March 2025

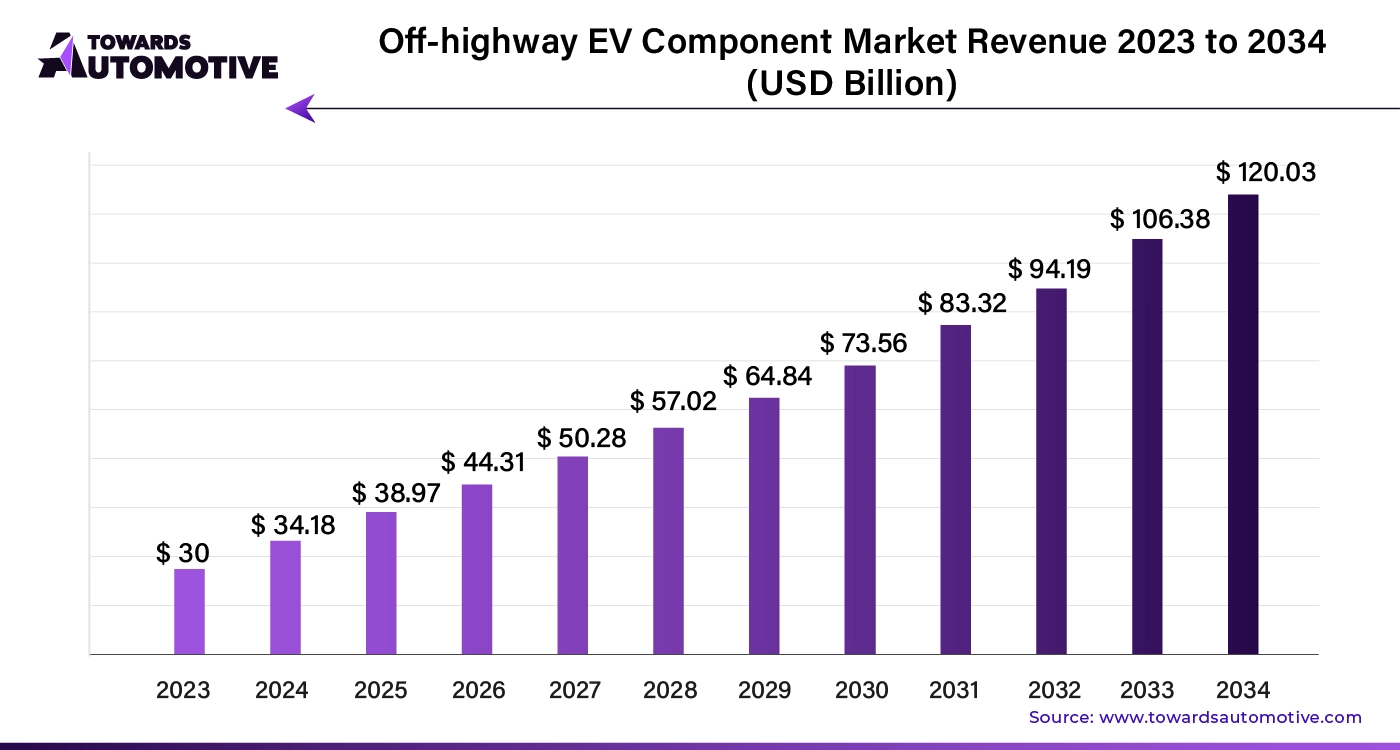

The global off-highway EV component market size is calculated at USD 34.18 billion in 2024 and is expected to be worth USD 120.03 billion by 2034, expanding at a CAGR of 13.95% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The off-highway EV component market is rapidly growing as industries such as construction, agriculture, and mining are increasingly adopting electric vehicles (EVs) for their off-road operations. This shift is driven by the need for sustainable and efficient machinery that reduces emissions and operating costs. Key components such as electric drivetrains, battery systems, and power electronics are in high demand, as they are crucial for the performance and reliability of off-highway EVs.

