March 2025

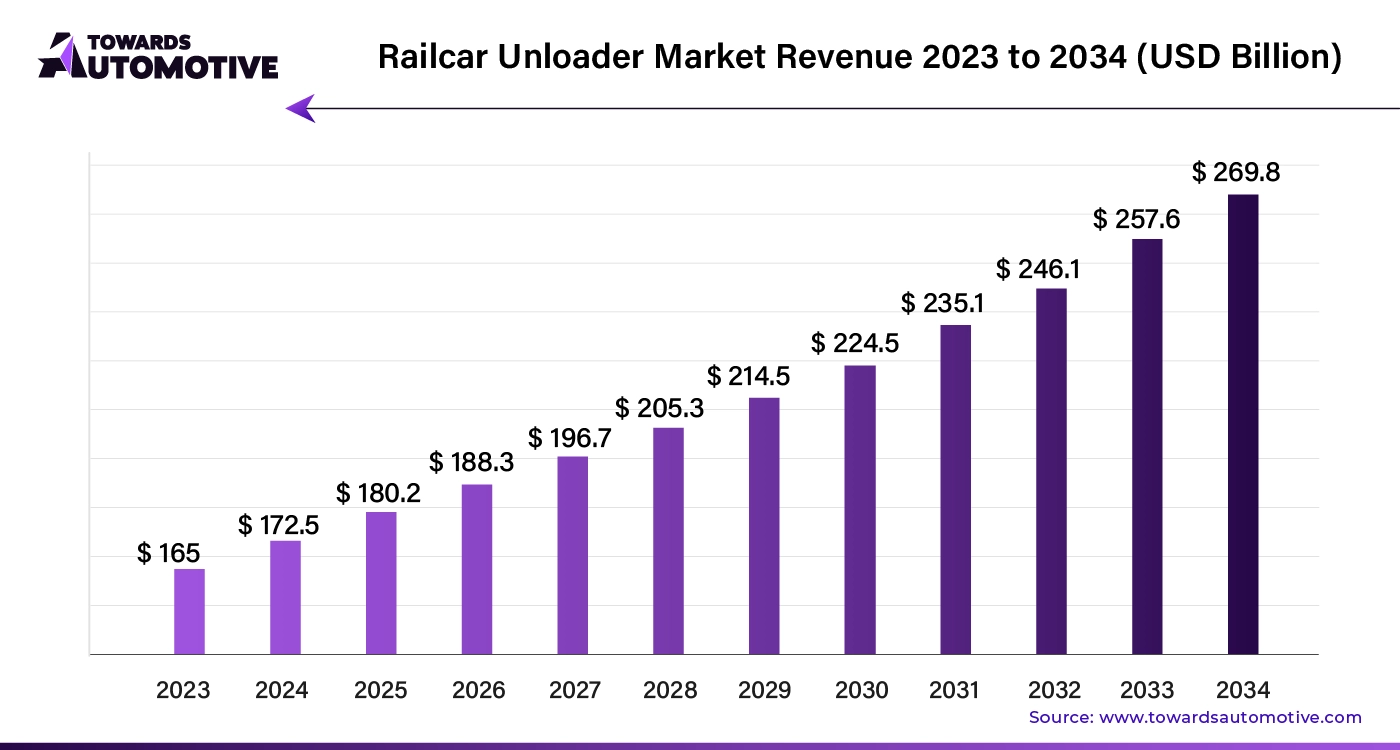

The global railcar unloader market size is calculated at USD 172.5 billion in 2024 and is expected to be worth USD 269.8 billion by 2034, expanding at a CAGR of 4.54% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The railcar unloader market is experiencing significant growth due to advancements in rail transport and logistics efficiency. Railcar unloaders play a crucial role in streamlining the unloading process of bulk materials from railcars, enhancing operational efficiency and reducing turnaround times at distribution centers. As industries like mining, agriculture, and manufacturing continue to expand, the demand for efficient and reliable unloading solutions increases.

Technological innovations in railcar unloader designs, such as automated systems and advanced control mechanisms, are driving the market forward. These innovations improve accuracy, safety, and speed in unloading operations, catering to the needs of modern, high-capacity rail systems. Additionally, the focus on reducing operational costs and optimizing supply chain logistics further fuels the adoption of advanced unloading technologies.

