October 2025

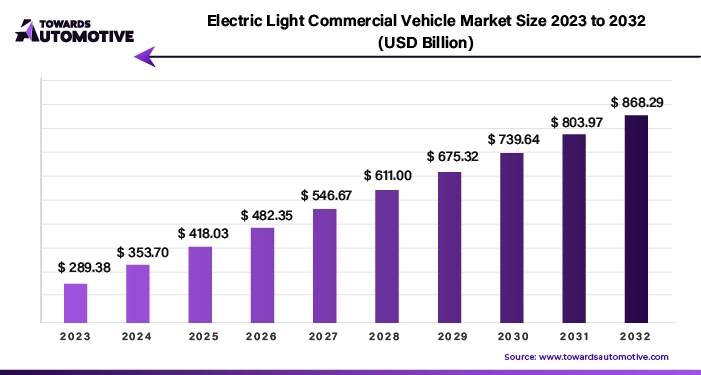

The electric light commercial vehicle market is forecasted to expand from USD 369.44 billion in 2025 to USD 1,108.94 billion by 2034, growing at a CAGR of 12.99% from 2025 to 2034.

The significant growth observed in the electric light commercial vehicle (eLCV) market can be largely attributed to the increasingly stringent environmental regulations and sustainable development measures being implemented across various industries worldwide. Governments are enacting strict standards and regulations aimed at combating air pollution and reducing greenhouse gas emissions, prompting businesses and fleet operators to seek cleaner and more sustainable transportation solutions. eLCVs offer a compelling alternative as they produce zero tailpipe emissions, contributing to cleaner and safer urban environments.

Moreover, the adoption of eLCVs aligns with businesses' goals to comply with regulatory mandates and demonstrate their commitment to environmental sustainability. By transitioning their fleets to electric vehicles, companies can not only meet regulatory requirements but also enhance their corporate social responsibility initiatives and improve their public image.

Advancements in battery technology have played a pivotal role in driving the growth of the eLCV market. Continuous innovations in battery chemistry and design have led to significant improvements in the performance, range, and cost-effectiveness of electric vehicles, including commercial vehicles. For instance, the introduction of vehicle-to-grid (V2G) technology enables eLCVs to not only draw energy from the grid but also feed surplus energy back into the grid during periods of peak demand. This two-way energy exchange not only provides valuable support to the grid but also generates additional revenue streams for fleet operators.

However, despite the numerous benefits of eLCVs, challenges remain, with one of the primary concerns being the availability and accessibility of charging infrastructure. Unlike traditional gas stations, charging stations for electric vehicles, particularly for commercial fleets, may not be as widespread or convenient. This limitation can cause considerable stress for buyers and drivers alike, as well as pose logistical challenges in route planning and managing vehicle charging schedules. Addressing this challenge will require significant investment in expanding and enhancing charging infrastructure to support the growing adoption of eLCVs and ensure the seamless integration of electric vehicles into the commercial transportation ecosystem.

E-commerce and the transportation sector are serving as pivotal drivers in propelling the automotive industry forward. The surge in online sales and e-commerce activities, fueled by the widespread adoption of internet and smartphone technologies, has created a growing demand for efficient transportation solutions, particularly in the realm of light commercial vehicles (LCVs). These vehicles play a crucial role in facilitating timely deliveries of goods to customers, thus becoming indispensable assets in the modern logistics landscape.

In response to the burgeoning e-commerce market, the production of light commercial vehicles has witnessed a steady increase, with global production projected to reach 185.9385 million units in 2021. The rise of online shopping has not only boosted revenues but also reshaped consumer behavior, with a growing number of individuals relying on digital platforms for their purchasing needs. The COVID-19 pandemic further accelerated this trend, compelling people to shift towards online shopping as a safer alternative to traditional brick-and-mortar stores.

The rapid expansion of the global e-commerce market, which reached a staggering $26.7 trillion in revenue in 2021, underscores the growing prominence of online retailing in driving economic growth. This trend is underscored by the increasing number of online shoppers worldwide, indicating a fundamental shift in consumer preferences and shopping habits. Major markets such as Europe, the United States, and China have witnessed exponential growth in e-commerce activities, driving the need for efficient distribution networks and transportation solutions.

Leading automotive manufacturers such as Daimler, Nissan, Ford, and Renault have capitalized on the surge in e-commerce sales, leveraging their expertise to cater to the evolving needs of the logistics sector. The growing demand for trucks and pickup trucks, particularly in the context of last-mile delivery and transportation services, has further bolstered the global light commercial vehicle market. These vehicles are not only instrumental in fulfilling the delivery requirements of the e-commerce sector but also play a vital role in supporting various other industries reliant on efficient transportation solutions.

The synergy between e-commerce and transportation is reshaping the automotive industry landscape, driving innovation, and fostering growth opportunities in the light commercial vehicle segment. As online shopping continues to gain momentum, the demand for efficient and reliable transportation solutions is expected to remain robust, positioning light commercial vehicles at the forefront of the evolving logistics ecosystem.

