March 2025

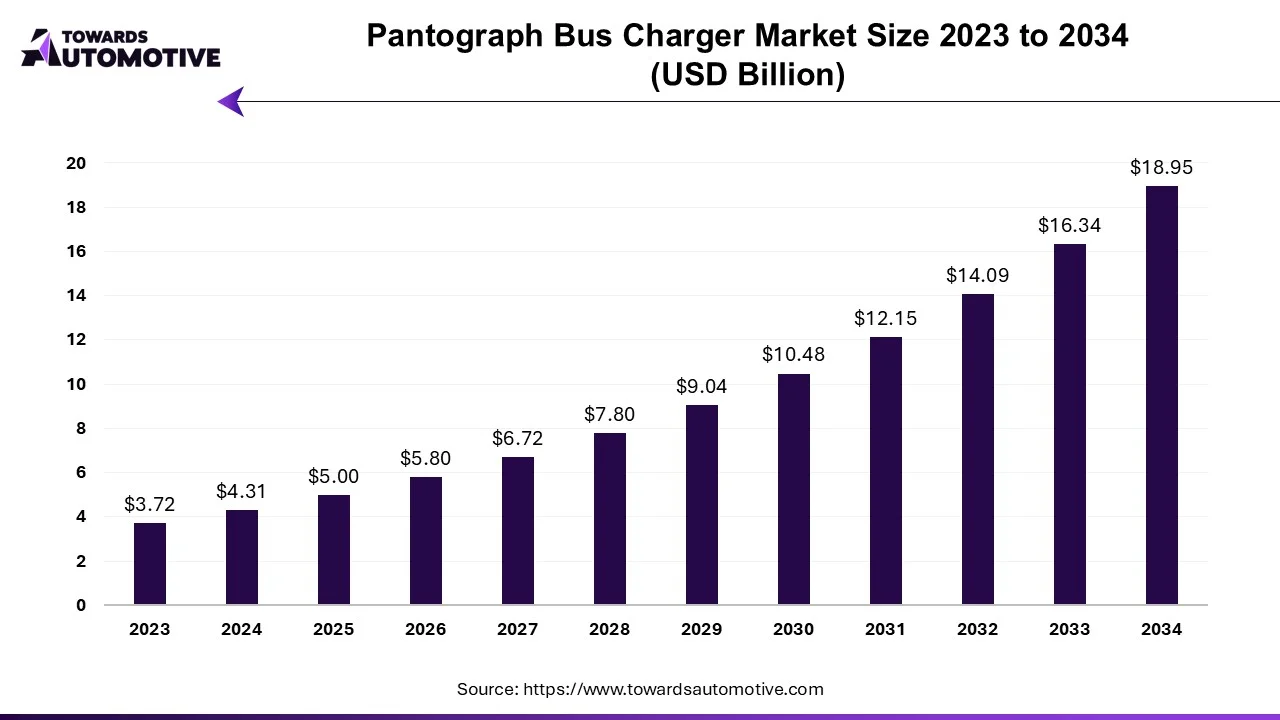

The pantograph bus charger market is forecasted to expand from USD 5.00 billion in 2025 to USD 18.95 billion by 2034, growing at a CAGR of 15.95% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The COVID-19 pandemic significantly impacted the transport pantograph charger market in the first half of 2020, as lockdowns and restrictions led to reduced demand from transportation and related sectors. Additionally, delays in electric transport projects and disruptions in the supply chain exacerbated the situation in the market. However, the majority of automakers and EV charging providers resumed pantograph charger production with limited capacity and necessary precautions. Sales of electric buses witnessed significant growth since the latter half of 2020 and are expected to continue during the forecast period, driving the market focus.

Over the medium term, the demand for pantograph chargers is expected to increase due to the growing adoption of electric buses, not only for public transportation but also for school transportation across major countries worldwide. Moreover, increasing government initiatives and their focus on enhancing charging infrastructure are anticipated to drive demand in the market during the forecast period. Additionally, a new development in the charging station market by companies is also expected to support growth.

For example,

Furthermore, investments from key players and growing strategic collaborations between charging solution providers and bus manufacturers are expected to provide new opportunities for players operating in the market. There is a surge in the adoption of electric bus charging systems due to the decreasing cost of batteries. The increasing efforts to reduce greenhouse gas (GHG) emissions, along with the emergence of favorable government regulations, are likely to enhance the growth of the market over the forecast period.

