By leveraging innovative solutions to address driver fatigue and distraction, driver alert systems are poised to play a pivotal role in enhancing safety standards across passenger vehicles, ultimately contributing to the reduction of accidents and fatalities on roads.

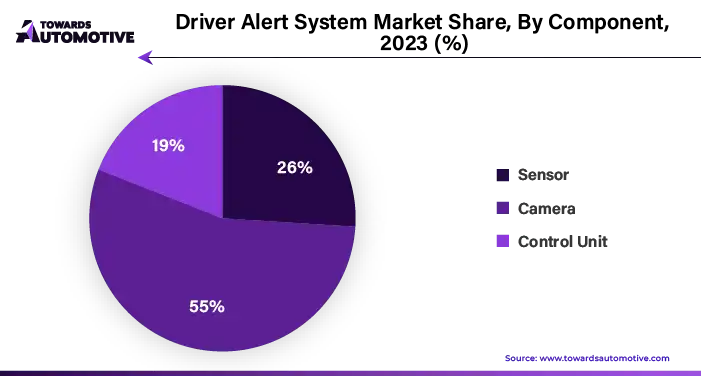

The camera segment is poised to hold a substantial share of the driver alert system market, projected to encompass approximately 40% of the market by 2022. Cameras play a crucial role in enhancing road safety by leveraging cutting-edge technology and sophisticated image recognition algorithms to monitor driving behavior and environmental conditions in real-time.

One of the key advantages of camera-based driver alert systems lies in their ability to accurately assess various parameters such as driver fatigue, potential collisions, and other hazardous situations on the road. By continuously monitoring the driver's actions and the surrounding environment, these systems can proactively detect signs of fatigue or distraction, thereby helping to prevent accidents before they occur.

Integration of in-car cameras enables precise identification of driver involvement and potential hazards, facilitating timely intervention or alerts to mitigate risks. This real-time monitoring capability enhances the overall effectiveness of driver alert systems in enhancing safety standards on roadways.

The increasing demand for security features and the growing collaboration between automakers and technology companies have further accelerated the adoption of camera-based driver alert systems. As consumers increasingly prioritize safety features in their vehicles, automakers are keen to incorporate advanced camera technologies to offer comprehensive safety solutions that meet customer expectations.

Overall, the camera segment represents a significant growth opportunity within the driver alert system market, driven by its ability to provide real-time monitoring and proactive accident prevention capabilities. By leveraging the latest advancements in image recognition and AI technologies, camera-based driver alert systems are poised to play a pivotal role in enhancing road safety and reducing the incidence of accidents on highways and urban streets alike.

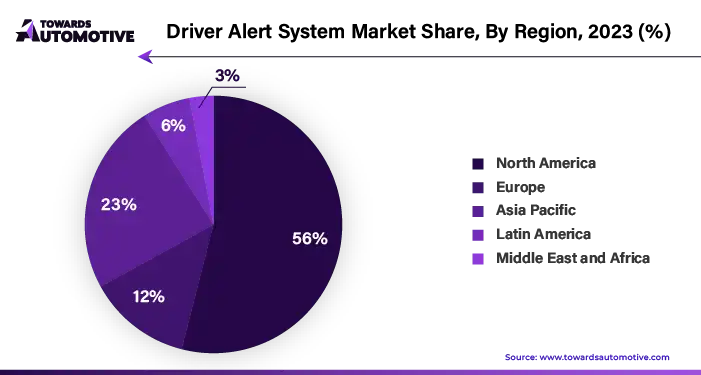

The surge in automotive sales, particularly in regions like Canada and the United States, has spurred collaboration between automotive manufacturers and technology companies to develop and integrate advanced driver alert systems. The Canadian Automotive Outlook report highlights a notable increase in auto sales, with Canadian sales in the first quarter rised by 4.4% compared to the corresponding period in the previous year.

This uptick in auto sales underscores the growing demand for vehicles equipped with cutting-edge safety features, including driver alert systems. With consumers placing greater emphasis on vehicle safety and advanced technology, automakers are increasingly partnering with technology firms and suppliers to incorporate innovative driver alert functionalities into their vehicles.

By leveraging partnerships and collaborations, automotive manufacturers can access specialized expertise and resources to enhance the effectiveness and sophistication of driver alert systems. These systems play a crucial role in mitigating the risk of accidents by monitoring driver behavior, detecting potential hazards, and issuing timely alerts or interventions to prevent collisions.

The integration of driver alert systems aligns with broader industry trends focused on enhancing vehicle safety standards and meeting regulatory requirements. As automotive sales continue to climb, driven by consumer demand for safer and more technologically advanced vehicles, the development and integration of driver alert systems are expected to remain a priority for automakers and technology partners alike.

Major companies operating in the driver alert system market are:

By Vehicle Type

By System Type

By Component

By Geography

February 2025

February 2025

February 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us