October 2025

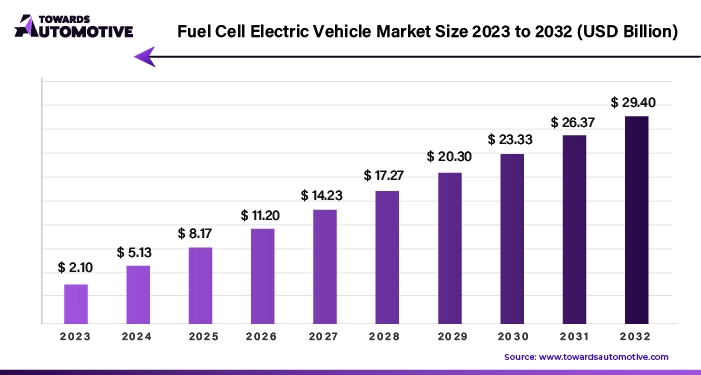

The fuel cell electric vehicle market is forecast to grow at a CAGR of 21.40%, from USD 3.09 billion in 2025 to USD 17.73 billion by 2034, over the forecast period from 2025 to 2034.

The challenges posed by climate change; renewable energy has emerged as a critical component of the global energy landscape. Governments worldwide are enacting favorable regulations, offering subsidies, and providing tax incentives to incentivize entrepreneurs to engage in renewable energy production. This concerted effort aims to stimulate investment in sustainable energy sources and drive economic growth.

Moreover, pollution reduction initiatives and stringent government regulations are pushing companies to curb carbon emissions and enhance vehicle fuel efficiency. As a result, manufacturers are increasingly turning their focus towards developing vehicles powered by Fuel Cell Electric Vehicles (FCEVs). These vehicles utilize hydrogen fuel cells to produce electricity, emitting only water vapor as a byproduct, thus offering a clean and environmentally friendly transportation solution.

Amidst this shift towards cleaner energy, electric vehicle charging infrastructure has become a focal point for major investors. Collaborating with governments, significant investments are being directed towards the establishment of charging stations, particularly hydrogen fuel cell stations, to support the growing fleet of FCEVs. Notably, initiatives such as California's $115 million investment plan to construct 111 new hydrogen fuel cell stations by 2027 underscore the commitment towards expanding the infrastructure for FCEVs.

Additionally, partnerships between companies like GreenCore and Loop Energy further demonstrate the collective efforts to advance hydrogen-powered transportation. By collaborating on the design and implementation of hydrogen-powered fast charging stations, these entities aim to alleviate concerns regarding charging infrastructure and enhance the accessibility of electric cars, thereby promoting their widespread adoption.

Overall, the convergence of government support, environmental imperatives, and private sector investments is driving momentum towards renewable energy adoption, particularly in the realm of hydrogen-powered transportation. These initiatives not only contribute to mitigating climate change but also foster economic growth and innovation in the renewable energy sector.

The cost of raw materials and production poses a significant challenge to the growth of the Fuel Cell Electric Vehicle (FCEV) market. The utilization of precious metals such as platinum and iridium as catalysts in the fuel cell process contributes to the high prices associated with FCEVs. These metals are essential components of fuel cell stacks, driving up manufacturing costs and consequently impacting the overall affordability of FCEVs.

The scarcity of well-established hydrogen fueling stations presents a barrier to the widespread adoption of FCEVs. The limited availability of refueling infrastructure hampers consumer confidence and adoption rates, as prospective buyers may be deterred by concerns over refueling convenience and accessibility.

Despite these challenges, ongoing efforts in infrastructure development and investments in renewable energy hold promise for the FCEV market. Governments and private sector entities are actively investing in expanding the hydrogen refueling network and enhancing infrastructure to support FCEVs. These initiatives aim to address the infrastructure gap and create a more conducive environment for FCEV adoption.

Advancements in fuel cell technology and manufacturing processes are driving down production costs, making FCEVs more economically viable in the long term. As the industry continues to innovate and scale up production, economies of scale and technological advancements are expected to contribute to cost reductions, further bolstering the growth prospects of the FCEV market.

