April 2025

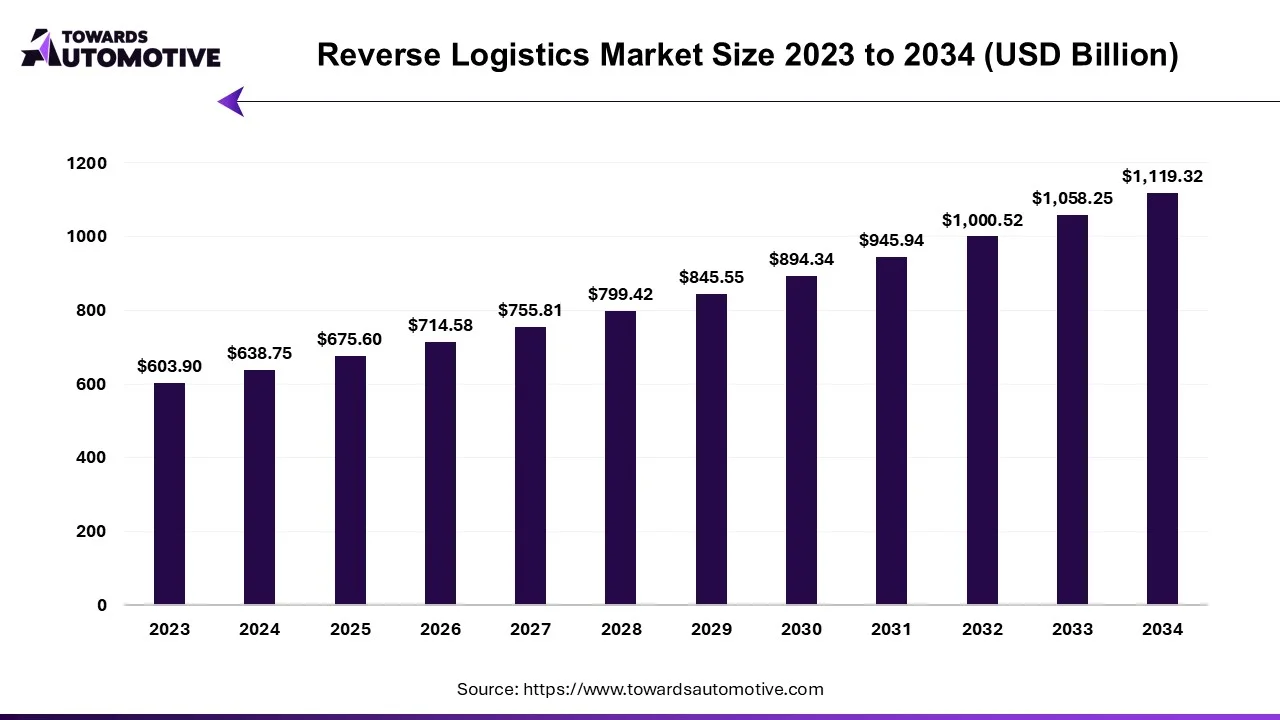

The reverse logistics market is predicted to expand from USD 675.60 billion in 2025 to USD 1119.32 billion by 2034, growing at a CAGR of 5.77% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The reverse logistics market refers to the process of managing the return, disposal, refurbishment, and recycling of products and materials from the end customer back to the manufacturer or a designated facility. It encompasses a wide range of activities, including product returns, repackaging, repairs, refurbishment, recycling, and disposal. As e-commerce continues to grow and consumer expectations for convenience rise, reverse logistics has become a crucial aspect of supply chain management. It provides a structured approach to managing returns, reducing waste, and recovering value from returned products, which can be resold, refurbished, or recycled. With sustainability being a key driver, businesses are increasingly focusing on implementing efficient reverse logistics systems to minimize environmental impact while reducing operational costs.

Moreover, the rise of digital technologies, such as AI and big data, has allowed companies to optimize reverse logistics processes by improving inventory management, enhancing customer service, and boosting profitability. As industries across various sectors, including retail, electronics, automotive, and pharmaceuticals, continue to embrace reverse logistics, the market is expected to expand further, driven by both consumer demand for more sustainable solutions and the growing complexity of global supply chains.