The COVID-19 pandemic has left an indelible mark on the electric vehicle (EV) market, causing disruptions across production, supply chains, and consumer demand. The imposition of curfews and business uncertainty resulted in a slowdown in production activities and adversely impacted the utilization of light commercial vehicles (LCVs). Moreover, the pandemic underscored the inefficiencies within certain industries, prompting a reevaluation of investment strategies, including a shift towards electric vehicles.

In the initial stages of the crisis, the EV market experienced a downturn as manufacturing facilities grappled with shutdowns and logistical challenges. Disruptions in global supply chains further exacerbated the situation, leading to delays in production and delivery of electric commercial vehicles. Additionally, weakened consumer confidence and economic uncertainties dampened demand for EVs, including light commercial vehicles, as businesses prioritized cost-cutting measures amidst the prevailing uncertainty.

However, despite the initial setbacks, the pandemic served as a catalyst for highlighting the importance of sustainable transportation solutions. As governments and businesses increasingly recognize the need for environmental stewardship and carbon emission reduction, interest in electric commercial vehicles is expected to persist. The economic recovery efforts post-pandemic, coupled with a renewed focus on environmental initiatives and sustainability goals, are likely to drive continued interest and investment in electric commercial vehicles.

Moreover, the resilience demonstrated by the electric vehicle market amidst the challenges posed by the pandemic underscores its long-term viability and potential for growth. As the global economy gradually rebounds and industries adapt to the new normal, electric commercial vehicles are poised to play a pivotal role in driving sustainable transport solutions and fostering a greener, more resilient future.

COVID-19 pandemic has posed significant challenges for the electric vehicle market, including light commercial vehicles, it has also underscored the importance of sustainable transport and accelerated the transition towards electric mobility. As the world emerges from the crisis, the momentum towards electric commercial vehicles is expected to intensify, driven by economic recovery efforts, environmental imperatives, and the pursuit of resilient, future-proof transportation solutions.

| Rank | Manufacturer | 2024 Share (%, est.) |

| 1 | Stellantis (Pro One: Peugeot, Citroën, Opel/Vauxhall, Fiat, Ram) | 16–19% |

| 2 | SAIC Maxus (incl. MG-branded LCV in some markets) | 15–18% |

| 3 | Ford (E-Transit family) | 11–14% |

| 4 | Renault (Kangoo E-Tech, Master E-Tech, Trafic E-Tech) | 9–12% |

| 5 | Rivian (Commercial Van / RCV) | 7–9% |

| 6 | Mercedes-Benz Vans (eSprinter, eVito) | 6–8% |

| 7 | Volkswagen Commercial Vehicles (ID. Buzz Cargo, e-Crafter regional)* | 4–6% |

| 8 | BYD (eLCV & electric pickups; early-stage international rollout) | 3–5% |

| 9 | Nissan / Mitsubishi (Townstar EV, Minicab MiEV / kei LCV niches) | 2–4% |

| 10 | Others (Hyundai, Maxus competitors, LDV-localized brands, startups) | 15–20% |

Focusing on last-mile solutions presents a significant opportunity to bolster the market prospects of the light commercial vehicle (LCV) segment. With the rapid growth of e-commerce and the escalating demand for efficient long-distance delivery services, the importance of LCVs in urban logistics has become increasingly evident. Projections from the Indian Brand Equity Foundation (IBEF) indicate a substantial expansion in the Indian e-commerce market, expected to reach a value of $350 billion by 2030, with a projected compound annual growth rate (CAGR) of 27%. By 2026, the Indian e-commerce market is anticipated to soar to USD 163 billion.

Efforts to reduce emissions in densely populated urban areas and achieve sustainable development goals are driving a heightened focus on energy-efficient solutions, particularly in short-haul applications where LCVs play a pivotal role. The adoption of electric vehicles (EVs) in this context holds promise for mitigating environmental impacts and addressing transportation challenges. Advanced electronic equipment, such as batteries utilizing solid-state technology with electrolytes, offers notable advantages over traditional liquid electrolyte batteries. These advancements result in greater energy efficiency, enhanced safety, and the potential for longer battery life.

As solid-state power sources continue to evolve, the performance and safety standards of batteries utilized in commercial electric vehicles are poised to improve significantly. The ongoing advancements in battery technology are rendering electric vehicles increasingly viable across diverse industries. Lower battery costs, coupled with enhancements in energy efficiency and the development of robust charging infrastructure, are rendering the electric vehicle market more appealing to businesses seeking to optimize operational costs and minimize their carbon footprint.

By embracing last-mile solutions and leveraging cutting-edge technology, particularly in the realm of electric vehicles and advanced battery systems, the light commercial vehicle market stands poised to meet the evolving needs of urban logistics, foster sustainable transportation practices, and capitalize on the burgeoning opportunities presented by the surging e-commerce sector.

By 2023, light trucks are anticipated to dominate approximately 80% of the market share, a trend attributed to their blend of sustainability and efficiency. With a growing emphasis on environmental consciousness and stringent emissions regulations, businesses are increasingly turning to clean energy products to align with sustainability objectives. Light trucks offer a favorable overall cost of ownership, characterized by reduced repair costs, lower battery expenses, and enhanced efficiency, making them an attractive option for companies prioritizing sustainability and cost-effectiveness.