Regulatory requirements and industry standards for safety and environmental impact also influence market growth, as companies seek equipment that complies with stringent regulations while delivering high performance. As the global economy grows and industries demand more efficient rail transport solutions, the railcar unloader market is poised for continued expansion and innovation

AI is playing a transformative role in the railcar unloader market by enhancing operational efficiency and safety. AI-powered systems improve the accuracy and speed of railcar unloading through advanced automation and real-time data analysis. AI algorithms optimize the unloading process by predicting maintenance needs, identifying potential faults before they occur, and adjusting operational parameters to improve performance and reduce downtime.

Additionally, AI-driven computer vision systems can monitor the unloading process, ensuring proper alignment and preventing errors or equipment damage. Machine learning models analyze data from various sensors to fine-tune operations and enhance the overall efficiency of the unloader systems. By leveraging AI, companies can achieve higher levels of precision and reliability in their unloading operations, leading to cost savings and increased productivity. As AI technology continues to advance, it will further revolutionize the railcar unloader market by offering smarter, more adaptive solutions that meet the evolving demands of the logistics and transportation industries.

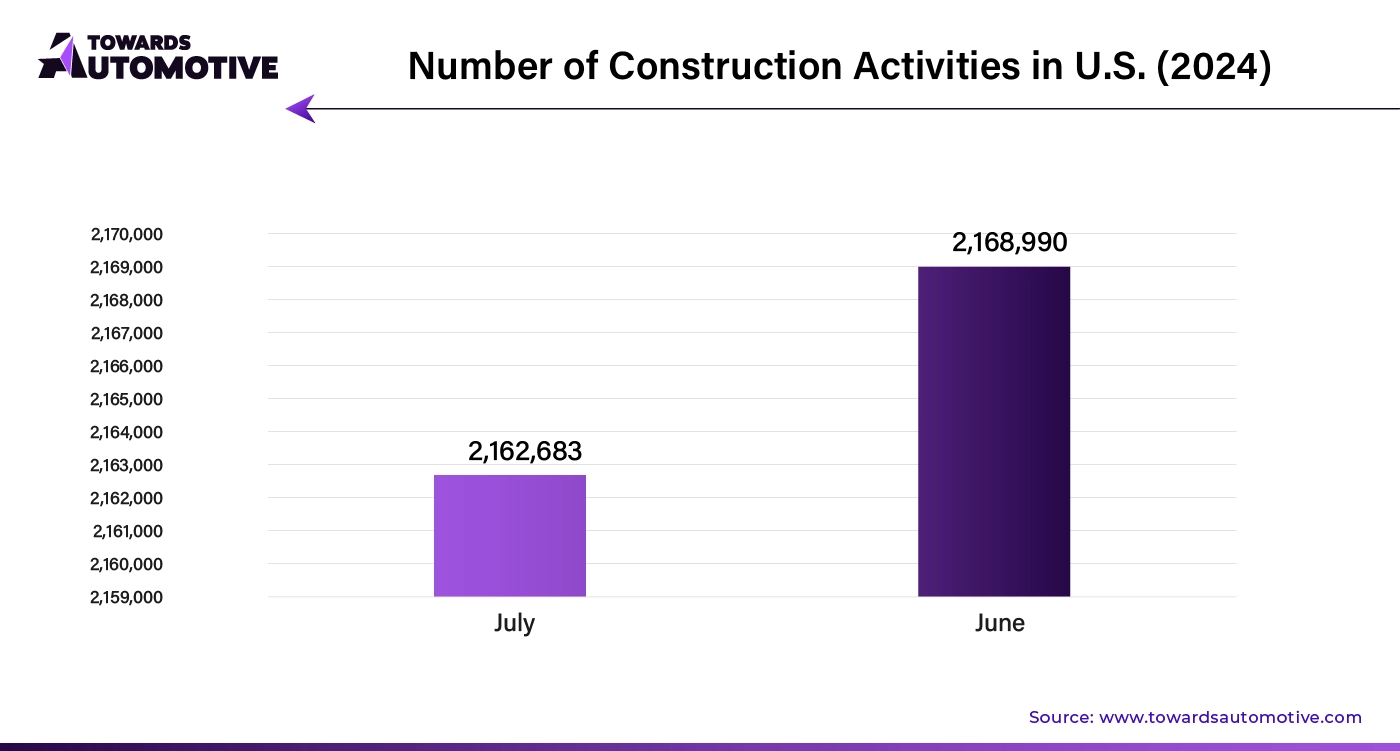

The growth of the construction and building sector is a major driver of the railcar unloader market. As the sector expands, the demand for efficient bulk material handling solutions increases, making railcar unloaders essential for modern construction operations. Railcar unloaders facilitate the rapid and effective transfer of materials such as sand, gravel, cement, and aggregates from railcars to construction sites, improving logistics and operational efficiency.

The surge in large-scale construction projects and infrastructure developments necessitates advanced unloading technologies to manage high volumes of materials. Railcar unloaders play a crucial role in minimizing downtime and optimizing the flow of materials, which is vital for meeting project deadlines and maintaining productivity. Additionally, the push towards automation and innovation within the construction industry encourages the adoption of state-of-the-art unloading systems that offer greater speed, accuracy, and safety.

As construction activities continue to grow and evolve, the railcar unloader market benefits from increased investments in advanced equipment and technology. The need for reliable, high-capacity unloading solutions drives the market's expansion, supporting the construction and building sector's ongoing development and modernization efforts.

The railcar unloader market faces several restraints, including high capital costs and complex maintenance requirements. The initial investment in advanced unloading systems can be substantial, which may deter smaller companies from upgrading their equipment. Additionally, the complexity of maintaining and servicing sophisticated railcar unloaders requires specialized knowledge and resources, potentially leading to higher operational costs and longer downtime. These factors can limit market growth and hinder adoption rates.