While cost and infrastructure challenges persist, concerted efforts in infrastructure development, renewable energy investment, and technological innovation are poised to overcome these obstacles and propel the FCEV market towards sustainable growth in the foreseeable future.

Fuel cell vehicles offer several advantages over traditional electric vehicles, including lower maintenance costs, faster refueling times, extended driving range, and zero emissions during operation. These benefits make fuel cell technology an attractive option for addressing the challenges of climate change and air pollution while meeting the growing demand for sustainable transportation solutions.

As the automotive industry continues to explore alternative technologies to conventional gasoline-powered vehicles, entrepreneurs and industry players are venturing into new markets with the aim of driving transformative changes in technology and sustainability. This commitment to innovation and sustainability is expected to fuel the growth of the fuel cell vehicle segment in the coming years.

One notable example of industry innovation is the introduction of advanced hydrogen fuel cell technology by MG Motor India at the 2023 Auto Expo. This cutting-edge technology, designed for use in fuel cell passenger cars and other vehicle platforms, underscores the automotive industry's commitment to advancing hydrogen fuel cell technology and expanding the market for fuel cell vehicles.

By leveraging advancements in fuel cell technology and investing in research and development, automotive companies are positioning themselves to meet the growing demand for clean and efficient transportation solutions. As consumer awareness of environmental issues continues to grow, fuel cell vehicles are poised to play a significant role in shaping the future of sustainable mobility.

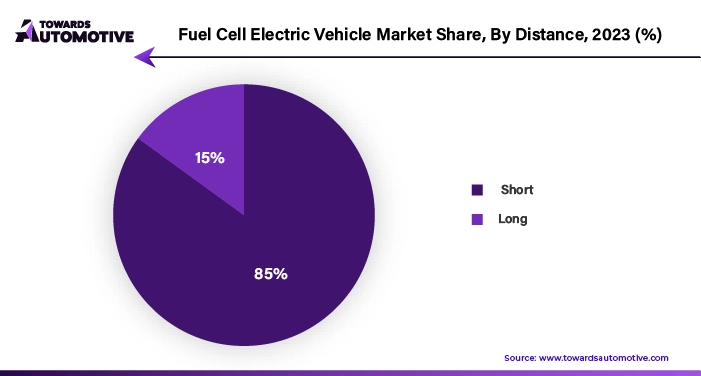

The longer range of hydrogen cars compared to electric vehicles (EVs) is a key advantage that appeals to consumers, particularly for those who require vehicles for longer trips or have concerns about range anxiety. Despite this, the increasing preference for EVs is notable, driven by factors such as their sleek design, user-friendly features, and minimal environmental impact. This shift in consumer behavior has also contributed to the popularity of electric two-wheelers and e-bikes, especially for short-distance travel, further bolstering the growth of the electric vehicle market.

The rise of electric vehicles and sustainable transportation solutions is expected to support economic growth, with projections indicating continued expansion in this sector until at least 2032. As advancements in battery technology and charging infrastructure continue to improve, electric vehicles are becoming increasingly competitive with traditional internal combustion engine vehicles. In fact, some forecasts suggest that the cost of operating electric vehicles could reach parity with diesel vehicles within the next eight years, further incentivizing the transition to electric mobility.

The evolving landscape of transportation, coupled with advancements in alternative fuel technologies, presents opportunities for economic growth and environmental sustainability. By embracing electric and hydrogen vehicles, consumers and industries alike can contribute to a cleaner, more efficient future for transportation while also stimulating economic development.