For example,

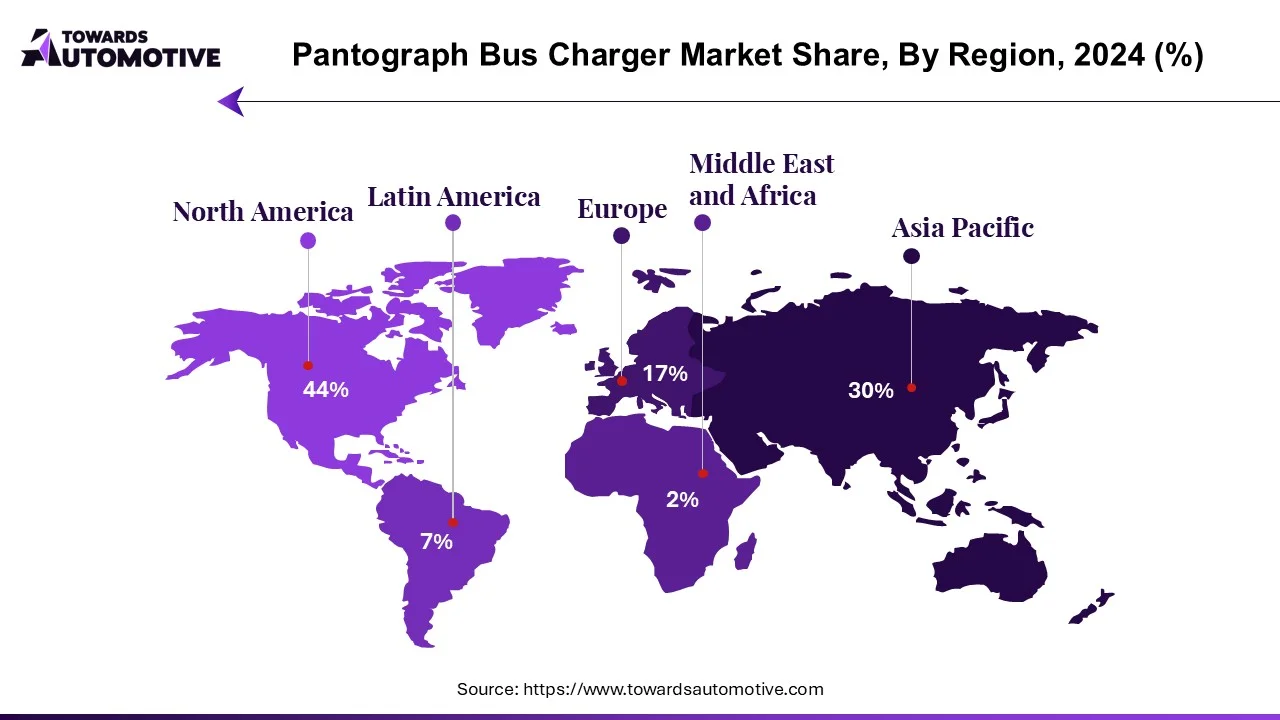

The North American region is expected to grow at a significant rate during the forecast period due to the rising adoption of electric buses across major countries in the region. Moreover, China and India are expected to contribute to growth in the Asia-Pacific region due to strong support from governments, transit agencies, and other green vehicle-supporting communities and organizations.

Diesel buses remain a staple in urban transportation globally, especially in densely populated areas where air quality concerns persist. To address environmental challenges, governments around the world are enacting regulations and policies to promote eco-friendly transportation solutions.

In the United States, the EPA and NHTSA have proposed implementing the Safer Affordable Fuel-Efficient (SAFE) vehicles rule from 2021 to 2026. This rule seeks to establish guidelines for corporate average fuel economy and greenhouse gas emissions across passenger and commercial vehicle segments. As part of this initiative, Original Equipment Manufacturers (OEMs) are expected to introduce a specified standard of clean and zero-emission vehicles under the Zero-emission Vehicles (ZEV) Program, with the goal of deploying 12 million ZEVs, including buses, by 2030.

In India, the government aims to encourage 30% of total vehicle sales to be electric by 2030. This objective is supported by a USD 1.4 billion investment in phase two of the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) program through 2022. The focus of this phase is on electrifying public and shared transportation, with funding allocated for the procurement of 7,090 electric buses. These initiatives have spurred fleet operators to transition towards electric buses.

Moreover, the improvement of air quality through public transportation initiatives contributes to the overall sustainability of urban environments by reducing reliance on private vehicles for multiple trips. Recognizing these benefits, governments around the world are actively advocating for sustainable and efficient public transport solutions, thereby driving positive momentum in the market.

For Instance,

North America is poised to make a significant contribution to market growth in the coming years, with the United States expected to be a major driver of this growth. The government's various initiatives and the widespread adoption of electric buses across the country are anticipated to fuel demand for electric buses in the region. This increased demand is likely to be supported by governments, municipalities, and other entities.

For Instance,

Furthermore, the Canadian government is committed to fostering a sustainable transportation industry in the country:

The positive growth trajectory in North America is driving the adoption of pantographs by key players involved in electric bus projects. This trend is expected to further increase demand for bus pantograph chargers in the forecast period.

For example:

Considering these developments and examples, North America is predicted to experience the fastest growth compared to its counterparts during the forecast period.

Major players in the electric bus industry have employed strategies like launching new products, forming joint ventures, making acquisitions, and entering partnerships to effectively manage their businesses. Additionally, governments worldwide have supported economic development in this sector.

For Instance,

Similarly, in December 2021, the Berlin Transport Authority (BVG) board approved the purchase of an additional 90 electric buses, to be charged at stations. This decision reflects the increasing demand for pantograph charging systems nationwide and presents growth opportunities for entrepreneurs.

The development of electric buses is expected to drive up the demand for charging stations. Moreover, it has strengthened commercial activities through agreements with bus pantograph charging companies, major vehicle manufacturers, and charging stations.

For Instance,

Pantographs serve as a mechanism for establishing automatic contact between electric buses and charging stations, facilitating the charging process for battery electric vehicles. Currently, there are two primary methods for establishing this connection: the pantograph can be raised from the ceiling of the electric bus when payment is required, or it can be lowered from beneath the bus by mounting it on the payment platform.

The market for bus pantograph chargers is categorized based on the charging process, including Level 1, Level 2, and direct current charging (DCFC). Furthermore, segmentation is based on the type of equipment, encompassing both hardware and software components. Additionally, the electrical charging method is considered, which includes on-board top-down pantograph and on-board bottom-up pantograph configurations. Geographically, the market is segmented into North America, Europe, Asia-Pacific, and the rest of the world.

The comprehensive report provides market size and forecasts for the bus pantograph charger market, measured in US dollars (USD) million, across all the aforementioned segments. This analysis aids businesses and stakeholders in understanding the current market landscape, identifying growth opportunities, and making informed decisions regarding investment and expansion strategies within the bus pantograph charger industry.

By Charging Type

By Component Type

By Charging Infrastructure Type

By Geography

March 2025

March 2025

March 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us