Dry Bulk Shipping Market Size, Share and Emerging Trends

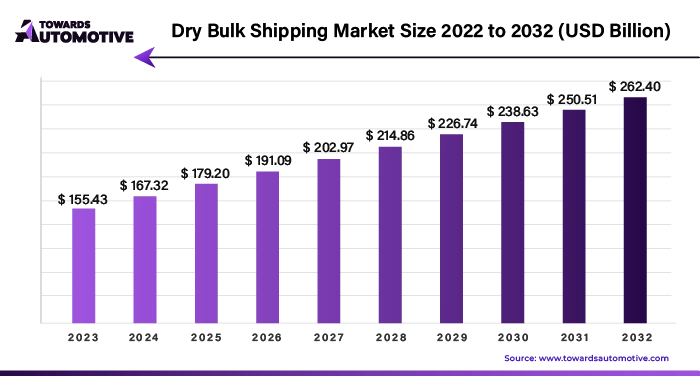

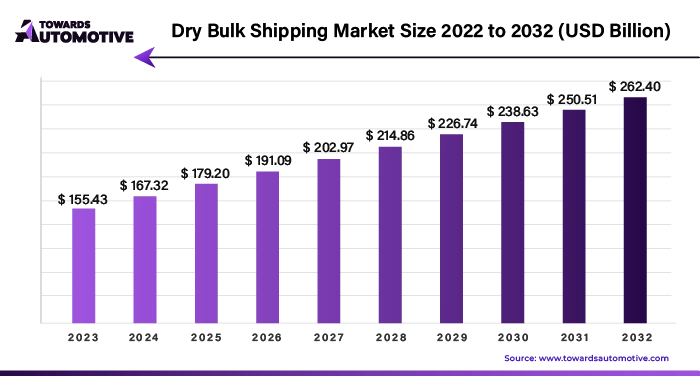

The dry bulk shipping market is forecasted to expand from USD 174.61 billion in 2025 to USD 294.75 billion by 2034, growing at a CAGR of 5.99% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The dry bulk shipping market is a cornerstone of global trade, facilitating the transportation of essential commodities such as coal, iron ore, grain, and minerals across oceans and continents. Characterized by its resilience, volatility, and interconnectedness with global economic trends, the dry bulk shipping industry plays a vital role in driving economic growth and sustaining supply chains worldwide.

The dry bulk shipping market is a dynamic and indispensable component of global trade, serving as a vital link in the supply chain for essential commodities worldwide. Despite inherent challenges and uncertainties, the market continues to evolve and adapt to changing economic, regulatory, and technological landscapes. By embracing innovation, sustainability, and collaboration, stakeholders in the dry bulk shipping market can navigate challenges, unlock opportunities, and chart a course towards a resilient, efficient, and sustainable future for maritime transportation.

The dry bulk shipping market encompasses the transportation of unpackaged, homogeneous cargo in large quantities, typically loaded directly into the holds of specialized vessels known as bulk carriers. With a diverse portfolio of commodities ranging from raw materials to agricultural products, the market serves as a linchpin of the global economy, catering to industries such as construction, manufacturing, energy, and agriculture. Despite fluctuations in demand and freight rates, the dry bulk shipping sector remains indispensable for facilitating international trade and meeting the evolving needs of a growing population.

Key Components and Functions of the Dry Bulk Shipping Market

Bulk Carriers: Bulk carriers are purpose-built vessels designed to transport dry bulk cargo efficiently and cost-effectively across long distances. These vessels come in various sizes and configurations, including Capesize, Panamax, and Handysize, tailored to accommodate different cargo volumes and trade routes. Equipped with advanced navigation systems and cargo-handling equipment, bulk carriers play a pivotal role in facilitating the seamless movement of commodities between ports worldwide.

Cargo Types: The dry bulk shipping market encompasses a wide array of commodities, including

- Iron Ore: Essential for steel production, iron ore constitutes a significant portion of dry bulk cargo, primarily transported from major exporting countries such as Australia, Brazil, and South Africa to steel mills worldwide.

- Coal: A cornerstone of energy generation, coal is transported via bulk carriers from mining regions in countries such as Indonesia, Australia, and the United States to power plants and industrial facilities.

- Grain: Agricultural commodities such as wheat, corn, and soybeans are transported in bulk carriers from major exporting regions such as the United States, Brazil, and Argentina to global markets, catering to food security and consumption needs.