Government incentives and policy changes further incentivize the adoption of electric trucks, providing additional appeal to businesses seeking to reduce their carbon footprint and demonstrate commitment to environmentally friendly transportation solutions. As responsible corporate citizens, companies are embracing electric trucks as part of their broader sustainability initiatives, thereby reinforcing their dedication to eco-friendly practices and reducing environmental impact.

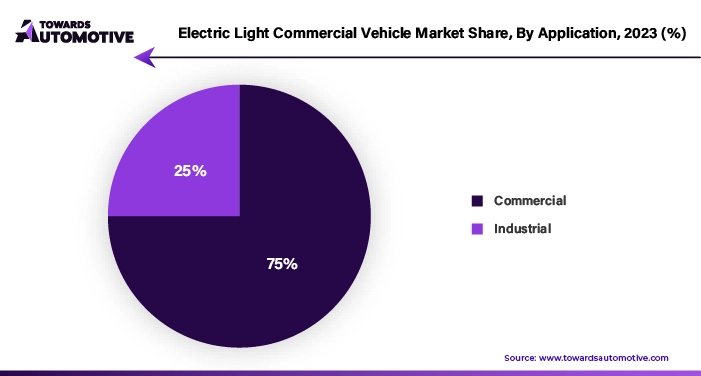

In the commercial market, which is poised to capture 65% of the market share by 2023, the emphasis on sustainability and sound business practices is a driving force. Stringent environmental regulations worldwide are compelling businesses to transition to light commercial vehicles to minimize their carbon footprint and adhere to emission standards. The economic benefits are compelling, with lower operating costs stemming from reduced maintenance and battery expenses.

Government incentives, coupled with societal support, create an enabling environment for the widespread adoption of light commercial vehicles. As businesses increasingly prioritize sustainability in their operations, light commercial vehicles emerge as a compelling solution for achieving both environmental and economic objectives. By embracing these vehicles, companies can not only reduce their environmental impact but also realize cost savings and contribute to the advancement of sustainable transportation practices.

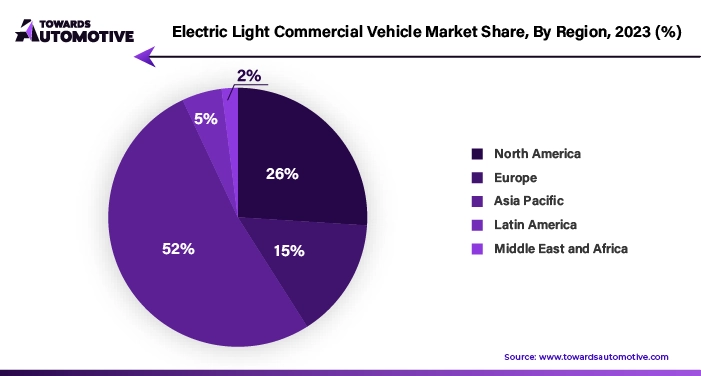

The Asia-Pacific region is poised to assert its dominance in the global electric light commercial vehicle market, capturing a substantial more than 50% share by 2023. This trend is fueled by a convergence of factors contributing to the region's leadership in electric vehicle adoption. Governments in key countries such as China, Japan, and South Korea have implemented robust policies and incentives aimed at promoting the widespread use of electric light commercial vehicles. These initiatives not only drive investment in electric vehicle production but also incentivize businesses to transition their fleets toward cleaner, more sustainable alternatives.

Heightened concerns surrounding poor air quality and pollution in densely populated urban areas further underscore the appeal of electric light commercial vehicles. As governments and citizens increasingly prioritize environmental sustainability, electric vehicles emerge as an attractive solution for mitigating the adverse impacts of vehicle emissions on air quality and public health.

Moreover, the burgeoning growth of e-commerce, particularly in countries like India, has emerged as a significant catalyst propelling the electric vehicle market in the Asia-Pacific region. The surge in online shopping activities has led to a heightened demand for efficient and environmentally friendly shipping options, driving businesses to adopt electric light commercial vehicles for last-mile deliveries and logistics operations. This trend not only aligns with sustainability goals but also addresses the pressing need for more energy-efficient and eco-friendly transportation solutions in the rapidly evolving landscape of urban commerce.

The convergence of strong government policies, growing environmental awareness, and the expanding e-commerce sector positions the Asia-Pacific region as a powerhouse in the global electric light commercial vehicle market. As businesses and governments alike embrace the transition towards electric mobility, the region is poised to lead the way in shaping the future of sustainable transportation.

Ford Motor Company and Mercedes-Benz, along with other companies in the electric vehicle market, are implementing a range of strategies to enhance their business presence and drive growth in the rapidly evolving electric vehicle industry.

Ford Motor Company, Mercedes-Benz, and other players in the electric vehicle market are employing a multifaceted approach to strengthen their business presence and drive growth. By investing in technology development, forming collaborative partnerships, expanding infrastructure financing, and advocating for supportive government policies, these companies are positioning themselves for success in the rapidly expanding electric vehicle industry.

Major players operating in the market are:

By Solution

By Propulsion Type

By GVW

By Application

By Geography

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us