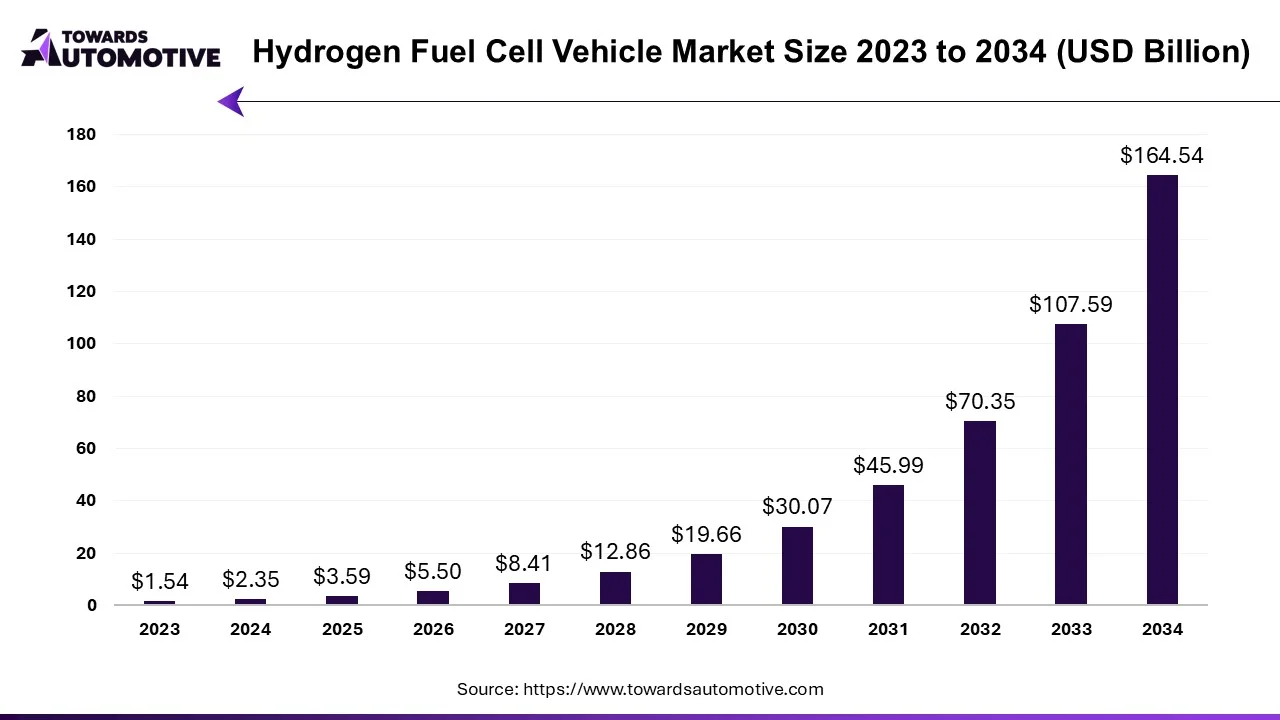

The hydrogen fuel cell vehicle market size is projected to reach USD 164.54 billion by 2034, growing from USD 3.59 billion in 2025, at a CAGR of 52.94% during the forecast period from 2025 to 2034.

The hydrogen fuel cell vehicle market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of vehicles that use hydrogen gas to power electric motors. There are several types of vehicles developed in this industry comprising of buses, LCVs, passenger cars and trucks. It has different components including air compressors, fuel processors, fuel stacks, humidifiers, power conditioners and some others. These vehicles are differentiated based on various operating miles such as 0-250 miles, 251-500 miles and above 500 miles. The rising awareness to reduce GHGs emission in the environment has contributed to the industrial development. This market is expected to rise significantly with the growth of the automotive technology sector across the world.