AI plays a crucial role in transforming the reverse logistics market by enhancing efficiency, reducing costs, and improving customer satisfaction. One of the key contributions of AI is in predictive analytics, where it analyzes historical return data, customer behavior, and product trends to forecast return rates accurately. This helps businesses optimize their inventory management, ensuring they are well-prepared for returns and can streamline processes accordingly. AI also automates various stages of the reverse logistics process, such as sorting returned goods. Using machine learning algorithms, AI systems can categorize items based on their condition, whether they should be repaired, refurbished, resold, or recycled, which speeds up processing times and reduces human error.

Furthermore, AI optimizes transportation by suggesting the most efficient routes for return shipments, cutting down on fuel consumption, transit time, and operational costs. AI-driven customer service tools, such as chatbots, also improve the returns experience by offering real-time assistance to consumers, making the return process smoother and more convenient. Additionally, AI helps companies analyze return patterns to identify opportunities for product improvement and better-quality control, reducing future returns. As the reverse logistics market continues to grow, AI is becoming an indispensable tool for businesses that are aiming to streamline operations and enhance sustainability.

The developments in the pharmaceuticals sector play a significant role in driving the growth of the reverse logistics market, primarily due to the unique challenges associated with managing the returns of medical products, including drugs, equipment, and devices. As the pharmaceutical industry continues to expand, particularly in emerging markets across Asia-Pacific and Latin America, the need for efficient reverse logistics solutions becomes more critical. One of the main factors influencing this demand is the regulatory environment governing the handling, storage, and disposal of pharmaceutical products. In many countries, strict regulations require the return of expired or recalled products to be managed properly to ensure public safety and compliance with health standards. This drives the need for specialized reverse logistics services that can handle sensitive pharmaceutical returns efficiently and securely.

Additionally, the growth of e-commerce related to the pharmaceutical sector, including online pharmacies and drug distribution platforms, has further amplified the volume of product returns. Consumers and healthcare providers often return products due to reasons like incorrect prescriptions, damaged goods, or unutilized medications. Proper returns management in the pharmaceutical sector involves not only sorting and processing returns but also ensuring that any returned items are safely disposed of or repurposed, in compliance with regulatory guidelines. Moreover, the rise of sustainability concerns in the industry is encouraging pharmaceutical companies to adopt more eco-friendly reverse logistics practices, such as recycling packaging or refurbishing medical devices.

The reverse logistics market faces several restraints that can hinder its growth. One major challenge is the high operational costs associated with managing returns, including storage, transportation, and processing of returned goods. The complexity of sorting, refurbishing, or recycling products can lead to significant inefficiencies. Additionally, the lack of standardized procedures and infrastructure across regions can create logistical challenges, particularly in emerging markets. The inconsistency in return policies and consumer behavior can also complicate operations. Moreover, regulatory compliance, especially in industries like pharmaceuticals and electronics, adds layers of complexity and cost to the reverse logistics process. These factors, combined with the need for advanced technology, pose ongoing challenges to the market.

The increasing trend of remanufacturing and refurbishing activities is creating significant opportunities in the reverse logistics market. As businesses and consumers become more focused on sustainability and cost-effectiveness, the demand for remanufactured and refurbished products is growing. Reverse logistics plays a crucial role in managing the return, inspection, and processing of used goods, enabling them to be restored to their original condition or repurposed for resale. Industries such as electronics, automotive, and appliances are leading the way in remanufacturing, where returned products are disassembled, components are repaired or replaced, and the items are reassembled for resale at a lower price. This process not only reduces waste but also lowers production costs, providing a competitive edge for businesses.

As a result, companies are increasingly integrating reverse logistics into their supply chain strategies to manage the flow of returned products efficiently. The growth of remanufacturing and refurbishing activities is pushing businesses to invest in advanced sorting technologies, testing processes, and inventory management systems to streamline operations. Moreover, this trend supports the circular economy by giving products a second life, reducing environmental impact, and encouraging responsible consumption. The rise of remanufacturing and refurbishing activities, therefore, presents a valuable opportunity for reverse logistics providers to expand their services, cater to growing demand, and contribute to sustainability goals, fueling the growth of the reverse logistics market.

