February 2025

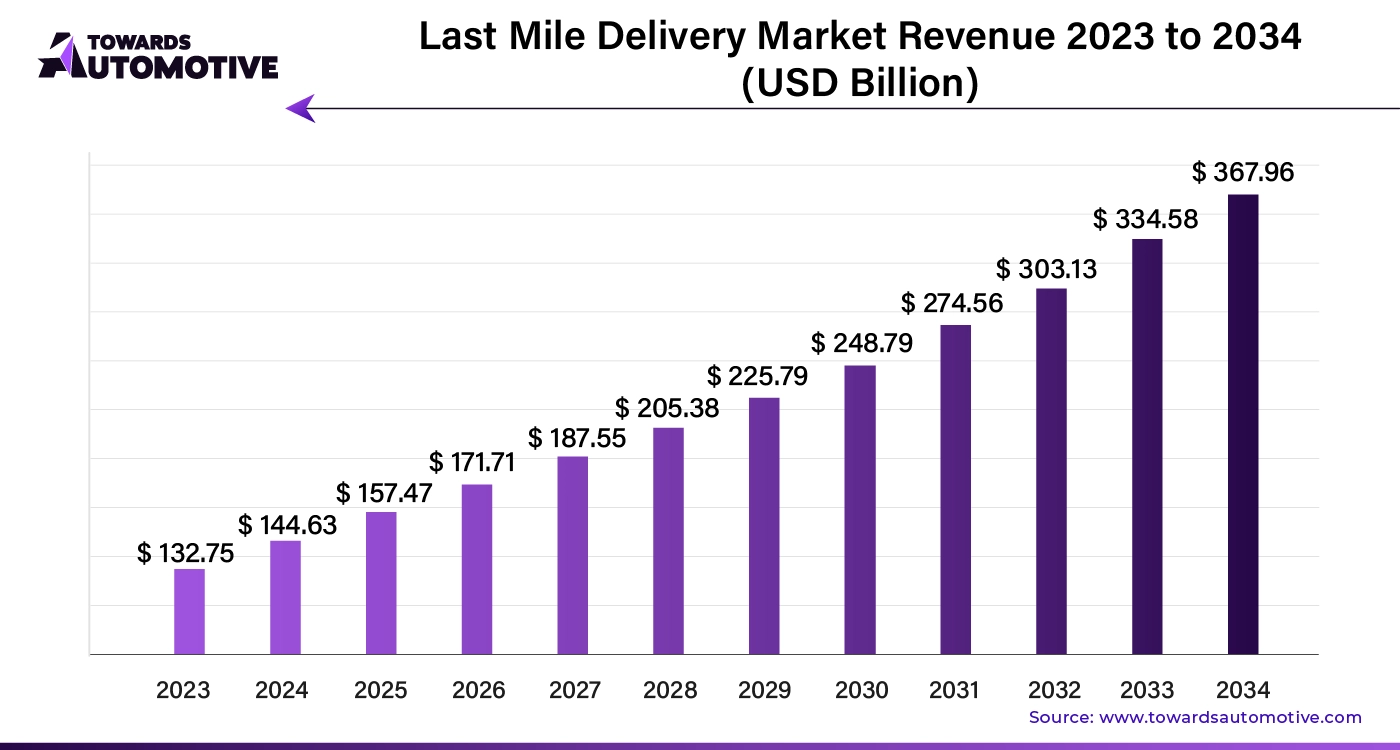

The global last mile delivery market size is calculated at USD 144.63 billion in 2024 and is expected to be worth USD 367.96 billion by 2034, expanding at a CAGR of 8.84% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The last mile delivery market has gained significant attention as e-commerce and digital retailing continue to grow. Last mile delivery refers to the final stage of a product’s journey from a transportation hub to the customer's doorstep. This segment of the supply chain is crucial for ensuring customer satisfaction, as it directly impacts delivery speed, reliability, and cost. Factors such as urbanization, rising consumer expectations for faster deliveries, and the demand for real-time tracking have intensified the focus on last mile logistics.

Additionally, the rapid adoption of technology-driven solutions like drones, autonomous vehicles, and route optimization software is revolutionizing this market. With increasing pressure to reduce carbon footprints, companies are also exploring eco-friendly delivery options. As a result, the last mile delivery market is becoming a critical area for innovation and competition, shaping the future of logistics and distribution networks across various industries.