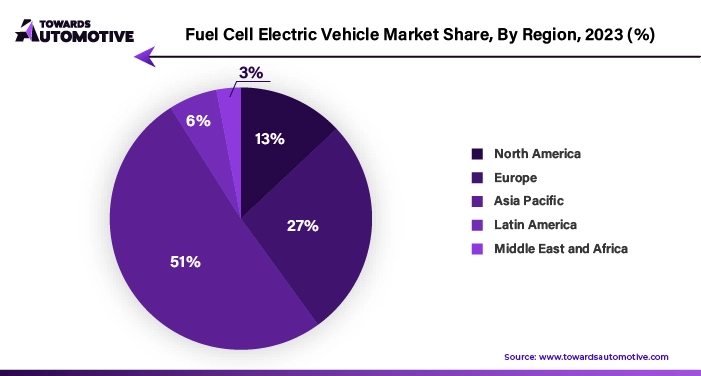

The Asia-Pacific region, particularly China and Japan, is poised to experience significant growth in the fuel cell electric vehicle (FCEV) market, driven by robust government initiatives aimed at promoting low-cost transportation solutions. In October 2020, the Chinese government unveiled incentives designed to bolster the country's position in hydrogen vehicle production, providing a strong impetus for the adoption of FCEVs. These incentives incentivize electric vehicle manufacturers to invest in and expand their hydrogen vehicle offerings, thereby stimulating growth in the FCEV market.

Automotive manufacturers in the region are actively embracing new technologies to revolutionize the automotive industry, with a particular focus on fuel cell electric vehicles and construction equipment. This technological innovation is driving advancements in the automotive sector, positioning the Asia-Pacific region as a key player in the global automotive market.

In February 2023, Honda Motor Co. and General Motors Co. announced plans to collaborate on the development of a new hydrogen fuel cell system, underscoring the region's commitment to promoting hydrogen-based transportation solutions. This partnership aims to advance the hydrogen business and accelerate the adoption of FCEVs, further solidifying the Asia-Pacific region's position as a leader in sustainable mobility.

The Asia-Pacific FCEV market stands to benefit significantly from government support, technological innovation, and strategic partnerships, paving the way for widespread adoption of fuel cell electric vehicles and driving sustainable growth in the automotive industry.

The COVID-19 pandemic has indeed had a profound impact on the transportation sector, including the global auto industry. Measures implemented to mitigate the spread of the virus, such as lockdowns and travel restrictions, have disrupted supply chains, production schedules, and consumer demand. This disruption has been particularly challenging for electric car manufacturers, as the industry continues to rely on subsidies and government support to stimulate demand and drive adoption.

Despite the challenges posed by the pandemic, the electric car industry has demonstrated resilience and continued to grow at a rapid pace. Automakers have adapted to the new operating environment and are actively preparing for a post-pandemic future. Governments worldwide have also played a crucial role in supporting businesses during these challenging times, providing financial assistance and implementing policies to bolster economic recovery.

Looking ahead, the electric car industry is poised for further growth as countries prioritize sustainable transportation solutions to address environmental concerns and reduce carbon emissions. With ongoing government support and technological advancements, electric vehicles are expected to play an increasingly prominent role in the global automotive market, driving innovation and shaping the future of transportation.