The returns management segment led the industry. The returns management segment is a major driver of growth in the reverse logistics market, as it directly addresses the increasing volume of product returns, particularly in e-commerce and retail sectors. Effective returns management involves the process of handling, sorting, inspecting, and processing returned goods, with the aim of minimizing costs and maximizing recovery value. As consumer demand for hassle-free and flexible return policies grows, businesses are focusing on improving their returns management strategies to ensure a seamless and efficient process. This includes determining whether returned products should be resold, refurbished, recycled, or disposed of. The rise of online shopping has significantly contributed to this trend, as the ease of returning products is now a key factor in customer satisfaction. To remain competitive, businesses are investing in technology and infrastructure to streamline returns management, utilizing tools such as AI, machine learning, and automated sorting systems to reduce processing time and human error. Additionally, returns management helps companies recover value from returned items, reducing overall costs and minimizing waste. The segment’s ability to optimize the handling of returned goods makes it an essential component of the reverse logistics market, driving operational efficiency and improving sustainability practices, which further fuels market growth.

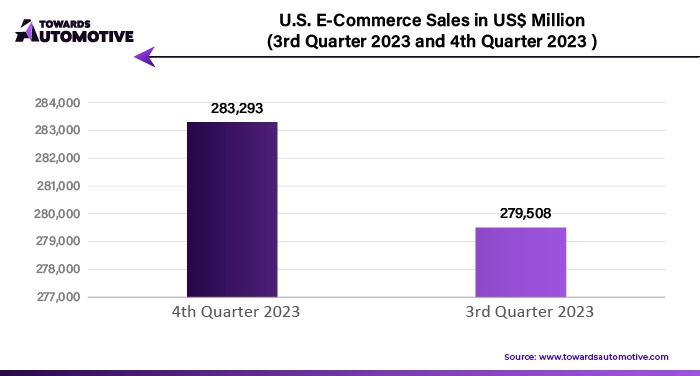

The retail & e-commerce segment dominated the market. The retail and e-commerce segments are pivotal drivers of the growth of the reverse logistics market, primarily due to the surge in online shopping and the increasing volume of product returns. As e-commerce continues to expand across the globe, particularly in regions like North America and Asia-Pacific, businesses face the challenge of managing returns efficiently to maintain customer satisfaction and operational efficiency. Retailers and e-commerce platforms are investing heavily in reverse logistics solutions to handle the rising number of returns, which are often triggered by factors like incorrect sizing, product defects, or consumer preferences. These returns necessitate the development of robust systems for sorting, processing, and reselling or recycling goods. Additionally, the growing demand for fast and convenient return policies in the retail and e-commerce sectors has further intensified the need for effective reverse logistics. Companies are leveraging technology, such as AI, automation, and data analytics, to streamline returns management, reduce processing times, and enhance customer experience. The increasing focus on sustainability is also encouraging retailers and e-commerce businesses to adopt more efficient reverse logistics practices, such as recycling or refurbishing returned products. As these trends continue to grow, the retail and e-commerce sector will act as a key driver of the reverse logistics market, ensuring its ongoing expansion.