AI is playing a transformative role in the last mile delivery market, addressing the complexities of this critical phase in the supply chain. One of its primary functions is optimizing delivery routes. AI algorithms process data on traffic, weather, and order volumes to generate the most efficient routes for drivers, reducing fuel consumption, delivery times, and operational costs. This is particularly important in urban environments where congestion is high, and timely deliveries are essential.

Another significant role of AI is in predictive analytics and demand forecasting. By analyzing historical delivery data and customer behavior, AI can predict future demand patterns and optimize resource allocation accordingly. This helps companies to better plan their delivery fleets and staffing levels, ensuring smoother operations during peak periods such as holidays or sales events.

AI also enhances customer experience through real-time tracking and dynamic delivery updates. Machine learning models can predict delays due to unforeseen circumstances, allowing companies to communicate accurate delivery times and resolve issues proactively. This improves customer satisfaction by offering greater transparency and reliability.

Automation is another area where AI shines, especially in the use of autonomous delivery systems like drones and self-driving vehicles. These AI-powered solutions aim to reduce labor costs and expedite deliveries, particularly for last mile services in congested or hard-to-reach areas.

Lastly, AI improves warehouse efficiency, from inventory management to order fulfillment, ensuring products are packed and dispatched with minimal delays. In sum, AI is revolutionizing last mile delivery, making it faster, more efficient, and customer-focused.

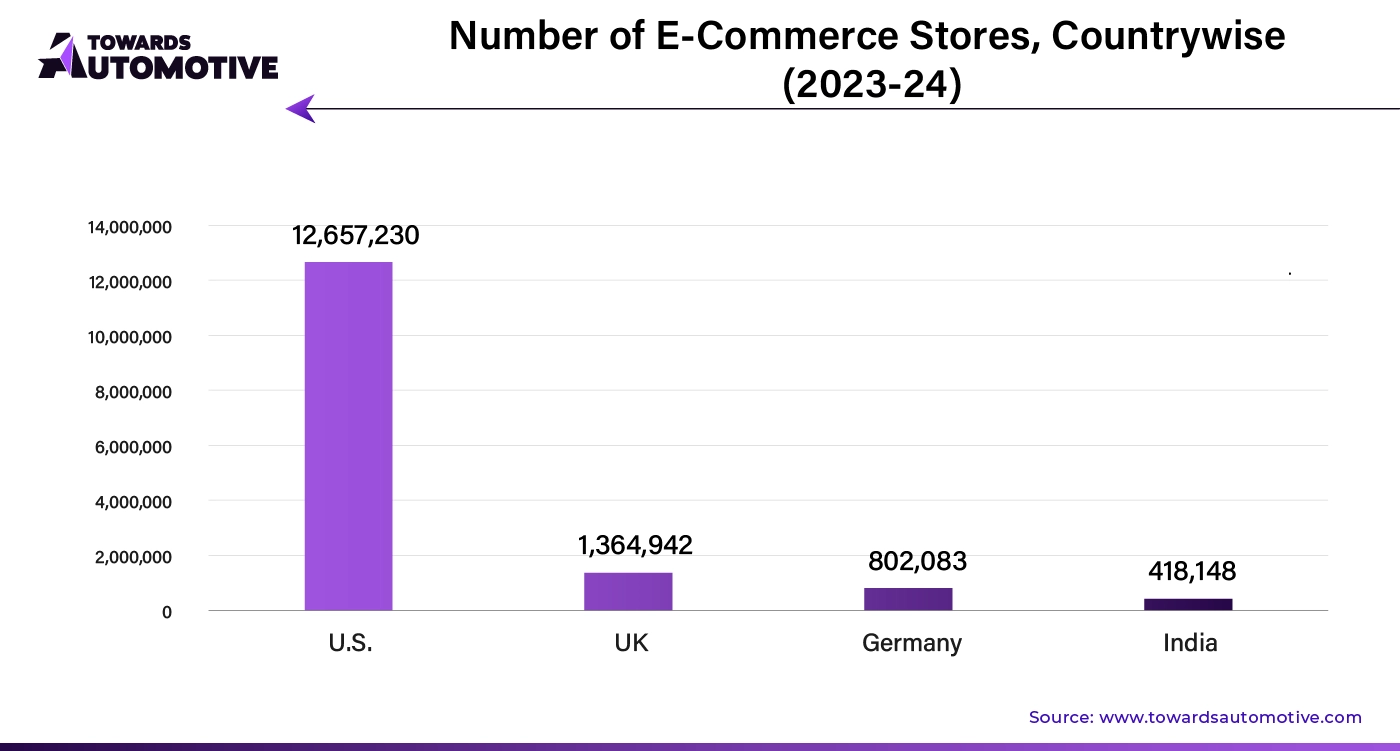

The rise of e-commerce platforms has been a key driver of growth in the last mile delivery market. As more consumers shift towards online shopping, the demand for efficient and timely delivery services has skyrocketed. E-commerce has created the need for a robust logistics infrastructure to handle the increasing volume of small, individual packages that need to be delivered directly to customers’ homes or offices. This surge in delivery volumes has placed last mile logistics at the forefront of supply chain innovations.

