October 2025

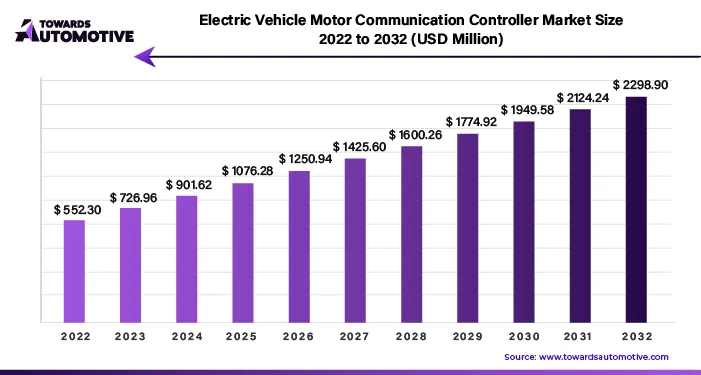

The electric vehicle motor communication controller market is forecasted to expand from USD 969.45 million in 2025 to USD 3,540.67 million by 2034, growing at a CAGR of 15.48% from 2025 to 2034.

The market for electric vehicle charging infrastructure (EVCI) is being propelled by the rising demand for electric charging solutions, driven in part by increased financial incentives provided by governments worldwide. Various governments, such as India's, have initiated programs like the Adoption and Manufacturing of Electric Vehicles in India (FAME India) program to incentivize the purchase of electric vehicles by offering subsidies. This has led to a surge in demand for electric vehicle supply equipment (EVSE), particularly for large-scale charging centers, as businesses in sectors like transportation, logistics, and fast-moving consumer goods (FMCG) invest in electric fleets.

Companies like FedEx have made significant investments in EVSE equipment for their transportation fleets, and industry players such as Siemens, Efacec, and ABB Ltd. are actively involved in developing advanced solutions like pantograph chargers to meet the growing demand. Furthermore, government initiatives to establish national electric vehicle charging networks, as seen in the partnership between ABB Ltd. and Mitsubishi Electric in Estonia, are driving the demand for electric vehicle charging infrastructure (EVCI) globally.

Despite challenges posed by the COVID-19 pandemic, the demand for electric vehicles has remained resilient, particularly in regions like Asia-Pacific and Europe, creating a positive outlook for the EVCI market. As economies continue to grow, governments are increasingly investing in electric vehicle projects, incentivizing both automakers and consumers to embrace electric mobility. This growth in electric vehicle adoption is expected to drive sales of electronic products like physical communication controllers, presenting opportunities for companies operating in the EV motor control sector.

In response to these trends, manufacturers are ramping up research and development efforts to innovate and introduce new products tailored to meet the evolving needs of the electric vehicle market. This strategic focus on product development and innovation reflects a commitment to capitalizing on the opportunities presented by the burgeoning electric vehicle industry, both now and in the future.

The global electric vehicle motor market is anticipated to grow from USD 24.58 billion in 2025 to USD 143.85 billion by 2034, with a compound annual growth rate (CAGR) of 21.69% during the forecast period from 2025 to 2034. The market is driven by the rapid penetration of electric vehicles (EV), government policies to promote EVs, and growing investment by automotive brands.

The electric vehicle motor market is experiencing rapid growth due to the rising adoption of electric vehicles globally. As governments implement stringent emission regulations and promote sustainable transportation, the demand for efficient and reliable electric motors for EVs is surging at a rapid pace. The increasing focus on reducing greenhouse gas emissions is driving further innovation in electric motor designs. These innovations include improvements in efficiency, power density, and thermal management.

Additionally, the push for high driving range and faster acceleration has spurred the development of high-performance electric motors, particularly in the luxury and high-performance EV segments. Countries such as China, the U.S., and Germany are adopting electric vehicles, fostering a strong market for EV motors. Furthermore, the integration of cutting-edge technologies such as AI and machine learning in motor control systems is expected to enhance the overall performance and efficiency of electric vehicles.

AI plays a crucial role in the electric vehicle motor market by enhancing motor performance, efficiency, and overall vehicle functionality. Advanced algorithms can help in managing torque, speed, and power output of EV motors that in turn ensures smooth and efficient operation across various driving conditions. AI-driven predictive maintenance systems can monitor motor health in real-time and enhances longevity of motors.

Despite a global downturn in car sales due to the COVID-19 pandemic, electric vehicle (EV) sales surged in China by 154% in 2021, indicating a growing preference for clean transportation among consumers. Chinese EV manufacturers sold 3.3 million cars in 2021, a significant increase from 1.3 million in 2020 and 1.2 million in 2019.

