April 2025

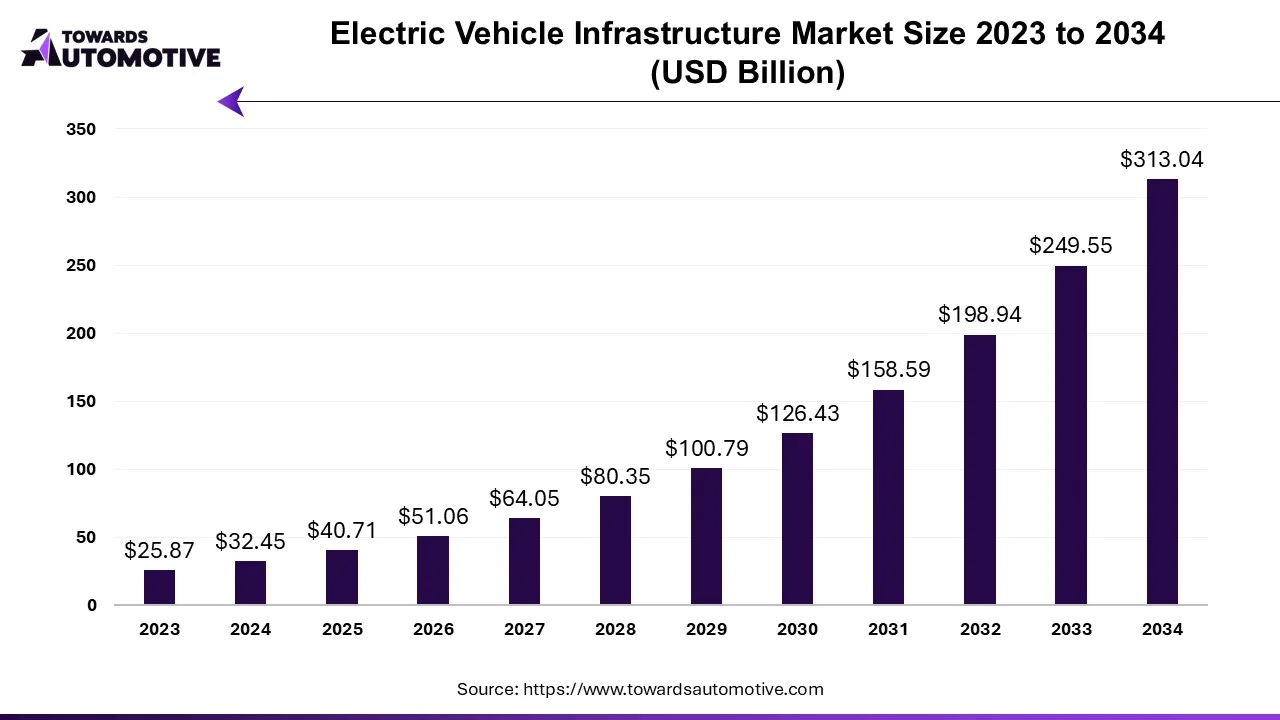

The electric vehicle infrastructure market size is calculated at USD 32.45 billion in 2024 and is anticipated to reach around USD 313.04 billion by 2034, growing at a CAGR of 25.44% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Electric vehicles are the next big thing for the automobile sector as it may be in huge demand in the coming future. Electric vehicle infrastructure can be defined as machinery, substructure and all the equipment needed to support Electric vehicles such as rapid chargers, battery chargers and battery swap stations. A battery charger is a cluster of component assemblies that are specially made to charge batteries in an EV. A rapid charger is an industrial-level electrical station that helps for faster charging of electric vehicle batteries using higher power levels. A battery swap station is totally an automated facility that enables an electric vehicle with a swappable battery to go into a drive lane and interchange the worn-out battery with the completely charged battery. The infrastructure should meet all relevant standards, state building codes and regulations.

Tata Motors announced its partnership with Delta Electronics India and Thunder Plus Solutions to establish EV charging stations across India. Together they have installed more than 1,00,000 home EV chargers. TATA has also partnered with big oil retailers like Shell and HPCL which will include charging stations in their fuel stations across India. Hyundai, MG Motors and Mahindra and Mahindra are also planning to do similar in the coming future.

The Electric Vehicle Infrastructure Market is a huge market with the presence of numerous key players. Some of the popular companies include, ABB Ltd., Tritium DCFC Limited, Delta Electronics Inc., BTC Power, Siemens, Eaton Corporation plc, bp pulse, Webasto Group, Tesla Inc., ChargePoint Inc., Schneider Electric and some others. These dominant players are investing with their full potential for developing an advanced electric vehicle infrastructure market to maintain their dominant position in this industry.

By Charger Type

By Charging Type

By Installation Type

By Connector

By Level of Charging

By Connectivity

By Operation

By Deployment

By Application

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us