Automation and smart technologies are creating significant opportunities in the railcar unloader market by enhancing operational efficiency and reliability. Advanced automation systems streamline the unloading process, reducing the need for manual intervention and minimizing human error. These systems use real-time data and AI-driven algorithms to optimize unloading operations, improving speed and accuracy while lowering labor costs.

Smart technologies, including IoT sensors and connectivity, provide valuable insights into equipment performance and maintenance needs. These technologies enable predictive maintenance, allowing for timely repairs and reducing unplanned downtime. Additionally, automation facilitates the integration of railcar unloaders with other logistics and supply chain systems, enhancing overall efficiency and coordination.

The adoption of automation and smart technologies also aligns with the industry’s push towards sustainability and energy efficiency. By optimizing operations and reducing energy consumption, these innovations contribute to more sustainable and cost-effective material handling solutions. As the market continues to evolve, the integration of automation and smart technologies will drive growth and offer new opportunities for advanced, efficient railcar unloading solutions.

The mobile railcar unloader segment dominated the market with a share of 56.88%. Mobile railcar unloaders are significantly boosting the growth of the railcar unloader market by offering versatile and efficient unloading solutions. These mobile systems provide flexibility and adaptability, allowing for quick deployment and use at various locations. Unlike stationary unloaders, mobile railcar unloaders can be easily moved to different railcar positions or sites, optimizing material handling across diverse operational environments.

The convenience of mobile railcar unloaders appeals to industries with fluctuating unloading needs or those operating in multiple locations, such as construction, mining, and agriculture. Their ability to quickly and effectively unload materials from railcars enhances operational efficiency and reduces downtime.

Additionally, mobile railcar unloaders often incorporate advanced features, such as automation and real-time monitoring, which further enhance their performance and reliability. As industries increasingly demand adaptable and high-performance solutions, the rise of mobile railcar unloaders is driving market growth, meeting the needs of a dynamic and evolving logistics landscape.

United States is expected to grow with a CAGR of 5.14% during the forecast period. The country’s robust industrial and manufacturing sectors rely heavily on efficient bulk material handling, making advanced railcar unloaders essential for streamlining operations. As industries such as mining, agriculture, and construction expand, the demand for high-performance unloading solutions grows, driving market development.