E-commerce platforms often promise quick delivery times, such as same-day or next-day delivery, which has intensified the need for optimized last mile delivery solutions. Companies must invest in technologies and strategies to meet these expectations, such as route optimization software, fleet management systems, and real-time tracking capabilities. Additionally, e-commerce growth has driven innovation in alternative delivery methods like drones, autonomous vehicles, and parcel lockers, all aimed at enhancing delivery speed and efficiency.

The shift toward online retail also extends to rural and suburban areas, increasing the complexity and cost of last mile delivery. This has led to a focus on reducing delivery costs through AI, automation, and crowd-sourced delivery networks. As e-commerce continues to expand globally, the last mile delivery market is evolving to meet the demands of fast, cost-effective, and reliable deliveries, fueling its growth.

The last mile delivery market faces several restraints, including high operational costs driven by inefficient routes, fuel consumption, and labor expenses. Urban congestion and traffic delays further hinder timely deliveries, while meeting rising consumer expectations for fast, low-cost services adds pressure. Additionally, the environmental impact of increased deliveries is a growing concern, pushing companies to invest in costly eco-friendly solutions. Lastly, logistical challenges in rural or hard-to-reach areas make it difficult to maintain consistent service quality and profitability.

Drones are creating significant opportunities in the last mile delivery market by offering faster, more efficient, and cost-effective solutions for transporting goods. With the ability to bypass traffic and direct road routes, drones can significantly reduce delivery times, particularly in densely populated urban areas and remote locations where traditional delivery vehicles face logistical challenges. This speed advantage helps meet the growing consumer demand for same-day or even same-hour deliveries, enhancing customer satisfaction and brand loyalty.

Moreover, drones offer cost savings by reducing the need for human labor, fuel consumption, and vehicle maintenance. For companies, this translates into lower operational costs, which can be particularly valuable during high-demand periods such as holidays or major sales events. Drones also create opportunities for companies to expand their delivery networks into previously underserved or hard-to-reach areas, including rural regions where delivery routes are often inefficient and expensive.

Drones are also contributing to sustainability in last mile delivery. Powered by electric energy, they offer an eco-friendly alternative to traditional delivery vehicles, helping companies reduce their carbon footprint and align with growing environmental concerns. As regulations around drone deliveries evolve and technology becomes more advanced, drones are expected to play an increasingly important role in revolutionizing last mile logistics, opening up new opportunities for growth and innovation.

The B2C segment dominated the market. The B2C (business-to-consumer) segment is a major driver of growth in the last mile delivery market, fueled by the rapid rise of e-commerce and online retail. As consumers increasingly shop online for everything from groceries to electronics, the demand for efficient, reliable, and fast delivery services has surged. This shift in consumer behavior is placing immense pressure on businesses to streamline their last mile logistics, as the final stage of delivery is critical in shaping the overall customer experience. Companies are responding by investing heavily in optimizing last mile delivery operations, leading to significant growth in the market.

B2C deliveries, especially in urban areas, are characterized by high delivery volumes and small order sizes, which create challenges for efficiency and cost management. However, this has spurred innovations such as micro-fulfillment centers and crowd-sourced delivery models, where gig workers or local couriers are utilized to handle last mile deliveries at a lower cost. These approaches help businesses scale their operations, even during peak periods, while maintaining fast and reliable service.

Furthermore, the B2C segment’s emphasis on customer satisfaction is encouraging companies to focus on sustainability, with many adopting electric vehicles and eco-friendly packaging to meet consumer expectations for environmentally conscious practices. As the B2C segment continues to grow, it will remain a key driver of innovation and expansion in the last mile delivery market, reshaping logistics strategies worldwide.

