April 2025

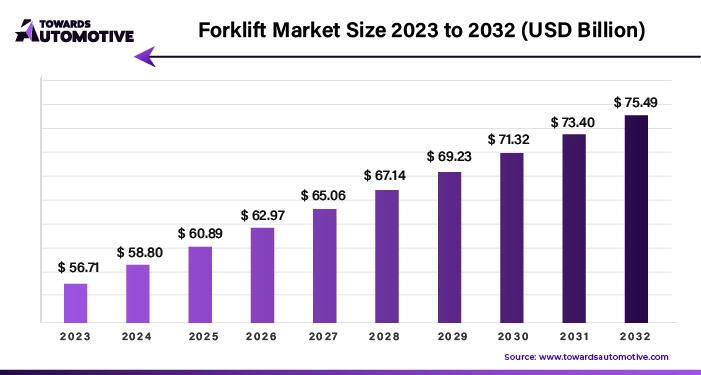

The forklift market is forecasted to expand from USD 60.43 billion in 2025 to USD 80.45 billion by 2034, growing at a CAGR of 3.23% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Over the medium term, the market anticipates steady growth as manufacturers adopt automation to enhance production capacity. Electric forklifts, in particular, are gaining traction as they streamline material handling processes, reducing physical labor and facilitating efficient movement of goods within warehouses and production facilities.

The burgeoning e-commerce and logistics sectors, especially in major economies like Europe, the United States, and China, are driving the demand for forklifts, emphasizing the critical role of distribution in today's market landscape. Recent technological advancements, including fleet management systems, connected vehicles, and Internet of Things (IoT) integration in forklifts, are further propelling the adoption of electric forklifts. Unlike traditional internal combustion engine forklifts, electric variants produce zero carbon dioxide and nitrogen oxide emissions, aligning with sustainability goals and contributing to the growth of the electric forklift market.

Moreover, industry players are ramping up their production capacities in response to the increasing demand for eco-friendly forklifts.

For Instance,

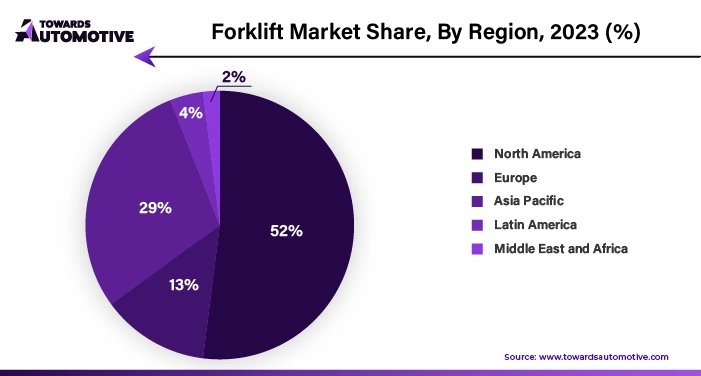

Asia Pacific is poised to dominate the forklift market, driven by robust demand from developed and emerging economies alike. The region's expanding market share, fueled by significant demand from countries like China and India, underscores its pivotal role in supporting overall market growth. With increasing emphasis on sustainability and technological innovation, the forklift market is poised for sustained expansion, catering to evolving customer needs and market dynamics.

The forklift market is witnessing remarkable growth propelled by the demand for cargo handling, moving, and lifting applications, alongside the expansion of e-commerce platforms. The adoption of electric forklifts across various industries further amplifies market growth. Technological advancements, such as the development of fast-charging batteries that minimize wear and tear while extending service life, are also contributing to the industry's expansion.

In 2021, global forklift sales reached approximately 2.1 million units, with fully electric vehicles (BEVs) comprising over half of all sales. Projections indicate that by 2030, global forklift sales will escalate to around 2.4 million units, with electric vehicles accounting for approximately 1.5 million units. According to the China Industrial Vehicle Association, China's forklift production is anticipated to exceed 80,000 units by 2030, with electric forklift sales surpassing household power tool sales.

The advantages of electric forklifts, such as eliminating on-site fuel storage and reducing pollution, have prompted companies to opt for electric vehicles, particularly for household tasks. Electric forklifts are extensively utilized on construction sites across North America, Europe, and Asia, driven by the surge in e-commerce, stringent energy standards, and infrastructure development projects. Nonetheless, in emerging markets, there remains a preference for internal combustion engine forklifts. Numerous companies are actively engaged in the development of electric forklifts, introducing new models to gain a competitive edge. For instance, in June 2022, Mitsubishi Logisnext unveiled the MX2 and MXL series of 4-wheel electro-pneumatic forklifts with capacities ranging from 5,000 to 7,000 pounds and 9,000 to 12,000 pounds.

Electric forklifts offer numerous advantages, including zero emissions, reduced noise levels, enhanced visibility, and more, compared to internal combustion counterparts. Consequently, electric forklifts are poised to dominate the market during the forecast period, with increased adoption across industries expected to drive sustained growth and market penetration.

North America emerges as a key sales hub in the global forklift market, fueled by robust demand and significant investments from renowned companies based in the United States. These industry leaders have allocated substantial resources towards replacing traditional forklifts with modern, advanced equipment, driving market growth.

Forklifts powered by alternative energy sources such as hydrogen are gaining traction worldwide, with governments in various regions offering incentives and implementing policies to support the industry's expansion.

In line with this trend, Hyster-Yale, spurred by Chicago government regulations promoting innovation, introduced two new products from its research and development division. Notably, the company unveiled its first balanced electric stacker equipped with a factory-integrated lithium-ion battery pack, reflecting a commitment to sustainable solutions and technological advancement.

The current administration in the United States prioritizes job creation, further boosting economic growth and property sales in the region. This dynamic environment positions North America as one of the fastest-growing regions in the forklift market.

For Instance,

Following North America, the Asia-Pacific region emerges as another significant market in terms of revenue during the forecast period. The rapid expansion of small and medium-sized businesses, coupled with the burgeoning e-commerce sector in countries such as India, Japan, and China, is expected to drive substantial demand for forklifts. This trend underscores the pivotal role of Asia-Pacific in shaping the global forklift market landscape, with opportunities for growth and market penetration abound.

For Instance,

By Power-train Type

By Vehicle Class

By End-user Vertical

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us