- Minerals: Various minerals, including bauxite, copper concentrate, and nickel ore, are transported by bulk carriers to meet the demands of industries such as metallurgy, construction, and manufacturing.

Freight Markets: The dry bulk shipping market operates within dynamic freight markets, where vessel owners, charterers, and brokers engage in transactions to transport cargo on a spot or long-term basis. Freight rates fluctuate based on supply and demand dynamics, vessel availability, geopolitical factors, and macroeconomic trends, influencing the profitability and competitiveness of market participants.

Key Market Dynamics and Trends

- Commodity Demand and Economic Growth: The performance of the dry bulk shipping market is closely intertwined with global economic trends and commodity demand-supply dynamics. Economic growth, industrial activity, infrastructure development, and population growth drive the demand for raw materials and commodities, influencing shipping volumes and freight rates in the dry bulk sector.

- China's Role: As the world's largest importer of dry bulk commodities, China exerts a significant influence on the dry bulk shipping market. The country's voracious appetite for iron ore, coal, and other raw materials fuels demand for bulk carriers, shaping trade patterns, shipping routes, and freight market dynamics. Shifts in Chinese economic policies, infrastructure investments, and industrial activity have profound implications for the dry bulk shipping sector globally.

- Environmental Regulations: The dry bulk shipping market is undergoing a transformative shift towards environmental sustainability and regulatory compliance. Stringent emissions standards, including the International Maritime Organization's (IMO) sulfur cap regulations and greenhouse gas (GHG) reduction targets, are driving vessel owners and operators to adopt cleaner fuels, energy-efficient technologies, and eco-friendly practices to mitigate environmental impact and ensure compliance with regulatory requirements.

- Technological Advancements: Innovation and technological advancements are reshaping the dry bulk shipping market, enhancing vessel efficiency, safety, and operational performance. From the adoption of digitalization and automation solutions to the development of eco-friendly propulsion systems and hull designs, the industry is embracing technology-driven solutions to optimize fleet management, reduce fuel consumption, and enhance environmental sustainability.

Global Trends and Market Outlook

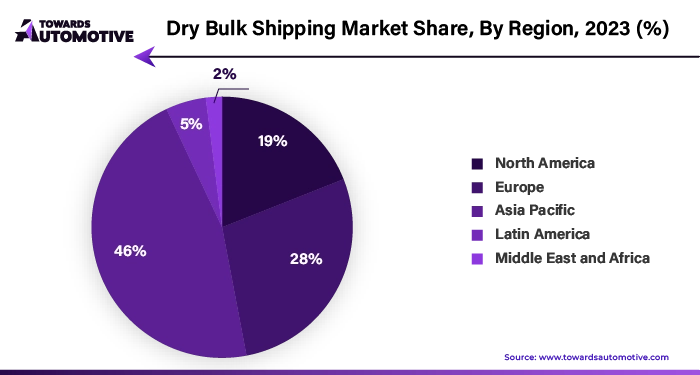

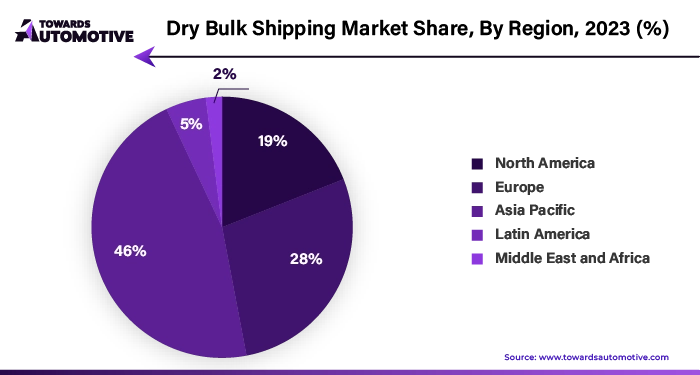

- Asia-Pacific Dominance: The Asia-Pacific region remains the epicenter of dry bulk trade, driven by robust economic growth, industrialization, and urbanization. Countries such as China, India, Japan, and South Korea are major importers and exporters of dry bulk commodities, fueling demand for bulk carriers and shaping regional shipping dynamics. The emergence of Southeast Asian economies as key players in commodity markets further amplifies the region's significance in the dry bulk shipping market.

