April 2025

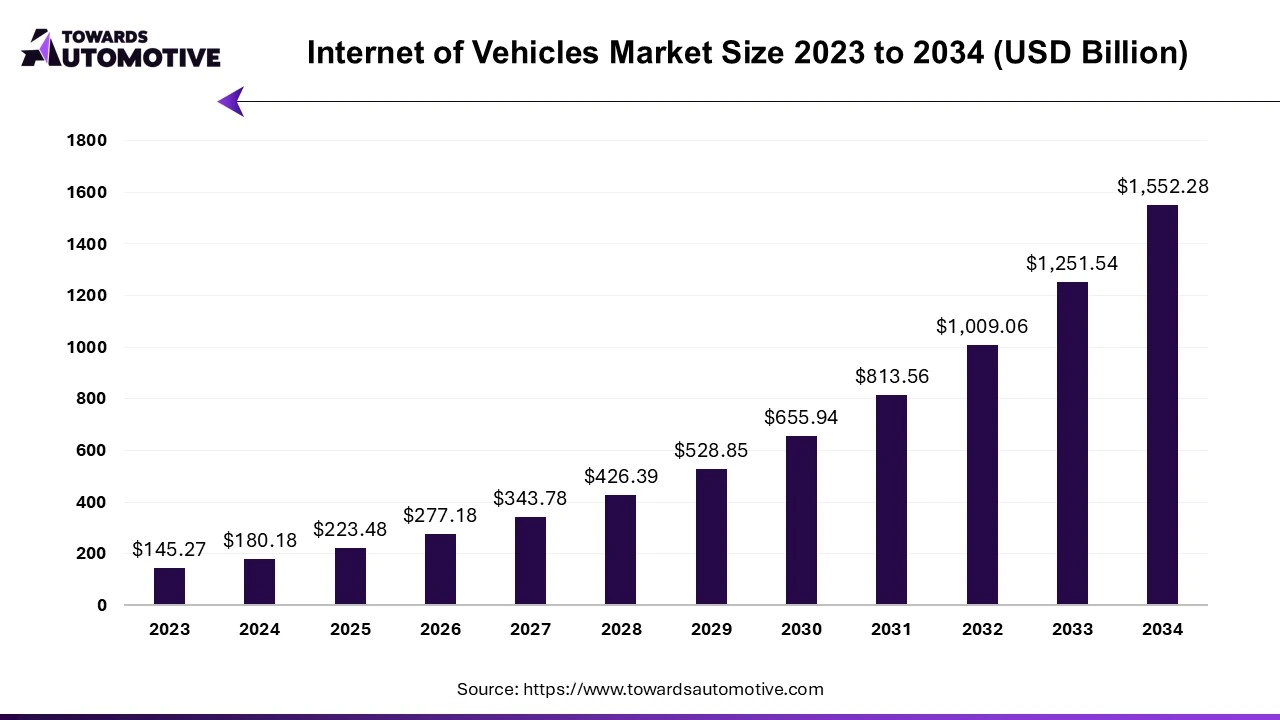

The internet of vehicles market is forecasted to expand from USD 223.48 billion in 2025 to USD 1552.28 billion by 2034, growing at a CAGR of 24.03% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