Manufacturers are investing heavily in research and development to create robust, durable components that can withstand harsh environments and heavy workloads typical in off-highway applications. Additionally, advancements in battery technology are extending the range and efficiency of these vehicles, further boosting market growth. Government regulations and incentives promoting green technologies are also encouraging the adoption of off-highway EVs, driving demand for specialized components. As industries continue to prioritize sustainability, the off-highway EV component market is set to expand, playing a crucial role in the evolution of industrial machinery.

AI is playing an important role in the off-highway EV component market by enhancing the design, manufacturing, and operation of electric vehicles used in industries including construction, agriculture, and mining. Manufacturers leverage AI to optimize the development of key components such as batteries, electric drivetrains, and power electronics, improving efficiency and durability. AI-driven simulations and predictive analytics help engineers design components that can withstand the harsh conditions typical of off-highway environments, ensuring reliability and performance.

In manufacturing, AI-powered automation improves production processes, reducing costs and increasing precision. AI also plays a crucial role in the operation of off-highway EVs, enabling real-time monitoring and predictive maintenance of components. By analyzing data from sensors embedded in the vehicles, AI helps to prevent breakdowns, extend the lifespan of components, and improve overall vehicle efficiency. As the demand for off-highway EVs grows, AI’s role in optimizing component performance and production becomes increasingly vital, driving innovation and market expansion.

The integration of smart and connected technologies is significantly driving the growth of the off-highway EV component market. By incorporating advanced sensors, IoT connectivity, and real-time data analytics into off-highway electric vehicles, manufacturers are enhancing the efficiency, safety, and performance of these machines. These technologies enable seamless communication between various vehicle components, allowing for precise control and optimization of operations in industries such as construction, agriculture, and mining.

Smart technologies also facilitate predictive maintenance by monitoring the condition of key components, such as batteries and drivetrains, in real-time. This reduces downtime and extends the lifespan of the equipment, making it more cost-effective for operators. Additionally, connected technologies provide valuable insights into vehicle usage and performance, enabling operators to make informed decisions that improve productivity.

As industries increasingly adopt digitalization and automation, the demand for smart and connected off-highway EV components is rising. This trend is fueling innovation and driving the market forward, as manufacturers strive to meet the evolving needs of modern industrial operation.