The non-autonomous segment held the largest share of the market. The non-autonomous segment continues to drive significant growth in the last mile delivery market, particularly through its ability to handle complex logistical challenges with a high level of flexibility. Despite the rising interest in autonomous delivery systems like drones and robots, non-autonomous methods—primarily involving human-driven vehicles and manual labor—remain the dominant force in last mile logistics. This segment is highly adaptable to varying environments, such as congested urban areas, rural locations, or regions with difficult terrains, where autonomous technologies may not yet be fully feasible or cost-effective.

Human-driven delivery vehicles, whether trucks, vans, or bikes, are still essential in managing the high volume of packages generated by the booming e-commerce sector. Their ability to make multiple deliveries efficiently, adjust to real-time changes such as traffic or weather conditions, and provide personalized customer service, makes them indispensable. Additionally, non-autonomous deliveries offer more customization options, such as in-person signature collections or special handling for fragile goods, further meeting the diverse needs of consumers.

One of the main ways the non-autonomous segment drives market growth is through innovations in route optimization and fleet management technologies. Companies are leveraging advanced software solutions to help drivers navigate more efficiently, reducing delivery times and operational costs. These tools enhance the effectiveness of human-driven delivery, enabling businesses to scale their operations while maintaining a high level of service.

While autonomous delivery solutions are evolving, the non-autonomous segment continues to dominate the last mile delivery market by offering flexibility, scalability, and reliability, driving sustained growth in the sector.

The retail & e-commerce segment held the dominant share of the market. The retail and e-commerce segment is a key driver of growth in the last mile delivery market, fueled by the increasing consumer demand for fast, convenient, and reliable delivery services. As online shopping becomes more prevalent, particularly in sectors such as fashion, electronics, and groceries, the need for efficient last mile logistics has surged. Retailers and e-commerce platforms are investing heavily in enhancing their delivery capabilities to meet customer expectations for quick deliveries, often offering same-day, next-day, or even two-hour delivery options. This acceleration in delivery speeds is pushing the growth of the last mile delivery market as companies race to build competitive advantages in service efficiency.

The rapid growth of e-commerce has increased the volume of packages needing to be delivered directly to consumers, particularly in urban areas where online shopping is highly concentrated. This rise in delivery volume has created challenges related to congestion, time-sensitive deliveries, and cost management. To address these challenges, companies are adopting advanced technologies such as route optimization software, real-time tracking systems, and automated warehousing solutions. These innovations improve delivery efficiency, helping businesses manage high order volumes while controlling operational costs.

Moreover, the shift toward omnichannel retailing, where customers can purchase online and pick up in-store or have items delivered, has further expanded the need for last mile delivery solutions. Retailers are increasingly using micro-fulfillment centers and localized distribution hubs to ensure faster delivery times, creating new opportunities for growth in the market. Additionally, the retail and e-commerce segment is driving the adoption of alternative delivery methods, such as smart lockers and parcel collection points, which offer greater convenience for consumers and reduce the burden on last mile delivery networks.

As online retail continues to expand globally, the retail and e-commerce segment will remain a critical force in shaping and driving the growth of the last mile delivery market.