Infrastructure development and modernization projects across the USA also contribute to market growth. These projects require the efficient and timely unloading of materials from railcars to support construction and renovation activities. Additionally, the increasing focus on automation and technological advancements in railcar unloaders is further propelling market expansion. Innovations in smart technologies, such as real-time monitoring and predictive maintenance, enhance the efficiency and reliability of unloading systems.

The emphasis on improving supply chain logistics and reducing operational costs also drives the adoption of advanced railcar unloaders. Moreover, regulatory requirements for safety and environmental standards encourage the use of state-of-the-art equipment that meets stringent guidelines. As these factors continue to shape the industrial landscape, the railcar unloader market in the USA is poised for sustained growth and innovation.

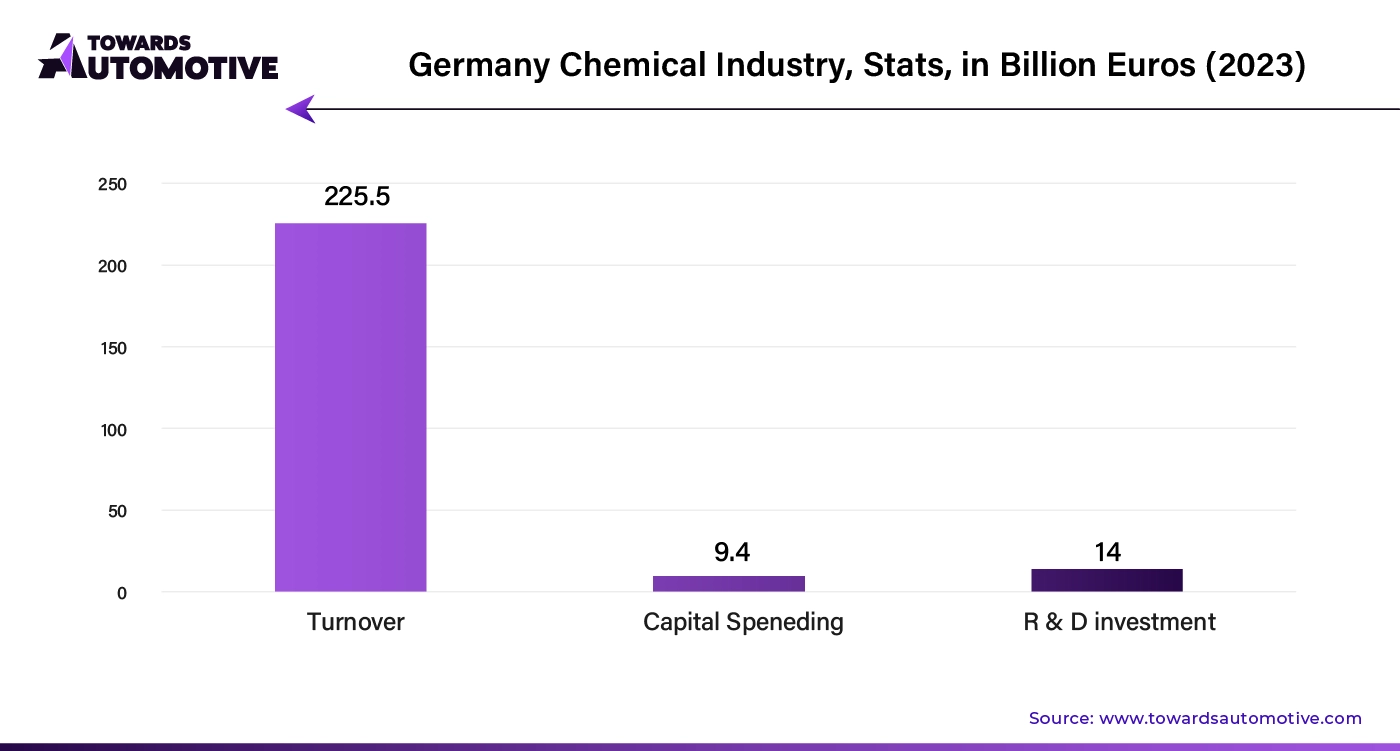

Germany is anticipated to grow with a CAGR of 6.79% during the forecast period. The country's strong industrial base, particularly in sectors such as automotive manufacturing, chemical processing, and construction, creates a substantial demand for efficient bulk material handling solutions. As industries expand and seek to optimize their supply chains, the need for advanced railcar unloaders that enhance operational efficiency becomes increasingly critical.