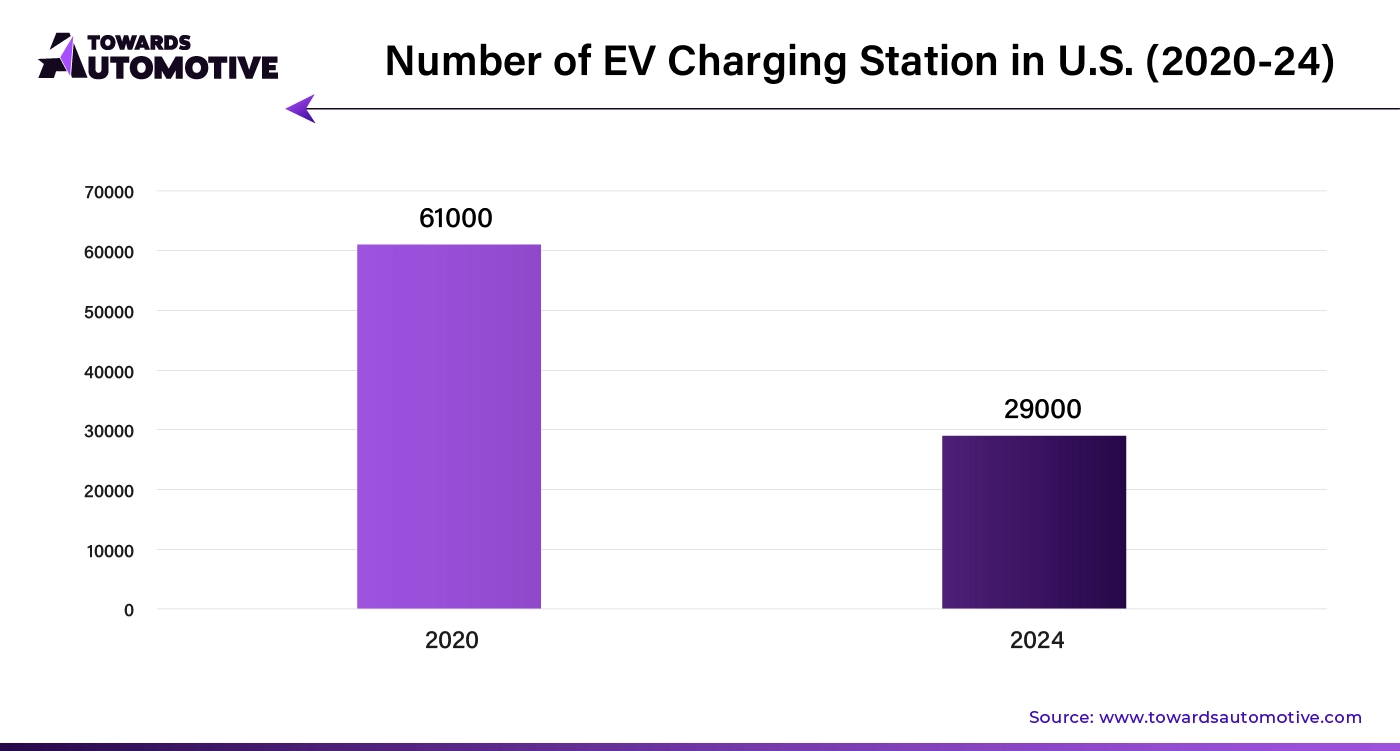

The off-highway EV component market faces restraints due to high initial costs and limited charging infrastructure in remote areas. The substantial upfront investment required for electric components such as batteries and drivetrains is very high. Additionally, the lack of reliable power sources in off-road locations hampers the consistent operation of electric vehicles. These factors along with concerns about component durability in harsh environments hinders the market growth.

Advanced battery technology is likely to create ample growth opportunities in the off-highway EV component market by addressing some of the key challenges associated with electric vehicles in demanding environments. Innovations such as solid-state batteries and fast-charging systems enhance the range, efficiency, and reliability of off-highway electric vehicles, making them more suitable for industries such as construction, agriculture, and mining.

These new battery technologies offer higher energy density, which translates to longer operating times and reduced downtime for charging, a critical factor in maximizing productivity in off-highway operations. Faster charging capabilities further increase operational efficiency, allowing vehicles to return to work more quickly after recharging.

Moreover, the improved durability of advanced batteries ensures that they can withstand the harsh conditions typical of off-road applications, including extreme temperatures and heavy loads. As these technologies continue to evolve, they open up new possibilities for electric vehicles to replace traditional diesel-powered machinery, driving growth and innovation in the off-highway EV component market.

The electric drive system component is projected to grow with a CAGR of 15.84% during the forecast period. Electric drive system components are key drivers of growth in the off-highway EV component market, revolutionizing how industries including construction, agriculture, and mining operate. These components, including electric motors, inverters, and controllers, are essential for powering electric vehicles in off-road environments. They offer several advantages over traditional internal combustion engines, such as higher efficiency, lower maintenance, and reduced emissions, making them increasingly attractive to operators looking to enhance productivity while meeting environmental regulations.

The demand for electric drive systems is rising as industries recognize their ability to deliver consistent power and torque, even in challenging conditions. This reliability is crucial for heavy-duty applications where machinery must perform under intense workloads without frequent breakdowns. Additionally, electric drive systems contribute to lower operational costs by reducing fuel consumption and minimizing the need for complex mechanical parts that wear out over time.

