March 2025

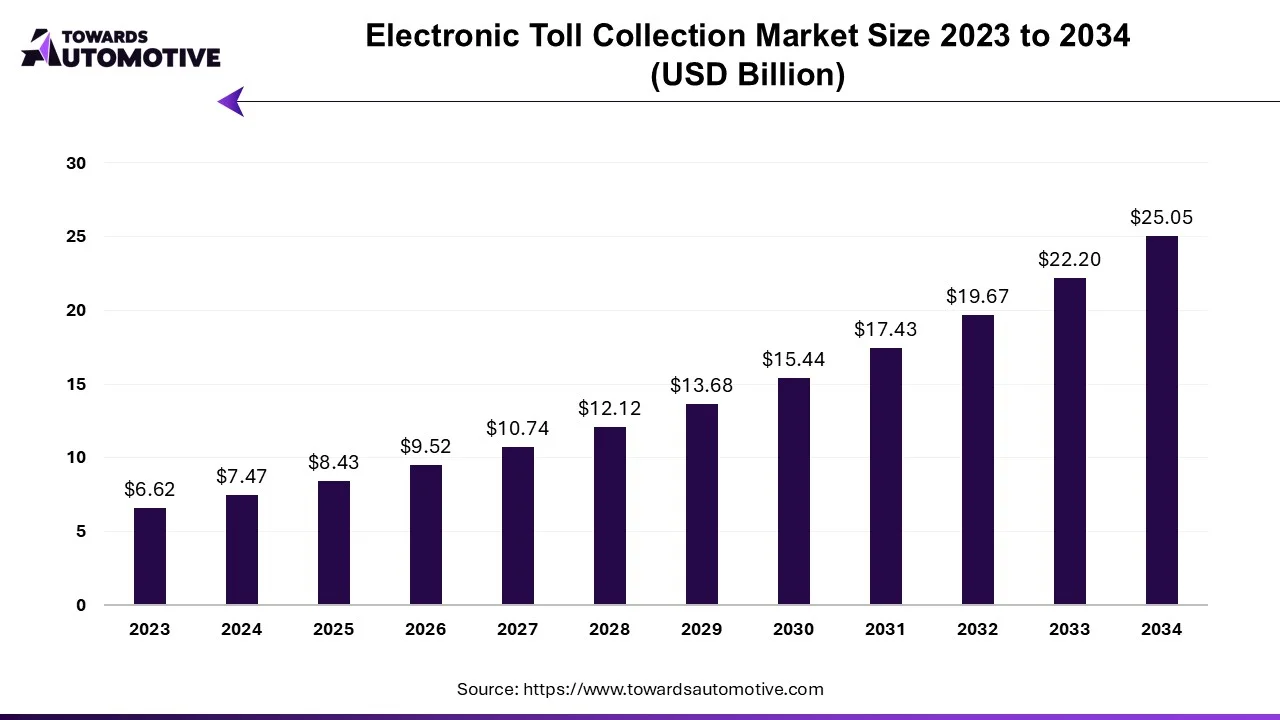

The electronic toll collection market is expected to increase from USD 8.43 billion in 2025 to USD 25.05 billion by 2034, growing at a CAGR of 12.86% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The European government's growing emphasis on electronic toll collection (ETC) is proving to be a significant catalyst for business expansion within the transportation sector. This strategic shift is driven by a multifaceted approach aimed at enhancing traffic management, alleviating congestion, and mitigating environmental impacts. Through various financial incentives, subsidies, and policy frameworks, governments across Europe are actively promoting the adoption of ETC systems among toll operators and vehicle owners alike.

These supportive measures are particularly evident in System 2 countries, where comprehensive agreements are being forged to streamline the invoicing process, diminish reliance on cash transactions, and enhance overall transportation efficiency. By incentivizing the adoption of electronic invoicing solutions, governments are not only fostering greater convenience for consumers but also paving the way for a more sustainable and technologically advanced transportation infrastructure.

In essence, the European government's concerted efforts to promote ETC reflect a strategic vision aimed at optimizing traffic flow, reducing environmental burdens, and fostering economic growth. By aligning regulatory frameworks with industry needs, policymakers are driving widespread acceptance of electronic toll collection solutions, thereby facilitating smoother and more efficient mobility across the region's transportation networks.

The burgeoning role of technology in the transportation sector has propelled the electronics market to unprecedented heights. With transportation systems evolving into increasingly digital and interconnected networks, electronic toll collection (ETC) systems have emerged as pivotal components, seamlessly integrating technologies like RFID, IoT, and artificial intelligence. These cutting-edge innovations not only offer mobile operators unparalleled convenience but also serve to optimize traffic flow and curtail operational expenses.

The integration of ETC systems with modern transportation infrastructure is catalyzing widespread adoption, thereby bolstering enterprise revenues. However, the implementation of such systems necessitates substantial investments in infrastructure, technology, and human capital. Moreover, the recurring costs associated with maintenance further compound the financial outlay.

