April 2025

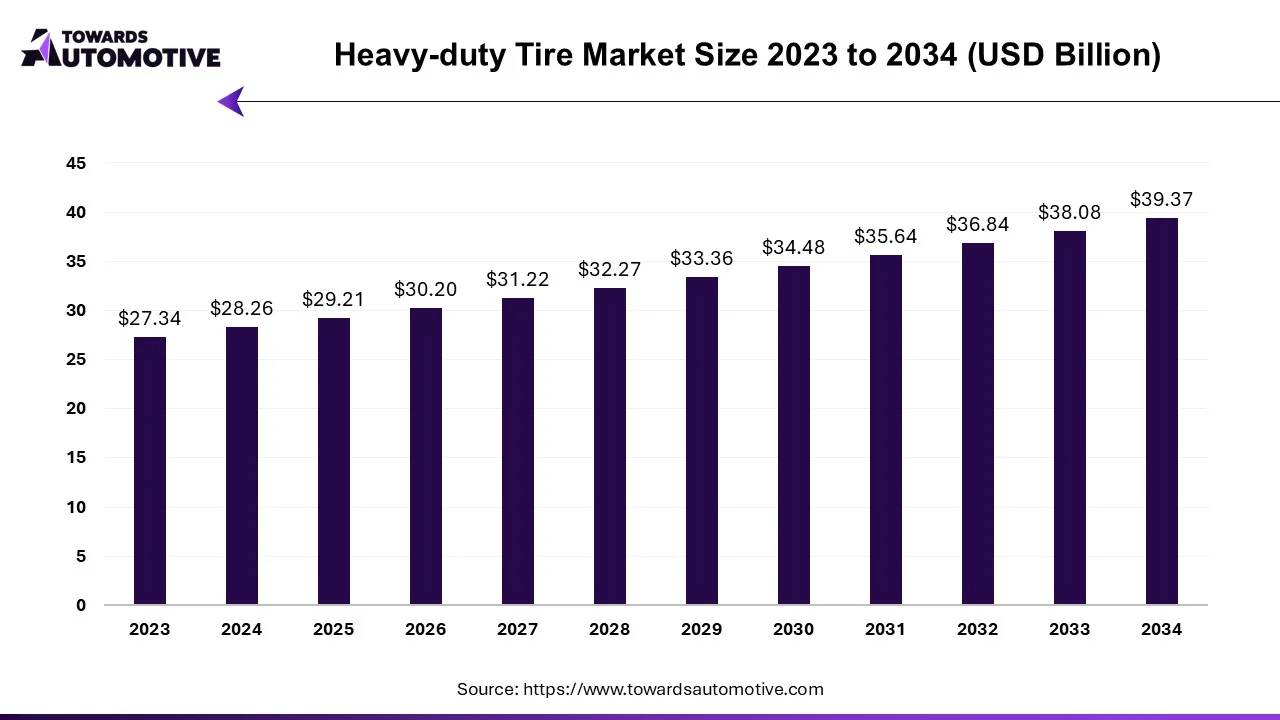

The heavy-duty tire market is anticipated to grow from USD 29.21 billion in 2025 to USD 39.37 billion by 2034, with a compound annual growth rate (CAGR) of 3.37% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The COVID-19 pandemic had a negative impact on the automotive market in the short term, resulting in a decline in new automobile production and sales in 2020. Transportation restrictions also led to reduced vehicle usage among owners, causing delays in tire repair or replacement. However, as automotive sales are expected to rebound significantly in the forecast period, the market is anticipated to recover, driven by a focus on new product development by market players.

Over the long term, the adoption of off-road vehicles in sectors such as construction, mining, and agriculture is expected to rise. This is driven by the increasing mechanization gap in developing countries and the growing number of civil and commercial construction projects, which generate parallel demand.

Fleet managers are increasingly turning to tire retreading for heavy-duty vehicles as part of cost-saving measures. Retreading offers significant savings compared to tire replacement, making it an attractive option for heavy truck businesses looking to reduce operating costs.

The demand for construction machinery such as cranes, wheel loaders, bulldozers, graders, excavators, telescopic loaders, forklifts, and excavators has increased in developed countries worldwide due to the recent rise in construction projects and expanded construction budgets over the past five years. This trend is driving growth in the Off-The-Road (OTR) tire market. Economic growth in both developed and developing countries, coupled with favorable financial conditions resulting from low interest rates, is expected to boost global economic development and stimulate investment in the construction market.