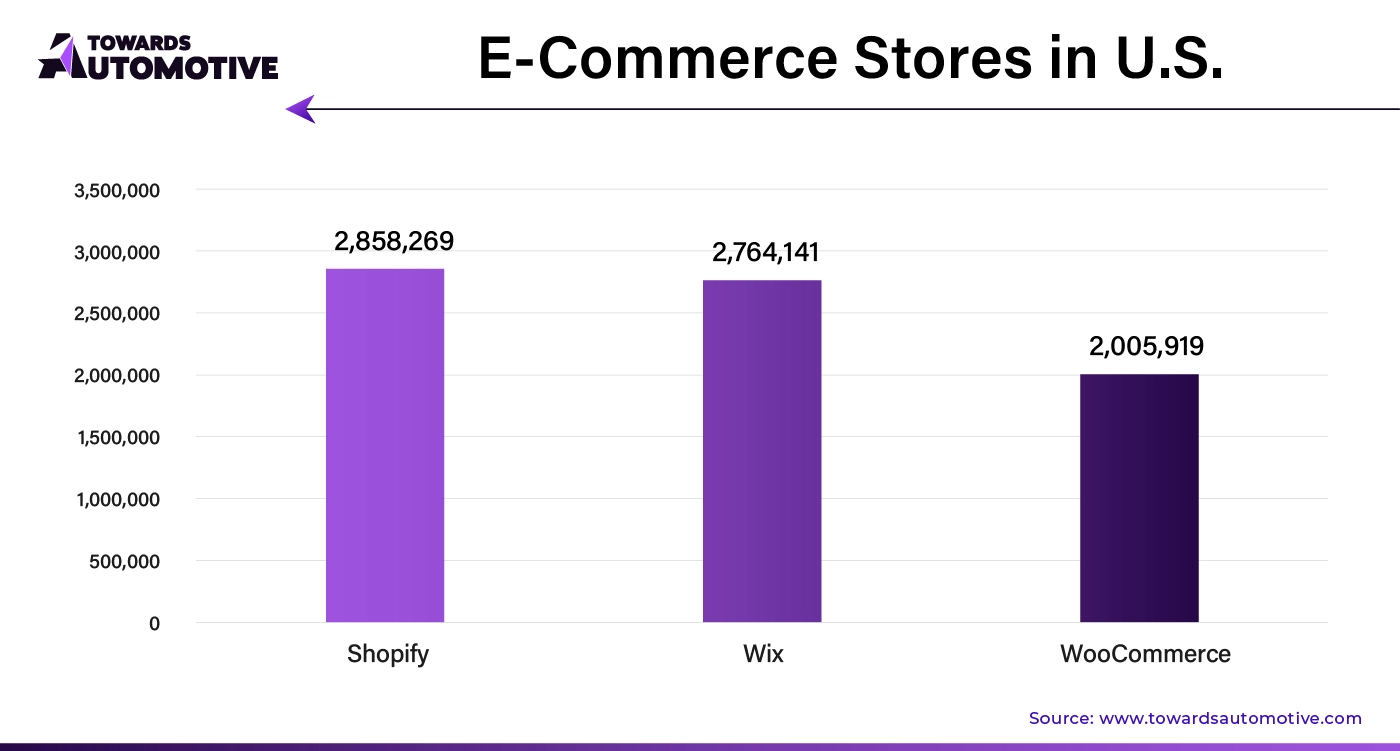

North America dominated the last mile delivery market. The last mile delivery market in North America is experiencing robust growth driven by several key factors. Firstly, the booming e-commerce sector is a major catalyst, as consumers increasingly expect fast and efficient delivery services. With giants such as Amazon, Walmart, and numerous other online retailers expanding their offerings, there is a significant demand for innovative last mile solutions to meet expectations for same-day or next-day deliveries. This surge in e-commerce activity is pushing companies to invest in advanced logistics technologies, including route optimization software and real-time tracking systems, to enhance delivery efficiency and customer satisfaction.

The demand for contactless delivery options, driven by health and safety concerns, has led to the adoption of no-touch delivery methods and curbside pickups. Additionally, the growing emphasis on sustainability is encouraging companies to invest in eco-friendly delivery solutions, such as electric vehicles and green packaging, to reduce their carbon footprint and appeal to environmentally conscious consumers.

Innovations in autonomous vehicles and drones are gradually being tested and implemented to tackle delivery challenges and enhance operational efficiency. The integration of AI and machine learning in logistics planning is also improving route efficiency and reducing costs.

Asia Pacific is expected to grow at a notable rate during the forecast period. The last mile delivery market in Asia Pacific is rapidly expanding, driven by several influential factors. One of the primary drivers is the significant growth of the online shopping sector across the region. As more consumers in countries such as China, India, and Southeast Asia turn to online shopping, there is an increasing demand for efficient and timely delivery services. This surge in e-commerce has led businesses to enhance their last mile delivery capabilities through the adoption of advanced logistics technologies, including real-time tracking, route optimization, and automated sorting systems.

With a substantial portion of the population residing in rapidly growing metropolitan areas, there is a growing need for innovative delivery solutions to manage high delivery volumes and navigate congested traffic conditions. This has spurred the development of micro-fulfillment centers and localized distribution hubs, which help to accelerate delivery times and improve service quality in urban environments.

Consumer expectations in Asia Pacific are also shaping the market. There is a growing demand for flexible delivery options, including same-day and next-day services, as well as alternative delivery methods such as parcel lockers and pickup points. Companies are responding by diversifying their delivery offerings and investing in technologies that support faster and more convenient delivery options.

Additionally, the rise of mobile commerce is influencing last mile delivery dynamics. With a high percentage of transactions conducted via smartphones, businesses are leveraging mobile technologies to enhance customer interactions and streamline delivery processes. Lastly, the emphasis on sustainability is driving the adoption of eco-friendly delivery practices, such as electric vehicles and green packaging solutions, to address environmental concerns and meet regulatory requirements.

By Service Type

By Technology

By Application

By Region

February 2025

February 2025

February 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us