The new energy vehicle (NEV) industry in China is experiencing continuous growth driven by increasing demand, investments, infrastructure improvements, and supportive government policies. The Chinese government aims for 20% of all vehicles sold in the country to be electric by 2025, including promoting the use of NEVs in government fleets. This emphasis on electrification has spurred both startups and established players to innovate and develop new solutions, bolstered by government incentives aimed at promoting EV adoption and infrastructure development.

China has emerged as one of the world's largest electric car markets, with nearly 500 EV companies competing in the market. Government support, as outlined in the Made in China 2025 industrial plan, is backing domestic brands like Nio, Xpeng, and Li Auto to strengthen their presence in the industry. However, recent policy changes, such as the reduction and eventual elimination of subsidies announced by the Chinese Ministry of Finance in January 2022, could impact the EV business landscape.

Manufacturing companies are investing heavily in new technologies, particularly in the development of electric vehicle batteries and components. For instance, the completion of the second phase of the China Lithium Battery Wuhan Power Energy Storage Battery Production project in June 2022 underscores the country's commitment to advancing battery technology.

India is also witnessing a significant uptick in EV sales, with sales reaching 3,29,190 units in 2021, marking a remarkable 168% increase from the previous year. The government's initiatives, such as the National Electric Vehicle Mission Program (NEMMP) and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME I and II) schemes, have played a crucial role in stimulating interest and investment in the electric vehicle sector. These initiatives include substantial financial assistance for the deployment of electric buses, three-wheelers, passenger cars, and two-wheelers.

To further incentivize the domestic electric vehicle sector, the Indian government offers tax exemptions and subsidies to manufacturers and consumers. Additionally, liberalized policies, such as 100% foreign direct investment, support the establishment of new factories and the expansion of charging infrastructure.

As electric car sales continue to soar in India, automakers are ramping up investments in new technologies and expanding production capacity to meet the rising demand for clean energy vehicles. Furthermore, regulatory reforms and supportive government policies are driving further growth in the industry, positioning India as a key player in the global electric vehicle market.

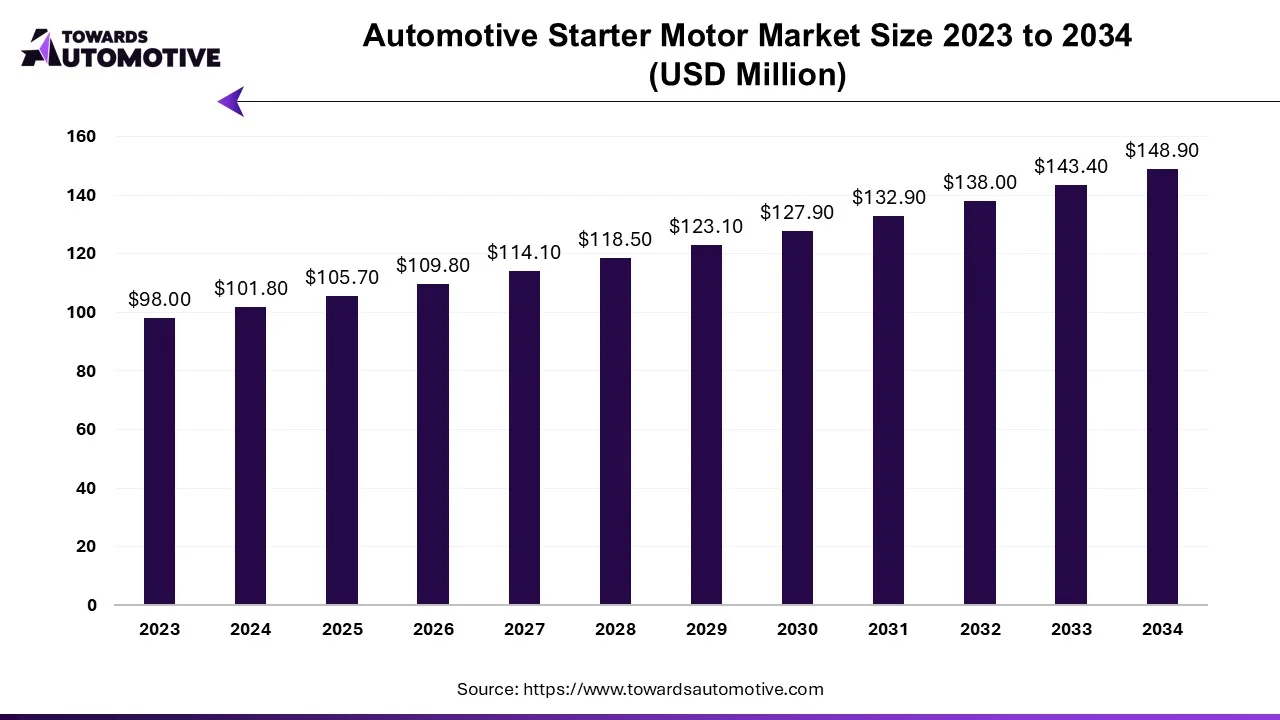

The automotive starter motor market is anticipated to grow from USD 105.7 million in 2025 to USD 148.9 million by 2034, with a compound annual growth rate (CAGR) of 3.9% during the forecast period from 2025 to 2034.