However, the heavy-duty tire market has experienced a decline over the past two to three years due to reduced usage of heavy-duty tires in industries such as compact trucks, skid steers, and backhoes. Nevertheless, the construction market is projected to grow by 5%, which will positively impact the heavy-duty tire market's growth during the forecast period. Furthermore, the market is expected to experience rapid expansion driven by economic development and increasing interest in agricultural technology. As fleet managers and operators seek to reduce operating costs, the demand for tire retreading services on these vehicles is increasing.

One of the primary drivers of economic growth is the expansion of the construction market, particularly in developing countries, driven by robust growth in both residential and non-residential sectors. This includes the rise in multifamily housing due to the proliferation of nuclear families, as well as increased investments in infrastructure such as roads, highways, smart cities, metros, and transportation networks to accommodate population growth and urbanization.

The advancement of automation is expected to further support business growth in the construction market. However, stringent regulations on construction machinery may hinder market growth.

Demand in the Asia-Pacific region, particularly in countries like India and ASEAN nations such as Malaysia, Indonesia, Vietnam, and Singapore, is on the rise due to increased construction activity and investments.

The construction market is highly dynamic, and factors such as the overall economy, financial conditions, and international trade significantly influence its growth. Changes in these areas can impact equipment production and rental businesses, leading to price fluctuations in new, used, and rental equipment.

The ASEAN region presents significant opportunities for the mechanical engineering sector. The rental equipment construction segment is expected to grow beyond 2020, driven by the approval of large-scale projects and changes in workforce dynamics.

After 2020, the construction market in ASEAN countries is projected to grow at a rate exceeding 6%, with the total value of major projects expected to reach US$2.9 trillion over the next five years. This includes significant investments in infrastructure development through initiatives such as Indonesia's National Medium-Term Development Plan, Vietnam's Economic Development Plan, and the Philippines' Build, Build, Build program, which involve both public and private investments.

In such scenarios, rental equipment often emerges as a more viable and profitable option for construction companies, helping them mitigate the impact of fluctuations in financial planning.

As the market continues to evolve and emissions standards become stricter, companies face challenges in providing compliant systems at affordable prices.

The construction sector remains the most promising, followed by construction and real estate, driven by the growth of the rental market and increasing employment indices. Additionally, strong government incentives for real estate investment in cities like Sydney and Melbourne are boosting housing and residential development.

Therefore, given these developments, the education market is expected to grow at a steady and gradual pace.

The global heavy-duty vehicle market is predominantly controlled by key market players such as Bridgestone Corporation, Michelin, Titan International, Trelleborg Wheel Systems, Balkrishna Industries Limited, and Continental AG. Collectively, these prominent international corporations hold a significant share of over 40% in the market. The trajectory of market growth is frequently shaped by the innovative endeavors spearheaded by these market leaders.

Illustratively, Continental unveiled its LD-Master L5 Traction OTR tire in September 2022. Engineered to endure challenging operating conditions, this new LD-Master L5 Traction radial tire incorporates cutting-edge tire sensor technology. Featuring an L5 traction tread design, it delivers superior traction while ensuring a smooth and safe working environment. The tire's robust tread blocks guarantee a consistent ride quality, while its deep tread pattern and sidewall protection enhance stability and durability.

In August 2022, Michelin North America unveiled the Michelin X Mine D2 Extra Load L5 35/65R33 tire, an upgraded iteration of one of the company's most sought-after mining truck tires. Tailored for quarry and underground mining operations, the new tire is engineered to endure the most challenging mining conditions and is now capable of bearing heavier loads during transportation, as per the company's statement.

May 2022 witnessed JK Tire & Industries introducing four new products in the off-road tire market. Among them, the 45/65-45 58PR VEM 63 L5 TL stands out. Additionally, the lineup includes the 14.00 to 24 GTL Champion 16 PR G3 TT, the Hard Rock Champion 20PR E4 TT from 19 mph to 24 mph, and the VEM 045 44PR E3 TT from 26 mph to 25 mph. These new tires have been enhanced to offer improved stability, extended tread life, and a durable tread compound that resists wear and tear for prolonged service life.

March 2022 saw BKT introducing the new size 875/65 R 29 L-5 for the EARTHMAX SR 51 OTR (off-road tire) series. Specifically designed for wheel loaders operating in rugged environments like quarries and landfills, the new 65 Series tires boast a cut-resistant, deep L-5 tread that provides exceptional cut and anti-slip protection, ensuring longer wear life, according to the company's announcement.

Heavy-duty tires are exclusively designed for specific heavy-duty application equipment. These machines are deployed across various sectors, including construction, mining, industrial, agriculture, and forestry. Operating in rugged environments to build critical infrastructure, these vehicles demand tires capable of enduring high loads.

By Vehicle Type

By End-user Type

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us