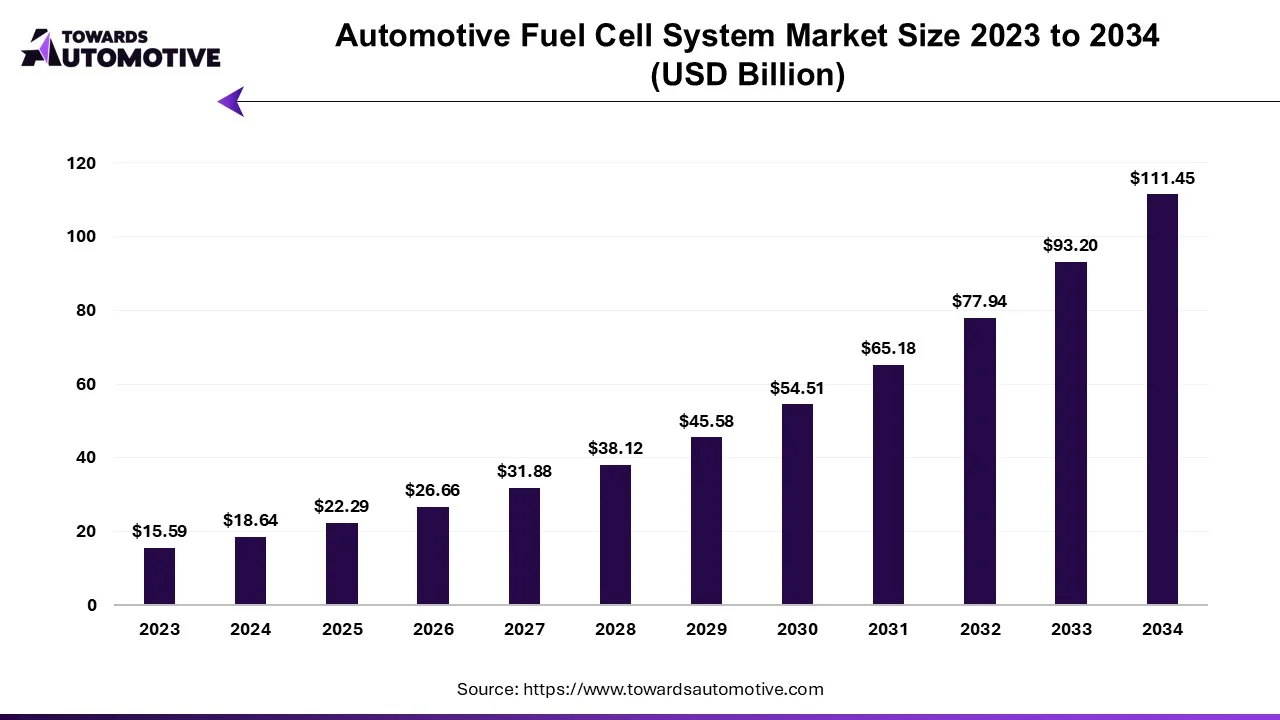

The global automotive fuel cell system market is predicted to expand from USD 22.29 billion in 2025 to USD 111.45 billion by 2034, growing at a CAGR of 19.58% during the forecast period from 2025 to 2034.

The automotive fuel cell system is a clean energy solution revolutionizing the transportation sector by offering an efficient and sustainable alternative to traditional internal combustion engines. It operates by converting hydrogen gas into electricity through an electrochemical process, producing only water and heat as byproducts. This makes fuel cell vehicles (FCVs) environmentally friendly, as they generate zero emissions while delivering long driving ranges and quick refueling times compared to battery electric vehicles (BEVs). The system typically consists of components such as a fuel cell stack, hydrogen storage tanks, and power electronics that work in synergy to provide seamless energy to the vehicle's motor. Increasing concerns over greenhouse gas emissions, rising fossil fuel prices, and global initiatives to curb air pollution have accelerated the adoption of automotive fuel cell technology.

Moreover, advancements in hydrogen production, storage, and refueling infrastructure are addressing key challenges in scaling up this technology. Automakers, including Toyota, Hyundai, and Honda, are spearheading the development of FCVs, driving innovation and market growth. With its potential to combine clean energy with high performance, the automotive fuel cell system is poised to play a pivotal role in achieving a carbon-neutral future in the global automotive industry.

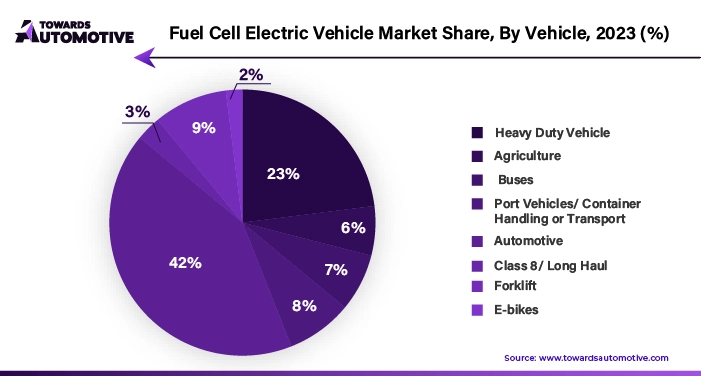

By Vehicle

By Distance

By Geography

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us