As manufacturers continue to innovate, electric drive system components are becoming more robust and adaptable, further driving their adoption in off-highway vehicles. The push for sustainability and the shift toward greener technologies also amplify the demand for these components, solidifying their role in propelling the growth of the off-highway EV component market.

The earthmoving segment is anticipated to grow with a CAGR of 14.84% during the forecast period. The earthmoving application is a significant driver of growth in the off-highway EV component market. As industries such as construction and mining increasingly adopt electric vehicles for earthmoving tasks, the demand for specialized EV components such as electric motors, batteries, and drivetrains is rising rapidly. These components are essential for powering the heavy machinery used in earthmoving, which requires substantial power, torque, and durability to operate effectively in challenging environments.

Electric earthmoving vehicles offer several advantages over traditional diesel-powered machines, including reduced emissions, lower operating costs, and quieter operation. These benefits are particularly important in urban construction projects and environmentally sensitive areas, where minimizing noise and pollution is crucial. As a result, the shift towards electric earthmoving equipment is gaining momentum, driving the need for advanced and reliable EV components.

Manufacturers are responding to this demand by developing more robust and efficient components that can withstand the harsh conditions typical of earthmoving applications, such as heavy loads, rough terrains, and extreme weather. This ongoing innovation not only enhances the performance of electric earthmoving vehicles but also propels the overall growth of the off-highway EV component market, as industries continue to prioritize sustainability and operational efficiency.

United States is expected to grow with a CAGR of 14.63% during the forecast period. The off-highway EV component market in the USA is driven by several key factors that are accelerating its growth. The country's strong focus on reducing carbon emissions and promoting sustainable practices is leading to increased adoption of electric vehicles across industries such as construction, agriculture, and mining. These sectors are transitioning to electric alternatives to meet stringent environmental regulations and reduce their carbon footprint, driving demand for essential components consisting of electric drivetrains, batteries, and power electronics.

Government incentives and support for green technology are also playing a crucial role in this market's expansion. Federal and state programs that offer tax credits, grants, and other incentives encourage companies to invest in electric vehicles and the necessary components. Additionally, the growing emphasis on technological innovation in the U.S. fosters advancements in EV components, leading to the development of more efficient, durable, and cost-effective solutions tailored for off-highway applications.

The expanding infrastructure for EV charging, even in remote and off-road areas, further supports the adoption of off-highway electric vehicles. As these factors converge, they collectively drive the growth of the off-highway EV component market in the USA, positioning it as a leader in the global transition toward sustainable industrial practices.