To address these challenges, collaborative initiatives between governments and telecom operators, such as public-private partnerships, can offer a viable solution by leveraging shared financing models. Furthermore, ongoing technological advancements and streamlining of deployment processes hold promise for cost reduction over time, rendering ETC solutions more economically viable and sustainable in the long run.

The COVID-19 pandemic has cast a shadow over the electronics market, particularly impacting the electronic toll collection (ETC) sector. Travel restrictions and temporary closures of manufacturing facilities have disrupted the supply chain, resulting in delays in the production and delivery of ETC equipment. This has created significant challenges for both toll collectors and ETC service providers, leading to financial pressure and production woes.

To mitigate the future impact of such disruptions, proactive measures are essential. Strengthening supply chain resilience through diversification of suppliers and adoption of digital tools for remote monitoring and management can enhance agility and responsiveness. Investing in flexible production strategies that allow for rapid adjustments to changing demand patterns can help mitigate the risk of future disruptions. Additionally, fostering collaboration and information sharing among stakeholders in the ETC ecosystem can facilitate coordination and problem-solving in times of crisis. By adopting a proactive and collaborative approach, the ETC sector can better navigate future challenges and safeguard its resilience in the face of uncertainty.

The mobile banking sector is witnessing a significant shift towards contactless payments, driven by the growing preference for convenient and hygienic payment methods among consumers. Technologies such as RFID, QR codes, and smartphone-based electronic toll collection (ETC) solutions are emerging as popular choices for travelers, offering a seamless and contactless way to pay tolls without the need for cash or direct interaction with toll operators.

This trend has been accelerated by the COVID-19 pandemic, which has heightened concerns about hygiene and safety during transactions. Contactless payment options provided by ETC systems enable users to adhere to health and safety measures more effectively, minimizing the risk of virus transmission through physical contact with cash or toll booth equipment.

By embracing contactless payment technologies, ETC systems are not only addressing health concerns but also enhancing the overall user experience. These solutions offer travelers greater convenience, efficiency, and ease of use, contributing to a more seamless and streamlined toll payment process. As a result, ETC systems with secure and contactless payment options are gaining popularity, catering to the evolving needs and preferences of modern consumers in an increasingly digital and health-conscious world.

The distinction between electronic toll collection (ETC) and artificial intelligence (AI) signifies a significant evolution in the electronic tolling industry. While ETC primarily focuses on automating the toll collection process, AI technology revolutionizes the way tolling systems operate by introducing advanced data analysis capabilities and dynamic pricing mechanisms.

Automation, a key feature of ETC, plays a crucial role in streamlining the tolling process by minimizing the need for manual intervention and reducing associated labor costs. With ETC systems in place, toll collection becomes faster, more efficient, and less prone to errors, benefiting both toll operators and users alike.

On the other hand, AI technology enhances tolling systems by enabling instant data analysis and decision-making. By leveraging AI algorithms, tolling systems can analyze traffic conditions, time of day, vehicle type, and other relevant factors in real-time. This dynamic analysis allows tolling systems to implement variable pricing strategies, adjusting toll rates dynamically based on current traffic conditions and demand levels. As a result, AI-powered tolling systems can optimize traffic flow, alleviate congestion, and enhance overall operational efficiency, delivering a superior experience for both toll operators and users.

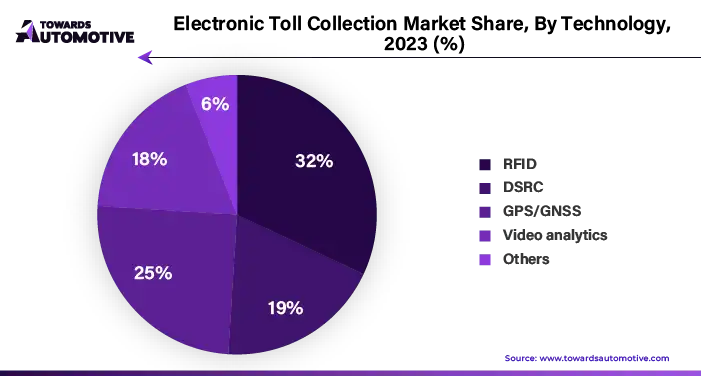

The RFID segment is poised to capture a significant portion, approximately 25%, of the electronic toll collection (ETC) market share by 2022, driven by various compelling factors. RFID technology addresses the increasing demand for convenient, contactless payment methods, offering an efficient solution for toll collection processes. With governments and tolling authorities worldwide striving to enhance infrastructure and promote cashless transactions, RFID's versatility and reliability have positioned it as the preferred choice for ETC systems.

One of the key advantages of RFID technology is its ability to provide seamless and hassle-free payment experiences for travelers. By utilizing a single RFID tag across multiple tolling points, users benefit from enhanced convenience and simplified tolling procedures. This interoperability not only streamlines the toll collection process but also contributes to a more user-centric approach to tolling services.