Germany's focus on technological innovation and automation also fuels market growth. The adoption of smart technologies, such as real-time monitoring and predictive maintenance, improves the performance and reliability of railcar unloaders. These advancements help companies reduce downtime and operational costs, aligning with Germany's emphasis on precision and efficiency in industrial operations.

Additionally, Germany's stringent environmental regulations and safety standards drive the demand for state-of-the-art unloading equipment that meets high compliance requirements. The country's commitment to sustainability and energy efficiency further encourages the use of advanced railcar unloaders that contribute to greener operations. As Germany continues to invest in infrastructure and technology, the railcar unloader market is set for continued expansion, supported by these dynamic growth drivers.

China is assumed to grow with a CAGR of 6.74% during the forecast period. The rapid expansion of industrial activities, including mining, construction, and manufacturing, fuels the demand for efficient bulk material handling solutions. As these industries scale up their operations, the need for advanced railcar unloaders that can handle large volumes of materials swiftly and reliably becomes essential.

China's ongoing infrastructure development and modernization projects also contribute to market growth. These projects require high-capacity unloading systems to manage the steady flow of materials from railcars to construction sites, supporting the country's ambitious urbanization and development goals. Additionally, the push towards automation and smart technology adoption in Chinese industries enhances the appeal of advanced railcar unloaders. Innovations such as real-time monitoring, predictive maintenance, and automated systems improve operational efficiency and reduce costs, aligning with the nation's focus on technological advancement.

The Chinese government's support for industrial upgrades and environmental regulations also drives market growth. Policies promoting energy efficiency and sustainability encourage the adoption of modern railcar unloaders that meet stringent standards. As China's industrial sector continues to grow and evolve, the railcar unloader market is set for sustained expansion and innovation.

Japan is likely to grow with a CAGR of 6.72% during the forecast period. The country's advanced manufacturing and industrial sectors require efficient bulk material handling solutions to maintain high productivity levels. As Japanese industries, particularly in automotive, electronics, and construction, expand their operations, the demand for reliable and high-capacity railcar unloaders increases.

Japan's commitment to technological innovation also fuels market growth. The integration of automation, smart technologies, and real-time monitoring systems in railcar unloaders enhances operational efficiency and reliability. These advanced features help reduce downtime and maintenance costs, aligning with Japan's emphasis on precision and quality in industrial processes.

Additionally, Japan's focus on environmental sustainability and energy efficiency drives the adoption of state-of-the-art unloading equipment. Stringent environmental regulations and a push towards greener practices encourage the use of railcar unloaders that meet high standards for energy consumption and emissions. As Japan continues to invest in infrastructure and technology, the railcar unloader market benefits from these dynamic growth drivers, ensuring ongoing expansion and innovation in the industry.

India is projected to grow with a CAGR of 5.76% during the forecast period. he country’s rapid industrialization and expansion in sectors such as mining, construction, and agriculture create a rising demand for efficient bulk material handling solutions. As industries scale up their operations, the need for advanced railcar unloaders that can handle large quantities of materials swiftly and reliably becomes crucial.

India's significant infrastructure development projects, including urbanization and transportation improvements, further drive market growth. These projects require high-performance unloading systems to manage the continuous flow of materials from railcars to construction sites. Additionally, the push towards modernization and automation in Indian industries enhances the appeal of railcar unloaders equipped with smart technologies. Innovations such as real-time monitoring, automated controls, and predictive maintenance improve efficiency and reduce operational costs.

Government initiatives promoting industrial growth and infrastructure development also support the railcar unloader market. Policies encouraging investment in modern equipment and adherence to safety and environmental standards stimulate demand for advanced unloading solutions. As India continues to develop its industrial and infrastructure sectors, the railcar unloader market is poised for sustained growth and innovation.

By Type

By Unloading Material

By Region

March 2025

February 2025

January 2025

January 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us