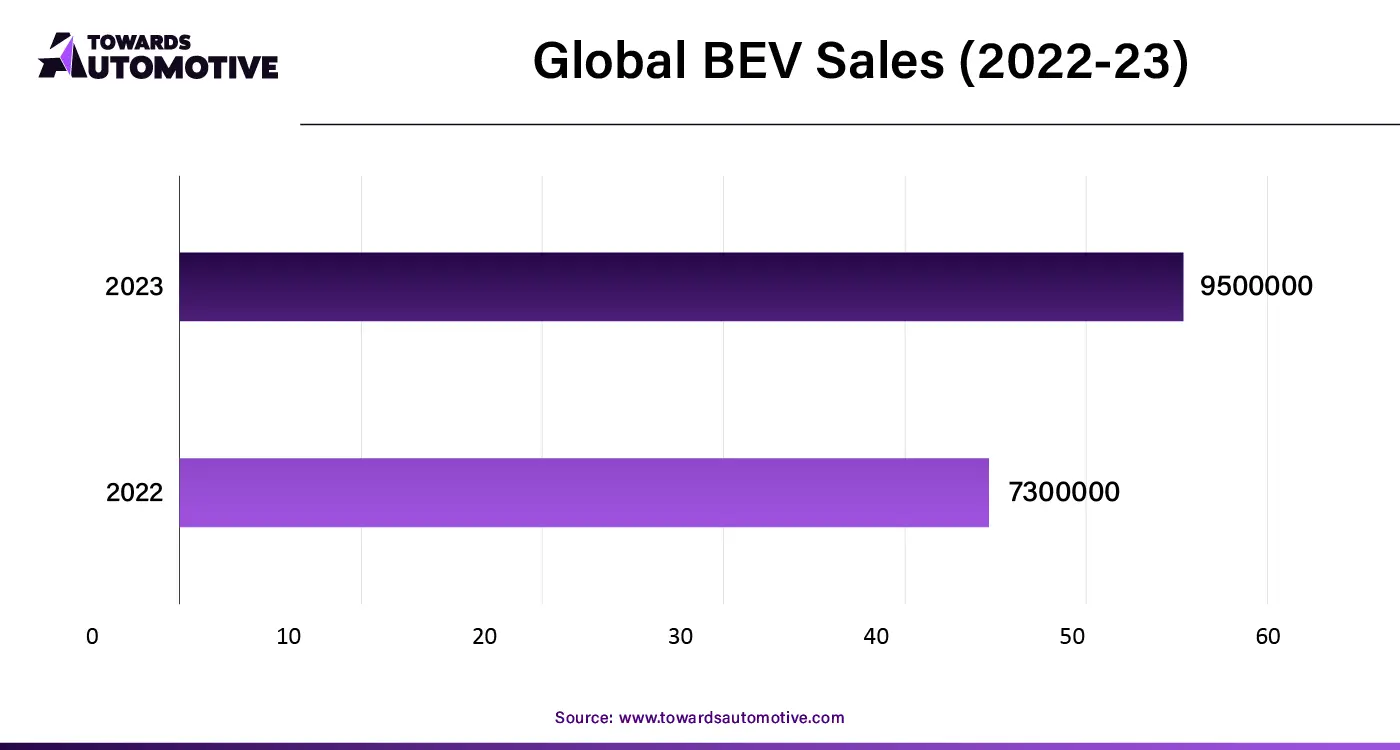

The internet of vehicles market is a prominent sector of the automotive technology industry. This industry deals in developing internet-based solutions for enhancing automotive communication. There are several communication solutions provided by this industry comprising of Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Vehicle-to-Pedestrian (V2P), Vehicle-to-Cloud (V2C) and some others. It includes several components including hardware, software and services. There are numerous applications of this sector consisting of fleet management, autonomous driving, traffic management, infotainment & connected services, predictive maintenance and others. The growing adoption of electric vehicles around the world has boosted the industrial expansion. This market is expected to grow significantly with the rise in the telecom sector across the world.

In November 2024, Kevin Cohen, the VP of Direct to Device Partnerships at Viasat announced that,” With a longstanding history in providing critical safety services in the air and at sea, and our continued innovation on direct-to-device connectivity, joining the 5GAA is a natural fit for Viasat. By utilizing already licensed L-band spectrum for mobile satellite services, vehicles could roam between space and ground network connectivity, With satellites helping to power a unified connectivity ecosystem, vehicles could automatically and autonomously work with each other and central management platforms to operate more safely, sustainably, and efficiently.”