A notable example of RFID's growing adoption is the implementation of electronic toll collection on the Padma Bridge by the Korea Equality Corporation (KEC) in July 2023. Through this initiative, RFID-based tolling systems are installed at both ends of the bridge, automatically registering RFID tags as vehicles pass through. Such innovative deployments underscore the effectiveness of RFID technology in delivering seamless, cost-effective, and user-friendly tolling solutions.

As the demand for efficient and modern tolling systems continues to rise, RFID technology is expected to play a pivotal role in driving the expansion of the ETC market. Its ability to provide reliable, contactless payment options aligns well with evolving consumer preferences and the broader shift towards digitalization and cashless transactions in transportation infrastructure globally.

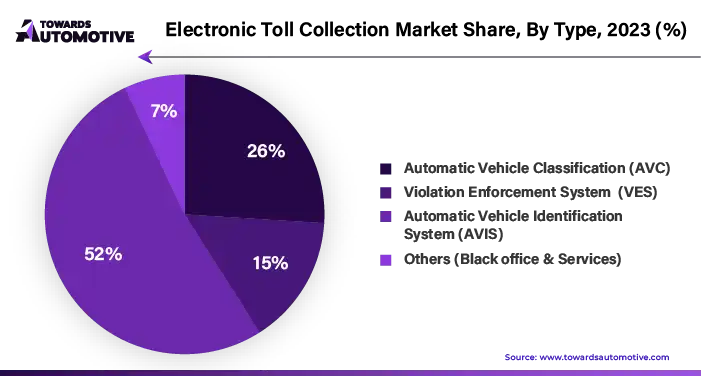

The automatic vehicle identification system (AVIS) market segment is poised to dominate the electronic toll collection (ETC) market, capturing over 45% of the market share by 2022. This remarkable growth is fueled by several key factors that underscore the significance of AVIS technology in modern transportation infrastructure.

One of the primary drivers behind the expansion of the AVIS market segment is its ability to enhance billing processes, reduce traffic congestion, and optimize operational costs. By leveraging automation and real-time data analysis capabilities, AVIS systems streamline toll collection procedures, leading to improved efficiency and resource utilization across tolling facilities.

Moreover, AVIS solutions play a crucial role in enhancing vehicle management and facilitating hands-free operations for drivers. With a growing emphasis on contactless and seamless transportation solutions, AVIS technologies offer a lightweight and user-friendly approach to addressing the complexities associated with daily travel requirements.

As the demand for efficient and modern tolling systems continues to rise, AVIS emerges as a key enabler of transformative advancements in transportation infrastructure. Its ability to deliver enhanced operational efficiency, cost-effectiveness, and user convenience positions AVIS as a cornerstone technology in the evolution of electronic toll collection systems worldwide.

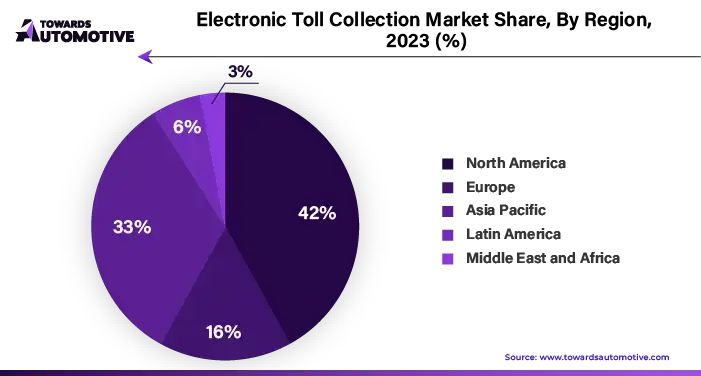

North America stands at the forefront of embracing cutting-edge solutions like RFID, AI-driven charging, and IoT sensors within the electronic toll collection (ETC) landscape. These technologies play a pivotal role in streamlining payment processes, slashing operational expenses, and enhancing overall cost-effectiveness. The region's unwavering commitment to smart city initiatives and robust infrastructure development aligns seamlessly with the integration of ETC systems aimed at optimizing traffic management and control.

A notable example illustrating this trend is the Digital Marchamo project initiated by the government of Costa Rica in May 2023. This groundbreaking initiative introduces RFID tags for vehicles as a modern alternative to traditional tax tags. These RFID cards serve as tangible proof of payment for annual road taxes while offering added functionalities such as toll-free access and parking fee management. By leveraging RFID technology, drivers and law enforcement agencies alike benefit from a streamlined and efficient solution that enhances compliance and reduces administrative burdens.

The adoption of such innovative ETC solutions underscores North America's proactive approach to leveraging technology for driving operational efficiencies and enhancing the overall transportation experience. As the region continues to spearhead advancements in smart mobility and infrastructure development, the integration of ETC systems will undoubtedly play a pivotal role in shaping the future of transportation across North America and beyond.

By Technology

By Type

By Payment Method

By Application

By Geography

March 2025

September 2024

February 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us