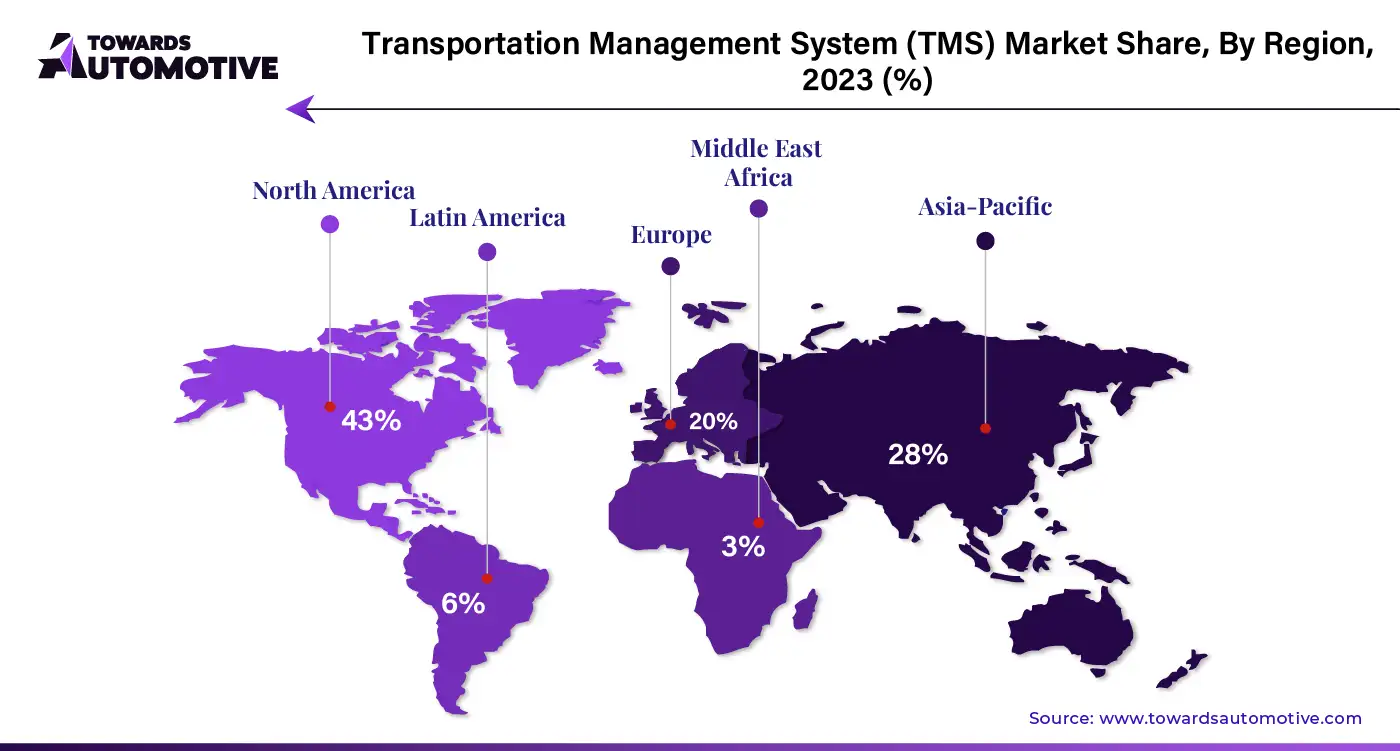

North America dominated the reverse logistics market. The growth of e-commerce, supply chain optimization, and return policies centered on consumer loyalty are pivotal drivers of the reverse logistics market in North America. E-commerce has surged, particularly in the United States and Canada, leading to a significant increase in product returns. Consumers' expectation of hassle-free returns is reshaping how businesses handle reverse logistics, as seamless return processes are now a critical factor in customer satisfaction. With the rise of online shopping, companies are investing in efficient reverse logistics systems to manage the high volume of returns. Moreover, supply chain optimization has become a key focus, with businesses striving to streamline operations and recover value from returned goods. Reverse logistics contributes by enabling businesses to resell, recycle, or refurbish products, reducing waste and enhancing cost efficiency. Additionally, lenient and flexible return policies are being used by companies to boost consumer loyalty. Offering easy returns creates a positive shopping experience, fostering repeat business and brand loyalty. As these policies become standard in North America, the demand for reverse logistics services continues to rise, making it an essential part of the e-commerce and retail sectors. This combination of e-commerce growth, supply chain optimization, and consumer-focused return strategies is driving the expansion of the reverse logistics market.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. In the Asia-Pacific (APAC) region, consumer expectations, well-developed healthcare industry, and regulatory compliances are key drivers propelling the growth of the reverse logistics market. As consumers in APAC demand more convenient, flexible, and hassle-free return processes, particularly in e-commerce, businesses are compelled to enhance their reverse logistics capabilities. The increasing trend of online shopping and the rise of return expectations create a significant demand for efficient and streamlined reverse logistics systems. Additionally, the healthcare industry is contributing to market growth, with the need for returns, recycling, and disposal of medical devices, pharmaceuticals, and other health-related products. As the healthcare sector continues to expand, particularly in emerging economies such as India and China, proper management of product returns, including recalls and expired products, is essential for compliance and safety. Furthermore, stringent regulatory frameworks in countries like Japan, South Korea, and India are pushing companies to adopt more sustainable and responsible reverse logistics practices. These regulations often require businesses to manage returns and waste disposal in an environmentally friendly manner, further boosting demand for reverse logistics services. Thus, consumer expectations for seamless returns, the healthcare sector's unique reverse logistics needs, and the pressure of regulatory compliance are driving significant growth in the APAC reverse logistics market.

By Return Type

By Industry

By Service Type

By Region

April 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us