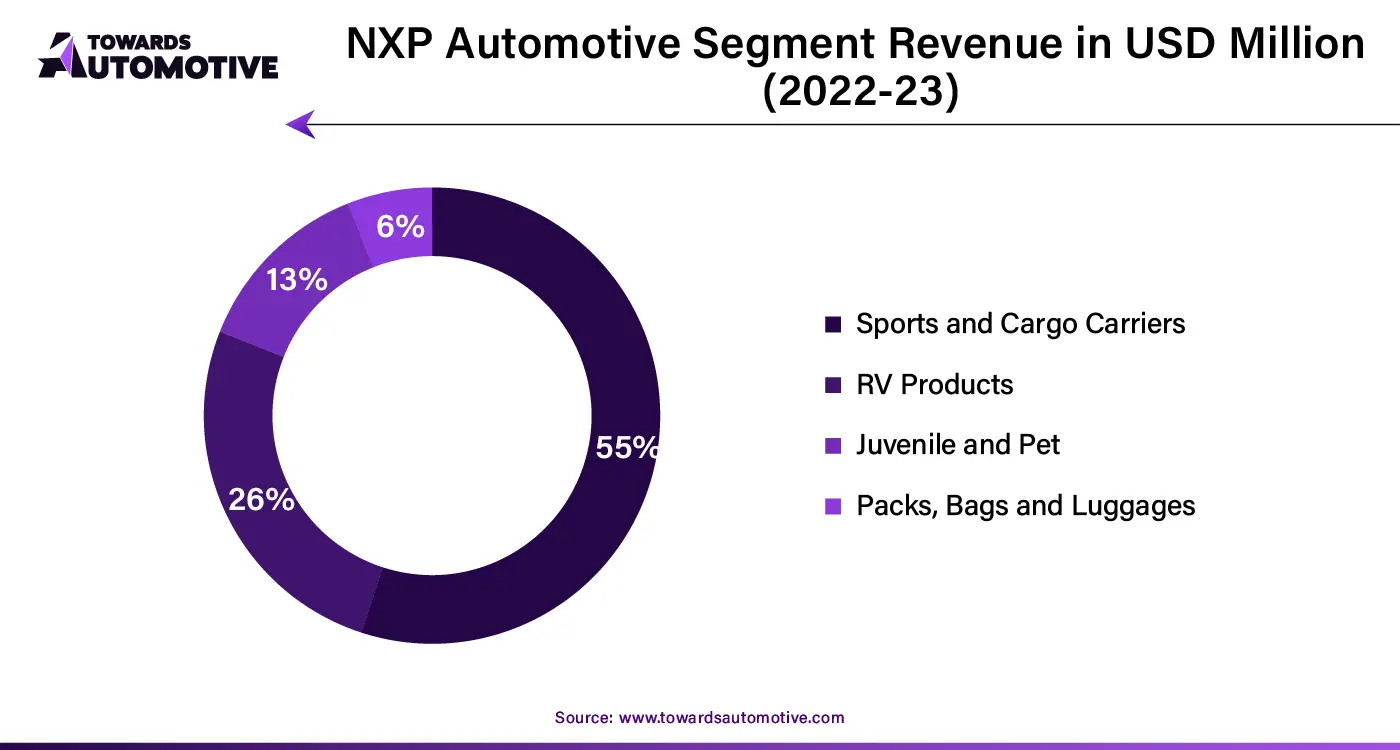

The internet of vehicles market is a highly competitive industry with the presence of various dominant players. Some of the prominent companies ruling this industry comprises of Cisco System, Inc. NXP Semiconductors (Netherlands), Intel Corporation (U.S.), IBM Corporation (U.S.), Google LLC (U.S.), (U.S.), Volkswagen (Germany), Ford Motor Company (U.S.), Veniam (U.S.) and some others. These market players are constantly engaged in providing superior communication solutions for automotives and adopting several strategies to sustain their dominant position in this industry.

By Solution

By Networking Technology

By Communication Type

By Region

April 2025

March 2025

March 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us