- Maritime Silk Road Initiative: China's ambitious Maritime Silk Road Initiative, part of the broader Belt and Road Initiative (BRI), aims to enhance maritime connectivity, infrastructure development, and trade cooperation across Asia, Africa, and Europe. The initiative entails significant investments in port infrastructure, logistics corridors, and maritime trade routes, presenting opportunities and challenges for the dry bulk shipping market as it navigates evolving trade patterns and geopolitical dynamics.

Challenges and Opportunities

- Volatility and Cyclical Nature: The dry bulk shipping market is inherently cyclical and prone to volatility, characterized by fluctuating freight rates, vessel oversupply, and demand uncertainties. Market participants must navigate these challenges by adopting agile strategies, optimizing fleet utilization, and diversifying revenue streams to withstand market downturns and capitalize on upturns.

- Regulatory Compliance: Stringent environmental regulations and regulatory requirements pose compliance challenges for vessel owners and operators in the dry bulk shipping market. From emissions standards to ballast water management regulations, adherence to regulatory frameworks requires investments in technology, training, and operational practices to ensure environmental sustainability and regulatory compliance while minimizing operational disruptions and financial penalties.

- Technological Disruption: The rapid pace of technological innovation presents both challenges and opportunities for the dry bulk shipping market. While digitalization, automation, and smart technologies enhance operational efficiency and competitiveness, they also require substantial investments in infrastructure, workforce skills, and cybersecurity to harness their full potential and mitigate associated risks.

Key Players in the Dry Bulk Shipping Market

Thedry bulk shipping market comprises a diverse ecosystem of stakeholders, including:

- Ship Owners and Operators: Companies owning and operating bulk carriers, managing fleet operations, and engaging in chartering activities.

- Charterers and Cargo Owners: Entities chartering vessels for cargo transportation, including commodity traders, mining companies, agricultural producers, and industrial manufacturers.

- Ship Brokers and Maritime Service Providers: Intermediaries facilitating vessel chartering, sale and purchase transactions, ship management, and maritime logistics services.

Market Segmentation and Regional Outlook

By Vessel Type

- Capesize

- Panamax

- Handysize

- Supramax

- Ultramax

By Cargo Type

- Iron Ore

- Coal

- Grain

- Minerals

- Other Commodities

By Region

- North America

- Europe

- Germany

- United Kingdom

- France

- Asia-Pacific

- Latin America

- Middle East and Africa

Recent Developments in the Dry Bulk Shipping Market

- In December 2023, Maersk Line, the world's largest container shipping company, announced its entry into the dry bulk shipping market with the acquisition of a fleet of bulk carriers. This strategic move by Maersk aimed to diversify its shipping portfolio and capitalize on growing demand for dry bulk transportation services, particularly in sectors such as agriculture, mining, and construction.

- In November 2023, Scorpio Bulkers Inc. unveiled its latest eco-friendly dry bulk carrier, equipped with innovative fuel-saving technologies and emission reduction systems. The new vessel features advanced hull design, energy-efficient propulsion systems, and ballast water treatment solutions, aligning with industry efforts to enhance environmental sustainability and regulatory compliance in maritime transportation.

- In October 2023, Mitsui O.S.K. Lines (MOL), a leading Japanese shipping company, launched a joint research initiative with industry partners to develop autonomous navigation systems for dry bulk carriers. The project aims to leverage artificial intelligence, sensor technologies, and big data analytics to improve operational efficiency, safety, and crew welfare onboard bulk carriers, paving the way for autonomous shipping in the dry bulk sector.

- In September 2023, Oldendorff Carriers, one of the world's largest dry bulk shipping companies, announced its investment in wind-assisted propulsion systems for its fleet of bulk carriers. The company partnered with renewable energy technology firms to retrofit its vessels with innovative wind propulsion technology, reducing fuel consumption, greenhouse gas emissions, and operating costs while enhancing sustainability and competitiveness in the dry bulk shipping market.

- In August 2023, China Merchants Energy Shipping Co., Ltd. (CMES) revealed plans to expand its fleet of dry bulk carriers to meet rising demand for raw materials transportation in China and global markets. CMES aims to invest in newbuildings and secondhand vessels, focusing on fuel-efficient designs, eco-friendly technologies, and digitalization initiatives to optimize fleet performance and support sustainable growth in the dry bulk shipping sector.