The automotive starter motor market is an integral branch of the automotive industry. This industry deals in manufacturing and distribution of starter motor for automotives. There are various types of motors developed in this industry comprising of electric motors, pneumatic motors and hydraulic motors. These motors consist of several components such as armature, starter drive gear, shift fork, return spring, solenoid, brush and some others. It is designed for diesel engines and petrol engines. The growing sales of passenger cars in different parts of the world has boosted the industrial expansion. This market is expected to rise significantly with the growth of the automotive components industry in different parts of the world.

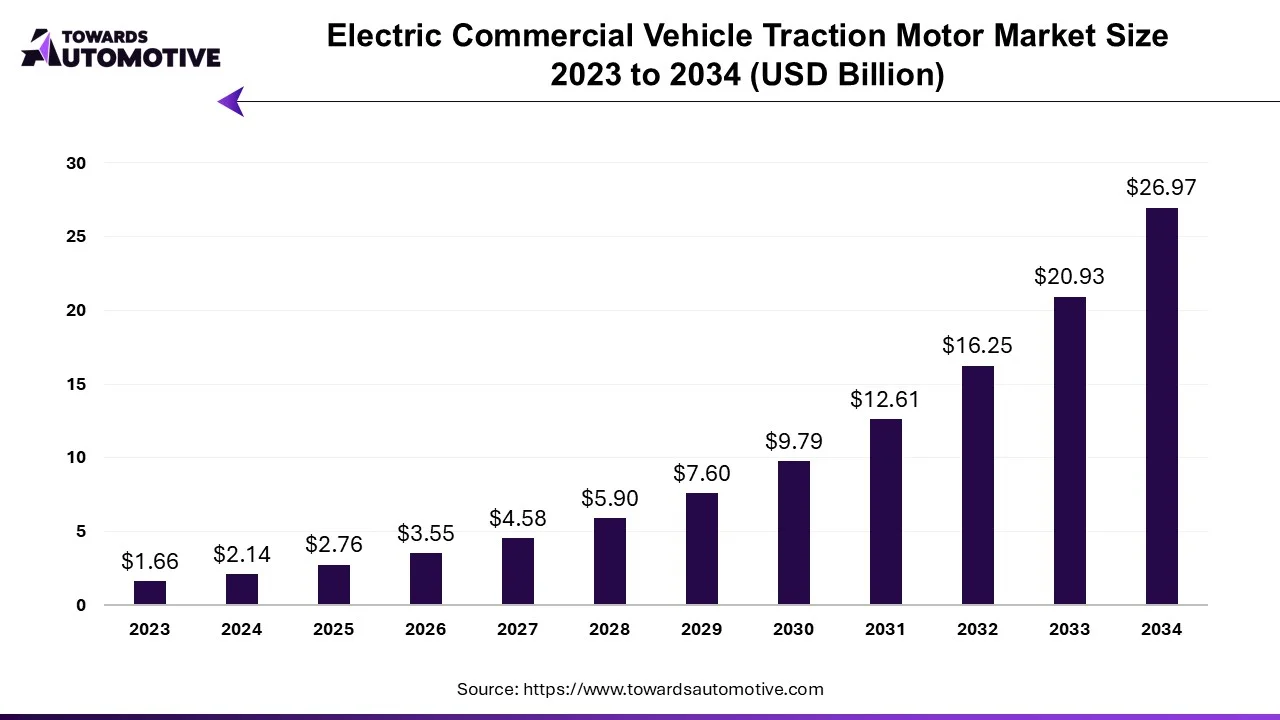

The electric commercial vehicle traction motor market is forecasted to expand from USD 2.76 billion in 2025 to USD 26.97 billion by 2034, growing at a CAGR of 28.84% from 2025 to 2034.

The electric commercial vehicle traction motor market is a prominent segment of the electric vehicle industry. This market deals in manufacturing and distribution of traction motors for commercial EVs. There are different types of traction motors developed in this sector consisting of permanent magnet synchronous motors, AC induction motors, DC traction motors and some others. These motors are designed for various types of vehicles including pickup trucks, trucks, vans, buses and some others. The growing sales of electric trucks in different parts of the world has boosted the market expansion. This market is expected to grow significantly with the rise of the automotive industry around the globe.

The electric vehicle communication management industry is characterized by consolidation and features. These companies play a significant role in driving market growth through their product innovations and technological advancements.

For Instance,

By Type

By Vehicle Type

By Propulsion Type

By Geography

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us