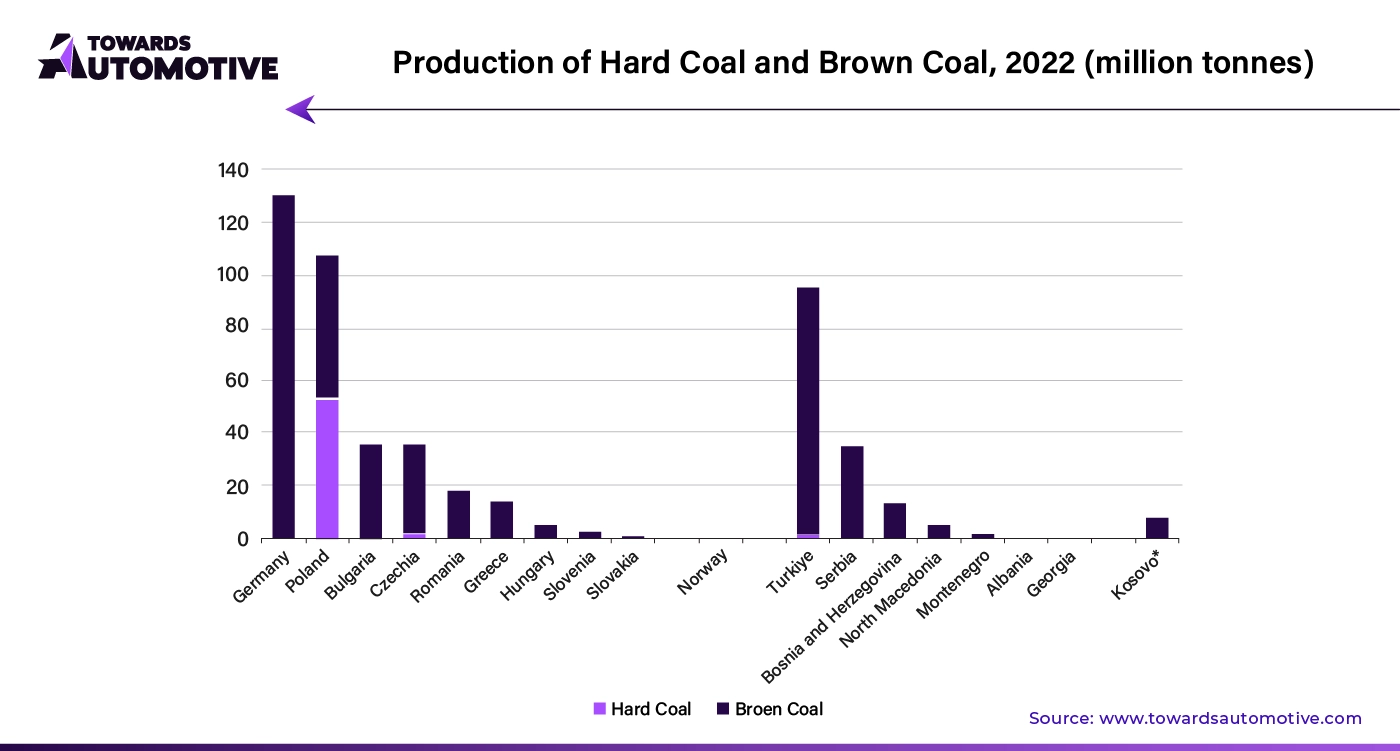

Europe is likely to grow at a CAGR of 10.16% during the forecast period. The off-highway EV component market in Europe is driven by several pivotal factors that fuel its expansion. Europe’s strong commitment to environmental sustainability and aggressive carbon reduction targets are leading industries to adopt electric vehicles for off-highway applications, such as construction, agriculture, and mining. This shift is driven by stringent EU regulations on emissions and a push for greener technologies, which increase the demand for electric drivetrains, batteries, and advanced power electronics.

Government policies and incentives across European countries further bolster this market. Various subsidies, tax breaks, and grants are available to support the transition to electric machinery and encourage investments in EV components. Additionally, Europe's robust infrastructure development for EV charging stations and support facilities enhances the feasibility of operating electric off-highway vehicles in diverse environments.

Technological advancements in electric vehicle components, combined with Europe’s focus on innovation and research, are also significant drivers. Manufacturers are developing more efficient, durable, and adaptable components to meet the demanding requirements of off-highway applications. As these factors converge, they collectively propel the growth of the off-highway EV component market in Europe, supporting the continent's transition to sustainable industrial practices.

Germany leads the market in European region. In Germany, the off-highway EV component market is driven by the country’s strong environmental regulations and commitment to reducing emissions. The push for sustainable practices in industries such as construction and mining increased the demand for electric vehicles and their components. Government incentives, such as subsidies and tax breaks, further support the transition to electric machinery.

Additionally, Germany’s focus on technological innovation fosters advancements in electric drivetrains and batteries, enhancing their efficiency and durability. These factors collectively boost the growth of the off-highway EV component market in Germany, positioning it as a leader in green industrial solutions.

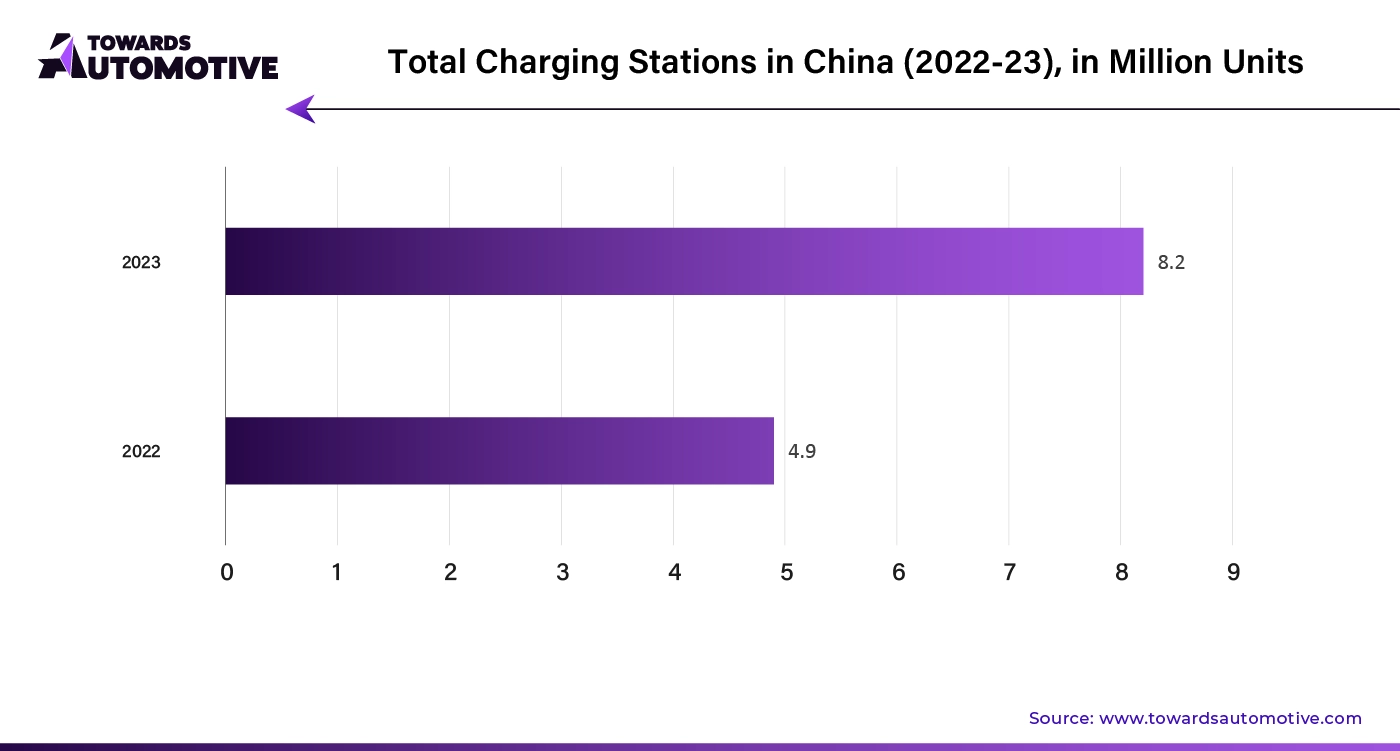

China is dominated the industry in APAC region. In China, the off-highway EV component market is driven by rapid industrialization and a strong push towards environmental sustainability. The Chinese government’s stringent emissions regulations and incentives for green technologies spur the adoption of electric vehicles in sectors such as construction and mining. Investments in research and development lead to advancements in electric drivetrains and batteries, enhancing their performance and durability. Additionally, the expansion of EV charging infrastructure in remote areas supports the feasibility of electric machinery. These driving factors collectively accelerate the growth of the off-highway EV component market in China, supporting the country’s transition to cleaner industrial practices.

By Component Type

By Propulsion Type

By Application

By Sales Channel

By Region

March 2025

March 2025

March 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us